How To Remove Late Payments From Your Credit Report

An accurately reported late payment can remain on your credit report for up to seven years. Even if you bring the account current and aren’t late anymore, your credit report is telling an accurate story of your history with the account.

If a creditor reports your payment late when you actually paid on time, however, you can dispute the late payment with the credit bureau. You can file your dispute for free by mail, over the phone or online, and explain why you believe the late payment is an error. You can also send, attach or upload supporting documents, such as bank statements or cancelled checks showing when you paid the creditor.

After receiving a dispute, the credit bureau will investigate your claim and either confirm the late payment was accurate or update your credit history to reflect what actually happened.

Get On The Electoral Roll

The easiest way to improve your credit score is to register to vote as this data is recorded on the public register which the credit bureaus check and include in your credit file. This is the first way to prove your identity and by far the easiest.

In the future when you apply for credit or a credit check is done, this will be the basis of their verification method for you and helps make you seem more creditworthy. You should check with your local council here if you are already on the electoral roll and if not you can register to vote here.

If you are not eligible to vote in the UK you will not be able to get on the electoral roll. In this case you can get a similar benefit by submitting a document to either Experian, Equifax or callcredit proving your identity and address. You can then ask them in writing to confirm that they have verified your identity on your credit file

What Happens When An Account Is Closed

When you pay off or close an account its not available for purchases or payments.

An account can be closed for many reasons such as paying off the amount borrowed or closing an unwanted line.

Once the account is closed, its then settled and will appear on your credit report as such.

When an account is closed with a balance, the creditor will still report the status and account details to the credit bureaus on a monthly basis.

The information that is reported is the balance, monthly payment history, and the date of your last payment.

You May Like: What Credit Bureau Does Target Pull From

Get A Credit Builder Loan

Another way to improve your credit score is by using a credit builder loan.

Credit Builder loans, just as they sound, help you build credit. The idea is you take out a loan but rather than receiving the loan funds these are deposited in an account and you make repayments to the loan provider every month.

As you make these loan repayments on time your credit file records this and your credit score improves. At the end of the loan term you get all your loan repayments and whatever interest you have gained.

Loqbox is a credit builder loan provider in the UK.

Can I Avoid Hard Credit Checks

To minimise the number of hard searches on your report, youâll need to make as few credit applications as possible. But you can ensure the applications you do make have a higher chance of acceptance, by only applying for credit youâre eligible for.

You can check your eligibility rating for credit cards and loans when you compare them with Experian. Itâs free and only a soft search will be recorded on your report, meaning your score wonât be affected unless you actually apply.

Don’t Miss: Does Paypal Working Capital Report To Credit Bureaus

Write A Goodwill Letter

If disputing the negative entry doesnt work because you couldnt find errors, or because the credit bureaus fixed them, your next step should be asking for a goodwill adjustment.

Write a letter to the original creditor or collection agency and ask them to remove the negative entry from your credit history as an act of goodwill.

This is most effective when youre trying to remove late payments, paid collections, or paid charge offs.

A goodwill letter is really easy to write. You can use my goodwill letter template as a starting point.

You will basically explain your situation to the creditor or collection agency. Explain how youre trying to get a mortgage and the negative entry means youre struggling to get approved.

While this may seem like a long shot, youd be surprised how often creditors make goodwill adjustments. This is especially true if youre a current customer because the creditor wants to keep your business.

This strategy wont work as well if you have a long history of keeping past due balances. It works best if your negative entry is an anomaly and if youve paid off the balance due.

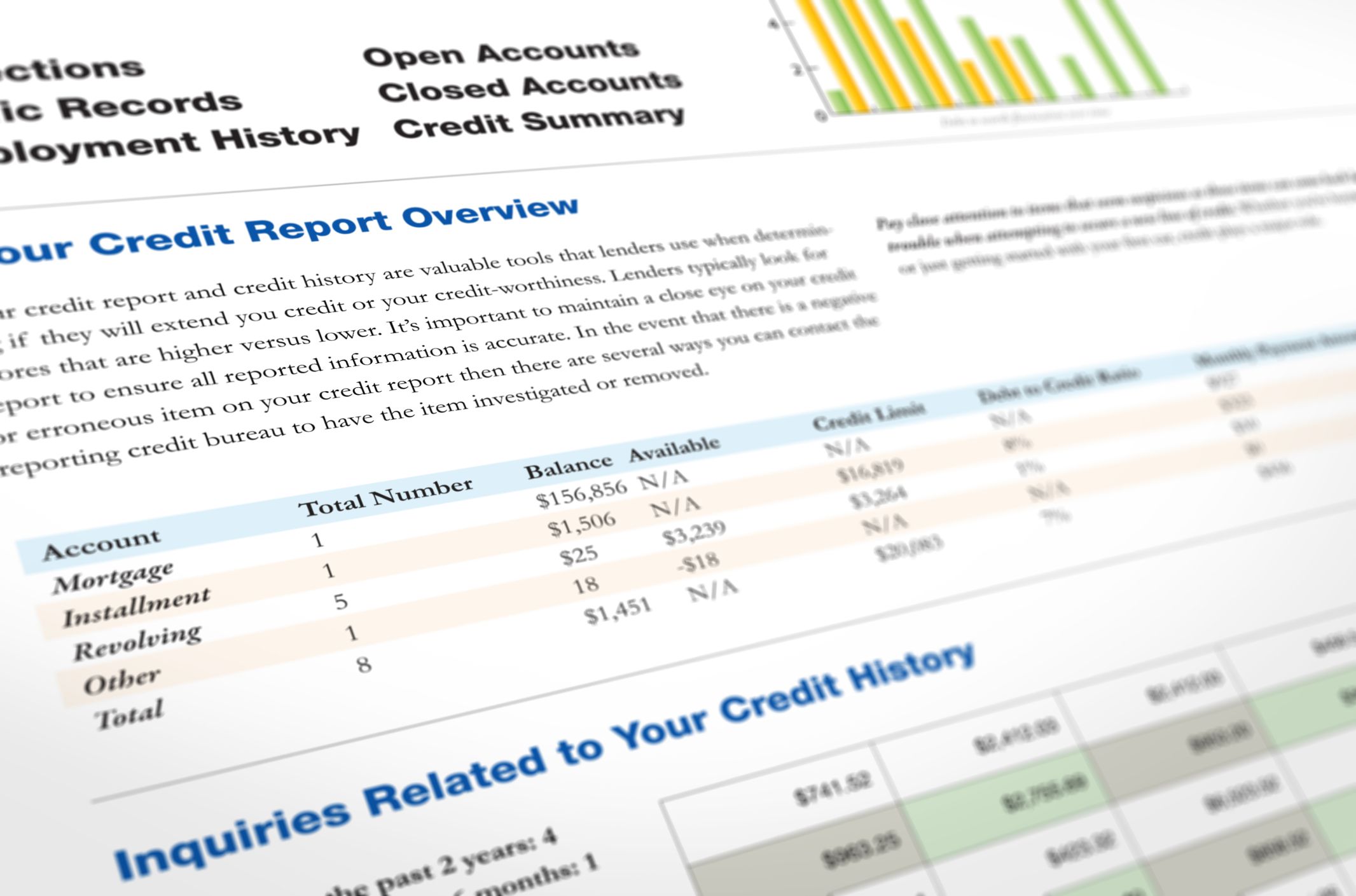

Review Your Credit Reports

You can also review and monitor your credit reports to watch your progress and make sure no unexpected collection accounts show up there. You can get your Experian credit report for free every 30 days, and take advantage of our free credit monitoring service, which can alert you to score changes and suspicious activity. If you find or are notified of something odd, you can use the Experian Dispute Center to submit a dispute online for free.

Don’t Miss: Minimum Credit Score For Carmax

Request A Change To Your Credit Report

What can you do if there is incorrect information on your creditreport?

You have the right under the General Data Protection Directive toaccess the records held about you by credit agencies and to have incorrectinformation rectified. If you are not satisfied with how your request ishandled, you can appeal to the DataProtection Commission.

Central Credit Register

If you believe there is inaccurate, incomplete or out-of-date information inyour credit report, you have a right to apply to your lender and the CentralBank to amend the information held on the Central Credit Register.

You can get more information in the Central Banks factsheet Howto request an amendment to information on my credit report.

Irish Credit Bureau

If you want to have inaccurate information on your credit record amended,contact the lender concerned and ask them to forward the correct information tothe ICB. The ICB cannot change the information unless the lender asks themto.

Can you add a statement to your credit report?

It is possible to add a personal statement to your credit record to clarifyit. This is known as an explanatory statement or personal declaration .

For example, if you have had significant expenses due to relationshipbreakdown, bereavement, illness or another cause, you may add these details toyour record.

The statement must be factual, relevant to the information in the creditreport, and under 200 words. It should not contain information that couldidentify another individual .

What Should I Do When I Get My Credit Report

Your credit report has a lot of information. Check to see if the information is correct. Is it your name and address? Do you recognize the accounts listed?

If there is wrong information in your report, try to fix it. You can write to the credit reporting company. Ask them to change the information that is wrong. You might need to send proof that the information is wrong for example, a copy of a bill that shows the correct information. The credit reporting company must check it out and write back to you.

Read Also: Check Credit Score With Itin

Avoid Making Too Many Credit Applications

Making applications for utility or credit can reduce your credit score. This is because everytime a utility or credit provider is about to open a new account they will do a hard credit search. You should only apply for credit or utility which you are pre-approved for. If you make multiple credit applications then multiple hard credit searches will be done on your credit file.

This means your credit score will go lower as the credit bureau will view too many credit applications as you being desperate. If you stop making blind credit applications then your credit score will likely improve.

You should always use an eligibility checker to see if you will be approved for credit or utility accounts before you apply. These checks are done with soft credit searches which only you can see.

Improving Your Credit When You Have Accounts In Collections

In addition to paying off collection accounts, you can take a variety of actions to improve your credit scores while there are collections in your credit history.

For example, if you have open credit cards or loans, make all payments on time going forward. Payment history has the biggest effect on your credit scores, so making at least your minimum payments on time every month will help. If you don’t have any open accounts, you may want to take out a secured card or to start building a positive credit history.

You can also work to lower your utilization ratean important scoring factorby paying down or consolidating credit card debt with a personal loan.

Having a long history of on-time payments and low debt relative to your available credit limits can help improve your credit over time.

Don’t Miss: Can A Repo Be Removed From Credit Report

Who Needs A Notice Of Disassociation

If you no longer have any joint financial arrangements with a third party, you should apply to have the association removed from your credit file. For instance, you may have separated from your partner with whom you had a joint mortgage, or you no longer share a joint account, but its still recorded on your credit report.

Its essential to regularly check your financial associates are correct. You can do this by checking your credit report.

Read our guide for more information about how to get your credit report.

Debts Always Disappear 6 Years After A Default

A debt will be deleted from your credit record six years after the default date. There are no exceptions to this rule so it applies if:

His default date was 30 April 2013, so by the end of April 2019 the debt will have gone.

One point that can confuse people is that after a default has been added, another default is added each month. These dont affect your credit score and dont matter for when the debt drops off the first default is the real one.

Also Check: What Credit Score Does Carmax Use

Paying To Remove Negative Credit Info Is Possible But May Not Succeed

A bad credit score can work against you in more ways than one. When you have poor credit, getting approved for new loans or lines of credit may be difficult. If you qualify, then you may end up paying a higher interest rate to borrow. A low credit score can also result in having to pay higher security deposits for utility or cellphone services.

In those scenarios, you may consider a tactic known as pay for delete, in which you pay to have negative information removed from your credit report. While it may sound tempting, its not necessarily a quick fix for better credit.

Hard Inquiry: Two Years

A hard inquiry, also known as a hard pull, is not necessarily negative information. However, a request that includes your full credit report does deduct a few points from your . Too many hard inquiries can add up. Fortunately, they only remain on your credit report for two years following the inquiry date.

Limit the damage: Bunch up hard inquiries, such as mortgage and car loan applications, in a two-week period so they count as one inquiry.

Read Also: Syncb/ppc Closed Account

Do The Three Credit Reference Agencies Hold Identical Information About Me

No. The information CRAs obtain from public sources, such as electoral register data, bankruptcies and County Court Judgments should be similar, but information supplied by lenders may well be different. Some lenders supply data about their credit accounts to all three CRAs, while others only supply data to one or two agencies.

Check Your Credit Score Regularly

Checking your credit score regularly is one of the ways to ensure that the information on your credit score is indeed up to date.

It also informs you on what your credit score is and this allows you to have an idea of which credit providers may lend to you.

If you find any errors on your credit score or report you can contact all of the credit bureaus or the specific credit bureau where the error is mentioned and ask them to make the necessary corrections.

The credit bureaus will check and investigate the matter but in the meantime put a notice of correction on the record entry so that any third parties who are checking your credit score will be aware that the entry may be incorrect.

The credit bureau will usually let you know the outcome of their investigations within 28 days.

If you are unsure of what your credit score is then you should check your credit score from the four credit bureaus in the UK: Experian, Crediva, Equifax and Transunion.

Some of these credit bureaus may charge you a fee to view your credit report so what you can alternatively do is request a statutory credit report which is a free credit report which each credit bureau must provide to you upon you requesting it.

Alternatively, you can also use credit score services such as Checkmyfile and clearscore to check your credit report.

Read Also: Paypal Credit Affect Credit Score

How Long Does Negative Info Stay On Your Credit Report

Thomas J. Brock is a Chartered Financial Analyst and a Certified Public Accountant with 20 years of corporate finance, accounting, and financial planning experience managing large investments including a $4 billion insurance carrier’s investment operations.

The information on your credit report changes throughout your lifetime as you carry on in everyday life. Certain businesses, like credit card companies and various lenders, report your activity to credit reporting agencies to be added to your credit report, but not everything stays forever.

The Fair Credit Reporting Act is the federal law that ensures credit reports are fair and accurate. That includes limiting the amount of time negative information can remain on your credit report. For student loans, the credit reporting time limit is governed by the Higher Education Act.

Have A Good Credit Mix

Mix things up a little by having a varying degree of accounts on your credit file. Like your partner, credit bureaus like to see you mix things up a little bit. By this, we mean that a proportion of your credit score is ranked by how diverse the different types of credit you have been utilizing is.

Examples include:

Revolving accounts

Installment accounts

Open accounts

Increase your variety and your credit score will increase.

You May Like: Does Carvana Report To Credit Bureaus

Bankruptcy: Seven To Ten Years

The length of time bankruptcy stays on your credit report depends on the type of bankruptcy, but it generally ranges between 7 and 10 years. Bankruptcy, known as the credit score killer, can knock 130 to 150 points off your credit score, according to FICO. A completed Chapter 13 bankruptcy that is discharged or dismissed typically comes off your report seven years after filing. In some rare cases Chapter 13 may remain for 10 years. Chapter 7 and Chapter 11 bankruptcies go away 10 years after the filing date, and Chapter 12 bankruptcies go away seven years after the filing date.

Limit the damage: Don’t wait to start rebuilding your credit. Get a secured credit card, pay nonbankrupt accounts as agreed, and apply for new credit only once you can handle the debt.

What Is A Credit History

Sometimes, people talk about your credit. What they mean is your credit history. Your credit history describes how you use money:

- How many credit cards do you have?

- How many loans do you have?

- Do you pay your bills on time?

If you have a credit card or a loan from a bank, you have a credit history. Companies collect information about your loans and credit cards.

Companies also collect information about how you pay your bills. They put this information in one place: your credit report.

You May Like: Speedy Cash Change Due Date

Hire A Credit Repair Service

A reputable company like may be a viable solution if your report is riddled with inaccuracies that further complicate the repair process. can help you with the following items:

- Cleaning up credit report errors

- Disputing inaccurate negative entries

- Handling creditor negotiations

If you decide to hire a credit repair service, know that laws govern how they operate and what they can do. The establishes the following regulations governing credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the service

- They cannot receive payment for the performance of any service until said service has been entirely performed

- There must be a written contract detailing the services to be performed, the time frame during which these services will be performed, and the total cost for those services

- They cannot promise to remove accurate information from a credit report before the term set by law

- The consumer will have three days in which to review the contract and cancel without penalty