Percent Of Americans Who Have A Credit Score Of 800 Or Higher

Another report from The Ascent reveals that only 22 percent of Americans have a credit score of 800 or greater7.

Those who have a credit score of 800 to 850 are considered to have exceptional credit, and it appears that older individuals as well as those with incomes ranging from $101,000 to $150,000 have much higher credit scores within the perfect range.

Can I Get A Car / Auto Loan W/ A 818 Credit Score

Trying to qualify for an auto loan with a 818 credit score is very cheap. There is little to no risk for a car lender .

Taking out an auto loan out with a 818 credit score, should be extremely easy.

It gets even better.

You can improve your loan terms with a few simple steps to repair your credit.

An ideal option at this stage is reaching out to a credit repair company to evaluate your score and see how they can increase it.

What Does A Credit Score Of 800 Mean

When you have a credit score of 800, that means you have an exceptional score. Since you have a credit score well above the average, you’ll probably have an easy time getting the very best credit offers when you apply for new credit. For example, if you want to buy a home, you may qualify for the lowest mortgage interest rates on the market.

Therefore, you may wonder what will happen if you slip to 799 or slightly lower. Remember, 799 is still categorized as a “very good” score and you’ll still have ample opportunities to qualify for good credit offers. That said, hitting the 800-850 range will still get you the best possible offer options.

Recommended Reading: Affirm Credit Score Requirement

Ask For Lower Interest Rates Higher Credit Limits

The first thing Wayne Sanford, owner of the Texas-based credit counseling firm Credit Bureau Investigations, recommends doing is contacting your current credit issuers to see if they can offer you a better deal.

Call up and say, I just checked my credit score and it was above 780, so why am I still paying this high interest rate? A good chunk of them will drop the rate down for you, he says. And if that doesnt work and youre carrying a high-interest balance, it may be a good time to look into a 0 percent balance transfer card deal, or look into applying for a new, low APR card.

While youre on the line with your credit card issuer, you also can ask for an increase to your credit line. If successful, this is a good win since it can make maintaining a great a bit easier if you tend to carry balances on your cards from time to time.

With a top score, youve already been good about not using too much of your available credit, but a higher limit gives you a bit more wiggle room should you wish to finance a larger purchase over a few months.

Tip:The higher you are up the mountain, the longer the fall, says Sanford. In other words, with a high credit score, even the slightest slip-up can cause as much as a 100-point drop. That said, dont start overspending just because you have a lower rate or a higher limit.

What Fico Says About Having The Perfect Credit Score

Even a representative at FICO the scoring model most lenders use to check applicants’ creditworthiness says that having a credit score in the top 2% of the U.S. population won’t further benefit you, so there’s no need to stress.

“The reality is that, from the standpoint of qualifying for credit, it doesn’t matter whether you have a perfect 850 or a score just below that,” Ethan Dornhelm, VP of FICO scores and predictive analytics, tells CNBC Select. “To lenders, a consumer with a score in the 800s is a sparkling applicant.”

You May Like: How Do I Report A Tenant To The Credit Bureau

Why You Should Be Pleased With An Exceptional Fico Score

A credit score in the Exceptional range reflects a longstanding history of excellent credit management. Your record of on-time bill payment, and prudent handling of debt is essentially flawless.

Late payments 30 days past due are rare among individuals with Exceptional credit scores. They appear on just 6.0% of the credit reports of people with FICO® Scores of 813.

People like you with Exceptional credit scores are attractive customers to banks and credit card issuers, who typically offer borrowers like you their very best lending terms. These may include opportunities to refinance older loans at better rates than you were able to get in years past, and excellent odds of approval for credit cards with premium rewards programs and the lowest-available interest rates.

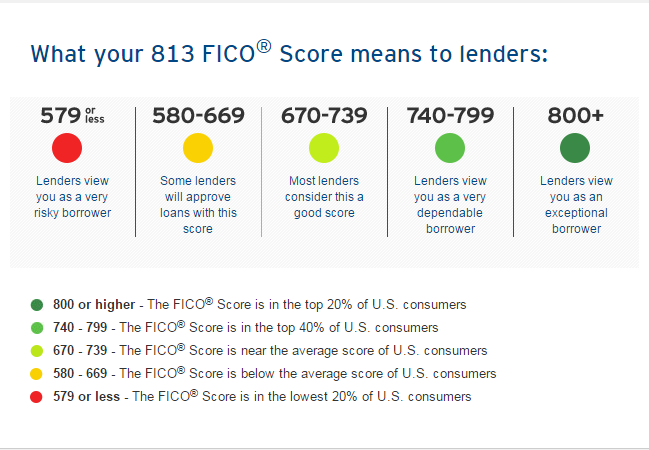

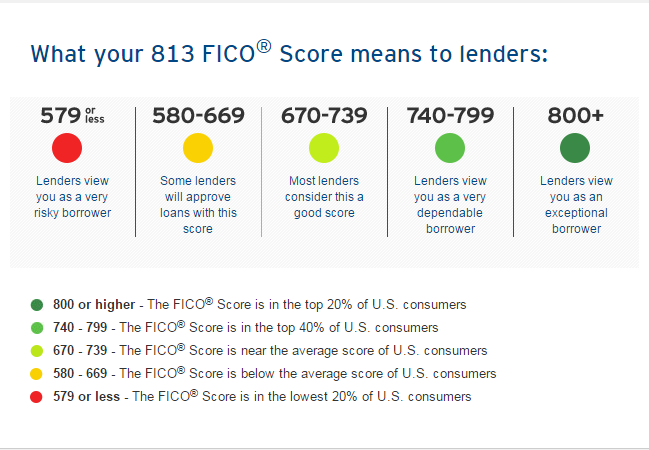

Credit Score Is It Good Or Bad How To Improve Your 813 Fico Score

An 813 credit score is excellent. Before you can do anything to increase your 813 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to identify what needs to be improved, you should probably be aware of all the things that count and dont count towards your score.

Read Also: Does Snap Finance Report To Credit Bureau

Your Credit Scores Are An Important Aspect Of Your Financial Profile

They may be used to determine some of the most important financial factors in your life, such as whether or not youll be able to lease a vehicle, qualify for a mortgage or even land that cool new job.

And considering 71 percent of Canadian families carry debt in some form , good credit health should be a part of your current and future plans.

High, low, positive, negative theres more to your scores than you might think. And depending on where your numbers fall, your lending and credit options will vary. So what is a good credit score? What about a great one? Lets take a look at the numbers.

Auto Loans You Can Get With An 813 Credit Score

Getting an auto loan is easy with a credit score of 813. Youll qualify for all the best interest rates, and youll even be eligible for 0% APR car loans that some new car dealers offer.

According to a 2020 quarterly report by Experian, people with credit scores of 781850 received average interest rates of 3.80% on used car loans and 2.65% on new car loans, whereas people with credit scores in the range of 501600 had much higher average interest rates, at 16.56% for used car loans and 10.58% for new car loans. 7

Depending on the loan term and how much youre borrowing, this difference could amount to hundreds or thousands of dollars in savings. If youre thinking about buying a car, then you might want to start looking around now while your score is high.

You May Like: How To Get Hard Inquiries Off Your Report

How To Read Your Credit Report

Your credit report contains both personal information and financial information. Your credit report illustrates who you are as a borrower, both the good and the bad. Checking it allows you to keep an eye on your accounts, make sure there are no errors, and even potentially prevent the damaging effects of fraud. Your credit report is the report card of your financial life and understanding how to read it can help you take control of your finances and be prepared for any of your future credit needs.

Measuring Your Credit Score

Measuring your credit score is something that has to be done. Every specific credit bureau has a different way of measuring the score. Some measure to 850 while others will measure to 830 and so on. Each one is different and while one might record one default on their records, another might not and so on.

With the three major credit reporting agencies: TransUnion FICO, Equifax and Experian, you can be sure that you have all of the information you need. Youre allowed to have a free print out of your credit score every year from each of these three bureaus. If youre ever curious about what is on your report or ways that you can find out what you can do to fix your report, printing a copy and reading it is the best way to find out more about it, as well as report anything that shouldnt be on the report.

Recommended Reading: 700 Credit Score Car Loan

Key Things That You Must Know About Credit Score

If you are new to the concept of credit or CIBIL score, you may have several questions about how it works, what impacts credit score, etc. Here are some of the additional aspects you must know about credit score.

1. You can check your credit score and get a credit report for free

Most credit bureaus and third-party websites provide credit scores for free. You can sign up with them and check your credit score for free at any time. It is good to check your credit score frequently to keep a close watch on your credit health. While checking your credit report, you can look for any errors and get them resolved by raising a dispute with the credit bureaus.

2. Not everyone has a credit score

A credit score is available only after an individual takes some form of credit from banks, NBFCs or online lenders. This can include credit card, personal loan, home loan, two-wheeler loans, loan against property, gold loan, car loan, etc. If you have never borrowed before, you would not have any credit score.

3. Factors that Make your Credit Score

If you are wondering how a credit score is calculated, you must know that it is based on factors such as your repayment history, credit utilisation ratio, credit age, credit mix and number of hard enquiries, etc. You will have a good credit score if you have a good combination of all of these factors.

4. It takes time to build an excellent credit score

5. Poor credit score can be improved

6. Checking your own credit score doesnt hurt it

Average Credit Score By Income

According to American Express, the average credit score by income are as follows4:

- $30,000 or less per year: 590

- $30,001 to $49,999: 643

- $50,000 to $74,999: 737

The correlation between lower average credit scores and lower-income may be associated with factors like higher-income individuals being able to pay back credit card debts more easily as well as being able to maintain a lower credit utilization ratio.

Those with higher income may also have higher credit limits in comparison to those with lower income.

That being said, income is not the most accurate measurement of scores. Income is only one factor that plays a role in your score. You can still have a low income and have good credit. If you fall into a lower income bracket, dont worry. Your income doesnt determine your score.

Read Also: Does Leasing Affect Your Credit

What Is A Good Credit Score

What is considered a good credit score? :59

Reading time: 3 minutes

-

Theres no magic number to reach when it comes to receiving better loan rates and terms

Its an age-old question we get, and to answer it requires that we start with the basics: What is a, anyway?

A credit score is a number, generally between 300 and 900, that helps determine your creditworthiness. Credit scores are calculated using information in your , including your payment history the amount of debt you have and the length of your credit history.

Its also important to remember that everyones financial and credit situation is different, and theres no magic number to reach when it comes to receiving better loan rates and terms.

There are many different credit score models used today by lenders and other organizations. These scores all have the same goal: to predict a consumers likelihood to pay their bills. There are some differences around how the various data elements on a credit report factor into the score calculations.

Although credit scoring models vary, generally, credit scores from 660 to 724 are considered good 725 to 759 are considered very good and 760 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behaviour in the past, which may make potential lenders and creditors more confident about your ability to repay a debt when evaluating your request for credit.

How Do Your Actions Impact Credit Scores?

Staying Out Of Subprime

Bruce McClary, vice president of communications at the National Foundation for Credit Counseling, says that a subprime FICO scoreat which a borrower is offered no credit or very expensive creditis similar to Experian’s range, with “good” starting at 660 or 670.

“Certainly if someone’s score dips below 600 on the FICO scale, thats a critical situation,” says McClary. “Many lenders wont lend to you, and those who will are going to offer you credit at the highest possible cost or interest rate.”

With a FICO score of under 600, you might be able to get a or subprime bank loancalled a signature loanbut it could charge up to 36 percent interest, the highest allowable by law, McClary says.

Katie Ross, education and development manager for the Boston-based American Consumer Credit Counseling, a nonprofit that offers guidance to consumers nationwide on budgeting, credit, debt, and related issues, plants the boundary between fair and good at 600. “What matters most is that you manage your credit so that it’s above the fair credit score range,” she says.

Read Also: Amazon Prime Rewards Visa Signature Card Credit Score Needed

Shopping For The Best Rates On Loans And Credit Cards For A Credit Score Under 813

If you are ever on the market for high-priced items, such as home appliances, it is very common for people to walk into the store and get offered a discount or an otherwise excellent financing deal.. .but only if they open up a credit card account with that store.

Why do stores offer these credit cards? The reason why is because theres usually a high interest rate or multiple fees that go along with them. Those rates and fees can be found on the small fine print of the credit card deal, but of course, the store doesnt tell you.

A golden rule of credit cards is that you should only apply for credit that is a necessity for your financial life. When applying for a credit card from a retail store, youre probably only going to use it once, twice, or three times maximum. You could just as easily be using an existing credit card that you already have.

Heres why this is so critical: applying for multiple credit cards within a few months of each other will be very harmful to your overall credit score. Never apply for a credit card that you dont need.

Now, when you do decide to apply for credit cards and loans in general, there are a few factors that you will want to remember, including:

Lending Standards Are Tightening

During a previous mortgage refinance in 2019, my loan officer said that he hadnt worked with a borrower with under an 800 credit score in over two years. I was surprised to hear this because I clearly remember banks offering the best refinance rates when you had at least a 760.

At the beginning of my refinance process, the mortgage officer asked whether I had over an 800 FICO score. I told him I thought so. But I felt like I had been caught in a lie because I didnt know for sure.

However, if I had said no, I felt like he would have hung up on me. He gave me this you better not be wasting my time vibe.

With the mortgage industry even tighter today thanks to so much demand, borrowers must really have their financial ducks in order to get the best rate.

For those interested, lets review the fundamentals of the credit score.

Recommended Reading: How To Check Credit Score With Ssn

Also Check: Paypal Credit Score Requirement

What Is A Good Credit Score In Canada

A good credit score in Canada is typically one that is 680 or higher. Of course, there are many different types of credit scores , and keep in mind that the credit scores a lender sees are usually different from those that you might have access to. Additionally, your Equifax credit scores might be different from your TransUnion scores. The image below illustrates the different credit score ranges in Canada and can help you determine if your credit score is a good credit score.

What Does An 813 Credit Score Mean

A credit score of 813 means that your credit reports show that you always pay your bills on time. It indicates to lenders that youre a very low-risk borrower. An 813 credit score is in the highest score bracket in both of the two major credit scoring models in the US , and its well above the national average.

An 813 credit score is very far from the lowest credit score of 300, and its very close to the highest credit score of 850. Your score is good enough to get the best terms on loans and lines of credit from the vast majority of lenders.

| Your Rating |

|---|

| 688 |

Don’t Miss: Open Sky Increase Credit Limit

The Credit Score Needed To Buy A Car

According to Investopedia, the average credit score you will need to purchase a car is 661 and above15.

You may be able to find financing options with a bad credit score, but you will generally need a cosigner or more money to put down towards your car loan when you have bad credit since you are a nonprime or subprime borrower.

You should also consider the role insurance scores play in your car buying journey as credit scores help insurance companies assess risk when you apply for insurance. Make sure your credit score is correct with Experian or other bureaus before you apply for insurance.