What Lenders Don’t Know Ignore Conspiracy Theories

Many people believe every element of their life is on their credit reference files, but actually it’s mainly just a strict set of financial data. Though over recent years, the information contained on them has grown.

So let’s debunk some myths. Here are a few of the more common things people think are on their files, but aren’t.

Race, religion, ethnicity

These personal details about you are not held.

Salary

How much you earn isn’t on your file either, though you’ll usually be asked on the application form.

Savings accounts

As savings are not a credit product, they don’t appear on credit files. This data is therefore only available to banks you hold savings accounts with. However, when you apply for a savings account, the provider might do a soft search of your credit report to check your ID, and do anti-money-laundering checks.

Medical record

Medical problems you may have had in the past aren’t listed.

Criminal record

No criminal convictions are listed.

There are a host of other things that aren’t held on your credit report, including:

Start A New Credit History

One strategy some people use to improve their payment history is to take out a credit card that is easier to qualify for, like a gas station or store card, and consistently pay off the balance each month. The good behavior can slowly put you in a better financial position. But be careful this strategy doesn’t backfire on you: you don’t want to take out new cards if you think you will be tempted to rack up more debt.

Join An Account As An Authorized User

You can also improve credit by joining a trusted family member’s or friend’s credit card account as an . You’ll be able to use the card to make purchases, and the card’s payment history will show up on your credit report. That makes it crucial to pick someone whose credit you will benefit from. Work with the primary cardholder to pay them for your purchases, as they’ll be ultimately responsible for any balance on the card.

Also Check: Will An Eviction Show Up On My Credit Report

You Don’t Have A Uniform Credit Rating

There’s no such thing as a credit blacklist. This is a myth. In the UK, there’s no uniform credit rating or score, and there’s no blacklist of banned people.

Each lender scores you differently and secretly.

This means just because one lender has rejected you, it doesn’t automatically mean others will. Though after a rejection, it’s always important to check your credit file for errors before applying again.

Of course, if you’ve got a poor credit history, or had problems, it can feel like you’re blacklisted. Credit scoring is intuitive would you lend to someone with a history of not repaying? However, on occasion there are firms that specialise in lending to those who have had past problems though they then charge a whacking rate.

The tools that lenders use to decide aren’t universal either. As well as your credit file, they also look at application information and any past dealings they’ve had with you, and use the three sources of information to build up a picture of you.

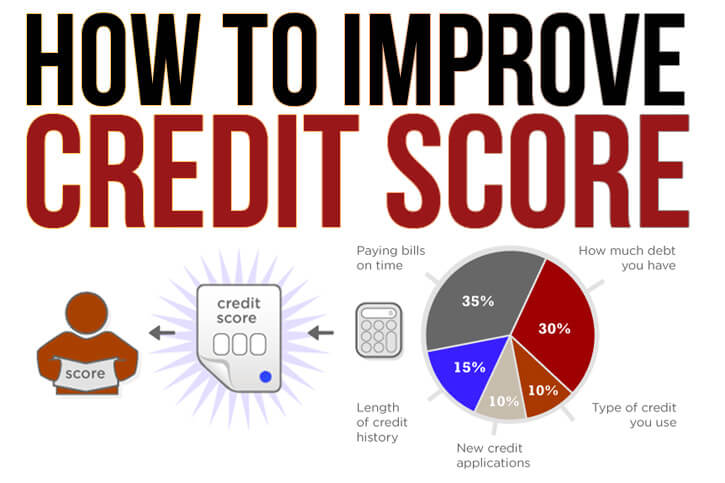

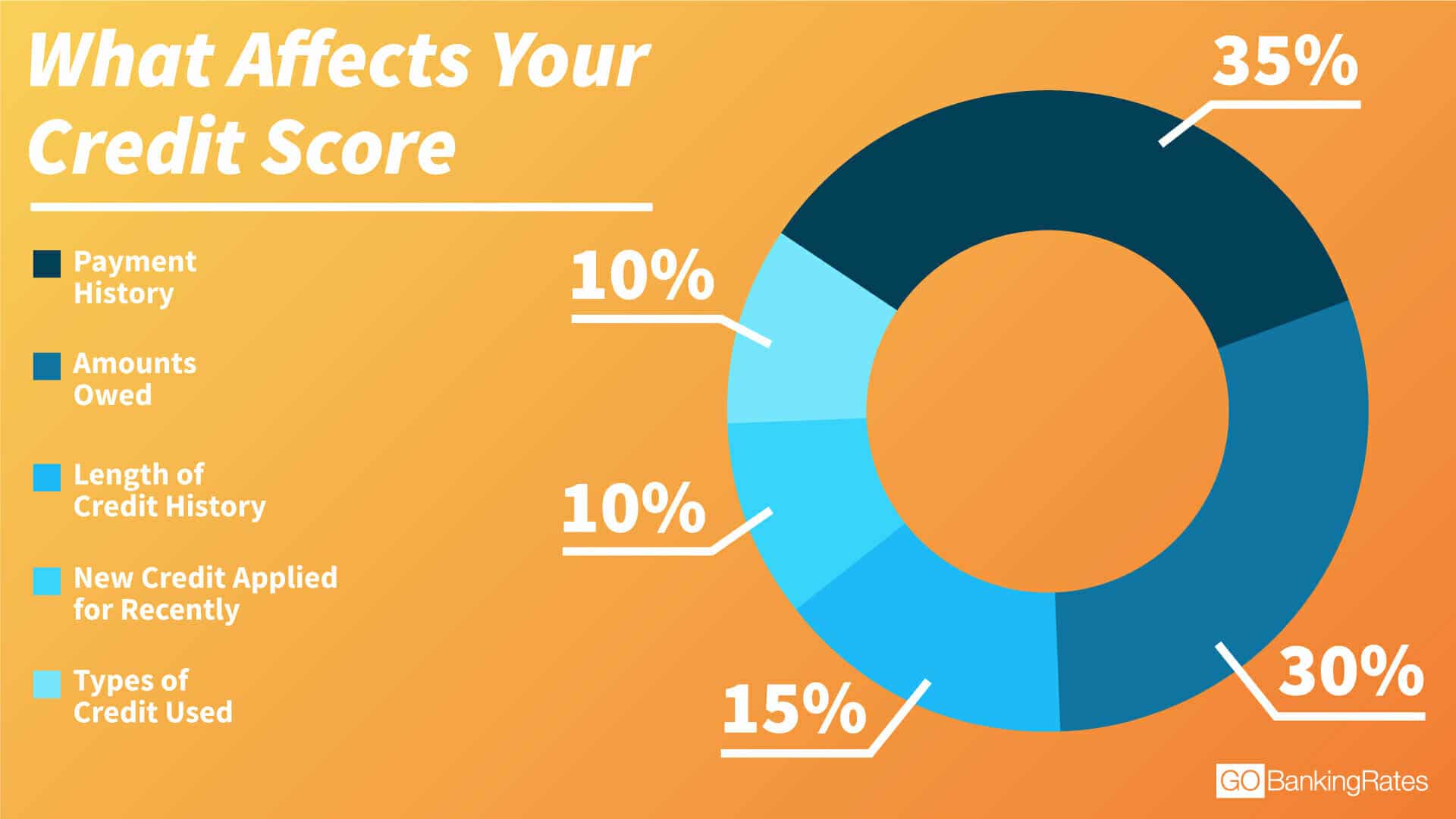

Strategies That Will Get You A Better Credit Score

Your is one of the most important measures of your financial health. It tells lenders at a glance how responsibly you use credit. The better your score, the easier you will find it to be approved for new loans or lines of credit. A higher credit score can also open the door to the lowest available interest rates when you borrow. If you’d like to improve your credit score, there are a number of simple things you can do. It takes a bit of effort and, of course, some time. Heres a step-by-step guide to achieving a better credit score.

Recommended Reading: Can Lexington Law Remove Repossessions

‘i Am Not A Number I’m A Free Man’ Er Not With Credit Scoring

We don’t have a right to be lent money. While the Government pushes lenders to offer more credit, especially in the small business and mortgage worlds, ultimately it’s still a commercial decision from firms about whether they want to lend.

This is done with a massive system of automated impersonal credit checks. It’s often far cheaper for a lender to reject some people who it should be lending to than it is to accept some it shouldn’t be lending to.

You may feel it’s unjust, but The Prisoner‘s call “I am not a number, I am a free man” doesn’t work in credit scoring. Here you are just a number, and you have to understand that, as frustrating as it may seem.

Negotiate A Lower Interest Rate

A lower rate can help you pay off your balance faster, because more of your payment can be applied to your principal balance than interest. Lower balances can mean a lower credit utilization ratio . Learn more about how to negotiate a lower interest rate.

Recommended Reading: 778 Fico Score

Here Are 10 Ways To Increase Your Credit Score By 100 Points

Be Wary Of New Credit

Opening several credit accounts in a short period of time can cause you to appear risky to lenders and, in turn, negatively impact your credit scores. Before you take out a loan or open a new credit card account, consider the effects it could have on your credit.

Note, however, that when you’re buying a car or looking around for the best mortgage rates, your inquiries may be grouped together and counted as only one inquiry for the purpose of credit scoring. In many commonly used scoring models, recent inquiries have a greater effect than older inquiries, and they only appear on your credit report for 24 months.

Read Also: Does Paypal Credit Report To Credit Bureaus

Banks Score You Based On Products They’d Like To Sell You In The Future

Imagine a bank wants new mortgage customers. That’s a costly sell. Instead, it offers a current account paying a high rate of interest on a small amount kept in it. Yet when you apply, rather than scoring you as a bank account customer, it could actually be scoring to see if you’re likely to be a profitable mortgage borrower in the future you might face rejection if you aren’t.

The secretive nature of credit scoring makes this difficult to ever truly know.

Be Patient And Diligent

Some aspects of your credit score take time and require your constant attention. For example, if you forget to make a loan payment for a single month and it drops your credit score, there’s not much you can do besides wait.

After all, your credit score is designed to show lenders how well you manage money in the long term. Yes, there are some quick fixes that can boost your credit score almost immediately. But when you boil it all down, the best thing you can do is make sure you never miss a payment and manage your debt responsibly.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Understand Your Risk Factors

When you request your free credit reports from AnnualCreditReport.com, you only receive the report. You dont see your actual credit scores. But for those who want to significantly increase their scores, purchasing a full credit report with scores can be beneficial.

Experian, TransUnion and Equifax include a list of risk factors along with purchased scores. Your credit score takes into consideration as many as 300 risk factors and knowing what your risk factors are will let you know where you can make improvements.

Your risk factors might list a specific account that is hurting your score or too many credit card applications in a short period. Even not having a mortgage can show up as a risk factor. You wont be able to fix everythingdont buy a house to increase your credit scorebut you might spot some factors you can change.

Check Your Credit Report Annually Or Before Any Major Application

Your credit reference reports, held at Equifax, Experian and TransUnion, contain enormous amounts of data on you. Errors happen and can kill applications, so it’s important to check them regularly and to go through line by line to check nothing’s wrong.

If possible, check your report at all three agencies as different lenders use different agencies and don’t assume the info will be identical on each.

Following the introduction of the General Data Protection Regulation in May 2018, it’s now always free to check your credit report. See our full Check Credit Files For Free guide, which also includes info on what to check.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Improve Your Payment History

Your payment history is the most important component of FICO® scoring models. Late and missed payments will reduce your credit scores, and bankruptcies and collections can cause significant damage. This negative information will remain on your credit report and impact your credit scores for seven to 10 years.

Your scores often take into account the size of your debt and the timing of your missed payments. The bigger your debt is, and the more recent your missed payments are, the worse your score will be, typically. Bringing accounts current and continuing to pay on time will almost always have a positive impact on your credit scores.

Sign Up For Experian Boost

If your low score is primarily the result of being new to the credit-seeking game and you are timely with your payments for utilities and your cell phone, ask the lender to pull a report from Experian, using its Experian Boost plan. This hybrid model draws on what the industry calls alternative credit data non-traditional payments that provide lenders useful insight into an applicants creditworthiness.

The way forward gets a little steeper from here, so its a good idea to know what youre up against.

Don’t Miss: What Is Syncb Ntwk On Credit Report

Keep Your Oldest Credit Card

If you have a credit card account that you havenât used for years, then you may be thinking about closing it. However, a better option might be to keep the account open, using it occasionally so your lender does not close it for lack of use. This is because a key factor that can affect your credit score is the age of the oldest account on your report in this case, the older the better! By keeping the account open, you are building your credit history and your total available credit , showing lenders your ability to consistently pay down your debts without missing deadlines.

Just remember that your oldest credit card could be cancelled by your credit card provider after a certain amount of time. An inactive card that’s suddenly been cancelled could hurt your credit score. To keep your oldest credit card open, use it to make the occasional small purchase, or set it to auto-pay one of your recurring expenses, like your streaming service account.

Build Your Credit If Needed

If you havent established credit yet, you might not even exist … in the credit report space, that is! If someone has never fallen in delinquency on any subscriptions or utilities or never had collections on anything and they have not utilized credit cards or loans in the past seven to 10 years, they may not have a credit profile at all, Nitzsche said. That presents a challenge when you want to buy a home.

If this sounds familiar, you may have to get a secured credit card where you put down a deposit, he advised. You still have to make payments and use it responsibly. Not all banks offer them but you can usually check with your local bank or credit union.

Don’t Miss: Does Getting Married Affect Your Credit Score

Boosting Your Credit Score Is A Bit Like Going On The Pull

You need to make yourself as attractive as possible to lenders, in the hope you’ll fit their bespoke lending criteria.

Some borrowers are unattractive to almost all lenders . However, a small few may have a fetish for those with poor credit histories as they can charge more.

And sadly for those rejected, just as when the guys ask Sarah or Jane why they’re not interested, they just say: “‘Cos I don’t fancy you,” and that’s about it. We don’t always get to know other than: “Your credit score wasn’t high enough.”

The tips below are to make sure that lenders see you in the best possible light. So that when they’re looking at you, you’re always dressed up to the nines, looking as hot as you can, and your skirt/shirt isn’t tucked into your pants without you knowing.

Keep Credit Cards Open

If you’re racing to improve your credit profile, be aware that closing credit cards can make the job harder. Closing a credit card means you lose that cards credit limit when your overall credit utilization is calculated, which can lead to a lower score. Keep the card open and use it occasionally so the issuer wont close it.

Recommended Reading: 611 Credit Score Mortgage

Council Tax Arrears & Parking Or Driving Fines

Councils don’t share data about your payments, whether good or bad. If you’re in arrears, it won’t affect your credit score. However, it’s always wise to prioritise your council tax payments as many councils are quick to prosecute. Council tax arrears are dealt with as a criminal matter, not a civil one, so you could end up with a criminal conviction.

Any fines you’ve incurred, for example, a parking or driving fine, won’t be listed. Even though they’re issued by the courts, they aren’t ‘credit’ issues, so they’re not listed.

Don’t Take Out Too Many Cards

Sometimes it seems like a good move to open a new credit card with a merchant to get a discount on an item. But try not to go overboard and take advantage of many discount offers over a short period of time. Each new card comes with a “hard inquiry” on your credit report by the merchant, which can have a negative impact on your credit score.

You May Like: Remove Repo From Credit

What Is A Credit Score

A credit score is a numeric summary of your credit history, a commonly used method for lenders to predict the likelihood that you will repay any loans they make to you.

There are no exact cutoffs for good scores or bad scores, but there are guidelines for each. Most lenders view scores above 720 as ideal and scores below 630 as problematic.

Consumers are becoming more aware of how raising their credit score improves their financial outlook and Homonoffs study has evidence of it. She found consumer behavior improved dramatically when people were aware of their credit score.

Many people thought they had a great score, but then found out they overestimated it, she said. They realized they had to start changing credit behaviors, so they stopped making late payments, they paid off cards with a balance and their scores improved.

The FICO credit score is used by 90% of the businesses in the U.S. to determine how much credit to offer a consumer and what interest rate to charge them for that credit.

FICO uses five major components in the equation that produces your credit score. Those five include:

Don’t Ask For Credit Too Often

Getting a new card from time to time shouldn’t ding your credit, nor should taking out a car loan or mortgage. People who default on loans tend to rack up a great deal of debt before they default, so lenders keep an eye on how many times you ask. New inquiries are 10 percent of your FICO score.

Lenders will pull your credit report when they are considering making a loan to you, and this type of inquiry is called a hard inquiry. Hard inquiries stay on your credit report for about two years. Lenders look at a cluster of hard inquiries as a sign of financial trouble.

“Soft inquiries are when someone looks at your credit as a background check an employer, for example, might pull your credit report if you’ve applied for a job. And sometimes lenders will pull your report to see if you’re a good candidate for a new credit card. Soft inquiries don’t affect your credit score.

John Waggoner covers all things financial for AARP, from budgeting and taxes to retirement planning and Social Security. Previously he was a reporter forKiplinger’s Personal FinanceandUSA Todayand has written books on investing and the 2008 financial crisis. Waggoner’sUSA Todayinvesting column ran in dozens of newspapers for 25 years.

Also of Interest

Please leave your comment below.

You must be logged in to leave a comment.

Featured AARP Member Benefits

Recommended Reading: Does Opensky Report To Credit Bureaus