How To Dispute Credit Report Errors

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Errors on your credit reports can cause your credit scores to be lower than they should be, which can affect your chances of getting a loan or credit card and how much interest you pay. Disputing credit report errors and getting those negative items removed can be a quick route to a better score.

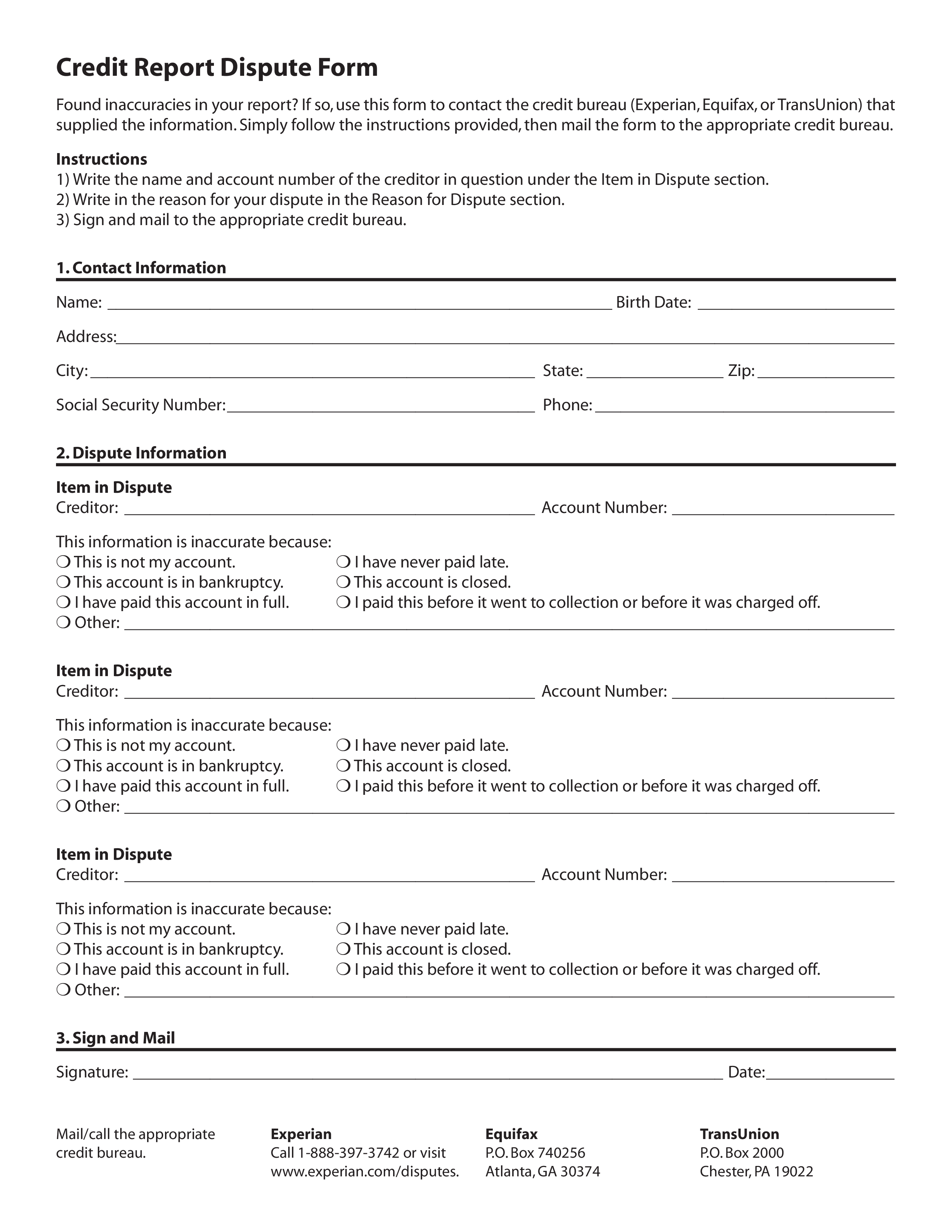

Here’s how to dispute credit report errors and have them removed in four steps.

How To Establish Business Credit

Its not unusual for a business owner who has been in business for several years to discover her business doesnt have a business credit report or scores. Many lenders and vendors that offer trade credit dont report to business credit reporting agencies, while some report to one or two bureaus, but not all of them.

It is not difficult to build business credit, but you will need to invest a little time and effort.

The key to building strong business credit is to get loans or accounts with companies that report payment history to these bureaus on a regular basis. Then pay on time, over time and monitor your reports for accuracy. If thats your only focus, you will be well ahead of most business owners who are not actively building business credit.

If you have two or fewer credit references reporting on your business credit, youll want to build out your credit history with additional accounts. Here are three simple ways to get started:

For step-by-step guidance on how to build business credit, use Navs BusinessLauncher tool, free with every Nav account.

Business Credit Report Request

Procedures for obtaining a copy of a business credit report from Experian or D& B

What Experian Commercial Relations Needs From the Business

- If the company has been declined for insurance a quote for insurance or has had its insurance increased due to an Experian commercial credit report in the past 60 days, a copy of the declination letter or an email, both from the insurance carrier to the business owner, must be supplied.

- On Company letterhead, state that you are requesting a copy of your company’s credit report. Include a list of company name variations and previous addresses, including PO Boxes and warehouse addresses. If you have only one address or one name, please state that in your written request.

- Request must be signed by an officer of the company .

Where To Submit the RequestThe Request for Report should be submitted to Commercial Relations by:

- Costa Mesa, CA 92628-5001

Procedures for obtaining a copy of a business credit report from Dun & BradstreetA current, registered executive officer of the company may contact Dun & Bradstreet by either of the following methods:

Phone: 1.877.753.1444.The business hours are Monday through Friday 8am to 9pm Eastern time.

Additional Information

Read Also: Does Rent A Center Report To The Credit Bureaus

What To Do If You Disagree With The Outcome Of Your Dispute

If you don’t agree with the results of your dispute, here are some additional steps you can take:

- Contact the information source. Your best next step is to contact the entity that originally provided the disputed information to Experian and offer proof their information is incorrect. The source may be the lender or financial institution that issued you a loan or credit, but it could also be a collection agency or government office. Contact information for each source appears on your credit report, and you can use it to reach out to them.

- Add a statement of dispute to your credit report. A statement of dispute lets you explain why you believe the information in your credit report is incomplete or inaccurate. Your statement will appear on your Experian credit report whenever it’s accessed or requested by a potential lender or creditor, so they may ask you for more details or documentation as part of their review or application process. To add a statement of dispute, go to the Dispute Center, choose the item in dispute, and select Add a Statement from the menu of dispute reasons.

- Dispute again with relevant information. If you have additional relevant information to substantiate your claim, you can submit a new dispute. If you’re filing the dispute online, follow the steps listed above for using the Dispute Center, and use the upload link to provide your supporting documentation.

Identify Any Credit Report Errors

Review your credit reports periodically for inaccurate or incomplete information. You can get one free credit report from each of the three major credit bureaus Equifax, Experian, and TransUnion once a year at annualcreditreport.com. You can also subscribe, usually at a cost, to a credit monitoring service and review your report monthly.

Some common credit report errors you might spot include:

- Identity mistakes such as an incorrect name, phone number or address.

- A so-called mixed file that contains account information belonging to another consumer. This may occur when you and another consumer have the same or similar names.

- An account incorrectly attributed to you due to identity theft.

- A closed account thats still being reported as open.

- An incorrect reporting of you as an account owner, when you are just an authorized user on an account.

- A remedied delinquency such as a collections account that you paid off yet still shows as unpaid.

- An account thats incorrectly labelled as late or delinquent, which could include outdated information such as a late payment thats over 7 years old or an incorrect date regarding your last payment.

- The same debt listed more than once.

- An account listed more than once with different creditors.

- Incorrect account balances.

- Inaccurate credit limits.

Read Also: Does Snap Finance Report To Credit Bureau

What Happens After You Dispute A Collection

After you filed a dispute, the creditor or the credit bureau shall run their investigation. Under the FCRA, theyre required to respond to your dispute within 30 to 45 days. Then, they should let you know the results of their investigation within 5 days after they acknowledged your dispute filing.

During the 30-day verification of the debt, debt collectors cant try to collect payments from you until it verifies that the debt in question is yours. Additionally, they cant take any negative course of action against you such as filing a lawsuit. Even so, you must not ignore calls or letters from debt collectors whether you owe them or not.

They also cant report your debt to the major credit bureaus. However, if they already sent a report to the credit reporting agencies before receiving your debt dispute letter, they need to notify the credit bureaus about the dispute.

Check Your Credit Reports For Updates

It may take some time for your credit reports to be updated. Creditors can take up to 45 days to send a credit bureau new information, according to TransUnion. If the information isnt updated after 45 days, contact the credit bureaus or data furnisher again to see why inaccurate information is still being reported.

Read Also: Does Opensky Report To Credit Bureaus

Experian Business Credit Report Sample

Experian gathers, analyzes, and processes your business credit data to provide a summary of your credit history. Theyve got 125 years of experience.

Your Experian business credit report data allows potential lenders to assess the risk you pose and make decisions to approve or deny your request for credit. And it provides a way for you to ensure that companies you do business with accurately report your activity.

How An Error On Your Credit Report Can Affect You

Is it really necessary to keep close tabs on your credit report? Can one error really have an impact on you? Yes. Your credit report contains all kinds of information about you, such as how you pay your bills, and if youve ever filed for bankruptcy. You could be impacted negatively by an error on your credit report in many ways.

To start, its important to understand that credit reporting companies sell the information in your credit reports to groups that include employers, insurers, utility companies, and many other groups that want to use that information to verify your identity and evaluate your creditworthiness.

For instance, if a utility company reviews your credit history and finds a less-than-favorable credit report, they may offer less favorable terms to you as a customer. While this is called risk-based pricing and companies must notify you if theyre doing this, it can still have an impact on you. Your credit report also may affect whether you can get a loan and the terms of that loan, including your interest rate.

Read Also: How To Report To A Credit Bureau Landlord

How To Check Your Business Credit Score

While there are dozens of free credit score and free credit report resources available for consumers, it gets tricky when you look for business versions. There are select free business credit score resources available, but you may not get the full picture compared to a service that requires you to pay.

To make things easier for busy business owners, we’ve rounded up the popular free credit report resources and summarized what they offer. We’ve also included some of the other services that cost money but can be worth the money if you’re looking for a comprehensive view of your business’s financial standing.

How Disputing Impacts Credit

Filing a dispute with one or all of the credit bureaus has no direct impact on your credit scores. But once the dispute process is completed, any changes to your credit reports could lead to changes in your credit scores.

Whether your score goes up, down or remains the same depends on what you’re disputing and the outcome of the dispute. Removal of mistakenly reported negative information, such as late payments or unpaid collections accounts, could lead to credit score improvements. On the other hand, corrections to your personal information, while important to maintaining accurate credit tracking, have no impact on credit scores.

Recommended Reading: Does Zzounds Report To Credit Bureau

Monitor Your Business Credit Reports Moving Forward

Once youve made sure the information on your business credit reports is accurate, your job doesnt end there. Your reports can change any time information is updated or added to them. You will need to develop a habit of consistently monitoring your business credit reports for accuracy from here forward.

Is Your Credit Report Accurate

The information in your credit report can affect your buying power and your chance to get a job, rent or buy a place to live, and buy insurance. Credit bureaus sell the information in your report to businesses that use it to decide whether to loan you money, give you credit, offer you insurance, or rent you a home. Some employers use credit reports in hiring decisions. The strength of your credit history also affects how much you will have to pay to borrow money. Youll want to be sure the information in your report is both accurate and complete. Find out by regularly checking your credit report. You have the right to get free copies of your credit report from each of the three major credit bureaus once every 12 months. To get your free credit reports, go to AnnualCreditReport.com.

Through the pandemic, everyone in the U.S. can get a free credit report each week from Equifax, Experian, and TransUnion at AnnualCreditReport.com. Also, anyone in the U.S. can get 6 free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. Thats in addition to the one free Equifax report you can get at AnnualCreditReport.com.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Keep Revolving Credit Account Balances Below 30% Utilization

A mistake many business owners make is maxing out their credit. The rule of thumb is to only spend up to 30% of your revolving credit line. Following this rule will reflect better on your credit report, increasing your credit score.

Here are some tips to help maintain a 30% utilization ratio:

Recommended: Learn more about revolving credit lines and business credit cards by checking out our guide to choosing the best business credit cards.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Which Credit Report Errors Should You Dispute

The most concerning errors are those that could hurt your scores or suggest identity theft. Those include:

-

Wrong account status .

-

Negative information that’s too old to be reported most derogatory marks on your credit must be removed after seven years.

-

An ex-spouse incorrectly listed on a loan or credit card.

-

Wrong account numbers or accounts that arent yours.

-

Inaccurate credit limits or loan balances.

-

Accounts you don’t recognize.

If you suspect your identity has been stolen, follow the steps to report identity theft.

Dispute Inaccuracies On Your Business Credit Reports

The first step to cleaning up your business credit is to dispute inaccuracies on your business credit report. This is important to do because often companies and even business credit bureaus make mistakes.

Heres how to dispute inaccuracies on your business credit reports:

Important: Privacy laws protect personal credit however, business credit is not protected, and anyone can gain access to your business information.

You May Like: Does Klarna Affect Your Credit Score

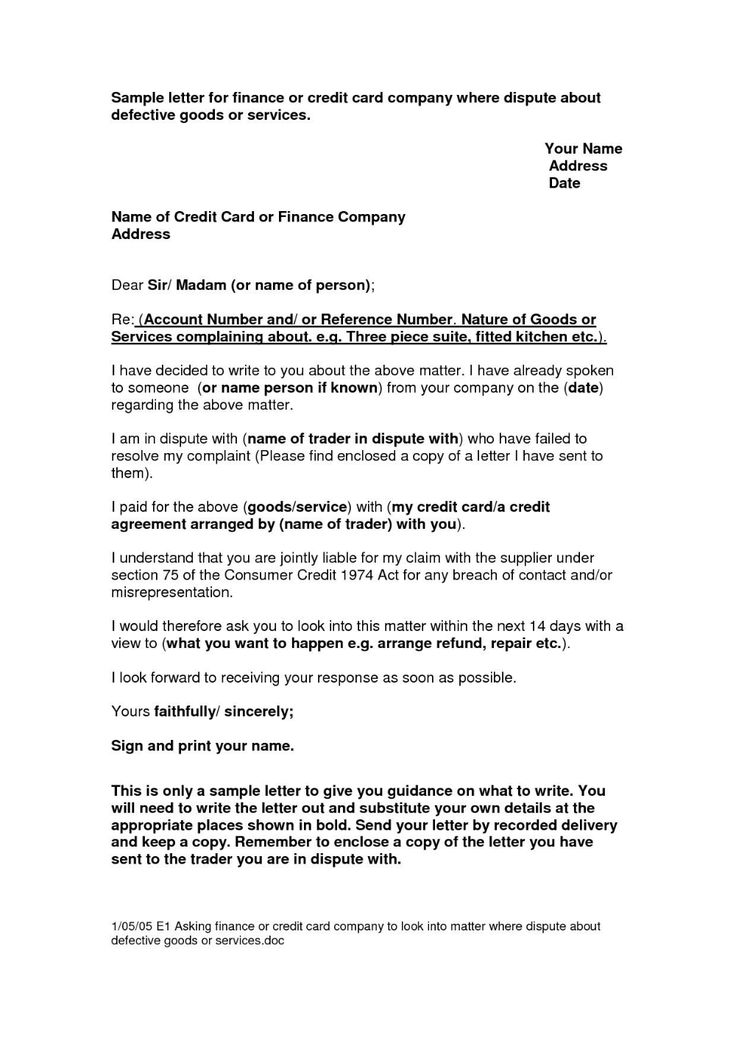

Send A Dispute Letter To The Debt Collector

You can call the creditor or debt collector and dispute the debt. However, they will continue their collection efforts and take negative actions against you. You have to send a dispute letter to verify the debt and to stop them from collecting payments or suing you for a debt you dont owe.

You can use the I do not owe this debt sample letter from the Consumer Financial Protection Bureau if you believe the debt is not yours. If you need more information, you can use the I need more information about this debt form. Keep a copy of the debt validation letter. Its also recommended to send it via certified mail with a return receipt requested for documentation purposes.

How To Dispute Credit Report Information

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

If you discover information on your credit report that shouldn’t be there, you can request to have it removed in a process known as a dispute. To dispute credit report information, you’ll need to contact the credit bureau in whose report you found the error.

It’s important to check for accuracy in your credit reports from the three major credit bureaus, Experian, TransUnion and Equifax. You can do that by requesting a free credit report from each of the bureaus at AnnualCreditReport.com once a year. Outdated or incorrect entries, such as a timely payment misreported as late or a collections account listed as open even though you’ve paid it off, can lower your credit scores. Correcting these issues can, in turn, improve your credit scores.

You should check all your credit reports for accuracy, and file disputes with each bureau separately to ensure the information is updated everywhere.

Don’t Miss: How To Remove Repossession From Credit Report

What Happens After You Submit Your Dispute

After you’ve submitted a dispute, Experian goes to work to resolve the issue. The data furnisher will be asked to check their records. Then one of three things will happen:

- Incorrect information will be corrected.

- Information that cannot be verified will be updated or deleted.

- Information verified as accurate will remain intact on your credit report.