What Does Your Credit Score Mean

Your credit score measures how often you pay bills on-time , how close you are to your credit limits , and how much experience you have with managing debt .

A higher credit score can give you more options for borrowing money. It also qualify you for low-interest loans, which can save you tens of thousands of dollars in interest.

The Best Auto Loans For Bad Credit

01.11.2021 ·Bad credit, no credit, even bankruptcies are no problem. Our pre-qualification process is simple, fast, and and it wont impact your credit score. We have a team of US-based Credit Specialists available 24/7 to answer any questions and get you behind the wheel of the car you want and deserve.

Mistakes Guaranteed To Wreck Your Credit Score

Every day, responsible consumers who think theyâre doing everything right unwittingly put their financial reputations at risk.

We pulled together a list of eight sure-fire ways to hurt your credit score. Here are two that you might not have thought of:

Not paying when a charge is in dispute: Even if a transaction is challenged, the account holder is expected to pay each month. The disputed charge will be designated as pending, but the cardholder is responsible for payment until the matter is resolved and a refund is issued.

Cosigning for friends or relatives: This could, and often does, have terrible repercussions down the road. Most people think of a cosigned loan as a shared responsibility, but in fact, the entire burden shifts to the cosigner if a friend or relative falls behind. Cosigning is potentially disastrous for credit scores and relationships alike.

LendingPoint is a personal loan provider specializing in NearPrime consumers. Typically, NearPrime consumers are people with credit scores in the 600s. If this is you, weâd love to talk to you about how we might be able to help you meet your financial goals. We offer loans from $2,000 to $25,000, all with fixed payments and simple interest.

Don’t Miss: How To Get A Repossession Off My Credit

What Does It Mean If Your Credit Score Is Low

A lower credit score means you might be seen as a high risk borrower. For example, if your credit report shows that youâve defaulted on a previous debt, your credit score is likely to be lower.

If you have a lower score, lenders might offer you credit at a higher interest rate or reject your credit application altogether. But don’t worry, there are plenty of steps you can take to improve your score.

Getting A Va Loan With Bad Credit

All rate availability will depend upon an individual’s credit score and details of the loan transaction. First-time homebuyers may not qualify for a jumbo product. The interest rates quoted here are subject to change at any time and cannot be guaranteed until locked in by your Loan Officer. All rates assume a single-family primary residence not including manufactured homes,

Read Also: Speedy Cash Open 24 Hours

What Is The Average Credit Score In Canada And How Do You Compare

What is the average credit score in Canada, and how do you rank among average Canadian credit scores? More so, what is a good credit score in Canada?

Often, Canadians want to know how they measure up to other people when it comes to their credit score. Is your credit score better than the average credit score? Maybe its worse?

First, let’s answer the question you are here to find out:

Bnpl: Bnpl Is Helping New Borrowers Build Credit Score

17.12.2021 ·BNPL is helping new borrowers build credit score, get credit access: Expert. By Shambhavi Mehrotra, ET Online | 17 Dec 2021, 10:45 AM IST. Post a Comment. Copy URL . Embed. In this video, we are in conversation with Siddharth Mehta, MD & CEO, Freecharge and he decodes for us the BNPL trend. Heres what borrowers can expect in the BNPL space going

Read Also: How To Get Repossession Off Credit Report

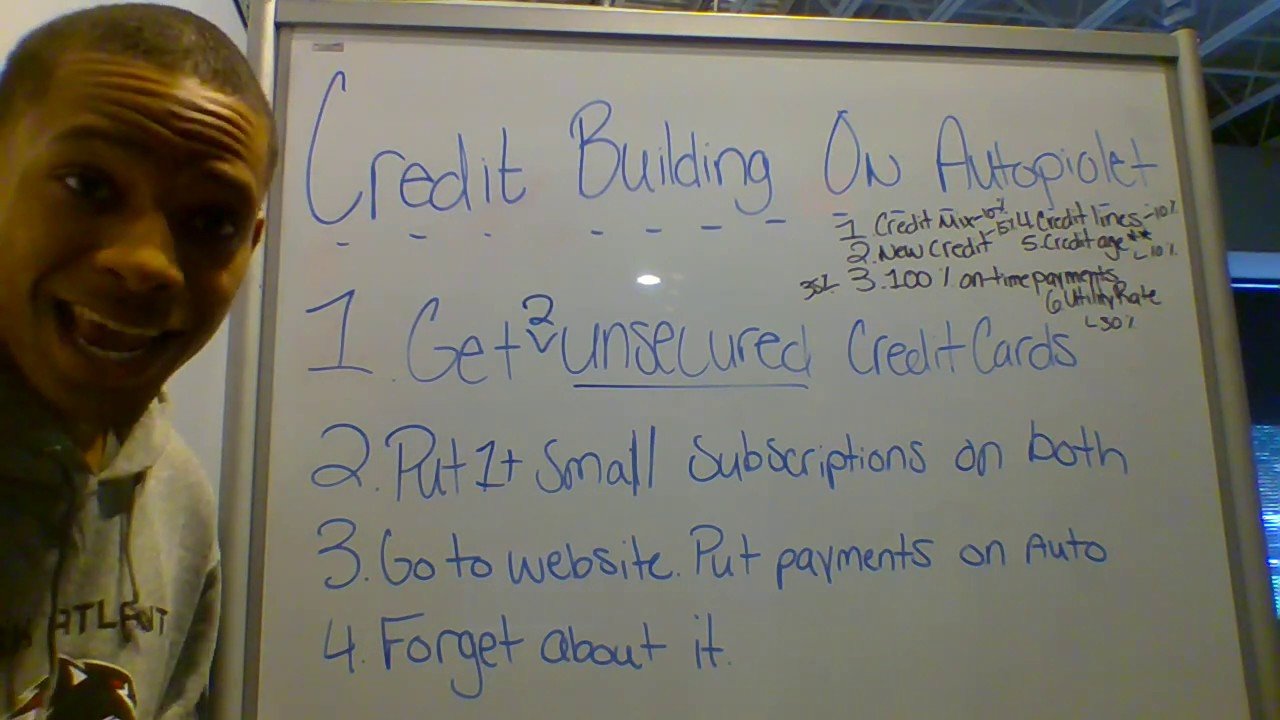

How To Get A Good Credit Score

Good credit habits, practiced consistently, will build your score. Heres what you need to do:

-

Pay bills on time. This is important because payment history has the largest impact of all the factors in your score. A missed or late payment can do tremendous damage to a credit score and it can stay on your credit report for up to 7 years.

-

Try to keep your credit card balances well below your credit limits aim for, and lower is better. High utilization dings your score, but the damage will fade when you’re able to reduce your balances and the lower utilization shows up on your credit reports. You also may be able to lower utilization by getting a higher credit limit or becoming an authorized user on a lightly used card with a large limit.

-

Keep credit accounts open unless there is a compelling reason, such as high fees or poor service, to close them. Keeping older accounts open helps your average age of accounts, which has a small influence on your score. Also, closing an account cuts into your overall credit limit, driving up your credit utilization.

-

Avoid making several credit applications in a short time frame. Credit checks for the purpose of credit decisions can cause a small, temporary dip in your score, and several in a short time can add up. That’s why it’s important to research credit cards before you apply.

-

Monitor your credit reports and dispute information you believe is incorrect or too old to be included .

How To Improve A 773 Credit Score

Its a good idea to grab a copy of your free credit report from each of the three major credit bureaus, Equifax, Experian, and TransUnion to see what is being reported about you. If you find any negative items, you may want to hire a credit repair company such as Lexington Law. They can help you dispute them and possibly have them removed.

Lexington Law specializes in removing negative items from your credit report. They have over 18 years of experience and have removed over 7 million negative items for their clients in 2020 alone.

They can help you with the following items:

- hard inquiries

- bankruptcies

Read Also: How To Get Rid Of Serious Delinquency On Credit Report

Shopping For Credit Cards With A 773 Credit Score

When shopping for credit cards, make sure you explore all of your options. In other words, dont just sit down with one potential creditor and decide to accept their deal or not. Sit down with multiple potential creditors and compare and contrast them to find out what works best for you.

If you already have a credit card, but have been shopping for one that is cheaper, you can then go to your existing creditor and request them to either match or beat an offer from another credit card company. Tell them that you believe you are paying too much money in fees and interest, and ask them if they are willing to lower their rates and fees down to the other credit card company that you are thinking about switching to.

If they refuse, then you can switch accounts, but dont close your existing account immediately. You still want to make the minimum payment on. it while you are waiting for your balance to transfer to your new account. You only want to close a credit account when your balance is at zero.

Pay Your Bills On Time

Your payment history is the most important credit score factorit accounts for 35% of your FICO score. Because of this, you should aim to never miss a payment. If your bills become 30 days past due, your creditors can report this to the credit bureaus. Once your credit report lists a late payment, it can cause serious damage to your credit score. To avoid paying your bills late, use a spreadsheet to keep track of your due dates or enroll in autopay.

Most people who have 800 credit scores or higher pay off their balances in full each month, according to FICO.

Don’t Miss: Chase Preferred Credit Score

What Does It Mean If Your Credit Score Is High

Lenders tend to look at your credit score when you apply for credit, such as a credit card. Theyâre looking for someone who will be able to meet the repayments – someone who is low risk.

A higher credit score means your credit report contains information that shows youâre low risk, so youâre more likely to appeal to lenders. For example, if your report shows that you always pay your bills on time, youâll be considered a reliable borrower.

If you have a high credit score, your application is more likely to be accepted. Youâre also more likely to be offered the best interest rates and higher credit limits.

Check your eligibility: See what offers you’re eligible for with your credit score.

What Is Considered A Good Cibil Score Range

A credit score ranging from 750 to 900 is considered an excellent credit score. Banks, NBFCs and other online lenders prefer candidates who have a credit score in this range. If your credit score is in this range, you will be eligible for most credit products. The following table will help you understand the CIBIL score range and its meaning.

|

Immediate Action Required |

Approval chances are very low |

As the table illustrates, having a credit score of 750 and above is considered to be excellent and it can help in easily availing several credit opportunities.

Recommended Reading: Remove Repo From Credit Report

Can I Get A Personal Loan Or Credit Card W/ A 733 Credit Score

Like home and car loans, a personal loan and credit card isn’t very difficult to get with a 733 credit score.

You donât need to apply for a secured card with Discover or Capital One, who may make you pay $500-$1000 just for a deposit.

You can get even better terms on your personal loan or credit card by repairing your credit and waiting a few short months until your score improves.

A 733 score means you likely have a few-no negative items on your report. Removing any outstanding negative items is usually the quickest way to fixing your report.

We recommend speaking with a friendly credit repair expert online to help guide you through this process. Your consultation is completely free, no-pressure, and will set you on the right path toward boosting your score.

How To Access Your Credit Report

Federal law entitles you to a free copy of your credit report once every 12 months from the three major credit-reporting agencies: Equifax, Experian and TransUnion. You can get a free copy of all three bureausâ versions of your credit report at AnnualCreditReport.com.

Rod Griffin of Experian.com says, âItâs an important step in rebuilding and maintaining good credit.â We say: make sure you take advantage of your free annual credit reports.

If you need access to your report more than once annually, then there are also paid options on each bureauâs websites.

Our step-by-step guide to getting your credit report will get you started.

Also Check: Will Carmax Approve You With Bad Credit

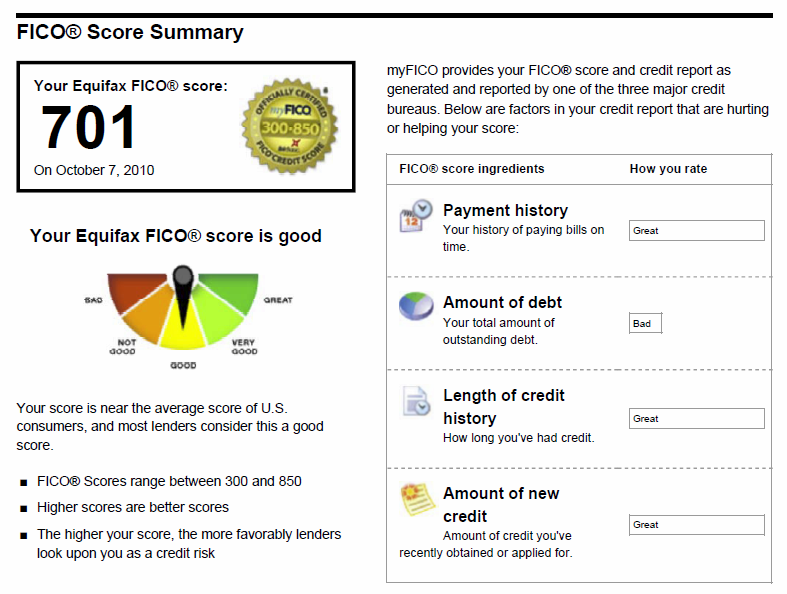

What Is A Good Fico Score

A good FICO score lies between 670 and 739, according to the company’s website. FICO says scores between 580 and 669 are considered “fair” and those between 740 and 799 are considered “very good.” Anything above 800 is considered “exceptional.”

According to FICO, the average credit score in 2021 was 716, which falls in the good range.

FICO comes from Fair Isaac Corp., the company that first developed a credit scoring system. It uses data about consumers from the three major credit reporting bureaus: TransUnion, Equifax and Experian.

FICO scores typically express a consumer’s creditworthiness as a number between 300 and 850.

Dont Apply For Every Credit Card

Too many credit inquiries in a short period of time can hurt your credit score. This can be difficult to avoid during Christmas when it seems that every department store is offering you a discount for signing up for its credit card.

Applying for new credit card accounts can account for 10% of your credit score, which isnt a huge number, but it can be enough to push you into the 800+ credit score club.

Holly Wolf, who with her husband has a credit score in the 800 range and is a chief marketing officer at Conestoga Bank, says she doesnt open a lot of credit cards and often closes cards she may have opened to get a store discount.

Honestly, this isnt a lifestyle to which most folks aspire, Wolf says. They need to have a nice car a big house and all the accouterments of prosperity over having a high credit score. Living debt-free or with as little debt as possible has enabled us to save for retirement, get the best rates on loans, and be prepared for unexpected expenses when they arise.

Recommended Reading: Aargon Collection Agency Bbb

Better Credit Card Offers

High-qualified borrowers with credit scores of at least 800 can qualify for the best 0% APR credit cards. These cards come with interest-free periods that last for up to 21 months on balance transfers and purchases. As long as you repay the balance in full before the promotional period expires, you can avoid interest payments.

Additionally, youll likely qualify for some of the best travel credit cards. Some of these cards come with generous travel bonuses after you reach their minimum spending requirements.

Shopping For The Best Rates On Loans And Credit Cards For A Credit Score Under 773

If you are ever on the market for high-priced items, such as home appliances, it is very common for people to walk into the store and get offered a discount or an otherwise excellent financing deal.. .but only if they open up a credit card account with that store.

Why do stores offer these credit cards? The reason why is because theres usually a high interest rate or multiple fees that go along with them. Those rates and fees can be found on the small fine print of the credit card deal, but of course, the store doesnt tell you.

A golden rule of credit cards is that you should only apply for credit that is a necessity for your financial life. When applying for a credit card from a retail store, youre probably only going to use it once, twice, or three times maximum. You could just as easily be using an existing credit card that you already have.

Heres why this is so critical: applying for multiple credit cards within a few months of each other will be very harmful to your overall credit score. Never apply for a credit card that you dont need.

Now, when you do decide to apply for credit cards and loans in general, there are a few factors that you will want to remember, including:

You May Like: When Does Open Sky Report To Credit Bureau

Auto Loans For Excellent Credit

Having excellent credit can mean that youre more likely to get approved for car loans with the best rates, but its still not a guarantee.

Thats why its important to shop around and compare offers to find the best loan terms and rates available to you. Even with excellent credit, the rates you may be offered at dealerships could be higher than rates you might find at a bank, credit union or online lender.

You can figure out what these different rates and terms might mean for your monthly auto loan payment with our auto loan calculator.

And when you decide on an auto loan, consider getting preapproved. A preapproval letter from a lender can be helpful when youre negotiating the price of your vehicle at a dealership, but be aware that it might involve a hard inquiry.

If you have excellent credit, it could also be worth crunching the numbers on refinancing an existing auto loan you might be able to find a better rate if your credit has improved since you first financed the car.

Compare car loans on Credit Karma to explore your options.

Auto Loans You Can Get With A 773 Credit Score

Getting an auto loan is easy with a credit score of 773. Youll generally qualify for the lowest interest rates on the market, and you may even be eligible for 0% APR car loans that some new car dealers offer.

According to a 2020 quarterly report by Experian, people with credit scores of 661780 had average interest rates of 5.59% on their used car loans and 3.69% on new car loans, whereas people with credit scores of 501600 had average interest rates of 16.56% and 10.58%. 6

Depending on the loan term and how much youre borrowing, this difference could amount to hundreds of dollars in savings. Nevertheless, you could save even more by waiting until your score reaches 781850, at which point youll be considered a super-prime borrower.

Don’t Miss: Public Record On Credit

Improving Your 773 Credit Score

A FICO® Score of 773 is well above the average credit score of 711, but there’s still some room for improvement.

Among consumers with FICO® credit scores of 773, the average utilization rate is 23.7%.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll also find some good general score-improvement tips here.

How Does Outstanding Debt Affect Your Credit Score

The amount of outstanding debt impacts your credit score. Lenders normally check this in the form of the credit utilisation ratio. This refers to the amount of money you are using out of the total credit available to you. The higher the ratio, the lower your credit score. However, this doesnt mean debt is bad for you. In fact, you will be able to build your credit score only when you take on debt. The key is to pay it off in a timely fashion and not go over your credit cards or bank accounts limit.

Read Also: Is Paypal Credit Reported To The Credit Bureaus