How To Maintain A Solid Credit Score

Although the credit-scoring models vary, theyre often similar enough that your scores will rise or fall in tandem. Knowing what factors impact your credit can help you improve your scores and increase your chances of being approved for credit cards and loans with lower interest rates.

To help keep your credit scores on the up-and-up, be sure to pay your bills on time and in full each month, maintain low balances, avoid closing credit card accounts whenever possible, minimize the amount of new accounts you open and sustain a good variety of credit accounts.

You should also check your credit score often to identify potential fraud, identity theft or legitimate errors, which can all bring down your credit score. You can check your credit score for free at LendingTree.

Recommended Reading: What Credit Score Do You Need For A Discover Card

How To Check Your Credit Score For Free

Once you understand how your credit score is calculated, you should check your score. This will give you insight into what products you may qualify for and what interest rates to expect. If you have a low score, you can take steps to improve it. If you have a good or excellent score, you can work to maintain it.

Checking your credit score doesn’t hurt your credit, and even if you’re not applying for a new card or a loan, it’s smart to get into the habit of checking it regularly.

Most credit card issuers provide free credit score access to their cardholders, making it easier than ever to check and know your score.

Some issuers, such as Citi and Discover, provide free FICO Scores, while others, such as Chase and Capital One, provide free VantageScores.

You can check your credit score in less than five minutes by logging into your credit card issuer’s site or a free credit score service and navigating to the credit score section. There will typically be a dashboard listing your score and the factors that influence it.

FICO and VantageScore will pull your credit score from one of the three major credit bureaus, Experian, Equifax or TransUnion.

Here are some free credit score resources that you can access even if you don’t have a credit card yet:

- Chase Credit Journey: Free VantageScore from TransUnion

- Discover Credit Scorecard: Free FICO Score from Experian

Tip : Pay Bills On Time And In Full

Payment history is the most important factor making up your credit score. If you miss a payment, it will show up on your credit report, and multiple missed payments can make it impossible to achieve an excellent score. For this reason, you should always pay at least your minimum payment.

It’s also a good idea to pay off your bill in full each month to avoid potential late payment fees, penalty and interest charges that often result from carrying a balance.

As a rule of thumb, set up autopay for at least the minimum payment, so you can avoid forgetting a payment. You can also schedule email, text or push notifications through your card issuer.

If you struggle to remember to pay your bills each month , there’s an easy fix: autopay. If you’re not sure you’ll be able to pay your bill in full, you can set it so you just pay the minimum as a safeguard to avoid missed payments.

Here are some tips:

The sooner you start paying on time, the sooner your score will begin to improve. And just as a bit of motivation, older credit penalties, such as late payments, matter less as time passes. So start now and stay consistent.

Some credit building credit cards reward cardmembers with an automatic credit limit increase after they make six on-time payments. An example is the Capital One Platinum Credit Card.

See our methodology, terms apply.

Don’t Miss: How Does Credit Score Work

Why Are My Fico Score And Vantagescore Different

A score is a snapshot, and the number can vary each time you check it.

Your score can vary depending on which credit bureau supplied the credit report data used to generate it. Not every creditor sends account activity to all three bureaus, so your credit report from each one is unique.

Each company has several different versions of its scoring formula, too. The scoring models used most often are VantageScore 3.0 and FICO 8.

Also, FICO and VantageScore weight scoring factors slightly differently.

How Are Business Credit Scores Used

Small business lenders rely on business credit scores from multiple credit rating agencies to decide whether or not to make loans to small businesses. The business credit score also helps lenders determine the size of a loan they are willing to make. Lenders look at factors like whether your business has been paying previous debts on time, how quickly you pay suppliers and how much revenue youve been bringing in over time.

Business credit scores provide them with recalculated ways of determining the creditworthiness of a business. High scores mean a business has been diligent in making payments to others while a low score sends up a red flag. Lenders need to know how likely it is that a business will repay the loan they are granting on a timely basis. The various rating agencies provide historical information that the lenders can access prior to making their lending decisions.

Like it or not, business credit scores are an important tool most small business lending companies use to decide whether or not you will get the loan you need. Most of the time, lenders consider both personal credit scores and business credit scores, paying attention to all the factors discussed above.

Your small business’ credit history also follows you from one business to another and records may become inaccurate over time so it is a good idea to maintain detailed records, even if one business closes and you open another one.

Don’t Miss: How Long The Collection On Your Credit Report

Can You Have A Credit Score Of Zero

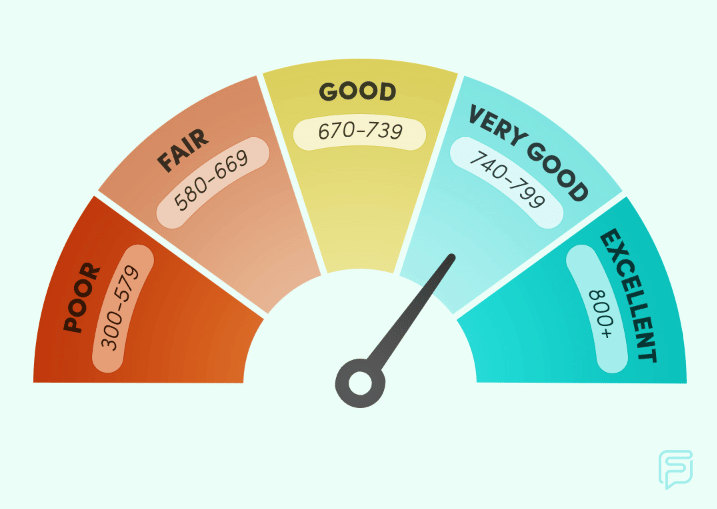

No you cannot have a zero credit score because the industry-standard range begins at 300 and reaches up to 850 for people who meet the minimum standard for a numerical rating.For example, suppose a lender looks at a persons consumer report with insufficient historical information. In that case, they might see a message stating No Record Found or Too New to Rate instead of zero.In another instance, a lender reviewing an applicant that recently filed bankruptcy might see a 300 result rather than zero.

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

Read Also: What Credit Score Does Navy Federal Require For Auto Loans

Getting Approved For A Credit Card

Check credit score requirements before applying for a credit card. Some credit cards only approve people with excellent credit. Others are made especially for people with low or no credit. Here are our favorite credit cards organized by credit score requirements:

- 740 or higher:Best cards for excellent credit

What Credit Score Does An 18

Credit scores dont miraculously appear when people turn 18 years of age. However, this is how old you need to be to apply for your first form of credit. Besides, there is no default credit score. Those over 18 years old get to build their credit in different ways. These include getting student or secured credit cards, becoming authorized users on others credit cards, making payments toward student loans while still in college and getting their utility/phone/rent payments to reflect on their credit reports.

While most of these cards have higher-than-usual interest rates, the top ones allow you to earn cash back/rewards while youre on your journey to build your credit. The Deserve EDU Mastercard for Students has no annual fees and offers 1% cash back on all your purchases. Likewise, Capital One Journey Student Rewards Card has no annual fees and offers up to 1.25% cash back if you pay your bill on time.

Capital One QuicksilverOne Rewards offers 1.5% unlimited cash back on all purchases. However, it charges an annual fee of $39 but charges no foreign transaction fees.

The links above will take you to one of our partner’s sites, where you can compare and apply for a selected credit card.

Also Check: Is 631 A Good Credit Score

What Is Insufficient Credit History

Its not uncommon to have an insufficient credit history when youre just starting out. Having an insufficient credit history simply means that your credit profile isnt old enough to satisfy the requirements of a certain lender. If youre told that you have an insufficient credit history, there are several strategies that you can take to help overcome this:

- Apply for a secured credit card

- Apply for a credit builder loan

- Ask your landlord to report your monthly rent payments

- Add an authorized user to your credit card, or become an authorized user on someone elses account

If you have an insufficient credit history, its important to know that youre not alone. Lets take a look at the number of people who are currently credit invisible:

Americans who are credit invisible

| Generation |

|---|

As you can see, an overwhelming majority of Gen Zers are considered credit invisible. This number continues to drop as the generations get older. For instance, only 24% of Millennials are considered credit invisible, and a mere 10% of Baby Boomers are.

To learn more about insufficient credit history and the steps you can take to help build your credit profile quickly, check out these articles.

Whats A Good Credit Score

So, what is a good credit score, anyway? Lets start at the beginning.

According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1

Recommended Reading: How Do You Raise Your Credit Rating

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

How Is Your Starting Credit Score Calculated

Once you open a line of credit, there are some factors that will have a direct impact on your scores. Here are a few the Consumer Financial Protection Bureau says can influence your credit score:

- Payment history: How well youâve done making payments on time.

- Debt: How much current unpaid debt you have across all your accounts.

- A ratio that reflects how much of your available credit youâre using compared with how much you have available. is usually expressed as a percentage.

- How many and what kinds of loans you have, such as revolving credit accounts and installment loans.

- How long your accounts have been open. But remember, what qualifies as your oldest line of credit depends on whatâs being shown in your credit reports.

- New credit applications: How many times youâve applied recently for new credit. The effect of a single application on your scores might be minor, but a lot of new applications, each of which triggers a hard credit inquiry, could still give a negative impression to lenders.

Also Check: A Credit Score Is Based In Part On Brainly

What Is New Start Financial

New Start Financial is a lead generator company that offers customers access to their network of lending companies. However, some of these companies have been accused of having high interest loans and other financial products. Some customers have claimed to be highly displeased with the interest rate and that the terms and conditions of these products are often unclear, making it difficult for consumers to understand the true costs of borrowing.

As a result, New Start Financial has been affected by these allegations as they are the company that helped the customers match with a lender in the first place. If youre considering taking out a loan with New Start Financial, be sure to do your research and understand the full terms and conditions before signing anything.

You’ll Have Limited Credit Card Choices

Bad credit limits which credit cards you can qualify for the options you have will be primarily secured cards. While a secured card, such as the Capital One Platinum Secured Credit Card, can help you rebuild credit, you’re required to make a security deposit typically $200 in order to receive an equivalent line of credit.

Even if your credit score falls within the bad range, it’s not a guarantee you’ll be approved for a credit card requiring bad credit, as card issuers consider more than just your credit score.

If you have a less-than-stellar credit score, you should take action as soon as possible, so you can work toward good credit and increase your odds of being approved for financial products like credit cards and loans.

Read Also: What Is A Hard Hit On My Credit Report

How Private/public Are Business Credit Scores And Fico Scores

While personal credit scores are kept private for legal reasons, business credit scores and FICO scores are considered a matter of public record and are easily accessed by banks, auto dealers, realtors, suppliers and customers. Bad credit reports follow your business wherever you go and can definitely work against you and your ability to conduct business.

Get A Secured Credit Card

If youre building your credit score from scratch, youll likely need to start with a secured credit card. A secured card is backed by a cash deposit you make upfront the deposit amount is usually the same as your credit limit. The minimum and maximum amount you can deposit varies by card. Many cards require a minimum deposit of $200. Some companies such as Avant, Deserve and Petal now offer alternative credit cards that don’t need a security deposit.

Youll use the card like any other credit card: Buy things, make a payment on or before the due date, incur interest if you dont pay your balance in full. Youll receive your deposit back when you close the account.

NerdWallet regularly reviews and ranks the best secured credit card options.

Secured credit cards arent meant to be used forever. The purpose of a secured card is to build your credit enough to qualify for an unsecured card a card without a deposit and with better benefits. Choose a secured card with a low annual fee and make sure it reports payment data to all three credit bureaus, Equifax, Experian and TransUnion. Your credit score is built using information collected in your credit reports cards that report to all three bureaus allow you to build a more comprehensive credit history.

Don’t Miss: Does Affirm Show Up On Credit Report

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

How Credit Bureaus Calculate Credit Scores

Each credit agency listed above parses the data into five main categories. Then, they calculate each segment into five percentage values. Heres a breakdown:

- Payment history: This factor represents 35 percent of your credit score. This accounts for the consistency and timeliness of your bill payments over time. The time range the credit agency includes can be anywhere from one to seven years.

- Also known as amount owed, this segment accounts for 30 percent of a credit score. tallies the amount you owe compared to the credit you have available.

- Length of credit history: This category adds up to 15 percent of value toward your credit score. This segment considers the age of your oldest and youngest accounts. Credit agencies also factor the average age of all your accounts into this segment. They may note your usage rate for these accounts as well.

These last two categories each count for ten percent of your credit score with the credit agency. But theyre quite different:

- Credit mix indicates the types of credit you have. These may include installment loans, credit cards or mortgages. It’s not necessary to have all kinds of credit. But it may be beneficial for your score if you have more than one.

- New credit accounts: This includes the total number of new credit accounts and loans youve opened or applied for recently.

Recommended Reading: What Is Transunion Credit Score