How Does A Credit Scoring System Work

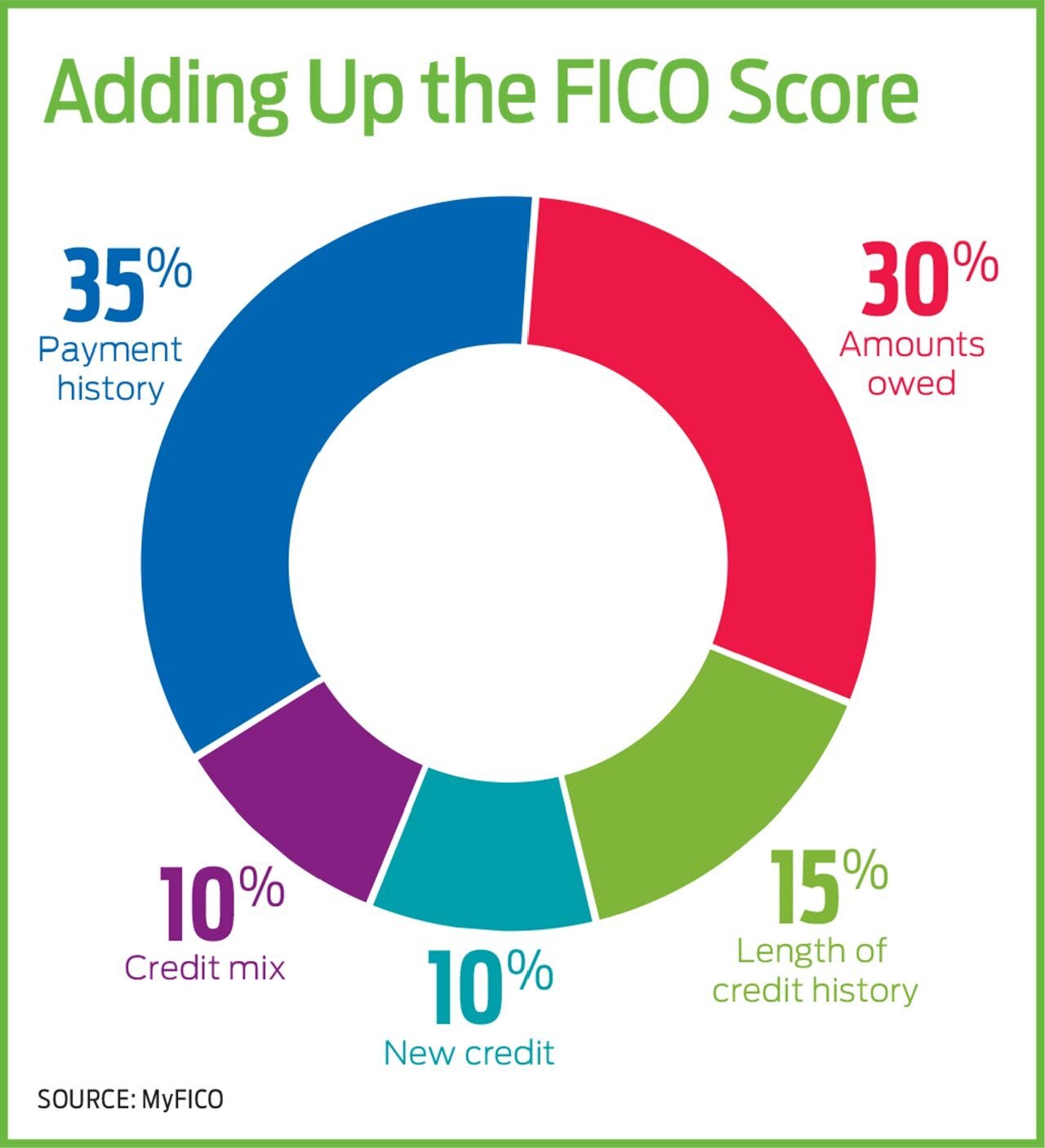

- Have you paid your bills on time? If your credit report shows that youve paid bills late, had an account put in collections, or declared bankruptcy, thats likely to affect your score negatively.

- Are you maxed out? Many scoring systems look at the amount of outstanding debt you have compared to your credit limits. If the amount you owe is close to your credit limit, its likely to hurt your score.

- How long have you had credit? Generally, scoring systems consider your credit track record. A short credit history may hurt your score, but paying bills on time and having low balances can offset that.

- Have you applied for new credit lately? Many scoring systems look at inquiries on your credit report to see whether youve applied for credit recently. If youve applied for too many new accounts recently, it could hurt your score. Not every inquiry is counted: for example, inquiries by creditors who are monitoring your account or making prescreened credit offers arent counted against you.

- How many credit accounts do you have, and what kinds of accounts are they? Although its generally considered a plus to have established credit accounts, too many credit card accounts may hurt your score. Also, many scoring systems consider the type of credit accounts you have. For example, under some scoring systems loans to consolidate your debt but not loans for buying a house or car may hurt your credit score.

Understanding Your Credit Profile

Determining your score is more complicated than just weighing the different aspects of your credit history. The credit scoring process involves comparing your information to other borrowers that are similar to you. This process takes a tremendous amount of information into consideration, and the result is your three-digit credit score number.

Remember, no one has just one credit score, because financial institutions use more than one scoring method. For some agencies, the amount owed may have a larger impact on your score than payment history.

How Can You Check Your Credit Scores

Reading time: 2 minutes

-

There are many different credit scores and credit scoring models

-

You can purchase credit scores from a credit bureau or get one free from some banks and credit unions

Many people think if you check your credit reports from the two nationwide credit bureaus, youll see credit scores as well. But thats not the case: credit reports do not usually contain credit scores. Before we talk about where you can check your credit scores, there are a few things to know about credit scores, themselves.

One of the first things to know is that you dont have only one credit score there are many different scores used by lenders and other organizations. Credit scores are designed to represent your credit risk, or the likelihood you will pay your bills on time.

Score providers, such as the credit bureaus Equifax and TransUnion along with companies like FICO, use different types of credit scoring models and may use different information to calculate credit scores. Credit scores provided by the two nationwide credit bureaus may also vary because some lenders may report information to both, one or none at all. And lenders and creditors may use additional information, other than credit scores, to decide whether to grant you credit.

So how can you check your credit scores? Here are a few ways:

In addition to checking your credit scores, its a good idea to regularly check your credit reports to ensure that the information is accurate and complete.

Don’t Miss: Does Barclaycard Report To Credit Bureaus

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

How Your Credit Score Is Calculated

Your credit score is calculated based on what’s in your credit report. For example:

- the amount of money youve borrowed

- the number of credit applications youve made

- whether you pay on time

Depending on the credit reporting agency, your score will be between zero and either 1,000 or 1,200.

A higher score means the lender will consider you less risky. This could mean getting a better deal and saving money.

A lower score will affect your ability to get a loan or credit. See how to improve your credit score.

Also Check: When Does Usaa Report To Credit Bureaus

How Can I Find And Dispute Errors On My Credit Reports

If you notice any big discrepancies between your credit reports, there might be an error. There are a number of ways to find and dispute these errors. Lets take a look at a few.

Free credit monitoring from Credit KarmaCredit Karmas free credit monitoring tool can help you stay on top of your credit and catch any errors that might impact your scores.

If we notice any important changes on your Equifax or TransUnion credit report, well send an alert so you can review the changes for suspicious activity. If you dont recognize the information and think it might be associated with an error or identity theft, you can file a dispute.

How to dispute errors on your Equifax credit reportIf you spot an error on your Equifax credit report, youll have to file your dispute directly with Equifax.

Start by reviewing your free report from Equifax on Credit Karma. If you come across an error, scroll down to the bottom of the account in question and click Go to Equifax. Youll have a chance to review your dispute before submitting it to Equifax.

How to dispute errors on your TransUnion credit report with Credit Karmas Direct Dispute featureCredit Karmas Direct Dispute tool makes it easy to file a dispute directly with TransUnion. If you come across an error on your TransUnion report, you can submit a dispute without leaving Credit Karma.

How A Credit Score Is Determined

Your personal credit score is generated by a mathematical formula using information in your credit report. Credit scoring was first developed in 1958 by Fair Isaac Corporation to help predict whether a borrower will repay their loan on time. The resulting score is commonly called a FICO score, after Fair Isaac. Higher scores are better than lower scores.

When a credit bureau calculates your score, they do not take race, religion, age, sex or marital status into account. Neither does your income, occupation or employment history figure into the score, nor if you’ve been turned down for credit.

Also Check: How To Get Credit Report With Itin Number

How Do I Get Credit

Do you want to build your credit history? You will need to pay bills that are included in a credit report.

- Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit.

- Many credit cards put information into credit reports.

- Sometimes, you can get a store credit card that can help build credit.

- A secured credit card also can help you build your credit.

Whats On Your Credit Report

Your credit report includes personal information, credit inquiries, open and closed credit accounts, your payment history and public records like bankruptcies, if you have any. All this information is part of your data identity, and you should manage it carefully to make sure youre accurately represented in the credit marketplace.

Lenders often use credit reports to help them decide if theyll approve a credit application. The information helps potential lenders understand your history of managing credit. Its important to remember that credit reporting agencies like TransUnion dont make lending decisions.

Recommended Reading: How Can You Get A Repo Off Your Credit

What Should I Do When I Get My Credit Report

Your credit report has a lot of information. Check to see if the information is correct. Is it your name and address? Do you recognize the accounts listed?

If there is wrong information in your report, try to fix it. You can write to the credit reporting company. Ask them to change the information that is wrong. You might need to send proof that the information is wrong for example, a copy of a bill that shows the correct information. The credit reporting company must check it out and write back to you.

What’s The Difference Between A Credit Score And A Credit Report

Your credit score is different from your . A credit report is a more holistic view of your credit that shows detailed information about your credit activity and current credit situation. Credit reports detail personal information , credit accounts , public records and inquiries into your credit. The three main credit bureaus who issue reports are Experian, Equifax and TransUnion.

“Your credit scores are a proxy for the health of your credit reports,” says Ulzheimer. “So if you’re not going to take the time to pull and review all three of your credit reports, then at the very least you should check your credit scores.”

Read Also: What Credit Bureau Does Usaa Use

What Is A Credit Score And How Is It Calculated

a credit score is a statistical representation of ones creditworthiness. it helps in evaluating your ability to pay back the amount you have borrowed. a persons credit score usually ranges from 300-900, and the one with the highest score is considered to be a trustworthy applicant. always try to reach the highest in range as it becomes very beneficial at the time of applying for a loan or a credit card. whereas, if you have a low score or you fall in lower range this displays you are an irresponsible loan applicant and have not made timely payments of your loans/dues.

|

range |

|---|

some common factors that impact credit score are:

- amounts owed

What Can Lenders See On Your Credit Report

Your creditreport provides a detailed summary of your credit history. It includes your personal information and lists details on your past and current credit accounts. It also documents each time you or a lender requests your credit report, as well as instances where your accounts have been passed on to a collection agency. Financial issues that are part of the public record, such as bankruptcies and foreclosures, are included, too.

Also Check: When Do Accounts Fall Off Credit Report

How Much Is Owed

When you apply for credit, how much you already owe really matters to a lender. Your current payments will determine if you can manage any more payments in your budget for the additional money you borrow.

While you might think that you can handle more credit, statistically speaking, theres a chance you might not be able to. If you are close to maxing out all of your credit cards or your line of credit, it means that you are a higher risk to lenders. Higher risk to a lender means that theres a greater chance that you wont keep up with your payments.

Another aspect of this part of your credit score reflects how much of your available credit limits you use on an ongoing basis. If you usually use 60% or more of your credit limit on a credit card or line of credit, it will impact your credit score negatively. This is because if something were to happen to your income and you owe a lot of money, you would find yourself struggling to keep up with payments.

How Do I Get My Free Score/check My Credit Scores

If you want to keep track of your credit report, you have three main options. Only two of them include your credit score, though. Heres a brief overview of each option:

AnnualCreditReport.com

Thanks to an amendment to the 1970 Fair Credit Reporting Act , all U.S. consumers get one free credit report from each credit bureau once a year. To claim your reports, visit AnnualCreditReport.com, call 1-877-322-8228 or send an Annual Credit Report Request Form to Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281. Importantly, your free annual reports do not include credit scores.

For a quick and helpful credit overview, sign up for your free credit report card at Credit.com. Youll see your Experian VantageScore 3.0 credit score right away, and youll also get a letter grade for each of the five factors that influence your credit score. The credit report card is free, but it doesnt include your full credit reports.

ExtraCredit

To develop a really in-depth understanding of your credit, choose ExtraCredit. For an affordable monthly fee, you can look at all three of your credit reports whenever you likeand you gain access to 28 of the FICO scores lenders use to make decisions. You can use ExtraCredit to delve deep into your own history, and see the areas you would most like to work on.

Don’t Miss: Report A Death To Credit Agencies

How To Access Your Credit Report

To access your credit report, all you need to do is visit AnnualCreditReport.com. Be prepared to provide personal information and verify your identity with the bureau.

In response to the pandemic, credit bureaus are offering weekly access to your credit reports through April 2022 . You can also submit a request or mail.

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

You May Like: How Do Companies Report To Credit Bureaus

Get Your Credit Score

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

You May Like: What Credit Report Does Comenity Bank Pull

Crisil Revises Credit Rating Of Basf India

CRISIL has decided to put the rating of CRISIL AAA to the Non-Convertible Debentures of BASF India under rating watch with negative implications. The move to do so is been seen as an emerging situation which may affect the credit profile of BASF India. It must be noted here that the ratings on Fixed Deposits have been reaffirmed at FAAA/Stable and that of Commercial paper at CRISIL A1+. CRISIL is a global analytical company providing ratings, research, and risk and policy advisory services.

9 April 2020

Repairing And Managing Credit

A low credit score can translate into higher loan and credit card interest rates. It can also inhibit your ability to secure insurance, school loans, rental housing, utilities and even elective medical procedures.

If you have credit problems, work to repair your credit on your own or use a credit-counseling agency. Ask several agencies about services, fees and repayment plans before signing a contract. Beware any that ask you to pay up front or promise a quick fix it may take years to repair credit legitimately.

If you find errors on your credit report, correct them as soon as possible. To dispute an error, contact the financial institution that reported it or go directly to the credit agency. Provide all necessary details in writing. They then have 30 days to investigate, submit any corrections needed to credit agencies, and provide a written response. Learn more about disputing information reported by TD Bank

To protect your credit in the future, create a budget and pay bills on time, every time. Consider fees, interest rates and monthly payments before obtaining new credit. The sooner you begin to re-establish good credit, the sooner you’ll improve your credit score.

Read Also: How To Get Credit Report With Itin Number