Fico Score Vs Credit Score

The three national credit reporting agencies Equifax®, ExperianTM and TransUnion® collect information from lenders, banks and other companies and compile that information to formulate your credit score.

There are lots of ways to calculate credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models. Many lenders look at your FICO® Score, developed by the Fair Isaac Corporation. VantageScore® 3.0 uses a scoring range that matches the FICO® model.

The following factors are taken into consideration to build your score:

- Whether you make payments on time

- How you use your credit

- Length of your credit history

- Your new credit accounts

- Types of credit you use

How To Get Excellent Credit: 5 Expert Tips

1. Always pay on time. Always.

Payment history heavily influences your credit score. In fact, it is the most influential factor for FICO and VantageScore.1 To stay on top of your payments, set up a calendar reminder or enroll in automatic payments. The on-time payment goal applies to all your bills, including utilities, rent and cell phone service.

What if you were late on a payment a few years ago? While late or missed payments can stay on your credit report for seven years, the impact on your credit score decreases over time. Most negative items have little impact on your score after two years2 so be patient, keep making timely payments, and youll soon be on your way to an excellent credit score.

2. Optimize your credit utilization ratio.

is another key piece of your credit score puzzle. Credit utilization measures the balances you owe on your credit cards relative to your cards credit limits. Its calculated on an overall basis .

The general rule of thumb with credit utilization is to stay below 30%.3 This applies to each individual card and your total credit utilization ratio. Strategies for improving your credit utilization ratio focus on reducing the numerator and managing the denominator .

Try one of these techniques to improve your credit utilization ratio:

3. Regularly monitor your credit scores for inaccuracies.

4. Be strategic about taking on new debt and closing accounts.

5. Consider your credit mix.

Good Credit Score Range For Auto Loans

When determining the interest rates for an auto loan, financial institutions typically rely on FICO® Auto Score 2, 4, 5, or 8. These scores range between 250 and 900. The higher the number the better the score. If youre shooting for the lowest possible APR on your auto loan your Auto credit score should be above 740.

We sampled auto loan interest rates from Unitus Community Credit Union to see how interest varied on a new car loan across a range of credit scores. The results can be seen in the table below.

New Auto Loans: Model Years 2014 and Newer

| 15.24% | N/A |

As with mortgages, the length of the loan also plays a huge impact in your rates. The longer the term on your auto loan, the higher interest you’ll pay. Having a good credit score can mitigate this negative effect.

Recommended Reading: When Do Companies Report To Credit Bureaus

What Mortgage Lenders Look For When Approving A Home Loan

When you apply to get pre-approved, your lenders will review your credit history and consider your current credit outlook. This includes looking at:

- How on-time have you been with your payments and obligations?

- What does your current debt load look like, and how is spread out?

- How much experience do you have managing credit?

- Have you been recently trying to acquire access to new sources of credit?

- Do you let items go into collection?

- Have you previously filed for bankruptcy?

Lenders ask these questions to get comfortable about you. Your financial health isnt the only consideration lenders make, but how you manage your bills tells a large part of your story.

Lenders also look for specific credit events known as derogatory items, like bankruptcy or delinquent accounts.

Derogatory items dont disqualify a mortgage approval. Generally, its only required that theyre historical events and not current ones. For example, you can get approved for a mortgage if youve declared bankruptcy in the past, or if youve lost a home due to foreclosure.

Lenders know that life is unexpected and bad things happen. Whats important is whats happened in the time since the derogatory event occurred.

How To Avoid Auto Loan Traps

Many auto buyers simply buy a vehicle that is more than they can afford, or just buy the wrong vehicle from the start. Here are a few simple rules to remember:

CarEdge.com is an automotive consumer advocacy site that assists car shoppers in making more-informed, better-educated vehicle purchasing decision. Our Loan Calculator tool will show you what your vehicle payments will be for the specific vehicle you are considering. We will also show you the rate at which that vehicles value will depreciate. The goal is to have you pay down your loan faster than your car depreciates, so that you arent underwater in your loanor have a balance that is greater than the value of your car. Depreciation is really important when considering a vehicle purchase, so see how your vehicle of interest does compared to others with our Depreciation Calculator. Happy shopping.

Also Check: Paypal Credit Score Requirement

What To Do If You Don’t Have A Credit Score

For FICO® Scores, you need:

- An account that’s at least six months old

- An account that has been active in the past six months

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

If you aren’t scorable, you may need to open a new account or add new activity to your credit report to start building credit. Often this means starting with a or secured credit card, or becoming an .

Personal Loans For Fair Credit

Once your score improves a bit, you have more options. Typically, interest rates will also be lower in this credit range when compared to bad credit loans.

To compare other options, you can check out our guide to the best fair credit loans.

Two Lenders Offering Personal Loans for Fair Credit

| Minimum Credit Score |

| View Rates |

You May Like: How Bad Is A 500 Credit Score

Good And Bad Credit Score

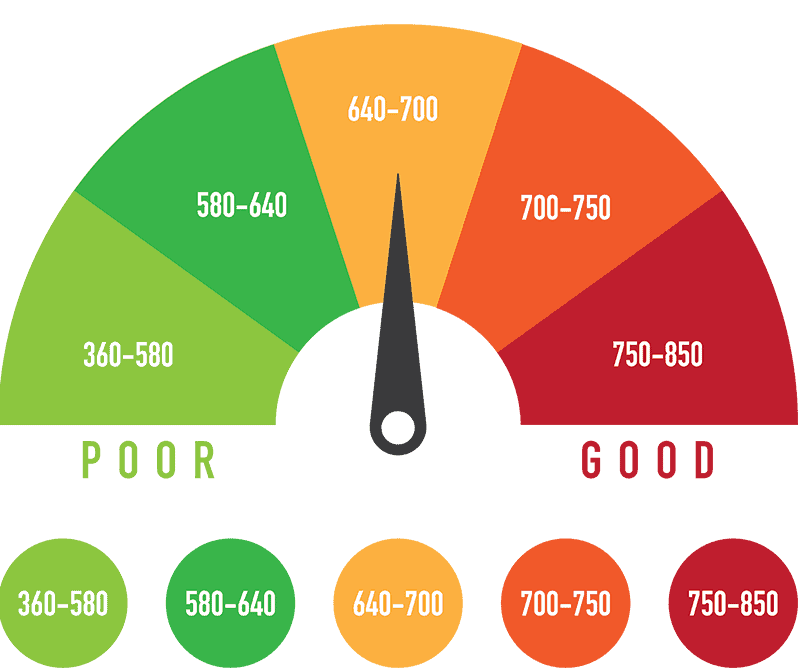

An individual credit score has a specific numerical value ranging from 1 to 1000. Conventionally, a rating scale in points is divided into several parts:

- 800-1000: good score the likelihood of approval is very high

- 600-800: average score some companies may refuse

- 300-600: you can get a loan for the short term but at a high-interest rate

- 0-300: most likely they will refuse a loan, you can contact an MFO.

A value between 800 and 1000 is considered the best. Clients with such points are most willingly provided with loans and credits. With a positive assessment of the financial history, credit becomes available to a person in any bank or MFI. A borrower can independently decide where and on what terms to issue a loan. Also, personal offers of banks for loans with lower interest rates can be formed in the favor of the borrower.

At the same time, those who have an indicator of 300 and below are reluctant to issue loans. It is believed that such borrowers are inherently insolvent and financially unstable. A credit rating of 300 means that a person:

- has a large debt burden, delays, and fines

- repeatedly took loans and with difficulty returned them

- was a guarantor of problem loans

- filed for bankruptcy of an individual

- has an insufficient status of activity on loans .

Before issuing a loan, a bank checks the financial history of an individual and only after that makes a conclusion about the possibility of lending it.

Factors That Can Affect A Credit Score

There are 5 main factors that can affect the calculation of a credit score. If youre interested in improving your credit these are the areas that you should focus on.

History of Payments

This is determined by the payments you have made to lenders or creditors. This ultimately reflects on how frequently you pay your loans or bills on time. Anyone looking to improve their credit scores should always make their payments on time, without fail.

Debt/ Credit Utilization

This shows the amount of outstanding debt a consumer has compared to the amount of available credit they have. For example, if you have a total credit limit of $5,000 and consistently carry a high balance, your credit score may be negatively affected. To help improve your credit scores, pay down your debt and make sure you need your balance to lower than 35% of your available credit.

This factor is straightforward, the longer a credit account has been open, the better it is for your credit scores. If youre considering cancelling a credit card, make sure you cancel a new one and keep the older ones open.

New Inquiries

Every time a potential lender or creditor pulls your credit, your credit score may take a small and temporary hit. If you apply for a lot of new credit within a short period of time, your credit score may drop and other creditors will be able to see that youve recently applied for a lot of credit which they may consider to be a red flag.

Diversity

Loans Canada Lookout

You May Like: How Long Does It Take Capital One To Report Authorized User

Cnbc Select Explains What Is A Good Credit Score How Good Credit Can Help You Tips On Getting A Good Credit Score And How To Get A Free Credit Score

Selects editorial team works independently to review financial products and write articles we think our readers will find useful. We may receive a commission when you click on links for products from our affiliate partners.

Credit scores range from 300 to 850. Those three digits might seem arbitrary, but they matter a lot. A good is key to qualifying for the best credit cards, mortgages and competitive loan rates.

When you apply for credit, the lender will review your to determine your eligibility based on this information, which includes that three-digit number known as your .

That magic number tells lenders your potential credit risk and ability to repay loans. Credit scores consider various factors, such as payment history and length of credit history from your current and past credit accounts.

There are two main credit scoring systems: FICO and VantageScore, and they aren’t created equal. FICO Scores are more valuable, as lenders pull your FICO Score in over 90% of U.S. lending decisions.

Below, CNBC Select explains what is a good for FICO and VantageScore, how good credit can help you, tips on getting a good credit score and how to check your score for free.

Find Your Credit Score

Visit AnnualCreditReport.com to get a free copy of your credit report, which reflects your account and payment history. You are entitled to receive one free report every year from each of the three credit reporting agenciesEquifax, Experian and TransUnion. Your report doesnt include your credit score, but it shows you what information the bureaus take into account in their credit score calculations. You may be able to obtain a free copy of your credit score through your bank or credit card provider.

Also Check: Syncb Amazon Credit Inquiry

Why Do I Need A Good Credit Score For A Personal Loan

When applying for a personal loan, or any other type of credit, a good credit score can mean a greater range of choice for you in terms of lenders and loan offers, and more attractive borrowing terms .

Credit scores represent your history with credit as recorded in your credit reports, and give lenders a sense of how experienced and responsible you are in handling debt. Higher credit scores correlate with lower likelihood of failing to repay debts, so lenders consider it riskier to lend money to borrowers with low credit scores than to those with high ones. They typically offer their best deals on loans and credit to borrowers with high credit scores. Lenders usually charge more to borrowers with lower scores to offset their greater chances of loan default, and if an applicant’s credit score is too low, might not even offer them credit at all.

Each of your credit scores reflects the information in your credit file at each of the three national credit bureaus , as analyzed by a credit scoring system such as the FICO® Score or VantageScore® model. While their specific calculations are highly guarded trade secrets, all credit scoring systems are broadly responsive to the same basic set of factors:

How Do You Apply For Personal Loans

When youve shopped around among lenders and found the right one, youre usually able to apply online and can often get a decision within minutes. However, some small local banks or credit unions may require you to visit a branch to apply for a loan.

When you apply for a personal loan, youll need to submit personal information, including your Social Security number and other relevant info. Lenders check your credit and either approve or deny your loan. Theyll also let you know the specific loan terms youve qualified for. Pay attention not only to the monthly payments, but also any fees youll have to pay and how long youll have to pay off the loan.

Read Also: Does Zebit Report To Credit

How Does The Credit Score Break Down

Let’s imagine you’re getting ready to buy a car. You’ve saved a good portion of the money to pay for it, but you’ll still need a loan to help purchase it from the dealer. Before any lender decides to give you a loan for the car, they will check your credit score.

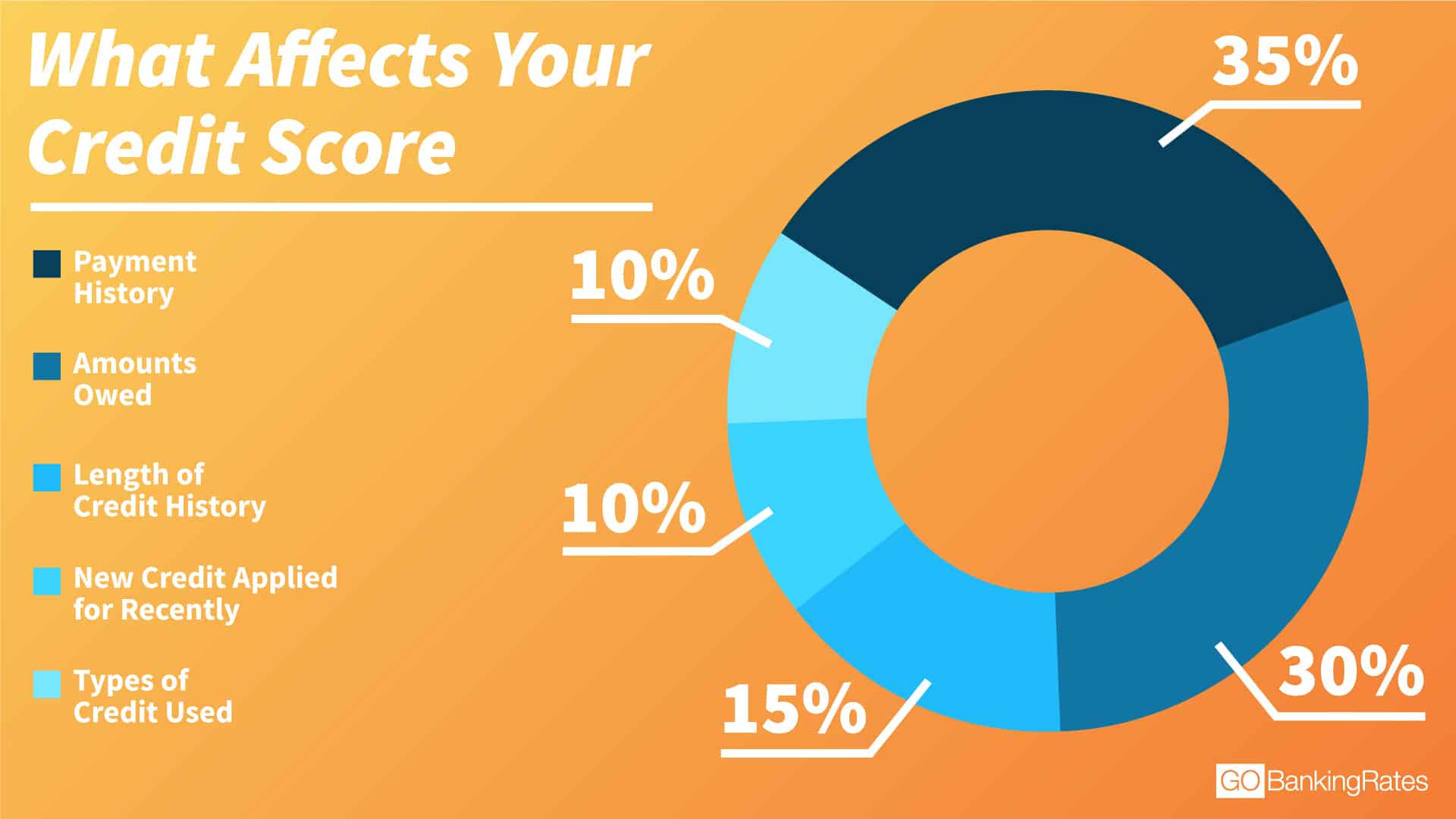

Your credit score is made up of five key components:

- payment history ,

- length of credit history ,

This data feeds into a credit report. The report basically indicates the level of responsibility with which you pay your bills and loans. If you have a history of consistently missing payments and maxing out your credit cards , you should anticipate a low credit score. On the other hand, if you make your payments on time and you stay under 30 percent of your credit limits, you’ll have a higher credit score.

Budgeting tip: Credit scores range from 300-850. Higher credit scores are favorable to lenders but if you have a lower score, it’s not the end of the world. You could make adjustments to improve your credit relatively quickly.

Have you ever wondered how you qualified for a loan? Or why you didn’t? Perhaps you ended up with an interest rate higher than the one advertised. Your credit score may be the reason. It’s a numerical scale that lenders use to determine your creditworthiness. The better the number, the more likely it is that you will get the credit you want at a desirable rate.

Factors That Affect Credit Scores

So, you can see credit-scoring models and credit reports are two big factors that determine your credit score. But if you donât know what information from your credit report is being used, itâs not much help.

Here are a few factors the CFPB says âmake up a typical credit scoreâ:

- Payment history: How well youâve done making payments on time.

- Debt: How much current unpaid debt you have across all your accounts.

- A ratio that reflects how much of your available credit youâre using compared with how much you have available. is usually expressed as a percentage.

- Loans: How many loans and what kinds they are, such as revolving credit accounts and installment loans. Sometimes this is called your credit mix.

- How long youâve had your accounts open. But remember, what qualifies as your oldest line of credit depends on whatâs being shown in your credit reports.

- New credit applications: How many times youâve applied recently for new credit. The effect on your scores might be minor, but a lot of new hard credit inquiries could still give a negative impression to lenders.

How Does FICO View Those Credit Factors?

FICO is pretty specific about what it views as the most important credit factors: Payment history makes up about 35% of its scoring. About 30% is based on the total debt. The other primary factors are credit history , credit mix and new credit .

How Does VantageScore View Those Credit Factors?

Read Also: Is Credit Wise Accurate

Tips To Improve Your Credit Score

Even if you have good credit, putting in a little work to raise your credit score could save you money on your loan. Use these tips to boost your score:

- Look for errors on your reports. You can access one free annual credit report each from Experian, TransUnion and Equifax . Regularly examining your reports can help you catch any errors and make sure you aren’t being penalized for a financial misstep you didn’t make.

- Make on-time payments. One of the best ways to improve your credit score is to make timely payments on all of your bills. If you’re having trouble remembering to make payments, see if any of your lenders offer autopay.

- Pay down debt. Pay off as much debt as you can before applying for a loan. This will not only improve your credit score, but also lower your debt-to-income ratio, which many lenders take into account.

- Avoid opening new accounts. It’s good to have a diverse credit mix, but it’s best to avoid opening too many new accounts within a short time frame, as each application will run a hard check on your credit, lowering your score slightly.

- Don’t close old accounts. Credit scoring agencies take a close look at the age of your existing accounts. Even if you have an old credit card that you no longer use, keeping it open could be beneficial for your score.