Dispute Mistakes With The Credit Bureaus

You should dispute with each credit bureau that has the mistake. Explain in writing what you think is wrong, include the credit bureaus dispute form , copies of documents that support your dispute, and keep records of everything you send. If you send your dispute by mail, you can use the address found on your credit report or a credit bureaus address for disputes.

Equifax

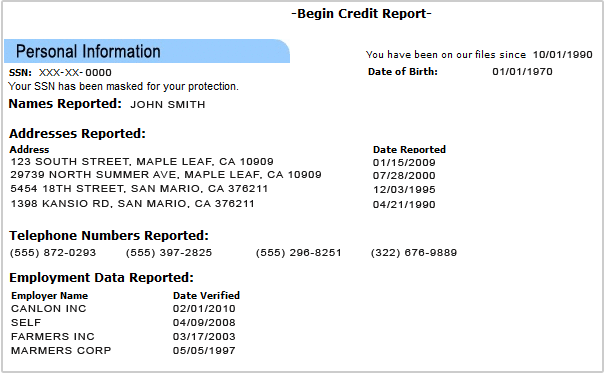

How Is A Credit Report Made

The national credit bureaus maintain millions of consumers’ credit histories, based on information supplied by lenders and other entities. Each file includes records relevant to a person’s history borrowing and making monthly payments. For identity verification purposes, your credit file also contains information such as your current name and any other names you may have used in the past, current and past addresses and your date of birth.

A credit file is not set in stoneit’s a living and breathing record that’s constantly being updated with the latest information being provided to the bureaus by your lenders and other institutions. When a company such as a lender, insurance provider or potential employer requests to check your credit, the bureau pulls the contents of your credit file that are relevant and disclosable by law to the company, and packages it in an organized document known as a credit report.

Your credit report does not contain all the data in your credit filethe credit bureaus have your full payment history on record, for instance, but are typically authorized to release only records for the last seven years. Your credit report also cannot be provided to just anyone there are strict limits on the types of companies that can check your credit and when they are allowed to do so.

When Should You Check Your Credit Score

Generally, people advise you should check your credit score at least every year. But there are advantages to checking it more often than just annually. Firstly, it will help you stay on top of your credit accounts. Youll also know where you stand or where you can improve if you want to apply for new credit. If you only check your credit report every year, you might not spot any drops in your credit score and correct it in time before you apply for a new loan.

Unfortunately, credit fraud and identity theft is also a reality. This can have detrimental effects on your credit score. Knowing what is going on with your credit report will help you identify any credit fraud or identity theft sooner than later. You can take action and correct the wrongs before too much damage is done.

It is also always possible for an error to creep in on your credit report that could unnecessarily hurt your score. If you review your credit report regularly, you can spot errors sooner and have them corrected immediately.

Remember, checking your own credit score doesnt have a negative impact on your score. You can check your credit score and credit report as often as you like without it ever hurting your credit health. It is only when a credit provider does a hard credit inquiry when you are applying for a new loan that it will affect your score.

Also Check: Lending Club Bbb Ratings

Estimating Credit Score Changes

While youre waiting for your credit report and score to update, you can use a credit score simulator toestimate how your credit score might change. Credit Karma and myFICO both offer credit score simulators that can show how your credit score might change if the information on your credit report changes, like if you pay off an account or open a new loan, for example.

How To Report Your Name Change To A Credit Bureau

3-minute readSeptember 20, 2020

Disclosure: This post contains affiliate links, which means we receive a commission if you click a link and purchase something that we have recommended. Please check out our disclosure policy for more details.

Lets say you get married and decide to take your spouses last name. Does that mean your credit will be affected? In other words, should you change your name with the credit bureaus to ensure your information is up to date?

Reporting your name change to the credit bureaus seems like the obvious thing to do, but thats not necessary. Instead, keep reading to find out how to update personal information on a credit report.

You May Like: Report Death To Experian

How Long You’ve Been Trying To Improve Your Credit Score

Although time is of the essence to improve payment history, there are some very powerful moves you can make to see noticeable signs of improvement within weeks:

- Checking your credit report for errors and disputing them

- Paying down a balance on a credit card to zero

- Improving your utilization ratio by paying all balances down to less than 30% of credit limit

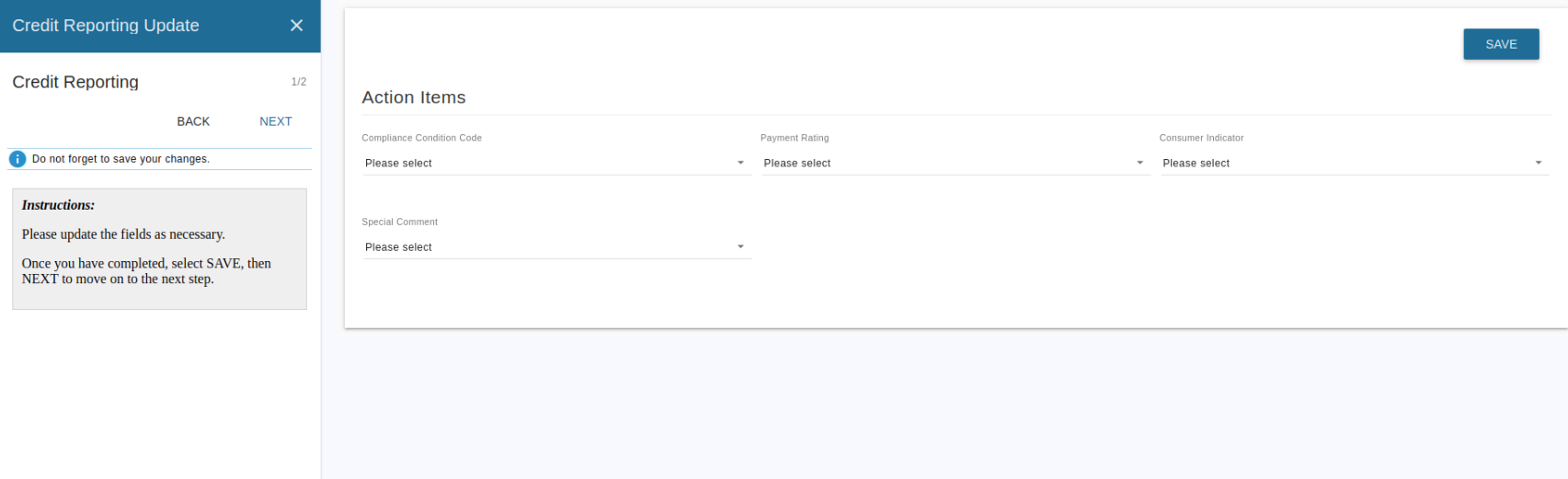

How To File A Dispute

If you want to dispute something in your credit report, you can do so by mail, fax, phone or online. Under federal law, it’s your right to dispute information you believe to be inaccurate in your credit reports for free.

When you use Experian’s online Dispute Center, you can verify your identity, review your credit report and file a dispute all in one place. To file a dispute, select the information you’d like corrected and the reason it’s incorrect, and then submit your dispute.

You May Like: Notifying Credit Reporting Agencies Of Death

Check Your Credit Report For Fraud

Look for accounts that don’t belong to you on your credit report. Accounts that you don’t recognize could mean that someone has applied for a credit card, line of credit, mortgage or other loan under your name. It could also just be an administrative error. Make sure it’s not fraud or identity theft by taking the steps to have it corrected.

If you find an error on your credit report, contact lenders and any other organizations that could be affected. Tell them about the potential fraud.

If it’s fraud, you should:

- report it to the Canadian Anti-fraud Centre

The Canadian Anti-Fraud Centre is the central agency in Canada that collects information and criminal intelligence on fraud and identity theft.

How Can I Get My Equifax Credit Score For Free

You can also create a myEquifax account to receive two free Equifax credit reports each year. You can also click “Get My Free Credit Score” on your myEquifax dashboard to subscribe to Equifax Core Credit⢠and receive a free monthly Equifax credit report and a free monthly VantageScore based on Equifax data.

You May Like: Paypal Bill Me Later Credit Score

Does Checking Your Credit Score Too Often Hurt Your Score

No, it doesn’t work. Checking your credit score does not affect your credit score. You can use any free credit assessment service as many times as you want and it will never affect you negatively. However, these services generally update your account on a monthly basis, so you won’t see any changes if you look between updates.

One Of My Defaulted Accounts Has Been Sold On To A Debt Collection Company This Debt Is Now Appearing Twice On My Credit File Is This Right

If it is clear from looking at the two entries that they relate to the same account, with the same default date and balances and the original debt is clearly showing as settled then it is likely that we would consider this to be fair in terms of the data protection law. However, if the entries are recorded on your credit file in a way that may look like they are two different debts, or that could make the debt remain on your credit file for longer than six years from the date of the original default it is unlikely that we would consider this to be fair.

Don’t Miss: When Does Capital One Report To Credit Bureaus 2020

Problems With Credit Reporting

Heres where it gets complicated. Some businesses only provide information to the CRAs when an account is past due or has been written off and/or turned over to a collection agency. Creditors will write off a debt when it is deemed uncollectible.

Some of these creditors include:

- Utility companies

- Doctors and hospitals

- Lawyers and other professionals.

The three reporting agencies are making increasing efforts to gather monthly information from utility companies, phone companies and local retailers. That increases the amount of data in an individuals credit profile, which cuts down on the guesswork.

Contact The Credit Bureaus

Both Equifax Canada and TransUnion Canada have forms for correcting errors and updating information. Fill out the form to correct errors:

Before the credit bureau can change the information on your credit report, it will need to investigate your claim. It will check your claim with the lender that reported the information.

If the lender agrees there is an error, the credit bureau will update your credit report.

If the lender confirms that the information is correct, the credit bureau will leave your report unchanged.

In some provinces, the credit bureau is required to send a revised copy of your credit report to anyone who recently requested it.

Also Check: Does Removing An Authorized User Hurt Their Credit Score

I Was Discharged From My Bankruptcy Last Year But The Cras Have Not Amended The Accounts On My Credit File To Show This What Should I Do

Once you have been discharged you will have to notify each of the lenders whose accounts were included in this bankruptcy as they will not automatically be told. You should send them the evidence of this and ask them to amend their entry on your credit file to reflect this. The specifics of how it will look vary depending on the CRA but the entries should be marked in such a way that any lender searching your credit file can clearly see that this debt is no longer outstanding and you are not being pursued for it. Most accounts that have been discharged from bankruptcy will show as settled/satisfied or partially settled/satisfied with a zero balance outstanding.

If any of the lenders respond refusing to amend their entry or fail to amend their entry within one month of receiving your proof of discharge you may wish to make a complaint to the ICO. Please note, in this instance it is the lender who is the subject of any complaint you raise with us, not the CRA.

Get Your Free Credit Report

Obtain a current credit report by going online to AnnualCreditReport.com, the official site to access your credit reports from all three credit bureaus . If you can’t access your credit reports online, request them in writing by providing your name, current and former address, Social Security number, date of birth and signature. Here are the addresses of the three major credit-reporting agencies:

Equifax: P.O. Box 740256, Atlanta, GA 30374

Experian: P.O. Box 9701, Allen, TX 75013

TransUnion: P.O. Box 2000, Chester, PA 19022

Don’t Miss: Credit Report With Itin

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Long Does It Take For A Credit Score To Update After Paying

It can take 30-60 days for reports to update, although this is usually closer to 30 days. As for the requirement, I think the law does not specify the duration, but only the time. 2. My assumption is that the original lender still owned the account and had just contracted with a CA to obtain it on their behalf.

Recommended Reading: Aargon Debt Collection

How Does Information Get On My Credit Report And Is It Updated On A Regular Basis

When you have an account with a lender, theyll typically submit account updates to at least one of the three major credit reporting agencies TransUnion, Equifax and Experian. Since lenders dont always report to all three agencies, the information on your credit reports may vary.

Its also important to note that lenders report at different times of the month, so you might see slight differences in your reports, and therefore your credit scores, at any given time.

Q How Do I Add A Potential Fraud Alert To My Credit File

A.If you think you may be a victim of fraud but there has been no reported misuse of your credit or no confirmed misuse of your personal information, you can place a Potential Fraud Alert on your credit file. If, for example, you’ve lost a purse or wallet, placing a Potential Fraud Alert will tell potential lenders that you may be a victim of fraud and provide them with your contact phone number.

- A Potential Fraud Alert can be placed on your credit file.

- An alert can also be placed on your Social Insurance Number .

- A Potential Fraud Alert on your credit file will remain in place for 6 years unless you request to have the alert removed earlier.

- An alert on your Social Insurance Number will remain in place for at least 1 year.

- If fraudulent misuse of your personal or credit information is confirmed, please contact us by phone or in writing to add a Confirmed Fraud Alert to your credit file.

There are three ways you can add a Potential Fraud Alert to your credit file:

- Online: to visit our self-service website. To promote our online Potential Fraud Alert service, sign-up is free for a limited time.

- Over the telephone: call 1-800-663-9980 and select option 3 to use our Interactive Voice Response system to place your alert. Please note that SIN protection is not available through the IVR.

- In writing: Click Here for additional information.

Also Check: How To Remove A Repo From Your Credit

What Is A Credit Score

A is a financial instrument lenders use to determine whether you are a creditworthy individual or not. In Canada, credit scores can range from 300-900. The number you have reflects how good or bad your credit profile is. Generally, the higher you score, the less risky of a borrower youll seem, and vice versa.

Moreover, the higher your credit score, the better chance you have when it comes to getting approved for a loan, and the better interest rate you will get on that loan. Generally, anything above 650 will qualify you for a standard loan but dont worry, there are plenty of loan options for people out there with a low score as well. Those with a low credit score can apply with alternative lenders, they often have more lenient requirements than banks. However, it can be more expensive as they typically charge higher rates and fees than banks.

Want to know the minimum credit score required for mortgage approval? Read this.

Q What Are Account Review Inquiries

A. After establishing a relationship with you, companies may periodically review your credit file for account renewals, limit increases and pre-approved offerings. Since these inquiries are for account review purposes only, they are not disclosed to any other companies viewing your credit file and have no impact on your credit rating. These inquiries are posted for your information.

You May Like: Affirm Credit Score Requirement

How Often Does Your Credit Score Update Or Change

While most lenders and credit card companies update your information at least once a month, your credit history is not updated immediately. Instead, your credit score will be recalculated upon request. After you update your credit report, the new information will be reflected in your score the next time someone asks you to calculate it.

How Much A Rapid Rescore Costs

Lenders pay a fee to credit-reporting agencies to request updates to your credit reports, but the borrower typically doesn’t pay a fee for the service. Under the FCRA, lenders aren’t allowed to charge a fee to borrowers for disputing errors on a credit report. However, nothing is freeyou’ll pay for your lenders capabilities in the interest rate and closing costs of the loan.

Don’t Miss: Usaa Authorized User

Can Credit Karma Hurt Your Credit Score

Avant loan reviewsIs avant a good company? Avant has a good environment for all employees. They are specialized in promoting you as a person. Your title means a lot, Avant, but your hard work and dedication are so much more important. They are a great company to be a part of that you will not regret.Is avant loans legit?Avant loans have become a popular and legal option for those with below-average credit. But the bad reviews of Avant Loan oâ¦

How Often Does Credit Score Update

How quickly does my credit score update? Depending on the lender, it can take up to 90 days for the updated account information to appear in your credit reports. If a particular account that you have authorized has credit problems, you can turn to the credit reporting agencies, which can speed up the reporting process.

Read Also: Repossessions On Credit Report

Q Why Are Some Of My Accounts Showing As Joint Even After A Divorce

A. The creditor is currently reporting the disputed information as a joint obligation. When co-signing for credit, you are equally responsible for repayment of that obligation. Unless you and the creditor agree to remove your name from the account, we will report these debts and subsequent credit information in the names shown on the contract or application. If the creditor agrees to release you from any obligation, please notify us immediately and we will re-investigate the account.A divorce decree does not override an original contract with a creditor. Any credit history established jointly before a divorce can be reported under both names shown on a contract or an application. If you have notified the creditor and they are willing to release you from your obligation, please notify us and we will re-investigate the account.