How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

Get Your Credit Score And Report For Free

If you’ve ever applied for credit or a loan, there will be a credit report about you.

You have a right to get a copy of your credit report for free every 3 months. It’s worth getting a copy at least once a year.

Your credit report also includes a credit rating. This is the ‘band’ your credit score sits in .

Usually, you can access your report online within a day or two. Or you could have to wait up to 10 days to get your report by email or mail.

Contact these credit reporting agencies for your free credit report:

Since different agencies can hold different information, you may have a credit report with more than one agency.

Some credit reporting agencies may provide your credit score for free check with them directly.

Alternatively, you can get your credit score for free from an online credit score provider, such as , Finder or Canstar. This usually only takes a few minutes.

Typically, you agree to their privacy policy when you sign up, which lets them use your personal information for marketing. You can opt out of this after you sign up.

Avoid any provider that asks you to pay or give them your credit card details.

The Credit Scores Lenders Use

The score you pulled from the or another third-party provider was an educational credit score, provided just to give you a perspective on your credit standing. Theyre not the scores that lenders actually use to approve your application. Services that provide credit scores include this information in their disclaimers.

On top of that, you likely purchased a generic credit score that covers a range of credit products. Creditors and lenders use more specific industry credit scores customized for the type of credit product youre applying for. For example, auto lenders typically use a credit score that better predicts the likelihood that you would default on an auto loan. Mortgage lenders use a score developed specifically for mortgage loans. Your lender also might also use a proprietary credit score thats developed for use by just that company.

Many lenders use the FICO score, but even the score you receive through myFICO may be different from what your lender sees. Some lenders also use VantageScore, but again, their version is different from yours.

The score the lender pulls might differ from the one you used sometimes by several points, possibly enough to disqualify you from the best interest rate or maybe enough to have your application denied. When you order your credit report and score from myFICO, you’ll receive access to the most widely used FICO industry scores. This will give the best idea of what the lender sees when they check your credit score.

You May Like: How To Remove Repossession From Credit Report

How Can I Get Errors In My Credit Report Fixed

If your credit reports are not accurate or dont reflect your agreements with your lenders, you can check your reports for errors and dispute any inaccurate information. If you find inaccurate information on your credit reports, use the CFPBs step-by-step guide to dispute that information with the credit reporting agency and the company that provided that information to them, known as a furnisher. After you send your dispute, check your report again. You may want to wait a month or two before checking to see if the errors have been corrected. You should check your reports with all three nationwide credit reporting agencies. Your lender or creditor may only report or furnish your information to one credit reporting agency, so checking all three will ensure that you know your information is correctly reported. And if you need to dispute incorrect information, you will know which credit reporting agency to contact.

If your dispute is not resolved with the credit reporting agency, you can ask that a brief statement of the dispute be included in your file and included or summarized in future reports. You can also submit a complaint at any time to the CFPB at consumerfinance.gov/complaint.

How Do I Get A Copy Of My Credit Report

Right now, its easier than ever to check your credit report more often. Thats because everyone is eligible to get free weekly online credit reports from the three nationwide credit reporting agencies: Equifax, Experian, and Transunion. To get your free reports, go to AnnualCreditReport.com. The credit reporting agencies are making these reports free until April 20, 2022.

Each of the three nationwide credit reporting agencies Equifax, TransUnion, and Experian are already required to provide you, on your request, with a free credit report once every twelve months. Be sure to check your reports for errors and dispute any inaccurate information.

In addition to your free weekly online credit reports until April 20, 2022 and your free annual credit reports, all U.S. consumers are entitled to six free credit reports every 12 months from Equifax through December 2026. You can access these free reports online at AnnualCreditReport.com or get a “myEquifax” account at equifax.com/personal/credit-report-services/free-credit-reports/ or call Equifax at .

Don’t Miss: Is 611 A Good Credit Score

It’s Not Credit Repair

Rapid rescoring isn’t credit repairits just an express lane for getting information to credit bureaus. You can’t dispute anything and everything that brings down your score , and the service won’t help you negotiate settlements with creditors. You’ll need to take action to improve your credit legitimately and then get a rapid rescore to have those actions reflected in your credit reports and credit score quickly.

Where To Check Your Fico Score Before Applying For A Mortgage

Many free credit services dont use the FICO scoring model, which is the one your mortgage lender will be looking at.

To be sure the score you check is comparable to what a mortgage lender will see, you should use one of these sites:

- AnnualCreditReport.com This is the only official source for your free credit report. Youre typically entitled to one free credit report per year, but the site is offering free reports each week during the coronavirus pandemic

- MyFico.com

Whether its free, or you pay a nominal fee, the end result will be worthwhile.

You can save time and energy by knowing the scores you see should be in line with what your lender will see.

As long as you continue to make your payments on time, keep your credit utilization relatively low, and you dont go shopping for new credit you dont need, over time your score is going to be pretty high for every credit scoring model.

Read Also: How To Unlock Experian Credit Report

Your Credit Karma Score May Be Insufficient

Credit Karma updates its scores once per week. For most people that’s plenty, but if youre planning to apply for in the near future, you may need a more timely update.

Although VantageScore’s system is accurate, its not the industry standard. Credit Karma works fine for the average consumer, but the companies that will approve or deny your application are more likely to look at your FICO score.

How Your Credit Report Is Maintained

TransUnion, Equifax and Experian are the three bureaus that maintain credit reports. They issue credit reports to creditors, insurers and others businesses as permitted under law.

When you apply for any new line of credit – for example, a new credit card – the creditor requests a copy of credit report from one or more of the credit bureaus. The creditor will evaluate your credit report, a credit score, or other information you provide to determine your credit worthiness, as well as your interest rate. If you’re approved, that new card – called a tradeline, will be included in your credit report and updated about every 30 days.

Tens of thousands of credit grantors – retailers, credit card issuers, banks, finance companies, credit unions, etc. – send updates to each of the credit reporting bureaus, usually once a month. These updates include information about how their customers use and pay their accounts.

Also Check: Opensky Credit Card Delivery

Doesn’t Checking My Credit Hurt My Score

When you request your own credit report, those requests will not hurt your score.

How to get your credit score

There are several ways to get a credit score, some of which are free. When choosing how to get a score, pay attention to the fine print about how the score is calculated. Some companies that offer credit scores use different scoring models than lenders use. Here are 4 ways to get a score:

If you have a low credit score

What Does A Credit Score Mean

Your credit score is a numerical representation of your credit report that represents your creditworthiness. Scores can also be referred to as credit ratings, and sometimes as a FICO® Credit Score, created by Fair Isaac Corporation, and typically range from 300 to 850.

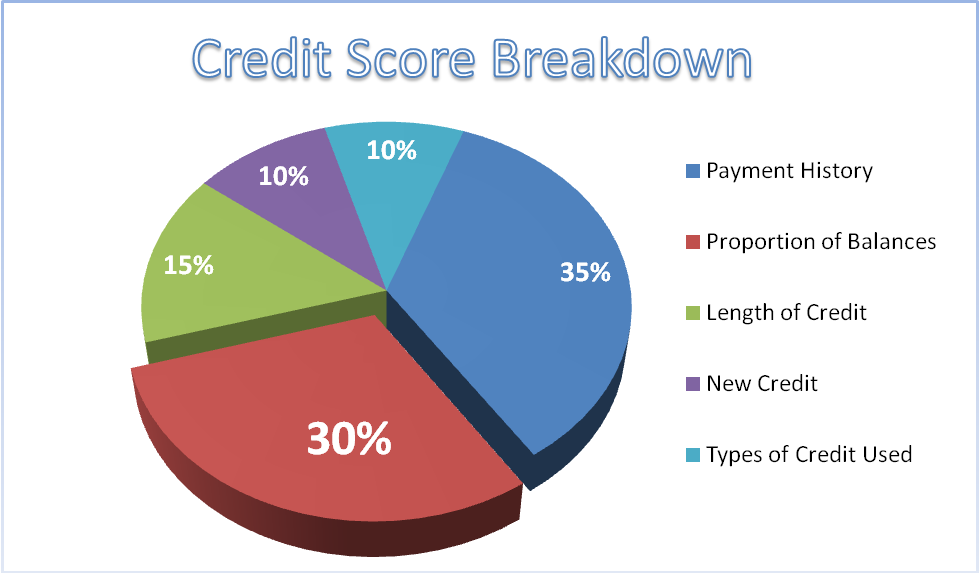

FICO® Scores are comprised of five components that have associated weights:

- Payment history: 35%

- Length of credit history: 15%

- How many types of credit in use: 10%

- Account inquiries: 10%

Lenders use your credit score to evaluate your credit risk generally, the higher your credit score, the lower your risk may be to the lender. To learn more, view how your credit score is calculated.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Credit Score plus tools, tips, and much more. Learn how to access your FICO Credit Score.

Don’t Miss: Does Paypal Working Capital Report To Credit Bureaus

How Fast Do Updates Appear On Your Credit Report

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

Youre looking to buy a home, a car or make a major purchase, and youve worked hard to pay your bills on time and maintain a good credit rating. But you wonder: How fast do updates appear on your ? Updates can enhance your credit score and give you a more favorable borrowing position.

The answer may surprise you. There is no exact deadline or single formula.

What Else Do Mortgage Lenders Consider

Your credit score is a key factor in determining whether you qualify for a mortgage. But its not the only one lenders consider.

Income: Lenders will also look at your income. They want to make sure you make enough money each month to afford your payments.

Debt-To-Income Ratio: Lenders also look at your monthly debts. Lenders vary, but they generally want your total monthly debts, including your estimated new mortgage payment, to consume no more than 43% of your gross monthly income. If your debt-to-income ratio is higher, you might struggle to qualify for a mortgage.

Down Payment: The bigger your down payment, the more likely it is that youll qualify for a mortgage with a lower interest rate. Thats because lenders think you are less likely to stop making your payments if youve already invested a significant amount of your money into your loan. A higher down payment, then, makes your loan less risky for lenders.

Savings: Lenders want to make sure that you have funds available to make your mortgage payment if your income should unexpectedly dry up. Because of this, most will want to see that you have enough money saved to cover at least two months of mortgage payments.

Employment History: Lenders vary, but they usually like to see that youve worked at the same job, or at least in the same industry, for at least 2 years. They believe youre less likely to lose that job, and that stream of income, if youve built up a longer work history.

Read Also: Does Paypal Credit Report To Credit Bureaus

How To Use Rapid Rescoring

Rapid rescoring is a service that your lender requests on your behalf, so you’ll need to ask your lender if you want to obtain a rapid rescore. Youll need to have the ability to make a legitimate improvement to your credit reports. If you can do so, take the action needed to improve your score. Your lender will then submit proof of the update to the credit-reporting agency, which will update your credit reports in an accelerated time frame. The next time you request your score, it should be higher.

If your lender isnt aware that you have the ability to improve your credit in a meaningful way, you might need to bring this up yourself. Similarly, if your lender does not offer rapid rescoring, youll either have to wait for things to update the old-fashioned way or work with a different lender.

Closeclosewhich Credit Scores Matter

The importance of a from a credit reportYour credit report reveals many aspects of your borrowing activities. All pieces of information should be considered in relationship to other pieces of information. The ability to quickly, fairly and consistently consider all this information is what makes credit scoring so useful. This is the value of FICO Scores.

Read Also: Can A Repossession Be Removed From Credit Report

Mortgage Lenders Typically Use Fico Scores

The simple answer to the question is, mortgage lenders typically use your FICO score to determine if youd be a good bet for a mortgage.

You might be wondering why mortgage lenders use the FICO model.

Its simple: They have identified a strong parallel between FICO credit scores and consumers mortgage-paying performance.

Basically, the lower your FICO score is, the more likely you are to default on your mortgage.

But its not that cut-and-dried.

Mortgage lenders tend to use all three of your scores from Experian, TransUnion and Equifax to evaluate you for a home loan.

As mentioned, there are different versions of the FICO score, and each credit bureau uses a specific one to determine borrowers creditworthiness.

Here are the FICO scores mortgage lenders typically use from each bureau:

- Experian: FICO Score 2 based on Experian data also known as Experian/Fair Isaac Risk Model Version 2

- Equifax: FICO Score 5 based on Equifax data also called Equifax Beacon 5.0

- TransUnion: FICO Score 4 based on TransUnion data also called TransUnion FICO Risk Score 04

These scores, which range from 300 to 850, dominate the mortgage market because most home loans purchased or securitized by Fannie Mae and Freddie Mac require them, said Alisa Glutz, licensed mortgage professional and author of the book Color My Credit.

These versions of FICO work in conjunction with the current automated underwriting systems each entity requires use of to determine loan eligibility, Glutz said.

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

Recommended Reading: Is Opensky Reliable

How Do My Fico Scores Affect My Ability To Get A Mortgage

Lending a huge amount of money is risky business. Thats why mortgage lenders need a good way to quantify the risk, and your FICO® scores with all of the data and research that go into them fit the bill.

Different lenders have different requirements for their loans. And because there are many different types of mortgages from many different types of lenders, theres no one single minimum FICO® score requirement.