Find Out How To Discover Derogatory Marks On Your Credit Score Report

To seek out out which derogatory marks are at the moment energetic, youll must order your free credit score report from every of the main credit score bureaus. Completely different collectors might solely report data to sure credit score bureaus, so its important to get all three. The Honest Credit score Reporting Act permits you to request a free credit score report each 12 months from every credit score bureau.

When youve downloaded your credit score reviews, scour every one rigorously. A few of the credit score bureaus enable you to discover derogatory credit score objects rapidly. Equifax, for instance, provides a fast abstract on the prime of your credit score report that lists probably unfavourable data.

You should use this as steerage for recognizing derogatory marks. Nonetheless, its nonetheless a good suggestion to have a look at every web page individually. First, test for delinquencies beneath all your accounts. Then, have a look at something listed beneath Adverse Accounts, Collections, and Public Data .

The Basics Of Disputed Accounts

It will help you to understand some basics of dispute wording:

- How the dispute wording got there.

- How to find disputed accounts.

- How to know when it is it is not necessary to remove dispute wording from an account.

- How to avoid damage your credit scores when removing dispute wording

How the Dispute Wording Got On Your Credit Report

Dispute wording can be put on a credit report account by the creditor, by one of the credit bureaus: Experian, Equifax, or TransUnion, or by both. Understanding that there are two sources of dispute wording guides our strategy for making sure we remove the dispute wording permanently. Your creditors furnish the current data on your accounts to one or more credit bureaus every month. So you will often see creditors referred to data furnishers. They are one in the same.

Dispute Wording Caused by Contact from You to the Creditor

Accounts are put in dispute by when they receive a question or complaint by direct contact from the consumer. Most dispute wording gets on your credit report because of routine, informal contact by the consumer to the creditor. When you notify a creditor, in any manner, that you disagree with any of your account information, the creditor must flag the account as disputed to avoid violation of federal law. Creditors have been sued for failing to mark disputed credit report accounts so they are very sensitive to any communication from you about your account.

Dispute Wording Caused by Contact from You to a Credit Bureau

Getting A Skilled To Assist With Disputes

For those who can spare the comparatively low value of hiring a credit score restore firm to assist along with your disputes, it might be a worthwhile expense.

A top quality credit score restore agency usually has a decade or extra of expertise dealing with derogatory mark disputes. They know the regulation inside and outside in order that theyll take the absolute best strategy at disputing every merchandise.

We suggest Lexington Regulation Agency. Theyve attorneys and paralegals on workers that will help you. You possibly can learn our full overview of them right here. Past the technical experience, a credit score restore firm additionally saves you the time and aggravation it takes to supervise disputes, particularly if in case you have a number of.

Read Also: Is Credit Wise Score Accurate

Consider Contacting A Data Furnisher

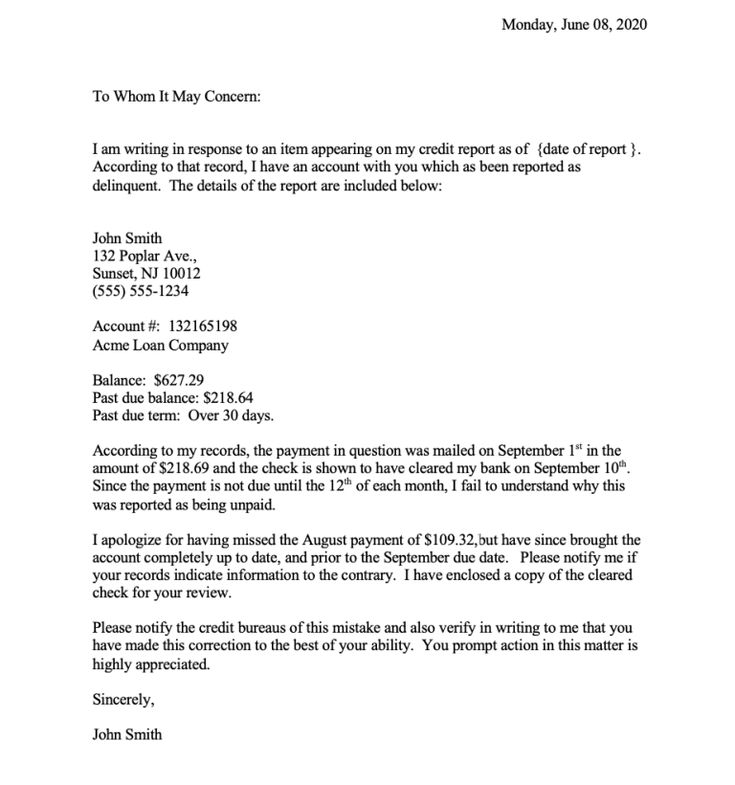

When disputing credit report errors, the FTC recommends sending a dispute letter to the data furnisher as well. A data furnisher is a financial institution, such as a lender or credit card issuer, that provides data to the credit bureaus. Each credit report that includes the error should list the furnishers name and address. If you dont see an address listed, contact the company.

Once you submit your dispute to the furnisher, it has 30 days to conduct an investigation. If it finds that the information youre disputing is inaccurate, it is required to notify each credit bureau it has reported the information. However, if the information is found to be accurate, it will remain on your credit report.

Two Different Types Of Dispute Comments

Variation 1 Account disputed or account disputed, investigation in process

While either of these comments is present on an account on the credit report, the particular account will not factor into the credit score. So Lenders normally want these two types of dispute comments removed, especially from negative accounts.

If the account reflects the first variation of account disputed, then the dispute comment may stay on the credit report indefinitely.

However, if a re-investigation is in the process, it indicates the credit bureaus are conducting an investigation and within 30 days, they will either update or remove the account.

In addition, the bureaus may change the comment to simply account disputed, which will keep the account from being factored into the score. They can also update the comment to show the dispute resolved, as explained next.

Variation 2. Account was in dispute-now resolved The account will reflect this comment, following the completion of a dispute investigation by the credit bureaus. However, with this comment, the account will be factored into the credit score. For this reason, banks and prospective lenders will not take notice of this particular type of dispute comment.

You May Like: How Long Do Repossessions Stay On Your Credit

How Do I Clear My Bad Credit History

How to Clean Up Your Credit Report

What To Do If Your Dispute Is Rejected

If you disagree with the results of the dispute, you can gather more evidence and attempt to dispute the item again. You can also add a statement of dispute that appears next to the line item whenever your report is accessed by a lender. Some lenders only look at numbers but it may help, for example, if a potential landlord pulls your report during the tenant approval process.

Recommended Reading: What Is Factual Data On Credit Report

Wait Out The Credit Reporting Time Limit

If all else fails, your only choice is to wait for those negative items to fall off your credit report. Fortunately, the law only allows most negative information to be reported for seven years. The exception is bankruptcy, which can be reported for up to 10 years. The other good news is that negative information affects your less as it gets older and as you replace it with positive information. The wait may not be as difficult as youd think. Consumers can request their own credit report for free every 12 months from the three major reporting agencies. So, to be sure, you should request a report after the aging period to confirm.

It is important to note, however, that while the credit reporting agency will generally delete the negative information from the report after the seven-year aging period, information may still be kept on file and can be released under certain circumstances. Those circumstances include when applying for a job that pays over a certain amount, or applying for a credit line or a life insurance policy worth over a certain amount. Depending on where you live there may be more favorable regulations under state law, such as a shorter statute-of-limitations. You should contact your state’s Attorney General’s office for more information.

In the meantime, you can improve your credit by making timely payments on accounts you still have open and active.

How To Get A Dispute Status Off Your Credit Report

The following tips can be used to get a dispute status off of your credit report. The best case scenario is that you have a few months to take care of this, but if you need to get this done in a hurry, these tricks will work, too. Make sure you acquire all three credit reports to verify if the dispute is showing on all the bureaus or just one or two of them.

If the disputed account is showing on your TransUnion report, you can call them directly at 800-916-8800 to request a customer-initiated dispute be removed and they will do it immediately.

At Equifax, you will need to write to Equifax Consumer Services LLC, P.O. Box 740256, Atlanta, GA 30374-0256, requesting that the dispute be removed from your report.

As for Experian, they state the dispute should fall off a credit report automatically once the dispute is resolved. In this instance, they said, you would be entitled to an extra free report because the loan has been delayed by the dispute statement. Go to www.experian.com/reportaccess and follow instructions to get a free report, indicating that adverse action was taken. If the dispute statement is still there, the free report will show it, and will also provide contact information to get in touch with Experian, if need be.

Recommended Reading: What Does Thd Cbna Stand For

How Do I Remove Negative Items From My Credit Report For Free

You can remove negative items for free, but youll have to invest some sweat equity in the form of time and attention. If youre watching every penny, its good to know you can get your credit reports and submit disputes for free.

You start your cost-free DIY odyssey by ordering a free credit report from AnnualCreditReport.com. This source is authorized by the federal government to give you a free annual credit report from each consumer reporting company: Equifax, TransUnion, and Experian.

If after scouring your reports you identify items you wish to dispute, you can do so for free online, thereby saving the cost of paper, ink, and postage.

Because youre going it alone, youll have to do the record-keeping and dispute tracking that a credit repair service would have done for you. This will take up your time, but you neednt shell out any money to do the job.

Perhaps you would like to make the job easier by spending just a little money. If so, consider a software package as an alternative to support from a credit repair service. For example, offers software-as-a-service for less than $20 per month that supports consumers who wish to dispute items on their credit reports.

Credit repair services can range from about $80 to $150 a month. As mentioned earlier, these companies aim to have you , so costs may run anywhere from $300 to $900 for the period. Thats how much money youll save if you do it yourself.

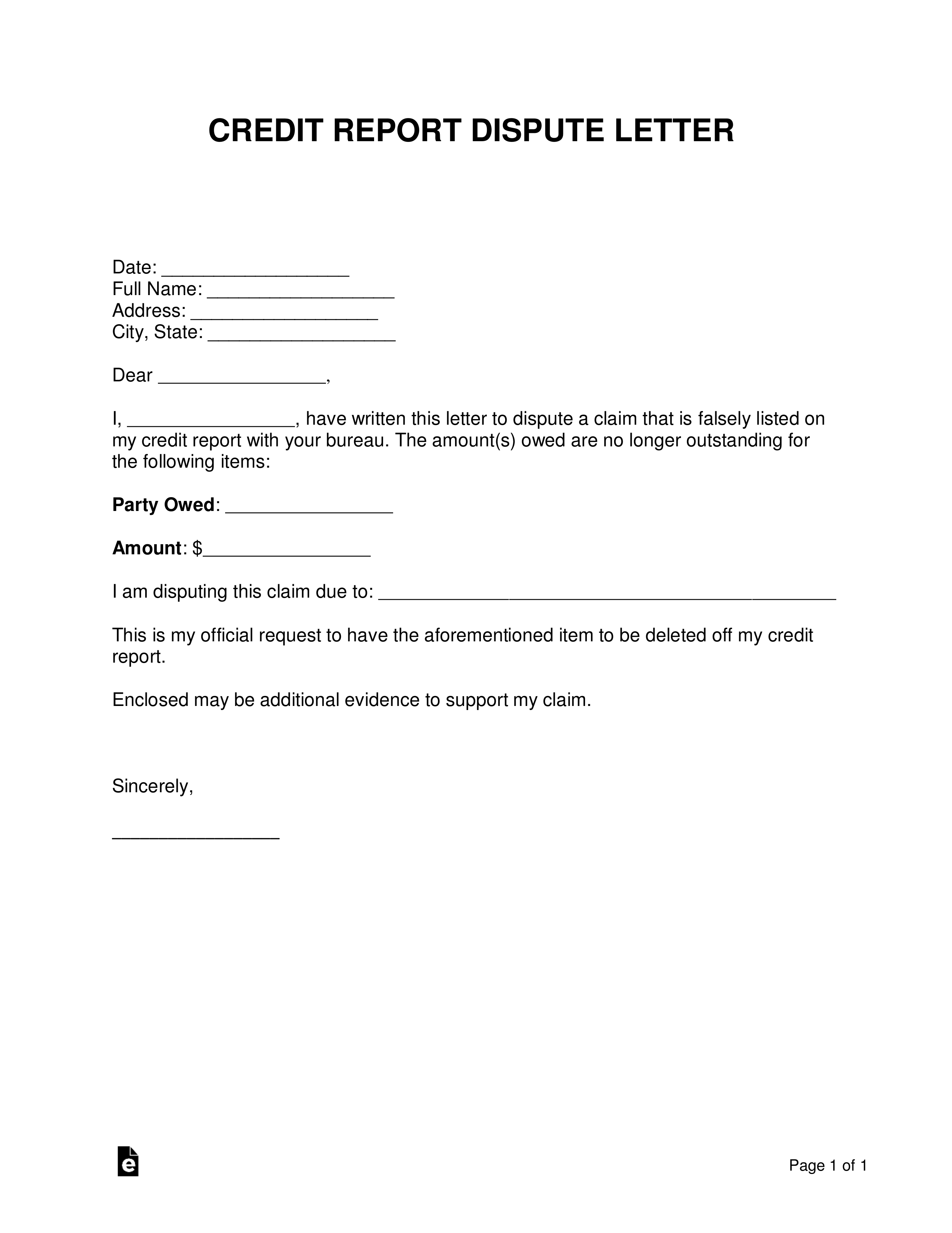

Dispute Credit Report Errors

All three bureaus have an online dispute process, which is often the fastest way to fix a problem, or you can write a letter. You can also call, but you may not be able to complete your dispute over the phone. Here’s information for each bureau:

How to dispute Equifax credit report errors

-

Write to Equifax, P.O. Box 740256, Atlanta, GA 30374-0256.

-

See our guide on how to dispute your TransUnion credit report for details.

Don’t Miss: Procedural Request Letter To The Credit Bureaus

Hard Inquiries Should Be Removed After 2 Years

The only way that a dispute will work is if the inquiry appears in error on your credit report. Fortunately, hard inquiries only appear for two years on your credit report. Most other negative information will remain for seven years. A Chapter 7 bankruptcy remains for up to 10 years, though its effects on your credit score are much more short-lived.

Do Your Research & Check All Credit Reports

To get details on your collection account, review all of your credit reports. You can do this by visiting AnnualCreditReport.com. Normally, you can only get one free copy of each report annually. However, due to the Covid-19 pandemic, you can check your reports from all three credit bureaus for free weekly until April 20, 2022.

Your credit report should list whether the collection is paid or unpaid, the balance you owe and the date of the accounts delinquency. If you dont know who the original creditor is and its not listed on your report, ask the collection agency to give you that information.

Afterward, compare the collection details listed on the credit report against your own records for the reported account. If you havent kept any records, log into the account listed to view your payment history with the original creditor.

Also Check: 611 Credit Score Auto Loan

How To Remove Negative Items From Your Credit Report

First, it’s important to know your rights when it comes to the information in your credit history.

Under the Fair Credit Reporting Act , credit bureaus and lenders must ensure that the information they report is accurate and truthful.

This means that, if you find mistakes in your , you have the legal right to dispute them. And, if the information disputed is found to be incomplete or erroneous, the bureaus are obligated to remove it from your record.

Some common credit report errors include payments wrongly labeled as late or closed accounts still listed as open. It’s also possible for your report to include information from someone else, possibly someone with a similar name, Social Security number, or identifying information.

Bear in mind that correct information cannot be removed from your credit report. So, if your score is being dragged down by accurate negative information, youll need to repair your credit over time by ensuring you make payments on time and decrease your overall amount of debt.

Here are some tips to help you repair your credit history:

Check All Three Credit Reports For Errors

Through April 2022, youre entitled to free weekly credit reports from the three major credit reporting bureaus: Experian, Equifax and TransUnion. Request them by using AnnualCreditReport.com.

There may be small differences among your reports, because some creditors dont report your account activity to all three bureaus. But if negative information has popped up on one report, its wise to see whether its also on the other two.

There is no cost to dispute credit report errors, and you can dispute as many items as you like. Filing a dispute does not hurt your credit score, but the result of the dispute may have an effect on your score.

You May Like: Notify Credit Bureau Of Death

Which Credit Report Errors Aren’t Worth Disputing

Small errors that dont affect your score like a misspelled former employer name or an outdated phone number dont hurt anyones assessment of your creditworthiness and aren’t worth disputing.

And sometimes a negative mark might surprise you but is not an error. If its accurate, don’t use the dispute process. Instead, try to resolve the problem directly with the creditor. For example, if you accidentally missed a payment, contact the creditor, arrange to pay up and ask if it will rescind the delinquency so it no longer appears on your reports.

The credit agencies are not obligated to investigate “frivolous” claims.

How Long Will It Take To Remove Dispute Remarks From Your Credit Report

Ideally, it should take between 24 to 72 hours to get any dispute remarks removed from your credit report. However, if you couldnt reach them on the phone and sent the request by mail instead, the process could take about a month or so.

For some reason, if youre unable to get the dispute remark removed, you can try contacting the original creditor/collection agency directly to request that they remove the comment asap. In case youre wondering, YES, if you still owe them money, they will use this opportunity to attempt to collect on that debt. With this in mind, weigh your options and plan accordingly. They cannot try to negotiate payment in exchange for removal of your dispute remark.

You Can Refile Your Dispute in the Future

If you took an account out of dispute for the sole purpose of being approved for a home loan, you can re-dispute the account after you have closed on your new home. This will give you an opportunity to dispute the item for permanent removal from your credit reports.

Don’t Miss: How To Get Inquiries Off Your Credit Report

How To Remove Hard Inquiries From Your Credit Report

Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

A hard inquiry is a record of every time that a creditor or lender runs your credit report to help decide what kind of credit or loan to grant you. When someone runs a credit check, it harms your credit score. Given the potential harm, you should look to remove as many hard inquiries as possible. This article takes you through how to remove hard inquiries from your credit report. It discusses which hard inquiries are removable and the specifics of disputing them.

Navigating your credit score can be confusing, since there are many personal finance factors to deal with. One issue is âhard inquiries.â A hard inquiry is a record of every time that a creditor or lender runs your credit report to help decide what kind of credit or loan to grant you. When someone runs a credit check, it harms your credit score. Given the potential harm, you should look to remove as many hard inquiries as possible.

This article takes you through how to remove hard inquiries from your credit report. It discusses which hard inquiries are removable and the specifics of disputing them.

Documentation To Provide For Your Dispute

In addition to the above, you’ll need to provide:

-

Proof of identity

-

Your Social Security number and date of birth

-

A copy of government-issued identification

-

Your current address and past addresses going back two years

-

A copy of a utility bill or bank or insurance statement that includes your name and address

Recommended Reading: Aargon Agency Phone Number