S To Improve Your Credit Score

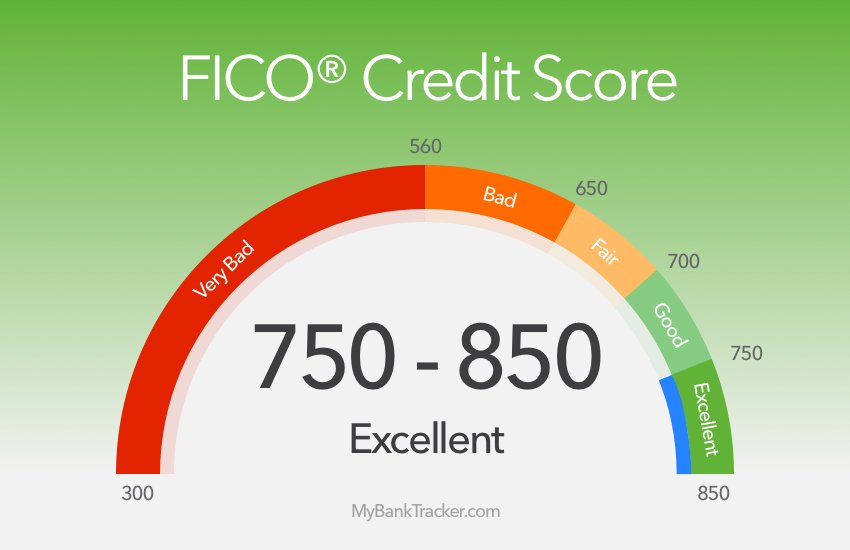

If you want to learn how to get an excellent credit score or if you already have excellent credit and want to work toward that perfect 850 here are some steps you can take to improve your credit score.

Start by making on-time payments every month, if you arent doing so already. Since 35 percent of your credit score is based on your payment history, making on-time payments is one of the best things you can do to boost your credit score.

Next, start paying down your balances. The lower you can get those balances, the more available credit youll have which is good for your credit utilization ratio and even better for your credit score. As the Washington Post reports, people with perfect credit scores have an average credit utilization rate of 4.1 percent. That doesnt mean they never use more than that much of their available credit it just means that they pay those balances off every month, and keep any revolving balances very low.

You can also increase your available credit by requesting a or applying for a new credit card. If your credit already falls in the Very Good range , going online and requesting a credit limit increase on one of your existing credit cards might give you the point boost you need to take you over 800.

Whats A Good Credit Score

So, what is a good credit score, anyway? Lets start at the beginning.

According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1

What Is A Fair Credit Score Range

Fair credit score = 620- 679: Individuals with scores over 620 are considered less risky and are even more likely to be approved for credit.

In the mid-600s range, consumers become prime borrowers. This means they may qualify for higher loan amounts, higher credit limits, lower down payments and better negotiating power with loan and credit card terms. Only 15-30% of borrowers in this range become delinquent.

Don’t Miss: Affirm Credit Requirements

How Can You Maintain A Good Credit Score

A good credit score comes with responsible credit behaviour. Here are some of the factors which will help you in maintaining a good credit score:

- Consistent Repayment: Credit score calculations lay nearly 35% weightage on your payment history. If you want to maintain a good credit score all the time, your repayment record should be 100% positive. For this, you must ensure to never miss a repayment.

Which Credit Agency Shows The Highest Fico Score

Equifax remains the only scoring agency to use FICO scoring methods. Therefore, the highest FICO score is always displayed. TransUnion and Experian use VantageScore. Of the two agencies, TransUnion is ranked as the top rated agency in most reports.

Fico score definition]What is a FICO score and why is it important? The FICO score is one of the most popular, affordable and reliable credit scores on the market today. Consequently, banks and companies rely on a person’s FICO score to determine that person’s credit risk. In fact, insurance companies are known to use credit scores to determine an insured’s risk.What exactly is a FICO score?FICO scores are the most important

Also Check: What Credit Score Is Needed For Les Schwab

How The Fico Credit Scoring Model Works

First of all, when I use the term “credit score,” I’m referring to the FICO score. There are other scoring models out there, but FICO is the model lenders most commonly use, by far.

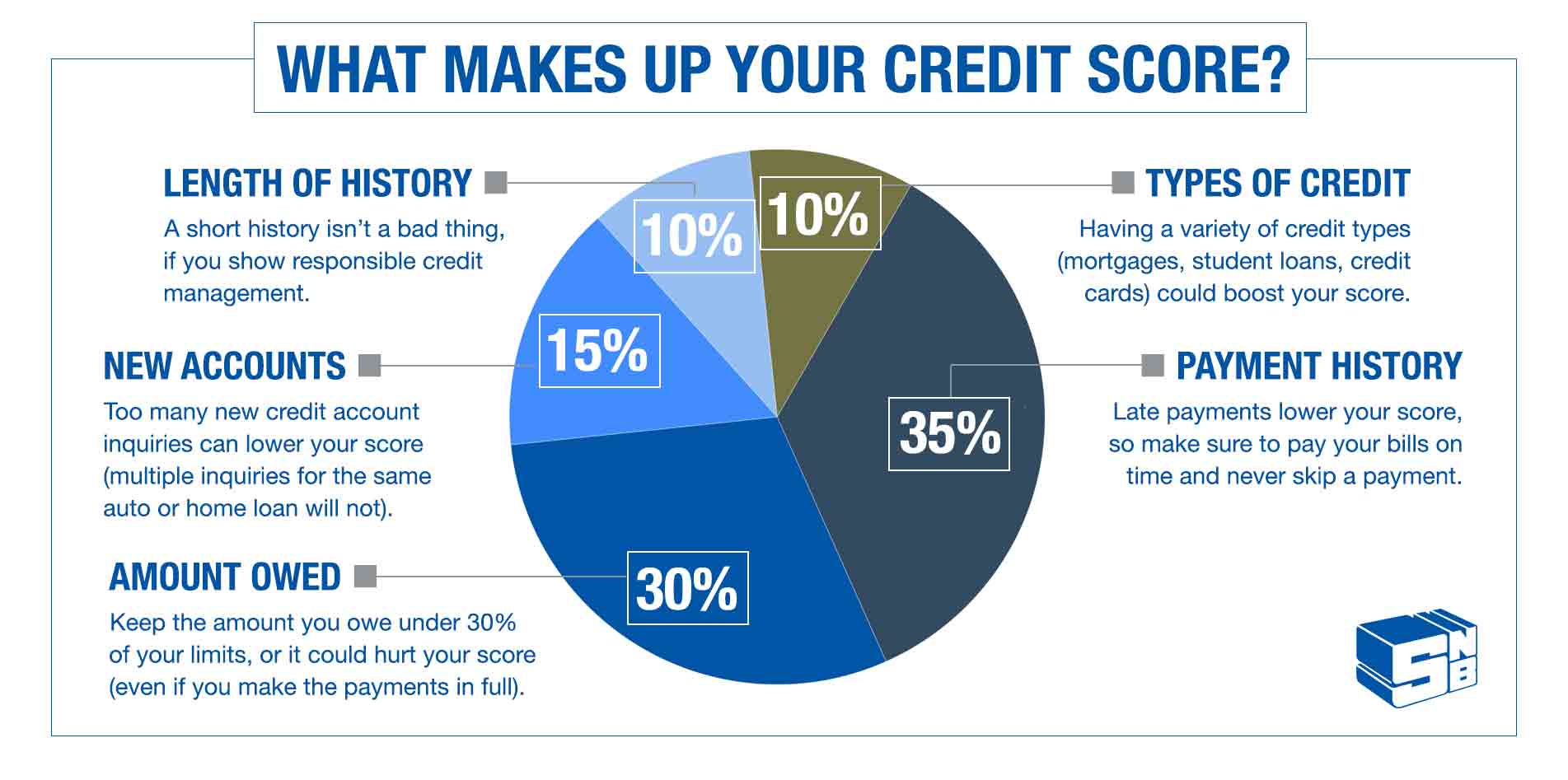

The formula that determines your FICO score is a well-guarded secret, but we do know that the FICO score is made up of five categories of information:

- Payment history : Do you pay your bills on time, every month?

- Amounts owed : How much do you owe on your credit accounts, particularly relative to your credit limits or original loan balances?

- Length of credit history : This considers various time-related factors, such as the age of your individual accounts, the age of your oldest account, and the average age of all of your accounts.

- New credit : Newly opened credit accounts, as well as your recent applications for credit, are included in this category.

- : Lenders want to see that you can be responsible with different types of credit, so having several different types of accounts can boost your score.

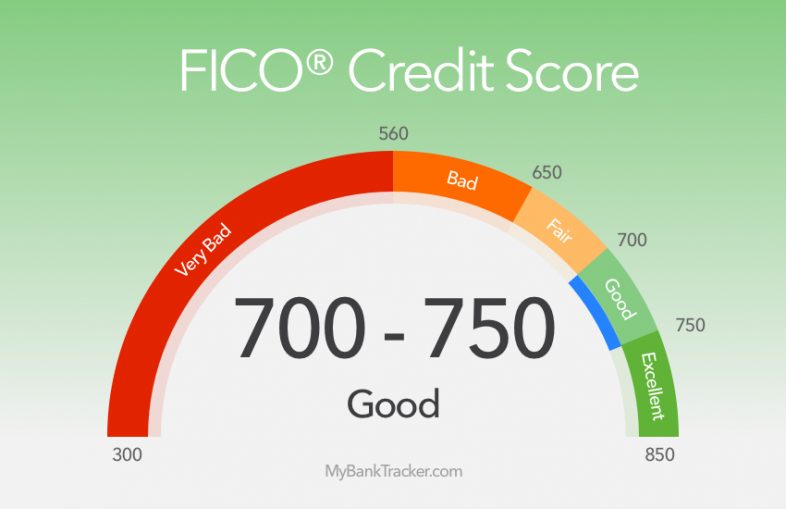

FICO scores range from 300-850, with higher scores being better, and most consumers have FICO scores in the 500-800 range.

Many credit card issuers give a free credit score to customers. These days, many offer the FICO score, but not all of them do. If your credit card company gives you a credit score that’s not based on the FICO model, it’s still probably a solid indicator of how you’re doing, but the scoring model and range may be a little different from those discussed here.

How A Good Credit Score Can Help You

A credit score is a numeric representation, based on the information in your , of how risky you are as a borrower. In other words, it tells lenders how likely you are to pay back the amount you take on as debt.

In general, the higher your scores, the better your chances of getting approved for loans with more-favorable terms, including lower interest rates and fees. And this can mean significant savings over the life of the loan.

Having a good score doesnt necessarily mean youll be approved for credit or get the lowest interest rates though, as lenders consider other factors, too. But understanding your credit scores could help you decide which offers to apply for or how to work on your credit before applying.

Recommended Reading: How To Check Your Credit Score With Itin

How Do Landlords Use Credit Scores

Landlords, however, are not lenders in the traditional sense. How are you going to use the credit score of prospective tenants to run your rental business?

Landlords use credit scores for the same base reason as lenders: to determine how likely a tenant is to pay their rent in a timely manner. By reviewing a prospective tenants credit report, you can get an idea about how they have handled payments in the past on loans, credit cards, and other things.

What Is Considered A Good Credit Score

A good credit score can be a welcome personal finance friend as you go through life. A score thats good or better can open doors when it comes to loans and other forms of credit. It can also make it easier to get insurance, reduce the number of hoops you might need to jump through when ordering utility services, and even expand job options.

But what exactly is a good credit score and do you have one? And if your score is poor or bad, how can you improve it? Find out in the quick guide to good credit scores below.

Read Also: How Do You Remove Hard Inquiries Off Your Credit Report

What Is A Good Credit Score For Tenants

Anyone with a credit score over 670 or higher is already at or above the national average for Americans. A good credit scoring for renting is going to be less compared to a good score for buying a home.

So, if your renter has a score of 670 or higher, thats a very good credit score for most rentals. Most landlords are looking for a score somewhere between 600 650 since renters dont have the credit history of making mortgage payments to boost their credit score.

Is A Fair Credit Score Average

A fair credit score is sometimes referred to as “having average credit.” However, this only means that people with fair credit, which includes anyone with a FICO score between 580 and 669, fall in the middle of the credit score ranges. It does not mean that the average American has a fair credit score.

Currently, FICO credit scores start at 300 points and run all the way to 850 points. In 2021, the average FICO credit score was 716 points, which means that the average American had good credit, not fair credit.

If you have fair credit, your credit score is neither good nor bad. It’s somewhere in between, which is why a fair credit score is often described as “average.”

You May Like: 700 Credit Score Car Loan

Are All Credit Scores Fico Scores

Not all credit scores meet FICO scores. For more than 25 years, FICO scores have been the industry standard for determining people’s credit risk. Today, over 90% of major lenders use FICO scores to help them make faster, fairer, and more accurate credit decisions. Other credit points can be very different from FICO points, sometimes up to 100 points!

How To Get A Good Credit Score

Good credit habits, practiced consistently, will build your score. Heres what you need to do:

-

Pay bills on time. This is important because payment history has the largest impact of all the factors in your score. A missed or late payment can do tremendous damage to a credit score and it can stay on your credit report for up to 7 years.

-

Try to keep your credit card balances well below your credit limits aim for, and lower is better. High utilization dings your score, but the damage will fade when you’re able to reduce your balances and the lower utilization shows up on your credit reports. You also may be able to lower utilization by getting a higher credit limit or becoming an authorized user on a lightly used card with a large limit.

-

Keep credit accounts open unless there is a compelling reason, such as high fees or poor service, to close them. Keeping older accounts open helps your average age of accounts, which has a small influence on your score. Also, closing an account cuts into your overall credit limit, driving up your credit utilization.

-

Avoid making several credit applications in a short time frame. Credit checks for the purpose of credit decisions can cause a small, temporary dip in your score, and several in a short time can add up. That’s why it’s important to research credit cards before you apply.

-

Monitor your credit reports and dispute information you believe is incorrect or too old to be included .

Don’t Miss: What Credit Score Do You Need For Amazon Prime Visa

Monitor Your Credit Report And Score

Checking your credit score right before you apply for a new loan or credit card can help you understand your chances of qualifying for favorable termsbut checking it further ahead of time gives you the chance to improve your score, and possibly save hundreds or thousands of dollars in interest. Experian offers free credit monitoring for your Experian report, which in addition to a free score and report, includes alerts if there’s a suspicious change in your report.

Keeping track of your score can help you take measures to improve it so you’ll increase your odds of qualifying for a loan, credit card, apartment or insurance policyall while improving your financial health.

Why Your Credit Score Changed

Your credit score can change for many reasons, and it’s not uncommon for scores to move up or down throughout the month as new information gets added to your credit reports.

You may be able to point to a specific event that leads to a score change. For example, a late payment or new collection account will likely lower your credit score. Conversely, paying down a high credit card balance and lowering your utilization rate may increase your score.

But some actions might have an impact on your credit scores that you didn’t expect. Paying off a loan, for example, might lead to a drop in your scores, even though it’s a positive action in terms of responsible money management. This could be because it was the only open installment account you had on your credit report or the only loan with a low balance. After paying off the loan, you may be left without a mix of open installment and revolving accounts, or with only high-balance loans.

Perhaps you decide to stop using your credit cards after paying off the balances. Avoiding debt is a good idea, but lack of activity in your accounts could lead to a lower score. You may want to use a card for a small monthly subscription and then pay off the balance in full each month to maintain your account’s activity and build its on-time payment history.

You May Like: Free Paydex Score

Staying Out Of Subprime

Bruce McClary, vice president of communications at the National Foundation for Credit Counseling, says that a subprime FICO scoreat which a borrower is offered no credit or very expensive creditis similar to Experian’s range, with “good” starting at 660 or 670.

“Certainly if someone’s score dips below 600 on the FICO scale, thats a critical situation,” says McClary. “Many lenders wont lend to you, and those who will are going to offer you credit at the highest possible cost or interest rate.”

With a FICO score of under 600, you might be able to get a or subprime bank loancalled a signature loanbut it could charge up to 36 percent interest, the highest allowable by law, McClary says.

Katie Ross, education and development manager for the Boston-based American Consumer Credit Counseling, a nonprofit that offers guidance to consumers nationwide on budgeting, credit, debt, and related issues, plants the boundary between fair and good at 600. “What matters most is that you manage your credit so that it’s above the fair credit score range,” she says.

What To Do If You Don’t Have A Credit Score

For FICO® Scores, you need:

- An account that’s at least six months old

- An account that has been active in the past six months

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

If you aren’t scorable, you may need to open a new account or add new activity to your credit report to start building credit. Often this means starting with a or secured credit card, or becoming an .

Recommended Reading: What Is Syncb Ppc On My Credit Report

What Credit Score Do You Need To Buy A House In 2021

Credit scores can be a confusing topic for even the most financially savvy consumers. Most people understand that a good credit score boosts your chances of qualifying for a mortgage because it shows the lender youre likely to repay your loan on time.

But do you know the minimum credit score you need to qualify for a mortgage and buy a house? And did you know that this minimum will vary depending on what type of mortgage you are seeking?

The importance Of FICO®: One of the most common scores used by mortgage lenders to determine credit worthiness is the FICO® Score . FICO® Scores help lenders calculate the interest rates and fees youll pay to get your mortgage.

While your FICO® Score plays a big role in the mortgage process, lenders do look at several factors, including your income, property type, assets and debt levels, to determine whether to approve you for a loan. Because of this, there isnt an exact credit score you need to qualify.

However, there is a minimum credit score youll likely need to buy a house.

What Is A Good Credit Score For My Age

Your age doesnât directly influence your credit scores. But as FICO and VantageScore show, the age of your credit accounts is one factor that affects how scores are calculated.

That could be a reason peopleâs credit scores tend to increase as they get older. Their accounts have simply been open longer. But credit scores can rise or fall no matter how old you are. And having good credit scores comes down to more than just your age.

Also Check: How To Report A Tenant To Credit Bureau

Why Good Credit Scores Matter

While credit scores help determine your availability of credit and the rate youll pay to access it, what it really measures is your statistically proven likelihood of defaulting on the money you borrow. The greater the risk, the lower your score and the more youll pay to access credit if you can access any credit at all.

In August 2021, the average interest rate on a subprime credit card or a card for customers with subprime credit was 25.88%, while the APR on a low-interest card was 12.96%.

If you carry an average balance of $3,000 month to month on an average subprime credit card, expect to pay about $64 in interest charges. Compare that to $32 in interest charges for an average low-interest credit card, and youre paying twice as much in interest. Low-interest credit cards are typically only available to people with excellent credit scores, and this example demonstrates the importance of building good credit.

How To Improve Your Credit Score:

Another common question when dealing with credit scores is What can I do to improve my score? There are many ways to improve your credit score to the higher end of the scale. Some of these methods include:

- Cleaning up your credit report

- Paying down your balance

- Negotiating outstanding balance

- Making payments on time

Credit.org offers consumers help in managing multiple payments. With a Debt Management Plan, you have the possibility of joining these payments into one lump sum with a lower interest rate. Learn more by reaching out to one of our today!

Don’t Miss: 24 Hour Inquiry Removal