How Do The Chase Sapphire Cards Work With Lyft

Chase Sapphire Cards offer bonus points for purchases made through the Chase Travel Portal, in addition to the 23 points you earn for all eligible travel purchases made with the cards. Specifically, through March 31, 2022, Chase Sapphire Preferred offers 5 Lyft points, while Chase Sapphire Reserve offers 10 Lyft points:

What Is The 5/24 Rule

Chase has a blanket, if unwritten, policy known as the 5/24 Rule that limits you to five new credit accounts within a 24-month period. Were talking about any five credit or charge accounts, not just the ones from Chase. If you flunk the rule, then no card for you, even if youre proudly sporting that 850 FICO score.

This rule apparently originated in 2015 with the introduction of the Chase Sapphire Preferred® Card. The rule expanded in May 2016 to most Chase cards rumor has it that some co-branded cards may be exempt.

Why did Chase create the 5/24 Rule? After all, if you have a good credit score, enough income, and a reasonable credit utilization ratio, why cant you apply for more than five cards before Chase gets on your case?

We believe one of the main reasons is to discourage abuse of introductory bonuses. In theory, you can open a new credit card as often as you like and earn the initial signup bonus by spending the required amount on purchases during the first three months. In return, you rack up cash back, miles, and/or points.

So, whats the problem? Well, rather than letting a dozen or two credit cards pile up on your desk, you will probably cancel many of the cards after you receive the bonus. Good for you, but bad for the credit card company. Those bonuses are loss leaders the bonuses you earn are worth more than the usual rewarded amounts.

High APRs generate a lot of income for credit card companies if the debt isnt paid off within the cards grace period.

How To Pay My Discover Credit Card

Method 1 of 3: Pay the loan online. Visit the Discover website. Access from your computer or mobile device. Method 2/3: pay by post. Separate the payment slip from the monthly statement. Method 3 of 3: Avoid payment problems. Please take processing time into account. Payments can be made online at any time, but are not always paid instantly.

Read Also: Bankrate Free Credit Score

Ink Business Cash Credit Card

For the Ink Business Cash card, youll generally need good to excellent credit, meaning a score of 700+. Thats because even though the Ink Cash is a business card, like with to the Ink Business Preferred, Chase will use your personal credit score when making its decision.

Whats great about this particular Chase business card is that its currently offering an all-time-high welcome bonus of $750 bonus cash back after you spend $7,500 on purchases in the first 3 months from account opening. This is an excellent deal because the Ink Business Cash has no annual fee. For more details, read our Ink Business Cash review here.

Chase Sapphire Reserve Benefits

The Chase Sapphire Reserve® 100k bonus is not available anymore, as it was a limited-time promotion that ran from August 2016 through March 2017. Cardholders who were approved during that period and spent $4,000 within 3 months of account opening got 100,000 bonus points. And that Chase Sapphire Reserve 100k bonus was worth $1,500 in travel an incredible deal.

But after March 2017, you get a bonus of 50,000 points after spending $4,000 in the first 3 months. That’s still one of the biggest credit card bonuses on the market, though. And it’s enough to cover more than a years’ worth of Chase Sapphire Reserve®’s $550 annual fee.

So, at the end of the day, the Chase Sapphire Reserve®’s 100k bonus is no longer available because it was never supposed to be permanent. It was the equivalent of 35% cash back, and that’s just not sustainable. Chase offered it to build some buzz for the new Chase Sapphire Reserve® Card when it was introduced. And since that seems to have worked, they retired that promotion. It’s possible Chase could do another 100,000 point bonus in the future. But don’t count on it.

You can use your Chase Sapphire Reserve for airport lounge access by first enrolling in Priority Pass Select. There is no additional cost to activate your Priority Pass membership and it is a one-time procedure.

Recommended Reading: Who Is Syncb/ppc

Chase Sapphire Preferred Vs Chase Sapphire Reserve Spending Example

Ultimately, the Reserve is the Sapphire card with the potential to earn the highest rewards, but youve got to be willing to spend. If you can take full advantage of the benefits and much of your spending is focused on dining and travel, youll easily earn back the Reserves steep $550 annual fee. If those credits arent useful for you, though, the Preferred will likely be of much more value.

Disregarding the credits, say you spend $20,000 each year on your card .

With the Sapphire Preferred, that would equal 40,000 total points on general dining and travel purchases and 4,000 on everything else for a total 44,000 points. Thats equivalent to about $550 in value when you redeem through Chase Ultimate Rewards with the 25 percent boost.

With the Reserve, though, your spending would bring in 48,000 points on general dining and travel purchases and 4,000 points for your other spending, bringing you to a total of 52,000 points. With the 50 percent boost you can get when redeeming points through Ultimate Rewards, thats about $780 in total value. Keep in mind that in order to earn the Sapphire Reserves 3X points on general dining and travel purchases, you first need to earn the $300 travel credit.

What You Can Get With Your Points

One of the biggest benefits of Chase Sapphire Preferred cards comes from the versatility of their points usage. Through Chase Ultimate Rewards, you can use your points for:

- Travel

- Purchases in the Apple® Ultimate Rewards Store

- Amazon.com orders

- Tickets to special events

And while you can usually exchange Chase Ultimate Rewards points at a rate of one point per cent, you get a 25% boost on your points if you book travel directly through the Chase Ultimate Rewards portal.

Don’t Miss: Remove Transunion Inquiries

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

Chase Sapphire Preferred Benefits

Its important to look at the card benefits in addition to bonuses and earning potential when making your decision to apply for a card, but if youre eligible for the Chase Sapphire Preferred and have been thinking about getting it, this is a great time to pull the trigger.

The sign-up bonus has never been this high before and you may not see it again as these promotions are usually for a limited time. Its very rare for a card like the Preferred at the mid-tier level with such high-value points to offer this much of a bonus just for signing up and meeting minimum spend.

Weve already talked about the value of 100,000 points when used for up to $1,250 in travel including airfare, hotels and travel experiences like tours through the Chase Ultimate Rewards travel portal. You can even book local tours if you are taking a staycation. Cardholders also have exclusive access to events in entertainment, dining, music and sports including tickets to the Sundance Film Festival and the Chase Sapphire Private Dining Series.

Weve also discussed the cards ability to earn more points when you travel and dine out or order in as it offers double points on those purchases. Its also important to note that Ultimate Rewards points never expire, especially after a pandemic that shut down travel and dining experiences over the past year.

You May Like: Aargon Agency Pay For Delete

How Important Is The Annual Fee To You

Are the extra perks of the premium Chase Sapphire Reserve worth paying the $550 annual fee? If you use the additional benefits and take advantage of bonus categories and rewards, then the higher annual fee may be worth it.

On the other hand, if you wont use your card enough to offset the annual fee, perhaps the Chase Sapphire Preferred is a better match.

How To Earn An Excellent/exceptional Credit Score:

Borrowers with credit scores in the excellent credit range likely haven’t missed a payment in the past seven years. Additionally, they will most likely have a credit utilization rate of less than 30%: meaning that their current ratio of credit balances to credit limits is roughly 1:3 or better. They also likely have a diverse mix of credit demonstrating that many different lenders are comfortable extending credit to them.

Don’t Miss: Open Sky Unsecured

Request A Credit Limit Increase

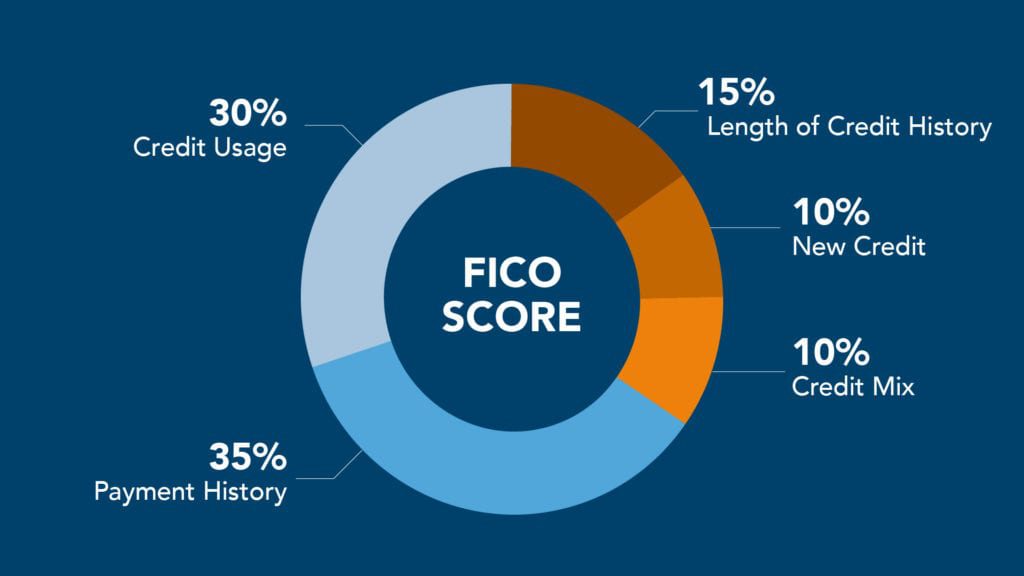

is an important factor in determining your credit score. It makes up 30% of your FICO score, and its best to keep your utilization ratio below 30%.

One of the most effective ways to reduce your credit utilization is to increase the amount of credit available to you. With most credit card companies, you can request a in your online account or by calling the issuer.

Can I Get The Chase Sapphire Reserve If I Already Have The Chase Sapphire Preferred Card

The fine print drops the hammer you cant get the Chase Sapphire Reserve® if you currently own any Sapphire credit card. Since the only other one available is the Chase Sapphire Preferred® Card, your quest for both cards just hit a landmine.

You can request an upgrade to the Chase Sapphire Reserve® card by calling the number on the back of your Chase Sapphire Preferred card and finding out whether youre eligible. You dont earn a new cardmember bonus by switching Sapphire products.

If you were a previous holder of a Sapphire rewards credit card, you cant rejoin the clan for 48 months from the date you received your last new-cardmember bonus. The wait time used to be 24 months but was doubled in 2020.

Also Check: How To Remove Hard Inquiries From Experian

Does Chase Sapphire Reserve Travel Insurance Cover Lost Luggage

Yes, if your checked or carry-on luggage is lost or destroyed on a common carrier, such as an airline or train, and you’re not able to receive a full refund from that carrier, you may be eligible for reimbursement from the Chase Sapphire Reserve® card’s lost luggage reimbursement policy.

For rates and fees of The Platinum Card® from American Express, please click here

For rates and fees of American Express® Gold Card, please click here

The information related to American Express® Green Card has been independently collected by ValuePenguin and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply to American Express credit card offers. See americanexpress.com for more information.

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Advertiser Disclosure: The products that appear on this site may be from companies from which ValuePenguin receives compensation. This compensation may impact how and where products appear on this site . ValuePenguin does not include all financial institutions or all products offered available in the marketplace.

Chase Cards Add Nexus Application Fee Credit

As first reported by Dan’s Deals, the NEXUS application fee credit has been added to numerous Chase credit cards as an option alongside Global Entry and TSA PreCheck. These cards offer up to $100 in reimbursement for one of these program’s application fees, every four years.

Although NEXUS reimbursement isn’t yet being advertised publicly , if you have a Chase card that already offers a Global Entry/TSA PreCheck credit, you’ll likely see the update under the card’s benefits section in your online Chase account. The screenshot below is from my Chase Sapphire Reserve® card.

I’m also seeing the credit mentioned in the fine print of the public benefits page for the IHG® Rewards Club Premier Credit Card. Other cards with existing Trusted Traveler credits, like the United Explorer Card, United Quest Card, United Club Infinite Card, and Southwest® Rapid Rewards® Performance Business Credit Card, aren’t showing similar public updates yet, but Dan’s Deals reports seeing the credit on most of these accounts, too.

Recommended Reading: Does Titlemax Go On Your Credit

Read Up On Chase Reconsideration

Also, if youre a borderline candidate, theres a high chance that your Sapphire Preferred application will end up in a Chase reconsideration phone call.

This is basically your chance to plead your case on why you should get approved for the card youre applying for and so it can be a huge factor for getting your credit card application approved.

For that reason, make sure you read up on my tips for the Chase reconsideration line. That will show you how to handle a recon call and possibly get Chase to overturn a rejection and approve you for Sapphire card.

What To Do If Youre Rejected

Since the Chase Sapphire Preferred is one of the best Chase credit cards, asking for reconsideration can be worthwhile. If you do decide to call and ask to be reconsidered, there are a few things to keep in mind. Call promptly, preferably within 30 days of receiving your rejection. Its important to get all of your financial information handy when you call in. The representative may have some questions.

One of the questions that weve heard some chatter about and that has stumped a few people is Why do you want this card? For many of you, the answer is obvious, I want points! But thats not quite what Chase is looking for.

Chase wants to build loyal customers and followers, not just point grubbers. Theyre less likely to approve you if you seem like someone who will get the card, spend the money for the sign-up bonus, and then cancel the card before having to pay the annual membership fee in the second year. With that in mind, review the Chase credit card benefits and find one thats important to you. Have a few sentences in your mind as to why that benefit is important to you.

You May Like: Does Balance Transfer Affect Your Credit Score

Chase Sapphire Reserve Travel Credit

A key feature of the Chase Sapphire Reserve® is the annual $300 travel credit. The beauty of this credit is that it essentially offsets more than half of the Chase Sapphire Reserve® annual fee. It’s also incredibly simple to use, as the credit is automatically applied to any qualifying travel purchases made with your card you’ll see these on your card statement.

Merchants that code as travel include:

- Airlines

- Travel agencies

- Trains, taxis and buses

The $300 travel credit resets every account anniversary. Note that Chase does not reward any Ultimate Rewards points for purchases that receive the annual travel credit.

Why Should I Apply For The Chase Sapphire Preferred

Now is a great time to apply for the Chase Sapphire Preferred. It currently offers new cardholders 60,000 Ultimate Rewards points after using their cards to spend $4,000 within three months of account opening. These rewards can be transferred to airline miles or hotel points with certain Chase travel partners on a 1:1 basis and are worth an extra 25% if you use them to book travel through Chase, yielding $750 in value.

In addition to the sign-up bonus, this card earns 5 points per dollar on travel purchased through Chase Ultimate Rewards, 3 points per dollar on dining purchases, 2 points per dollar on other travel purchases and 1 point per dollar spent elsewhere. The dining bonus is also valid on eligible takeout and delivery services, and the travel category also includes expenses such as parking, tolls and public transportation. Annually, you also earn $50 in Ultimate Rewards Hotel Credit.

The Sapphire Preferred offers valuable travel coverage, such as trip cancellation and interruption insurance, auto rental collision damage waiver, baggage delay insurance and trip delay reimbursement. Youre also covered by purchase protection and extended warranty protection when shopping. Theres a $95 annual fee, but you wont pay any foreign transaction fees. All in all, this card offers a ton of value both in its rewards and extra perks.

Read Also: Does Using Klarna Affect Your Credit Score

How To Earn A Good Credit Score:

If you currently have a credit score below the “good”rating, you may be labeled as a subprime borrower, which can significantly limit your ability to find attractive loans or lines of credit. If you want to get into the “good” range, start by requesting your credit report to see if there are any errors. Going over your report will reveal what’s hurting your score, and guide you on what you need to do to build it.