How To Remove Collections From A Credit Report

If youve been falling behind on your loan payments for a while, you may start receiving emails, phone calls, and messages from your creditor checking up on your payment status. If this is the case, you officially have outstanding debt.

But dont worry, in this article, we will explain all about collection debts and how to remove collections from a credit report, so continue reading to find out more.

What If I Dont Recognize An Account On My Report

If your there are typically two causes, either the information was reported incorrectly or the discrepancies are due to identity theft. If you notice a mistake or discrepancy, please contact Equifax or TransUnion to resolve the problem. Keep in mind that both bureaus have their own protocol for dealing with incorrect information and you may need to provide specific documentation as proof.

Problems like these are an important reminder of why you should check your credit report at least once a year.

What Going Into Collections Means

Depending on the type of debt owed, collections can affect you in different ways. If your debt is unsecured, such as credit card debt, and you default on your payments with that debt sent to collections, the credit card company would stop trying to collect the debt from you. Instead, the collections company that your debt was sent to, would pursue the debt and try to collect money from you. If your debt was secured, such as an auto loan and you default, then the lender might repossess your car, sell it at auction, and sell the remainder of debt you owe to a collections company. Lenders can collect money from debt in the following ways:

- Contact you on their own and ask for payment using their internal collection department.

- Hire a collection agency to try and collect.

- For revolving debt, such as credit card debt, the credit card company could sell your debt to a collection agency, which would then try to get the money from you.

- For installment loan debt, such as an auto loan, the lender may repossess the car, sell it auction, and then sell the remaining debt to a collection agency.

The federal Fair Debt Collection Practices Act strictly regulates how debt collectors can operate when trying to recover a debt. For example, they can’t threaten you with imprisonment or make any other kind of threat, if you don’t pay. However, they can and typically do report the unpaid debt to credit reporting agencies.

You May Like: Why Is My Credit Score Different On Credit Karma

When Will A Paid Collection Fall Off Your Credit Report

While its better to pay off a debt collection, unfortunately, payment doesnt immediately remove the account from your credit report unless you negotiate beforehand to have the account removed upon payment. Unless you negotiate a pay-for-delete agreement, the collection will stay on your credit report for the entire credit reporting time limit, and the balance due will be updated to $0. Still, a paid collection can improve your credit score and will look better when you apply for new credit.

How Many Points Can My Credit Score Increase If A Collection Is Deleted

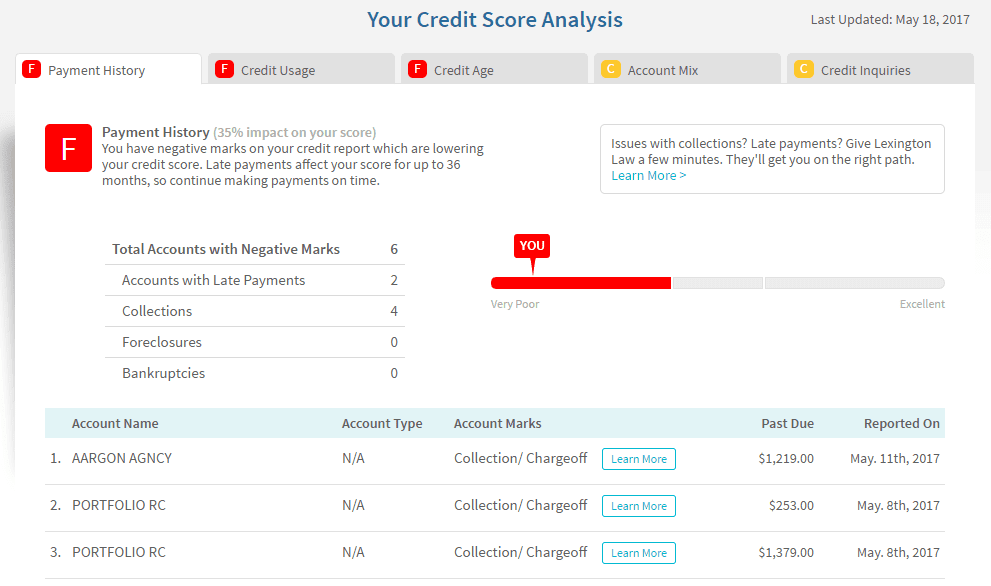

Late payments, skipped payments, and collection accounts are all factored into your credit score. Accounts that get to the collection stage are considered seriously delinquent. They will have a significant, negative impact on your credit score.

There is no fixed number of points that a credit score can increase if a paid collection is removed from your credit report. Each individuals credit score will be differently affected.

However, if the collection has lowered your score by 100 points, getting it removed from your credit report can increase your score by 100 points.

Also Check: How Long Does Information Stay On Your Credit Report Uk

What Debt Repayment Agencies Do

A debt repayment agency is a business that charges a fee to act for you in negotiating or making arrangements with creditors for you to pay what you owe. This is a voluntary agreement between the debt repayment agency and your creditors.

A creditor does not have to accept your payment proposal. Even if a creditor accepts your payment proposal, it can be cancelled if you do not abide by all the terms of the agreement. The creditor can then resume collection activity on your debt.

The agency must tell you within 30 days of being informed by a creditor that the creditor has decided not to participate in or has withdrawn from a debt repayment program.

For more information about how debt repayment agencies work, see the Bill Collection and Debt Repayment tipsheet.

Strategies For Dealing With Charge

One strategy that many people have had success with is asking the creditor to remove the charge-off in exchange for some sort of payment. You dont need to offer your accounts full balance — after all, even if the creditor accepts your offer, you still legally owe the entire debt to a third party — but, the more you are prepared to pay, the better position youll be in to negotiate.

As always, get any promises to delete the charge-off in writing. Ask the person youre speaking with to fax the agreement on a company letterhead, or through the mail, and dont send any money until you have the document in your hand.

You can send a removal request in writing. This is known as a pay-for-delete letter in which you state that youre willing to pay a certain sum of money in exchange for removal of the charge-off.

Heres one point to remember. The creditor youre dealing with is a business. At the end of the day, they really dont care about your life story or any excuses about why you didnt pay the debt. If it makes good business sense for them to stop reporting the charge-off, theyre likely to do it. Be polite and keep the conversation or letter to the point you want them to know — that its in their best interest to accept your offer of payment for removal.

Don’t Miss: What Kind Of Credit Score To Buy A House

How To Remove Negative Information From Your Credit Report

If you do not recognize something reported on your credit report, you should fix it. To fix it, you can get in contact with the credit bureau. This will help keep your credit report healthy and strong. It will also prevent any type of fraud or identity theft.

You can also call the reporting agency and inform them of the mistake. Companies need to know when an error has happened. If you are disputing something, both Equifax and TransUnion have processes for this.

How Should You Deal With A Charge

Your best course of action depends on which course of action the creditor uses to try and get some of its money back.

If the creditor has not yet sold your debt to a collector or tried to sue you, you can negotiate a settlement in the same manner that I discussed in the section about dealing with collection accounts. Generally, this is the case for the first three to six months after your account became delinquent, although the timetable can certainly be longer or shorter than this.

On the other hand, if the creditor sues you for the debt or sells it to a third-party debt collector, it gets a little more complicated. To be clear, either of these situations will likely result in two negative items on your credit report — the original charged-off account as well as the resulting collection account or legal judgement.

Youll probably need to deal with the collection and charge-off individually, especially if the debt has been sold to a third-party collector. In other words, a debt collector has no control over what the original creditor reports to the credit bureaus. Plus, the original creditor really has no incentive to help you out simply because you paid off the debt collector.

Don’t Miss: How Much Will A Secured Credit Card Raise My Score

How Do I Remove An Unpaid Collection From My Credit Report

To remove the collection account from your credit report early, you can ask a company for a goodwill deletion, but there’s no guarantee you’ll receive forgiveness. If you have a collection account on your report that’s inaccurate or incomplete, dispute it with each credit bureau that lists it on your credit report.

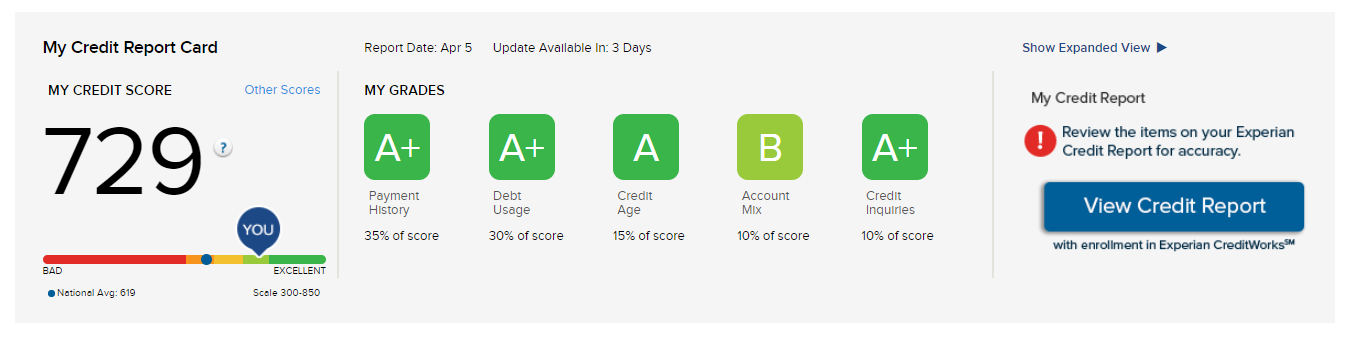

How Do Collections On Your Report Affect Your Credit Score

In general, collections seriously damage your credit by affecting your payment history, which is the most important factor considered in the calculation of your credit score.

The exact impact a collection account will have on your score depends on several factors, including:

- The type of credit scoring model used

- The type of debt it is

- Whether youve paid it

- Your personal credit history

For example, heres how different types of collections can have different effects on your credit score:

- Paid collections: Newer scoring models like FICO 9, VantageScore 3.0, and VantageScore 4.0 ignore paid collections and dont factor them into your credit score at all. 910

- Settled collections: If you negotiate a debt settlement instead of paying off your collection in full, your account will appear as settled. While settled accounts arent as bad as unpaid collections, theyre still more damaging to your score than having a collection account reported as paid in full.11

- Medical collections: Newer credit scoring models like VantageScore 4.0 and FICO 9 weight unpaid medical collection accounts less heavily than other collection accounts. However, older models like FICO 8 dont distinguish between medical and non-medical collections and are still commonly used by lenders.

- Small collections: If the amount you owe on a collection account is less than $100, newer FICO models will ignore the account as a small-dollar nuisance, which means it wont affect your score at all. 12

Read Also: How Can A Landlord Report To Credit Bureau

Should I Hire A Credit Repair Company

If youre feeling overwhelmed with the approaches mentioned above, a credit repair service or company may be able to save you time and stress by filing disputes with the credit bureaus and negotiating with debt collectors on your behalf.

But its good to know that they cant do anything that you cant do to remove negative marks on your credit report yourself. Weigh the pros and cons of a credit repair service before committing to hiring a professional. If you do decide to hire one, be aware of scammers. By law, credit repair companies are not allowed to charge you before theyve provided you with a service. So if a company is asking you for money before providing you with any services, thats a red flag and it might not be a reputable business.

How Does Collections Affect My Credit Score

Having debt in collections definitely negatively impacts your credit score. Paying off the debt will likely improve your score with credit bureaus that use FICO 9 or Vantage Score 3.0 or 4.0 the newest versions of credit scoring.

Debt in collections is considered under payment history the biggest factor in the most common credit score, FICO. Payment history drives 35 percent of your score.

Some lenders have special policies that prohibit them from lending to people with unpaid debts in collection.

Don’t Miss: How To Fix Your Credit Score Fast

How Much Do Collections Affect Your Score

Although there’s no formula to calculate how much a collections account affects your credit score, it’s important to know there is little difference between a paid collection account and those that remain unpaid regarding your credit score.

In fact, paying old collections accounts can activate them again and further impact your score. If you want to remove a collections account for the purposes of borrowing, check with your lender to find out the best approach for your loan approval.

The type of debt does play a part in how it affects your score. Medical collections, for instance, are given less weight in the latest FICO scoring models.

If A Collection Is On Your Report In Error Dispute It

You may have a collections account on your credit report that shouldnt be there. Maybe its too old to still be reported, or the collection itself is incorrect.

Too old to be reported: Delinquent accounts should fall off your credit report seven years after the date they first became and remained delinquent. But that doesnt always happen. For debts that linger longer than they should, file a dispute with any credit bureau that still lists the debt.

If a credit bureau has made a mistake on your report if you dont recognize the account or a paid account shows as unpaid, for example gather documentation supporting your case. Then, file a dispute by using the credit bureau’s online process, by phone or by mail. The bureau has 30 days to respond.

Collection is incorrect: If you think the error is on the part of the debt collector, not the credit bureau, ask the collector to validate the debt to make sure its yours. Note that you have 30 days from the date the collector first contacted you to dispute the validity of the debt. If the collector cant validate, the collection should come off your reports. Follow up to make sure.

Also Check: What Is Cbcinnovis On My Credit Report

Does The Open Date Of A Collection Account Determine When It’s Removed

It sometimes takes a year or more between an account’s charge-off and its sale to a collection agency, and collection agencies that fail to collect their debts sometimes resell them to still other agencies. That means multiple collection account entriesall related to the same unpaid debtmay appear on your credit reports.

While that’s not great news, you need not worry that each new entry has its own seven-year countdown to expiration. Any collection entries related to the same original debt will disappear from your credit report seven years from the date of the first missed payment that led up to the charge-off.

How Long Can A Creditor Pursue A Debt In Canada

The straight answer is that a collection agency can try to collect on a debt forever, but they only have a short window to pursue you legally to recover any money. Specifically, a limitation period sets a time limit during which a creditor can commence legal action by filing a claim with the court to collect on a debt.

Canadas base limitation period is six years however, many provinces have lowered that time limit to 2 years.

Is it legal for a debt collector to pursue a 20-year-old debt? Unfortunately, the answer is yes. A collection agency or creditor can try to collect an outstanding debt in perpetuity however, through provincial statutes of limitation, you have a defense against any legal action once the limitation period has expired.

This means that even though a collection agency can continue to call and try to collect the debt, any legal action they might suggest after the time limit is up is an empty threat. Moreover, you have the right to file a complaint with the consumer protection office if you feel that the debt collectors are harassing you.

Don’t Miss: How To Get Chapter 7 Off Credit Report

Stage : A Collection Agency

Most creditors and medical offices will wait until the original bill is at least 120 days past due before turning the account over or selling the account to a collection agency.

Once an account has been turned over or sold to a collection agency, its typically not very long before a new collection account appears on the consumers credit reports. Some collections might appear on just one or two credit reports. Many others will be added to reports with all three credit bureaus.

MoneyTermDebt Collection Agencies

Debt collection agencies generally buy debt for pennies on the dollar and are often very aggressive when it comes to collecting.

What Steps Must Collection Agencies Take Before They Report Debts

Debt collection agencies cannot report a debt to a credit reporting company or credit bureau until they have spoken to you and/or communicated with you in writing. Their choice is to:

- Discuss the debt with you in person.

- Talk to you about the debt by telephone.

- Mail a letter about the debt.

- Send an email or other electronic communication about the debt.

If collection agencies opt to put the information in writing, they must wait a reasonable length of time in case they receive a notification that the letter or electronic message wasnt delivered.

If a collection agency sends you a debt collection validation notice that contains all the required information about the debt, unless you dispute the debt, they can begin the reporting process after the requisite 30 days.

Read Also: Is 752 A Good Credit Score

What A Debt Repayment Agent Or Agency Cannot Do

A debt repayment agent or agency cannot:

- charge any fee for an NSF cheque unless the agency has disclosed in writing prior to the submission of the cheque that a fee will be charged

- make any arrangement with you to accept a sum of money that is less than the amount of the balance due to a creditor as a final settlement without the consent of the creditor

- give any false or misleading information including references to the police, law firm, credit history, court proceedings, lien or garnishment

- lend you money to pay your debts

- offer to pay or give you any other form of compensation for entering into a debt repayment agreement

- collect any fee for referring or helping you get an extension of credit from a lender, creditor or service provider

- fail to provide a receipt for all cash transactions or payments made in person or at your request

- discuss your debt or the existence of your debt with any person except you, a guarantor of the debt, your representative or the creditor of the debt

- make a claim for breach of contract if you cancel the repayment agreement

More information is available in the Bill Collection and Debt Repayment tipsheet.