Payment History And Credit Utilization

While everything on this list is worth considering, there are two factors;that always rise above the rest: your payment history and credit utilization.

Your payment history is the number one factor. If you miss payments or default on loans, it can do the most damage to your credit.

Your credit utilization is the amount of your available credit that youre actually using. If you have $10,000 in credit and youve borrowed $5,000, your ratio is 50%. Any ratio over 30%;can harm your score.

Your Credit Scores Are An Important Aspect Of Your Financial Profile

They may be;used to determine;some of the most important financial factors in your life, such as whether or not youll be able to lease a vehicle, qualify for a mortgage or even land that cool new job.

And considering;71 percent of Canadian families;carry debt in some form , good credit health should be a part of your current and future plans.

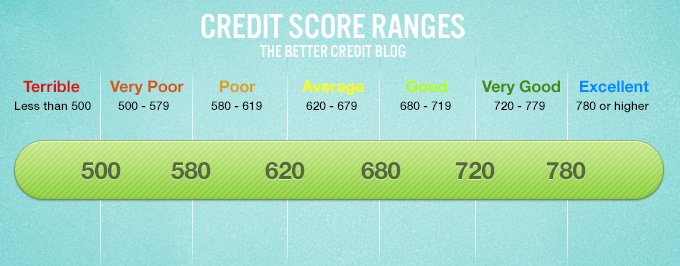

High, low, positive, negative theres more to your scores than you might think. And depending on where your numbers fall, your lending and credit options will vary. So what is a good credit score? What about a great one? Lets take a look at the numbers.

What Lenders Like To See

Since there are various credit scores available to lenders, make sure you know which score your lender is using so you can compare apples to apples. A score of 850 is the highest FICO score you could get. Each lender also has its own strategy, so while one lender may approve your mortgage, another may noteven when both are using the same credit score.

While there are no industry-wide standards for credit scores, the following scale from personal finance education website www.credit.org serves as a starting point for FICO scores and what each range means for getting a mortgage:;

;740850: Excellent credit; Borrowers get easy credit approvals and the best interest rates.

;670740: Good credit; Borrowers are typically approved and offered good interest rates.

;620670: Acceptable credit; Borrowers are typically approved at higher interest rates.

;580620: Subprime credit; It’s possible for borrowers to get a mortgage, but not guaranteed. Terms will probably be unfavorable.

;300580: Poor credit; There is little to no chance of getting a mortgage. Borrowers will have to take steps to improve credit score before being approved.

Recommended Reading: Aargon Collection Agency Bbb

What Is The Minimum Credit Score To Qualify For A Mortgage

There is no official minimum credit score since lenders can take other factors into consideration when determining if you qualify for a mortgage. You can be approved for a mortgage with a lower credit score if, for example, you have a solid down payment or your debt load is otherwise low. Since many lenders view your credit score as just one piece of the puzzle, a low score wont necessarily prevent you from getting a mortgage.

What Is A Good Credit Score

Reading time: 3 minutes

-

Different lenders have different criteria when it comes to granting credit

Its an age-old question we receive, and to answer it requires that we start with the basics: What is a credit score, anyway?

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report, including your payment history; the amount of debt you have; and the length of your credit history.

There are many different scoring models, and some use other data in calculating credit scores. Credit scores are used by potential lenders and creditors, such as banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. Its one factor among many to help them determine how likely you are to pay back money they lend.

It’s important to remember that everyone’s financial and credit situation is different, and there’s no “magic number” that may guarantee better loan rates and terms.

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit.

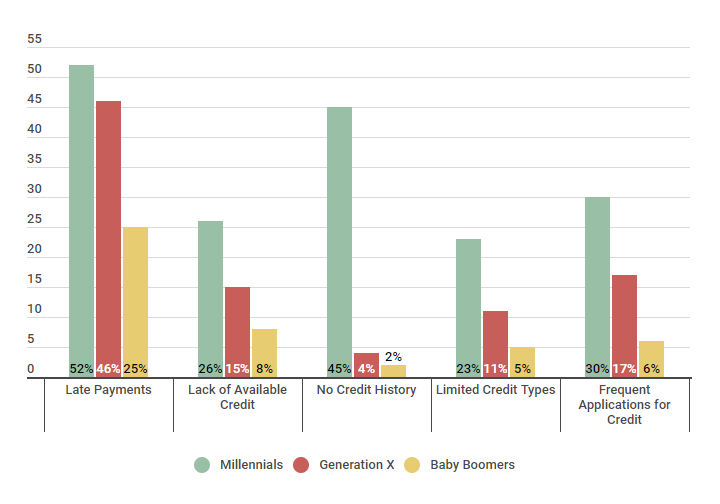

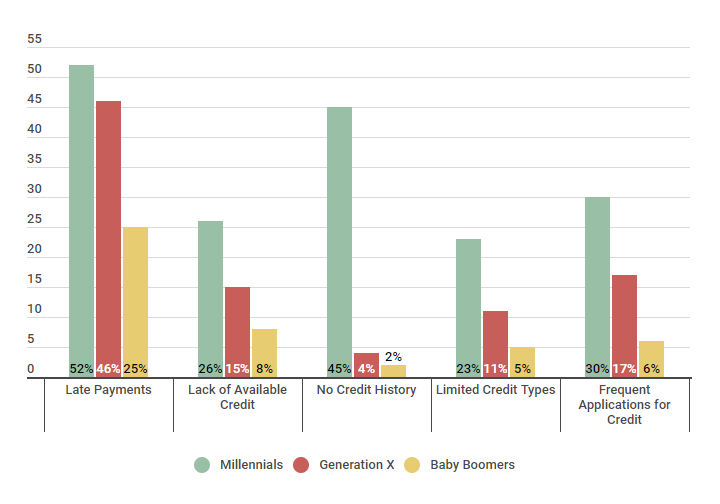

What Factors Impact Your Credit Score?

Also Check: 739 Credit Score Good Or Bad

How To Earn An Excellent/exceptional Credit Score:

Borrowers with credit scores in the excellent credit range likely haven’t missed a payment in the past seven years. Additionally, they will most likely have a credit utilization rate of less than 30%: meaning that their current ratio of credit balances to credit limits is roughly 1:3 or better. They also likely have a diverse mix of credit; demonstrating that many different lenders are comfortable extending credit to them.

Length Of Credit History

Lenders like to see that you can manage credit positively over a long period of time. This is generally measured by how long your current credit accounts have remained open.

Theres no shortcut to increasing the length of your credit history. But in the long run, keeping your old credit card accounts open, even after you get a new credit card, can help your credit age like a fine wine. At the very least, try to avoid closing your oldest credit account.

As someone with fair credit, you may be in the market for your first credit card. If thats the case, it pays to think ahead. Consider shopping around for a credit card that has no annual fee, so theres no pressure to close it if and when you graduate to a better card. You can compare offers for cards with no annual fee on Credit Karma to explore your options. Many of the cards available to people with fair credit tend to charge annual fees, but you might be able to find one that doesnt.

Don’t Miss: How To Get Credit Report Without Social Security Number

The Three Credit Reporting Agencies And Different Types Of Credit Scores

Equifax, Experian, and TransUnion are three major credit reporting bureaus. Each credit agency provides you with a credit score, and these three scores combine to create both your 667 FICO Credit Score and your VantageScore. Your score will differ slightly among each agency for many reasons, including their unique scoring models and how often they access your financial data. Monitoring of all five of these credit scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

New Credit And Credit Mix

Coming in at 10% with FICO and less influential for VantageScore are new credit accounts. Just like closing old accounts, you want to be careful about opening new ones. Opening new accounts creates uncertainty and can signal increased risk to lenders, which will bring your score down, at least in the short term.

As for credit mix called credit experience by VantageScore this is really where VantageScore and FICO differ. FICO only considers credit mix as 10% of your credit score while VantageScore weighs it as highly influential. This area accounts for the variety of credit extended to you, including credit cards, mortgages, student loans and car loans.

See related: 13 bad credit habits you need to break now

Don’t Miss: Innovis Consumer Assistance Letter

Is My Credit Score Good Enough For A Mortgage

Your , the number that lenders use to estimate the risk of extending you;credit or lending you money, is a key factor in determining whether you will be approved for a mortgage. The score isnt a fixed number but;fluctuates periodically in response to changes in your credit activity . What number is good enough, and how do scores influence the interest rate you are offered? Read on to find out.

Use Your Understanding Of Credit To Build Your Credit Score

The first step in your credit journey is understanding what a credit score is and how it is calculated. Once you know the basics about credit score, you can begin to improve your credit score. Doing so doesn’t simply improve your standing in the eyes of lenders, but it can also save you thousands of dollars in interest payments over the course of your lifetime.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

Also Check: Credit Score 524

What Does Not Count Towards Your 667 Credit Score

There are many things that people assume go into their 667 credit scores but that actually dont. Examples include how much money you earn, your age, your marital status, your child support payments , how much money you have donated to charity, where you work or live, or your employment history.

None of these things or anything like them do anything at all to your credit score, so instead, focus on the five primary factors that we outlined and discussed above.

Now that you know what counts towards your overall credit score and what does not, you should know exactly what you need to pinpoint in order to enhance your score. For example, maybe one reason your credit score is low is because youve opened several new accounts of credit.

Regardless, its important at this stage for you to positively identify what it exactly is that is lowering your credit rating. Once you have identified what that is, you can start to formulate a plan.

Dont Apply For Loans Or Credit Cards For At Least A Year

Once youve paid down your installment loans, I suggest you stop applying for loans and credit cards altogether. By this point, you should have a few credit cards in your wallet, a couple of paid off cars, and a mortgage.

When youre in this position, there is really no need to apply for more credit.

By not applying for credit, you wont get any hard inquiries on your credit report and this helps your credit score. If you need to apply for credit, just keep in mind the hard inquiries will stay on your credit for about a year.

Again, you should be in a situation by this point where you dont need anymore credit.

Also Check: Ccb/mprcc On Credit Report

Improving Your 755 Credit Score

A Credit Repair company like Credit Glory can:

An industry leader like Credit Glory can guide you through this process. Give them a call @ , or chat with them, today â

Inaccurate Credit Histories Are Common

Many people in this situation discover they have a few negative entries on their credit reports that are not accurate.

When you discover inaccurate credit information on your credit report, youll want to get that negative entry removed as soon as possible so your credit score can be all that it can be.

Unfortunately, when you apply for credit, credit card issuers and other lenders wont care whether your credit score doesnt really reflect your actual credit risk. No matter how well you explain things, the lender will rely on what myfico says.

The terms of your new car loan or personal loan will reflect this reported credit risk. In other words, youll pay higher interest rates because of your inaccurately low score.

When you have worked hard to establish a long history of on-time payments and responsible credit utilization, these kinds of lending decisions are beyond frustrating!

So removing inaccurate credit information from your credit history is a must. Doing this should restore your credit history within a couple months.

There are a couple ways to go about it:

- Do It Yourself Credit Repair: You can call the lender who reported incorrect credit information and ask that they correct the inaccurate data. I always recommend handling this in writing.

- Professional Credit Repair: If youre the type of person who would rather pay a professional handle it and just be done with the whole thing, I suggest you check out Lexington Law.

Also Check: How To Remove Items From Credit Report After 7 Years

What Is A Good Credit Score To Buy A Car

According to Experian’s analysis of auto loans in the first quarter of 2019, borrowers who received financing for a new car had an average credit score of 716, while borrowers who received financing for a used car had an average credit score of 657.

In its analysis of auto loans, Experian separates current auto-loan borrowers into five categories based on credit scores:

- Super prime

- Subprime 12.42%

- Deep subprime 14.97%

Interest rates tend to be even higher for used car loans, reaching 17.52% for subprime borrowers and 20.24% for deep subprime borrowers.

Some auto lenders may also require a cosigner for those with lower credit scores. A cosigner is somebody with established credit who legally agrees to take responsibility of paying back the loan if the primary borrower fails to do so.

A Good Credit Score Is In The Eye Of The Beholder

Although the FICO and VantageScore charts above display a general idea of how lenders may interpret different credit score ranges, lenders and other companies can, and often do, differ in their opinions of creditworthiness.

For example, just because youre considered to have a good credit score to an auto dealer doesnt mean a mortgage lender would consider that same score to be a good credit risk. Each lender has their own criteria for credit scoring as well as their own thresholds for a good score vs. a bad score.

Recommended Reading: Why Is There Aargon Agency On My Credit Report

Paying Your Bills On Time

While paying each of your bills on time may seem like the most obvious way to improve your credit score, its also the most important one. There is nothing that will harm your credit score as much as having a series of late payments on anything from car loans to mortgage loans. This is why it is extremely critical that you always make the minimum monthly payments by the determined date each month WITHOUT ANY EXCEPTIONS.

Even skipping just one mortgage payment is going to have a detrimental effect on your credit score. Sorry if that sounds cruel, but its the truth, and it should serve as your primary source of motivation for making your payment on time.

Heres an important fact to keep in the back of your mind: every time that you fail to make a monthly payment when you are required to do so, whether it be on a car or your home or anything else, it will be on your credit history and thus impact your credit score for up to seven years. Seven years. Think about that.

Now, one primary benefit to using a credit card here is that you can choose how much money you spend while using them, and then also determine how much you pay back each month, so long as that amount is equal or greater than the minimum payment you owe.

The reason why this is a benefit to you is because it allows you to budget your money accordingly and make the smartest financial decisions you can. In other words, you can avoid going into serious debt.

Some Auto Lenders May Use A Specific Credit

When deciding whether to extend a loan, auto lenders may use a specific Fair Issac Corporation credit-scoring model called the FICO Auto Score. The FICO Auto Score is a variation on the general scoring model, designed specifically to predict the risk of a borrower defaulting on car payments. It ranges from 250 to 900, according to Experian.

Many auto lenders will consider more than a credit score, though. A borrower’s debt-to-income ratio, full credit history, and down payment amount will also affect the terms of the loan.

Also Check: Is 524 A Good Credit Score

Can I Get A Mortgage & Home Loan W/ A 667 Credit Score

Getting a mortgage and home loan with a 667 credit score is going to be difficult. Can it be done? Maybe, but thereâs a few simple steps you can take to guarantee less headaches and higher chance of success.

The #1 way to get a home loan with a 667 score is repairing your credit.

After a few short months of repairing your credit , youâll be in a much better position to get your ideal home loan terms.

How Your Credit Scores Are Set

Canadian credit scores are officially calculated by two major credit bureaus: Equifax and TransUnion.

They use the information in your credit file to calculate your scores. Factors that are used to calculate your scores include your payment history, how much debt you have and how long youve been using credit.

Pro Tip:;You can view sample credit scores summaries from each bureau to get a sense of what to expect.

Recommended Reading: Paypal Working Capital Phone Number

Credit Score: Is It Good Or Bad

A FICO® Score of 667 places you within a population of consumers whose credit may be seen as Fair. Your 667 FICO® Score is lower than the average U.S. credit score.

17% of all consumers have FICO® Scores in the Fair range

.

Statistically speaking, 28% of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future.

Some lenders dislike those odds and choose not to work with individuals whose FICO® Scores fall within this range. Lenders focused on “subprime” borrowers, on the other hand, may seek out consumers with scores in the Fair range, but they typically charge high fees and steep interest rates. Consumers with FICO® Scores in the good range or higher are generally offered significantly better borrowing terms.