How Are Credit Scores Calculated

Its impossible to give a formula for all the different credit scores, because there are so many proprietary credit scoring models in use. However, the two main scoring models, FICO and VantageScore 3.0, do make their scoring criteria publicly known.

Information taken from your credit report is used to calculate credit scores. FICO considers the following criteria:

- Payment history, especially late payments

- Account balances

- Your credit history and how long youve had credit

- The different types of credit accounts you have

- New credit and new credit applications

The VantageScore 3.0 also looks at all of those criteria, but weighs these factors differently in determining your credit score.

There is some information included in your credit reports that doesnt factor into your credit scores, like hard inquiries that are more than a year old and less than two years old. This may be used by credit card companies to determine your credit limit or which credit card offers theyll approve you for.

MoneyFact

A perfect score with one formula doesnt guarantee a perfect score with another because factors may be weighted differently.

Dont Be Afraid Of A Fresh Start

Consult a credit counsellor before engaging in bankruptcy proceedingssuch a move can damage your credit for seven years and very few creditors will lend to you during that time. However, if you do take this drastic step, know that you can rebuild your credit with a secured card. This is a credit card requiring an upfront deposit that makes up your credit balance, but still gets reported to credit bureaus to help you re-establish your credit and eventually go back to an unsecured card.

Have a credit-related question that we didnt answer in this guide? Leave us a comment below or and well do our best to answer any inquiry you might have about credit scores, reports, ratings, and more.

Request A Credit Limit Increase

You can directly increase the denominator of your CUR, and thereby lower the ratios value, by increasing your available credit. You can do this without opening a new account if you already have one or more credit cards.

Most credit card companies will seriously evaluate a request for a higher credit limit, but you may have to provide extensive financial information to back your request.

The credit card company may ask for bank statements and tax returns before granting a higher limit. You should expect the creditor to do a hard pull of your credit, which reduces the positive impact of the higher limit, at least in the short run.

Naturally, youll get the biggest CUR improvement by not actually using your additional credit, as explained earlier. A credit card company expects you to use any card it issues to you otherwise, its not worth their effort.

Recommended Reading: Ccb/ppc Credit Inquiry

Credit Score: Is It Possible To Get

The most popular credit scores all use a range of 300 to 850. So a credit score of 900 isnt possible with those models, which include VantageScore 3.0 and 4.0 as well as FICO 8 and 9. But some older models, as well as some alternative scores, do go up to 900 . Its good to be familiar with these ratings, but you probably wont encounter them often.

So you should worry far more about where you stand on the standard credit score range. And you can see exactly where that is by checking your latest credit score for free on WalletHub.

Below, you can learn more about credit scores with unusually high ranges as well as which number you should really target on the standard credit score range.

Who Has The Highest Credit Score

Data from VantageScore suggests that the average credit score in the US was 697 in July 2021. According to FICO, the average credit score reached 716 in 2021. Nearly 63% of Americans have a credit score of 700-850, and 8.4% of people have a score below 550.

As mentioned, less than 2% of Americans have the highest credit score limit of 850 with FICO, Transunion, and Equifax.

People who are most likely to have the best credit scores have these factors in common:

- Perfect payment record

- Long history of using and paying back credit

Don’t Miss: What Is Aoc Credit Score

What Are The Benefits Of Having Higher Credit Scores

Thankfully, you dont need a perfect score to qualify for some of the best rates on loans and mortgages. Scores in the 700s can qualify you for great interest rates from lenders. Get your scores anywhere above 760 and youll likely be offered the best rates on the market.

Why is this the case? Because banks and credit card companies care less about the specific numbers on your credit reports and more about the broad credit score range where your scores fall.

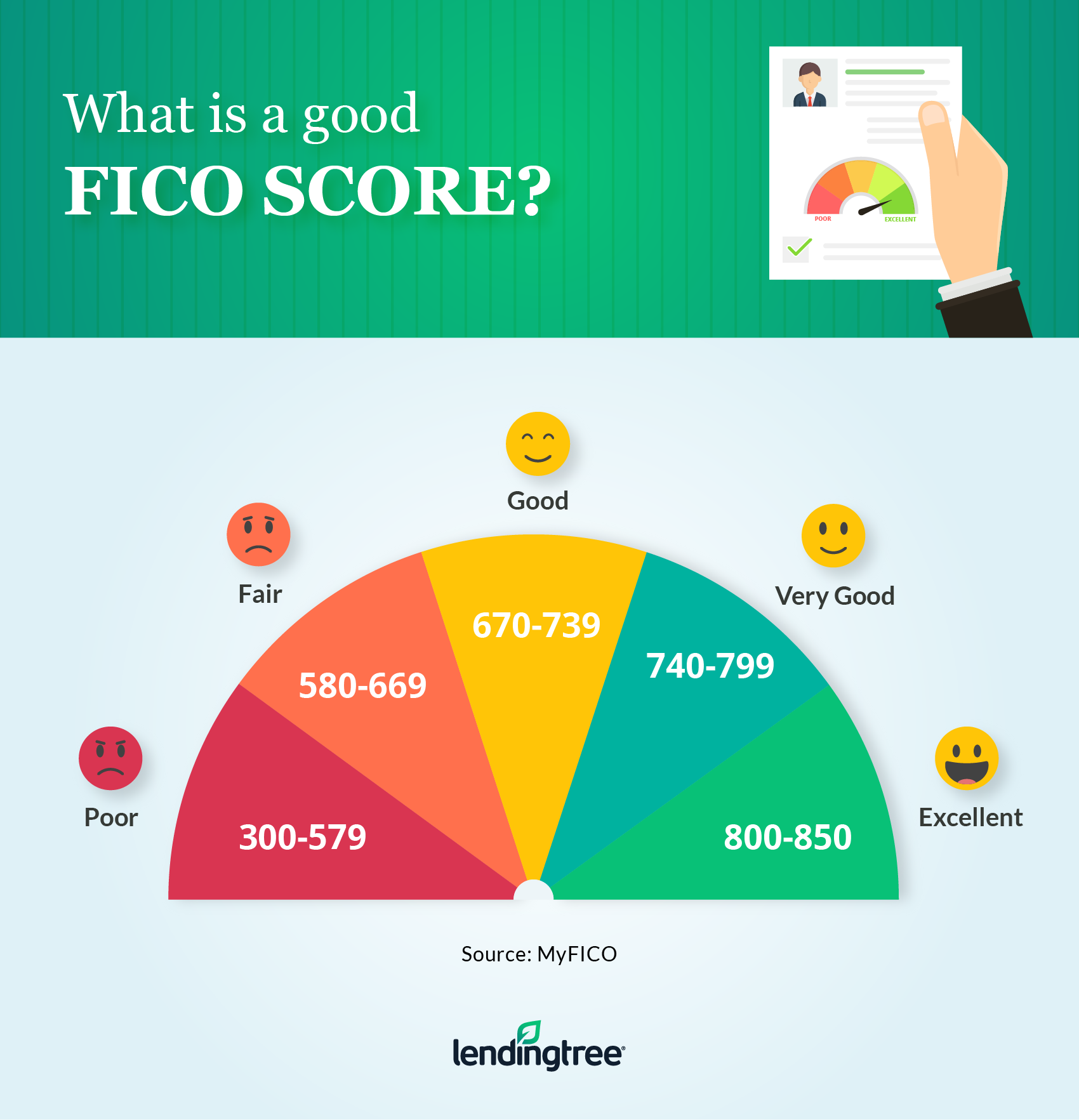

For example, FICOs score bands look like this.

- Poor: 300-579

- Very good: 740-799

- Excellent: 800+

Improving your scores from 740 to 790 will likely have little effect on your interest rate offers since both scores fall in the very good range. But moving your scores from 650 to 700 could mean getting lower interest rate offers.

If you want to improve your scores and get as close to 850 as you can, youll need to understand what causes your scores to go up or down.

Introduction To Understanding The Highest Credit Score Possible

Lets back up for a minute. Notice that we mentioned anything over 740 is generally considered to be great? Thats because credit scores are generally broken into the ranges poor, fair, good, very good, and excellent. The chart below outlines these various credit score ranges. As you can see, Excellent is generally defined as anything above 800 and 850, while a Good credit score is considered anything between 670 and 739.

FICO Credit Score Ranges

| 580 & below |

Well dive into more detail on ways to achieve the highest credit score later in this article, but for now lets look at why its important to have an understanding of the highest credit score and how it can impact you.

Don’t Miss: Check Credit Score Usaa

S To Improve Your Credit Score Right Now

Taking good care of your credit score is an important part of your financial life.

Interest rates on all kinds of products from personal and student loans to mortgages and have increased significantly since January, making it more costly for people to borrow money. When you apply for a new line of credit, a high credit score can help you qualify for a low interest rate. Good credit also makes it easier to refinance your debt, which can lower your monthly payments and free up money for other purposes.

Improving a credit score takes time, however. So if your score needs some work, the sooner you start working on it the better off youll be. Heres how to start.

Become An Authorized User

If you dont have a lengthy credit history, ask a family member who has excellent credit to add you as on their oldest credit cards. Your score can increase if the credit card issuer reports information to the credit bureaus for authorized users. However, the downside is that your score can decrease if the primary cardholder misses a payment and its reported on your credit report.

Don’t Miss: Syncb Ppc Account

Csc Partners With Transunion To Provide Cibil Score

The Common Service Centre has partnered with TransUnion CIBIL Ltd. to provide the CIBIL score. The new partnership will provide access to individuals in rural areas, where over 2.5 lakh CSCs are present. CSCs allow individuals to avail bank loans quickly for their personal and entrepreneurial needs. Lenders access the CIBIL score to check the individuals financial health and credit worthiness. Lenders use this data before loans are provided. Individuals will have to go through the authentication process in order to get the CIBIL score via CSCs. The report can also be downloaded. According to the Chief Executive Officer of the CSC, Dinesh Tyagi, individuals in rural areas lack awareness about the CIBIL score. Customers who have a good credit score can negotiate for better interest rates.

14 July 2020

You May Like: Which Credit Score Does Carmax Use

Does Income Play A Role In Having A Perfect Fico Score

Income is not a factor in determining your FICO® Score. While access to some credit products can be restricted by your income and financial situation, when it comes to achieving a perfect credit score, income is not a barrier.

In fact, in the fourth quarter of 2018, a little over 38% of perfect FICO® Scores were held by people with an estimated average annual income of $75K or less, according to Experian data.

Obviously, having more money can help you pay your bills, but building a healthy credit score really comes down to the basics of paying your bills on time every month and maintaining low , or the amount of debt you carry compared with total credit available.

Recommended Reading: Sywmc On Credit Report

Fixing Your Fico Score

If your FICO score is not as high as you would like it, there are things you can do to improve it. First of all, be sure to keep all of your bills current and in good standing. Always pay your bills when they come due, never make late payments, and pay more than the minimum balance on your or pay them off completely if you can. The longer you have a good payment history, the higher your will be.

Does Age Impact Achieving A Perfect Fico Score

While length of credit history is one of the main factors in calculating your FICO® Score, it is still possible for people from younger generations to attain a perfect score. Baby boomers held the majority of perfect credit scores, accounting for 58% of people with an 850, according to Experian data from the fourth quarter of 2018. Generation X came next, accounting for 25% of people with perfect scores, and the silent generation trailed with 13% of the best scores.

While most of those with perfect scores were in the older generations, millennials made up 4% of those with perfect scores and Generation Y less than 1%proving that it doesn’t take a lifetime to grow to a perfect 850.

Recommended Reading: Does Zzounds Do A Credit Check

What Do People With Perfect Credit Scores And The Loch Ness Monster Have In Common Most People Cant Decide If They Actually Exist

While we dont know about the elusive aquatic creature in Scotland, we do know there are humans out there who have reached credit-score nirvana.

For most credit-scoring models, including VantageScore 3.0 and FICO, the highest credit score possible is 850.

We were able to speak to two Americans who belong to the exclusive FICO 850 Club: Brad Stevens of Austin, Texas, and John Ulzheimer of Atlanta. Both proudly showed off computer screenshots proving theyve reached the pinnacle of credit scoring.

Many people are skeptical that 850 is attainable. But it certainly is, says Ulzheimer, who is president of The Ulzheimer Group and a nationally recognized credit expert.

How To Maintain Your Credit Score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. Thats the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 Thats because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

Legal

Read Also: 1?800?859?6412

Why Would You Want A Perfect Credit Score

Having an excellent credit score opens doors. It almost guarantees that youll be approved for any loan you can afford. Moreover, a good credit score can save you tens or hundreds of thousands of dollars over your lifetime compared to someone with a poor score. Thats because you should normally be offered the lowest interest rates available and pay the lowest loan costs.

Having a great score, even if not the highest credit score, gives virtually the same opportunities.

This is because lenders tend to use credit score ranges. When deciding on your rates and fees, most will lump those with perfect 850 scores in with those with scores that are nearly as good. Lenders may offer the same great deal to anyone with a score above 800. Experian says, In many situations, a score above 760 will qualify you for the best interest rates.

Having the highest credit score possible means you are probably doing a great job of managing your finances and money. You can take pride in that.

How To Control The Number Of Credit Checks

To control the number of credit checks in your report:

- limit the number of times you apply for credit

- get your quotes from different lenders within a two-week period when shopping around for a car or a mortgage. Your inquiries will be combined and treated as a single inquiry for your credit score.

- apply for credit only when you really need it

Also Check: Cbcinnovis Credit Check

How Can I Fix A Bad Credit Rating

You may be able to improve your bad credit rating by practicing responsible lending habits such as making payments on time. It could be worth consolidating debts to make your payments easier, which may improve your credit score in the long run.

There are also credit repair services that offer guidance and counseling to help improve your credit score. Keep in mind that credit repair services charge money and it may not be worth it depending on your circumstances.

Recommended Reading: What Does Syncb Ppc Stand For

How Credit Scores Work

A quick tutorial: Most people dont have one score they have many, and the scores change all the time.

Your scores also differ based on the scoring formula used and which of the three credit bureaus supplied the information used to create the score. If you want to track your credit score progress over time, monitor the same type of score from the same bureau.

You dont have to pay for a score you may be able to get a FICO or VantageScore for free from your credit card issuer or your bank. Financial sites such as NerdWallet also offer a free credit score, typically VantageScore 3.0, which measures the same behaviors that a FICO does.

You May Like: What Credit Bureau Does Capital One Report To

Average Credit Score By Year

The average U.S. credit score can tell us a great deal about the health of consumers and the economy more broadly. Thats especially true when you examine credit-score averages over time.

For example, the average VantageScore credit score improved by 11 points from 2007 to 2015, reflecting our rebound from the Great Recession. And in more recent years, average credit scores have stabilized along with the economy.

Average Credit Score by Year

What Percentage Of The Population Has A Credit Score Over 800

According to both FICO and VantageScore, only around 1% of their reported scores are 850. As for people who have scores above 800, the percentage is a little higher. The most recent data from FICO shows around 20 percent of scores reported at over 800 points. For VantageScore the number is a little lower, coming in at 17 percent.

Recommended Reading: How To Remove Repo From Credit

Tips On How To Build Good Credit

If your credit score isnt where you want it to be, dont worry. There are many small changes you can make that will help you build your score over time. Here are a few of our tips:

- Take out new credit. Taking on new credit, like car payments , and making those payments on time will help you build credit.

- Automate your payments. You wont miss payments if they happen automatically! Save yourself the hassle and keep them automated.

- Pay your credit card balance in full. The less money you have on your credit card, the better. If you pay off your bill in full each month, youll avoid interest fees and build credit.

- Have more available credit than used credit. Especially when it comes to credit cards, try to use less than half the credit you have available. If you can keep your balance under half, itll give your score a boost.

- Borrow what you can afford. Try not to live beyond your means. Borrowing what you can afford means you should have the funds to pay it back and maintain good credit.

Download our guide Repairing and Rebuilding Your Credit Score to learn more about your credit score, how it works and how you can rebuild it if its not where youd like it to be.

Dont Miss: Can A Closed Account On Credit Report Be Reopened

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

You May Like: 824 Credit Score