How To Use Affirm Payments

Affirm is a buy now, pay later service that allows you to make in-store and online purchases without paying the total bill upfront. Its a good choice for any consumer who needs to break down large payments into more manageable installments.

So, how does Affirm work? Well walk you through everything you need to know in this article.

How Can You Use Klarna At Walmart In

The process for using Klarna at Walmart is similar to the method for Quadpay. You have to first install the Klarna app and search for the Walmart store inside the app.

Once there, you can either add items to your cart and proceed to Pay with Klarna or specify the total amount you want to pay in-store at Walmart.

Once you have completed the initial transaction, you will have the freedom to complete the purchase through 4 easy installments, with each paid once every 2 weeks.

You May Like: Paypal Credit Soft Or Hard Pull

When Is A Loan Preferable To Using A Credit Card

As Hynds noted, a 0% installment loan can be helpful if you’re planning to make a large purchase but don’t have enough money to pay off your balance immediately. It might be a better option than racking up debt on a credit card, the average interest rate of which is currently 17.73%, according to . But only if you qualify for a low rate.

If you assess your budget and determine you can afford the payments, then you’ve locked yourself into a set schedule for repayment, rather than taking on revolving debt. That will save you in the long term.

One factor to watch out for, depending on the loan company: Deferred interest, which means that if you don’t pay off your entire loan within the agreed upon 0%-repayment period, extra interest will be added to your balance. And that could set you back hundreds of dollars, depending on the interest rate.

Hynds said Affirm performed a soft credit check to see if she qualified for the 0% loan. That didn’t impact her credit, but it’s important to remember that if you miss a loan payment, your credit score can take a hit just like if you missed any other bill.

“While they may seem like a more convenient or sometimes safer option than credit cards, at the end of the day, these loans often get reported to credit bureaus,” Adrian Nazari, founder and CEO of , tells CNBC Make It. “When consumers do not exercise caution to obtain these loans, it could end up being detrimental to their overall credit health.”

Don’t Miss: Is Creditwise Fico

Affirm Makes It Easy To Go Into Debt

Lets talk a little about how Affirm works.

You have to download the app or go to Affirms website to create an account. Account holders have to be at least 18 and be a permanent resident or citizen of the U.S. You hand over your personal infolike your cell number, email address and the last four digits of your Social Security number. And you have to agree to receive texts from Affirm. Oh, and dont forget, you need a decent credit score too.

Affirm works with thousands of sites and stores. In fact, as of August 2021, even some Amazon customers can go this route. As youre checking out, you just select Affirm as your payment method.

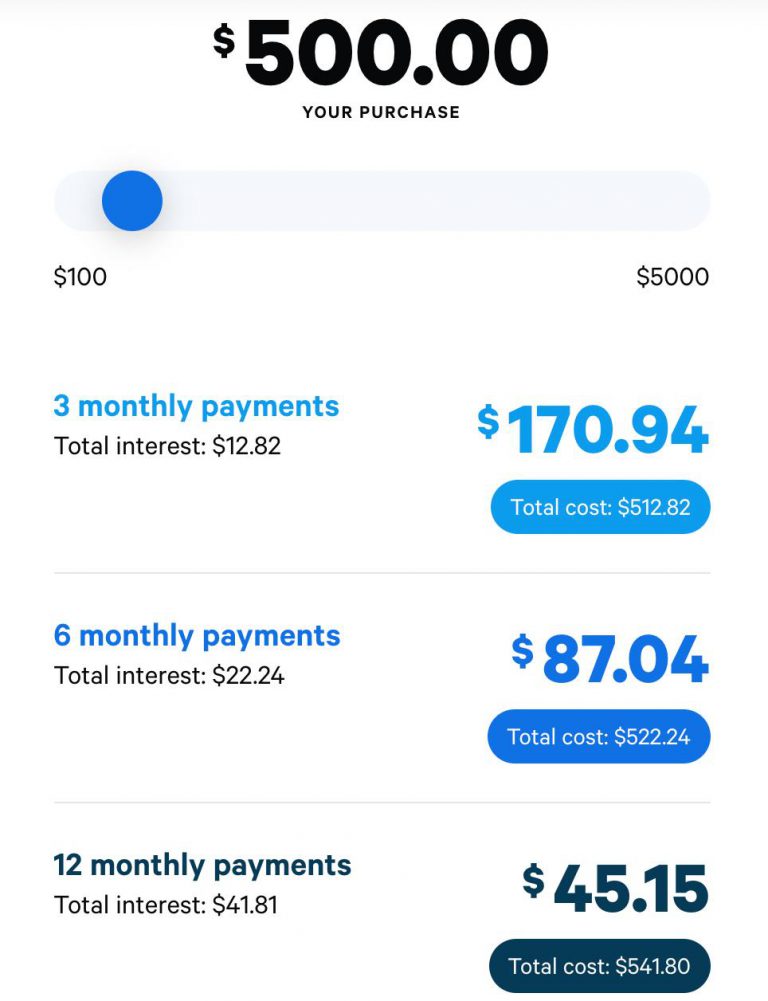

Then you pick if you want to pay for the item for three, six or 12 months . Once you select the financing option and click to purchase the item, Affirm pays the company, and then you have to pay Affirm the amount of the purchase, plus interest.

And lets talk about that interest. Remember, Affirm is banking on you paying as much interest as possible so they make more money. The idea of paying off an item in lots of little payments may seem so much more manageable to your budget. It feels like a good idea. But the longer you take to pay, the more you pay. Trust us: Thats nota good idea for your budget .

Side note: Affirm checks your credit to make sure youre eligible for the loan. The check itself wont affect your credit score, but late payments can. Well cover that gem more in a moment.

Start Raising Your Credit Score Today

An Affirm loan is a quick and easy way to finance large purchases at point-of sale. Offered at over 2,000 companies including Walmart, Wayfair, Casper, and Expedia, Affirm is known for requiring a soft credit check with no hidden fees.

In the sections below, we will discuss the Affirm loan in greater detail as well as how it will affect your credit.

What is an Affirm loan?

An Affirm loan is a point-of-sale payment plan that consists of monthly installments for consumers who are new to credit and want to make a large purchase. The companys point-of-sale financing appeals to many new buyers with since there is no minimum credit score required and no prior credit history requirements.

Affirm uses what is called a soft credit check, a soft credit inquiry that doesnt affect your credit score, to process their borrowers applications for approval.

Lenders at Affirm will also take a look at the extent of your credit and payment history. The company might even ask for a deposit or want to peer over your bank transactions to get a general idea of your spending habits before offering you a loan.

If youve already used a lot of credit and arent the sharpest at making payments, theres a good chance you wont get approved.

Pros and cons of Affirm personal loans

If youre trying to decide if an Affirm loan is the right choice for you, weigh the pros and cons. Here is a quick breakdown:

Pros:

A few other things you should know about Affirm loans:

TELL US,

Read Also: Does Balance Transfer Affect My Credit Score

How Do Affirm And Afterpay Work

With the Affirm app, you can shop online at your favorite participating stores. When you are ready to check out, select Affirm, enter some personal information, and youll receive a real-time approval decision. Next, select the payment schedule that works for you. Payment plans will vary based on duration, number of installments, and interest rate. Finally, make your monthly payments. Affirm will send you email and text reminders to help ensure that you dont miss a payment.

Like Affirm, Afterpay is an app that allows eligible shoppers to buy now and pay later. However, unlike Affirm, Afterpay does not charge any interest. After using the app to make a purchase, you can split your payments into four equal installments, although you do have to make an initial payment at the time of purchase. You then have six weeks to pay the remaining balance. You can use Afterpay online at checkout or you can use it in-store. To use Afterpay in a physical store, you will have to create a digital Afterpay card on the app that you can add to your Apple Wallet or Google Pay to make your purchase.

You can also use the app to check your balance and next payment due date. Note that if you miss a payment with Afterpay, you wont be able to use it to buy anything else until you settle your account.

Affirm Review: Affirm Pros And Cons

| Pros | |

|---|---|

| No upfront fees for loans | Interest rate offered can be high |

| Easy to receive a quote and sign up | Taking a loan can affect your credit rating |

| Can make purchases with regular monthly payments rather than an initial lump sum | Affirm does not report on-time payments to credit bureaus |

| Some merchants offer zero-interest loans | |

| No fee to pay back early |

A good way to see others opinions and experience of Affirm is to check reviews with sites like Trustpilot .

Affirm generally gets very positive reviews through Trustpilot. As of June 2021, 86% of Affirm reviews were in the top excellent category, with only 9% rated bad.¹

Some positive references include the easy-to-use system and the ability to repay early. The impact on credit score for missed payment is a common frustration.

Don’t Miss: What Credit Score Do You Need For Affirm

Dont Consider A Travel Loan If:

-

The APR on the loan is high: Consumer advocates say that a 36% APR is the highest rate a loan can have and still be affordable, but even a lower rate is sometimes not worth the cost. For example, a $3,000 loan with a 15% APR paid over 12 months would cost $250 in interest.

-

Youre struggling to pay off your current debt: If you carry a balance on credit cards or other loans, be careful about agreeing to more monthly payments. Too much debt can lead to a cycle of missed payments, fees and collection calls.

-

It tempts you to spend more than you can afford: A fly now, pay later loan can make it seem like youre spending less than you really are, since you dont have to pay the full amount upfront.

-

It takes money from your other goals: If the extra payments for this trip would eat into your emergency fund or other savings goals, it may be worth postponing the trip and saving up instead.

Also Check: Fingerhut Guitars

The Financing Options Offered By This Leader In The Buy Now Pay Later Field

Buy now, pay later is a financing method that more Americans are using to make discretionary purchases, especially online ones. In fact, at least 39% of consumers have tried this option, also known as a point of sale installment loan, at least once, according to a 2021 survey from the Strawhecker Group. One of the biggest players in this fast-growing financing field is Affirm .

Established in 2012 by CEO Max Levchin, who co-founded the company that eventually became PayPal, Affirm trades on Nasdaqit went public in January 2021and has a market capitalization of $13.9 billion.

Affirm purports to offer a new spin on consumer financing: helping people afford to buy the things they want without getting into unmanageable debt. Here’s a closer look at how Affirm works and the pros and cons of its short-term installment loan arrangements.

Don’t Miss: How To Remove Repossession From Credit Report

Does Affirm Report Your Activity To Credit Bureaus

Affirm generally will report your payment history to one credit bureau: Experian. There are a couple of cases where it wont, however:

- Youre paying back a four-month loan with biweekly payments at 0% APR.

- You were offered just one option of a three-month loan at 0% APR during checkout.

If you pay late, Affirm will report this to Experian without exception. In the two cases above you dont get any credit for making on-time payments, but, if you pay late, Affirm will report this.

Do Not Pay Your Accounts In Collections

If a collection agency will not remove the account from your credit report, dont pay it! Dispute it! A collection is a collection. It doesnt help your score AT ALL to have a bunch of collections on your report with a zero balance. The only way your credit score will improve is by getting the collection accounts removed from your report entirelly.

Dont pay collection accounts without a pay for delete letter. A pay for delete is an agreement that you will pay the outstanding debt if the collection company deletes the account from your report. You may be able to settle the balance for less than you owe, but many will want you to pay in full if they are deleting it from your report.

Also Check: How To Get Credit Report Without Social Security Number

Read Also: Does Titlemax Report To Credit Agencies

How Does Affirm Make Money

Affirm makes money on the interest it charges for its consumer loans as well as fees paid by the merchants to handle payments on their behalf.

So far, the firm has stirred away from focusing on any other income channels. Given that the global market for online payments is valued at almost $5.5 trillion, theres plenty of money to be made within its current business model.

Lets take a closer look at each of the two revenue streams down below.

You May Like: Paypal Credit Soft Pull

How Does Affirm Work

Affirm works by offering you a short term installment loan where you can spread out payments for the product you are purchasing over several weeks or months rather than paying it all upfront. When you go to check out after online shopping, Affirm may be listed as a payment method. You usually apply and can get approved within seconds to take on a short term loan with Affirm. Once youre approved, youll make a small down payment and then set up an arrangement where you agree to make payments on the rest of the balance over a specified period usually a few weeks or months.

Lets pause here for a second. Because holy crap! Taking on a loan to buy every day products. This is wild. Lets do an example purchase. So, I just logged onto walmart.com and added a BBQ grill to my shopping cart, total of $192. In my shopping cart, it shows me my total, of $192. Below my total it says $18/mo with Affirm. So I click it, and it shows me this screen:

Its wild to me that Affirm doesnt have to explicitly state that you are taking on a loan. Its not that you just get to make lower monthly payments to the merchant your buying from but rather, youd be taking on a loan with a third party Affirm. Walmart pays Affirm a fee and yet none of that is stated upfront. Just that you can have this expensive product, for only $18/mo.

Read Also: 8773922016

How Does Affirm Approve Borrowers For Loans

Affirm will ask you for a few pieces of personal information your name, email, mobile phone number, date of birth, and the last four digits of your social security number. Affirm uses this information to verify your identity and to make an instant loan decision. Affirm will base its loan decision not only on your credit score but also on several other data points about you. This means you may be able to obtain financing from Affirm even if dont have an extensive credit history.

Affirm Review: Instant Personal Loans With High Interest Rates For Consumer Purchases

In general, we wouldn’t recommend using Affirm to finance your purchases due to high interest rates and preferable financing alternatives. Affirm allows consumers to finance purchases at more than 1,000 online retailers, such as Wayfair, Expedia and Reverb, by offering an instant loan option at checkout or by applying for a one-time-use virtual card that can be used online or in select stores. It is essentially a combination of a credit card and personal loan, allowing consumers to purchase items usually bought with a debit or credit card and pay for them in high-interest monthly installments.

- on Affirm’s secure website

Generally speaking, we don’t recommend that consumers use personal loans to pay for discretionary purchases, such as TVs or furniture. Affirm only makes sense if you can qualify for the company’s interest-free financing, which is offered in more than 150 partner merchants, or if you want to finance educational or medical services. If you can’t qualify, you’re better off looking for a 0% interest credit card.

| Pros | |

|---|---|

|

|

You May Like: How Are Account Numbers Displayed In A Credit Report

Is There An Alternative To Affirm

Yes! Use a sinking fund in EveryDollar. This free budgeting app has a special feature that makes it super easy to save up for something. Instead of letting Affirm tell you how much to pay over an amount of time , do some math on your own.

How much would you have to sock away to be able to pay for that vacation or vegan leather jacket in three, six or 12 months? Instead of paying Affirm, pay yourself. Set up a fund and stick the money in there.

Guess whatthere are no late fees or penalties with sinking funds! And no interest. When you hand someone cash for an item youve saved up for, youre going to actually own it instead of owing for it. You can come back from vacation with memories, not debt. You can wear your jacket knowing its actually yours.

Affirm is all about entitlement: You deserve this stuff now. Were all about budgeting and savingthats empowerment.

Listenthe wolves are on the prowl. They want control of your money. But its your money. Take control. Become empowered by learning how to ditch all your debt , budget with confidence, and save real cash for emergencies.

Youll learn how to do all of that with Financial Peace Universityavailable only in a Ramsey+ membership. Plus, youll get the premium version of EveryDollar . And right now, you can try it for free. Dont give in. Dont put this off. Start your Ramsey+ free trial today.

About the author

Ramsey Solutions

Bnpl Plans Can Help You Build A Good Credit Historyor Get You Into Trouble

Buy now, pay later plans allow shoppers to pay for purchases in four or more installments, often interest-free. Dubbed BNPL for short, these point-of-sale installment loans are rising in popularity as people spend more time shopping online.

Overall, 60% of consumers say they’ve used a BNPL service at least once, and 51% did so during the past year. Though BNPL plans offer some attractive features, it’s important to understand what they can mean for your . We highlight some of the basics of buy now, pay later plans as well as some of the most common ones.

You May Like: Is 626 A Good Credit Score