How Does A Late Payment Impact My Credit Score

If youve recently missed your payment, you still have some time before it affects your credit score. Late payments arent reported on your until theyre at least 30 days past due. After that, itll be placed into one of these buckets:

- 30 days past due

- 150 days past due

- Charged-off

If youre late on making a payment, your provider will report it based on this schedule. The later it is, the more damage it will cause to your credit score. For example, a 150-day late payment will drop your credit score more than a 30-day late payment. This is why even if youre late, its best to pay it off as soon as possible so that it doesnt harm your score more.

In addition to how late your payment is, a few other factors related to late payments can affect your credit score, including the:

- Balance you owe with each late payment

- Number of late payments on your report

- Time elapsed since you made the late payment

- Number of other on-time payments youve made

Related:How To Review Your Credit Report

Common Questions About Credit Reporting

What information do you send to the credit reporting agencies?

We send a range of account information, including loan or lease amount, account balance, scheduled monthly payment, payment history and account status.

I missed a payment. Can you make a goodwill or courtesy adjustment and remove it from my credit report?

The information we report is required to be complete and accurate. Because of this, we dont make goodwill or courtesy adjustments. We understand that you may be concerned about the potential impact of a late payment. Learn more about credit reporting information, including tips for raising your credit score.

When is a payment reported as late on my credit report?

A payment may be reported as past due if its received 30 or more days after the due date.

How can I get a copy of my credit report?

Youre entitled to a free credit report every 12 months from each of the three major credit reporting agencies. To get your report or for more information, go to annualcreditreport.com

How do I correct an error on my credit report?

If you think weve reported information incorrectly, you can dispute it with us and/or with the credit reporting agency.

Fort Worth, TX 76101-2003

You can also provide the information directly to the credit reporting agencies by calling them at the numbers listed below:

Experian: 1-800-493-1058

TransUnion: 1-800-916-8800

My account charged off but I paid the balance. Why is the charge-off still showing on my credit report?

Use Credit Monitoring To Track Your Progress

are an easy way to see how your credit score changes over time. These services, many of which are free, monitor for changes in your credit report, such as a paid-off account or a new account that youve opened. They typically also give you access to at least one of your credit scores from Equifax, Experian, or TransUnion, which are updated monthly.

Many of the best credit monitoring services can also help you prevent identity theft and fraud. For example, if you get an alert that a new credit card account that you dont remember opening has been reported to your credit file, you can contact the credit card company to report suspected fraud.

You May Like: Synchrony Networks On Credit Report

Watch Out For Identity

Most late payment reporting errors are record reporting issues. But sometimes identity-related errors do happenthese less common errors include things like identity theft and filing errors.

Identity theft involves a criminal obtaining and then using your personal information to open an account in your name. This is becoming more and more common with the digital agehackers are always on the lookout for everyones valuable personal info, especially during the holidays and festive seasons.

Identity theft is an absolute mess that we sincerely hope you never have to deal with it. Unsecured accounts like credit cards and personal loans are the more common account types involved in identity theft.

If you are monitoring your credit report often, youll hopefully notice signs of identity theft far before a late payment occurs.

Filing errors are another identity issue. Sometimes a creditor or credit bureau mixes up information between two individuals. This is especially common with names that have close spellings. Also, if you have a common last name you are far more susceptible. Thats some tough luck.

Filing a dispute with the credit bureaus can correct both of these issues on a credit report. Though admittedly, theres a lot more you need to do to protect yourself when dealing with identity theft. We suggest checking out the Federal Trade Commissions official identity theft website that acts as a guide for identity theft victims.

What If Theres Been A Mistake

If you think you have a delinquency thats been misreported due to identity theft or because something was just misreported, you should attempt to negotiate with the creditor first. They will usually correct any errors quickly. Then notify the 3 credit bureaus once you contact them and present your evidence.

The first thing you should do is . This is especially if its just a simple clerical error.

Thats typically something theyll recognize right away. They might even be able to fix the error on the spot without needing any documentation.

If the problem is something more sinister, like identity theft, this may become a more tedious process. Your creditor may require copies of your identification, police reports, sworn affidavits, or other documents related to the case. The Federal Trade Commission has a helpful Identity Theft Recovery Plan on their website.

If the creditor is not legitimate, out of business, or not able to cooperate for some reason, you can always go directly to the credit bureaus. In this case, its best to send each bureau a dispute letter. Include any supporting documents you think theyll need.

If you arent sure what to send, you can first and ask. When you send the dispute letter, be sure to send it via certified mail.

It may be a quick and easy process or it might take a bit longer. However, once the issue is resolved, you could see an improvement in your credit score in a matter of weeks.

Also Check: Credit Score 766 Means

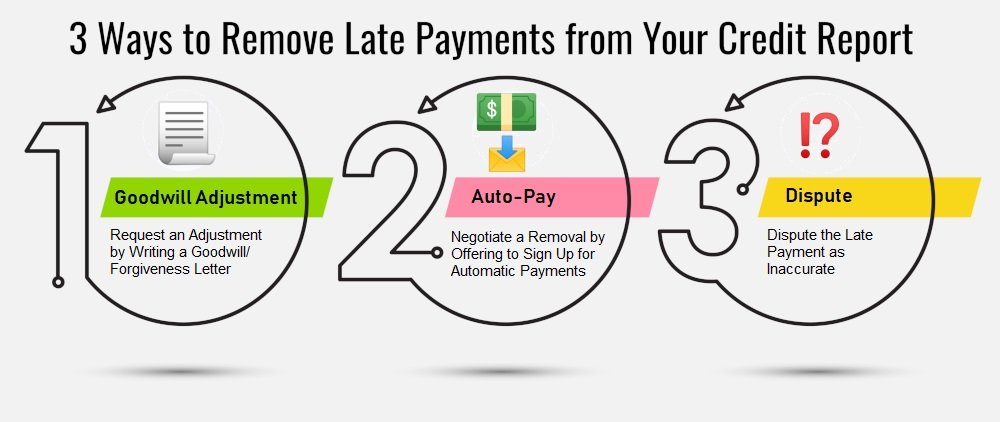

When To Consider Using A Goodwill Letter

When you send a goodwill letter to a creditor, youre asking them to do you the favor of removing accurate information from your credit reports. Your only hope is that the creditor will want to stay in your good graces and be willing to extend this courtesy. A goodwill letter also shows that you are willing to take some initiative when it comes to your credit health, and thats generally a good sign.

Typically, you should consider sending a goodwill letter to a creditor when youve made a late payment and have a good excuse. For example:

- You thought your bill was set up for automatic payment, but you were mistaken

- You switched banks and your payment was accidentally forgotten during the transition

- You moved and your bill never arrived at your new address

- You were in the midst of a balance transfer and you didnt realize your old balance wasnt paid off

- A financial crisis temporarily impacted your ability to cover your bills

In any case, your goodwill letter should ask for mercy and relief from an accidental late payment, but you should also be able to confirm the same mistake will not happen again. As a result, you should consider sending a goodwill letter when you are truly ready to take your credit seriously and never miss a payment again.

Have A Professional Remove The Late Payments

We understand that credit repair can be overwhelming.

If youd rather have a professional credit repair company help, I suggest you check out Lexington Law.

will typically charge a monthly subscription fee while you work with them but theyre also easy to cancel and theres no long-term commitment.

For someone with items that can be challenged, most times, progress can typically be made in 45 or 90 days.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus

Limit Your Requests For New Creditand ‘hard’ Inquiries

There can be two types of inquiries into your credit history, often referred to as “hard” and “soft” inquiries. A typical soft inquiry might include you checking your own credit, giving a potential employer permission to check your credit, checks performed by financial institutions with which you already do business, and credit card companies that check your file to determine if they want to send you preapproved credit offers. Soft inquiries will not affect your credit score.

Hard inquiries, however, can affect your credit scoreadverselyfor anywhere from a few months to two years. Hard inquiries can include applications for a new credit card, a mortgage, an auto loan, or some other form of new credit. The occasional hard inquiry is unlikely to have much of an effect. But many of them in a short period of time can damage your credit score. Banks could take it to mean that you need money because you’re facing financial difficulties and are therefore a bigger risk. If you are trying to improve your credit score, avoid applying for new credit for a while.

Ask For A Goodwill Adjustment

If you’ve only paid a bill late once or, at the most, twice, a creditor may remove your late payment notice if you write a straightforward latter asking for forgiveness. That may sound awkward at first, but companies do like to hear from customers who’ve made a mistake and work with them to fix their credit.

Read Also: Ccb/mprcc

Why A Goodwill Letter May Not Work

Weve heard from some readers who have said their credit card issuers say its illegal for them to remove late payments, or provide other similar reasons.

Its not illegal for a creditor or lender to change any information on your credit reports including late payment history. Credit reporting is a voluntary process. Theres no law that requires a lender or creditor to furnish data to credit bureaus. Theres also no law that requires the credit bureaus to accept the data a lender/creditor provides and include it on your credit reports.

Companies like lenders, creditors, and collection agencies must apply to be data furnishers with the credit bureaus. The application must be approved before a company can have information about their customers included on a credit report. When a company is approved to furnish data to the credit bureaus, the company has to sign agreements with Equifax, TransUnion, and Experian. The agreements say what a data furnisher is and isnt allowed to do when it comes to credit reporting.

Often, the credit bureaus will include language in their agreements which says a data furnisher agrees not to change accurate, negative account information. This is commonly the case for debt collectors, for example, who must agree not to delete a paid but accurate collection account simply because theyve received payment from a consumer.

How Will One Late Credit Card Payment Affect My Score

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Anyone who’s missed a credit card payment knows how alarming it can be once you realize it. You start thinking about how much this will cost you in late fees, and more importantly, what kind of a hit your will take.

It’s understandable to feel this way, especially when your payment history accounts for about 35% of your FICO® Score. No one wants an honest mistake to tank their credit. But before you worry, you should know exactly how late credit card payments work and whether your payment will even be reported as late.

You May Like: Does Snap Report To Credit Bureaus

How To Correct A Late Payment Record On Your Credit Report

Your credit report sums up your credit history of the past 36 months, indicating your ability to repay lenders and financial institutions, who often refer to your credit report before sanctioning a loan. Making sure your credit report is accurate, which also helps ensure your credit score is accurate, can help you get faster approval on a personal loan and other loans.

With late payment records on your credit report, your credit score is impacted and you are likely to face credit rejection from most lenders. Some lenders may offer you loans despite the late payment record however, the interest on these loans may be higher than normal. Apart from this, a few studies have also shown that a 30-day delay can bring your credit score down by almost 100 points. While it is important to remember to never miss your EMIs and pay them on time, here is what you can do about late payment records that are already on your credit report.

How Can I Remove Late Payments From My Credit Report

Late payments can stay on your credit reports for up to seven years. If you believe a late payment is being reported in error, you can dispute the information with Experian. You can also contact the original creditor directly to voice your concern and ask them to investigate. If they determine they reported the late payment by mistake, they can contact the credit reporting companies to have it removed.

Also Check: How To Remove Repossession From Credit Report

How Late Payments Are Killing Your Credit

After 60 days or three payment arrears, your credit rating begins to drop dramatically and can drop by 100 points or more. After 90 days, they will most likely send you to withdraw and see your balance taking long-term damage. Ultimately, after 180 days, your account is considered debited by default. This will be a huge to your creditworthiness, almost as heavy as bankruptcy. What to do in case of late payment?

How Long Do Late Payments Stay On Credit Reports

If all attempts to remove late payments on credit cards fail, dont fret! The FCRA governs the length of time negative entries can remain on reports. Most negative marks stay for seven years, such as late payments, foreclosures, collection accounts, and Chapter 13 bankruptcies. Paid-in full and closed accounts in good standing have a longer shelf life of up to 10 years.

If records of an active account contain a late payment that is seven years old, you can dispute the entry with the CRBs.

As you wait for the negative entry to fall off, you may need to apply for credit products, and lenders will review your reports. Credit Reporting Bureaus allow customers to add statements to explain various negative entries. The statements dont affect scores, but they can offer context to potential lenders, landlords, or employers. You can inquire about adding consumers statements by contacting each customer support team.

Recommended Reading: When Does An Eviction Show On Your Credit Report

Negative Credit Report Entries That Impact Your Score The Most

Accurate items will stay on the credit report for a determined period. Fortunately, their impact will also diminish over time, even if they are still listed on the report. For example, a collection from a few years ago will bear less weight than a recently-reported collection. If no new negative items are added to the report, your credit score can still slowly improve.

Dispute Credit Reporting Errors

Sometimes, you could make a payment on time, only for it to show up on your report as a late payment. If this is the case, itâs an example of a . For such a late payment to be deleted from your report, you need to dispute the inaccuracy.

You can dispute the error with both the credit bureau that provided the report containing the inaccuracy and the creditor who provided the information. Disputing such errors is relatively easy as it can be done online directly using sample dispute letters provided by the Federal Trade Commission.

If your dispute is valid and the late payment entry is found to be an error, then it would be removed from your credit report.

Don’t Miss: How To Remove Repossession From Credit Report

How To Remove A Late Payment From Your Credit Report

Disclaimer: This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Read our Disclaimer Policy for more information.

In this Article: Find out how to remove a late payment from your credit report.

Late payments make it hard to get credit moving forward. They hurt your and make future lenders wary about lending you money.

Keep reading to find out how to remove a late payment from your credit report and rebuild your credit moving forward.

Negotiate With A Pay For Delete Letter

If you dont have a great history with the lender, or if your debt has already been sent to a collection agency, you can consider sending a .

This letter is a negotiation tool you can use to offer a full payment of the debt in exchange for a removal of the negative mark. You can also offer to sign up for automatic payments to ensure payments are not late in the future.

The letter should explicitly include what youre offering , what you want in return and the date youd like a response.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

File A Dispute With The Credit Reporting Agency

Initiate a claim directly with the credit bureau by writing a dispute letter. The purpose of this letter is to notify them that you believe certain information in your credit file is inaccurate.

The Fair Credit Reporting Act requires creditors to report accurate information about every account. This means they have a legal obligation to review, investigate, and respond to your claim. This process is free and can take up to 30 days to complete.

You can begin a dispute with any one of the credit bureaus through their websites or via mail. The leading credit reporting agencies are Equifax, Transunion, and Experian. Its essential to have documentation and to be precise about the information you are challenging.

Each of the three major credit bureaus has an online section dedicated to walking consumers through the process of disputing a claim online. It would be best to dispute the entry with each credit bureau to make sure the removal is complete across the board. After receiving the initial claim, the credit bureau will contact the source of the erroneous information and dispute it on your behalf.

How to file a dispute letter: