Student Loan Delinquency Or Default

Late student loan payments can start to hurt your credit after 30 days for private student loans and 90 days for federal student loans, and those delinquencies stay on your credit report for seven years.

Federal student loans go into default if you dont make a payment for 270 days. And the government has strong debt-collection powers: It can garnish your wages, Social Security benefits or tax refunds. With private student loans, your lender can term you in default as soon as youre late, but it has to take you to court before it can force repayment.

What to do: If youve paid late but havent defaulted, consider switching to an income-driven repayment plan, putting your loan in deferment or forbearance, or asking your lender for a modified payment plan.

If youve defaulted on your federal student loans, the government offers three options: Repayment, rehabilitation and consolidation.

Does Bankruptcy Ever Come Off Credit Report

How long is your credit ruined if you file bankruptcy? Does it ever come off your credit report?

Sub: #1 posted on Sat, 01/14/2006 – 21:27

Sub: #2 posted on Sun, 01/15/2006 – 11:01

Sub: #4 posted on Sun, 01/15/2006 – 17:04

Sub: #6 posted on Thu, 01/19/2006 – 20:38

Sub: #7 posted on Fri, 01/20/2006 – 05:42

Sub: #8 posted on Fri, 01/20/2006 – 07:52

Sub: #9 posted on Fri, 01/20/2006 – 11:54

Sub: #10 posted on Fri, 01/20/2006 – 13:46

Myths About Credit Score After Bankruptcy

Everyone wants to know when considering bankruptcy: How long does bankruptcy affect my credit? What will my credit score be after bankruptcy? Will I ever be able to apply for a credit card again without being credit-shamed? There are a few myths about credit scoring and credit post-bankruptcy filing that we like to debunk to give our clients some peace of mind.

One is that you cant get a loan or credit card after filing for bankruptcy. This simply is not true. While Visa and Mastercard may not be sending you offers with frequent flier miles for a while, many clients successfully apply for secured cards to help them restore their credit faster. These cards require collateral, are available for people with damaged credit, and help build credit like any other card.

Another myth is that bankruptcy will ruin your credit forever. In fact, some imagine a dramatic movie where a character realizes they are bankrupt and yells Im ruined to the heavens. But this is also a myth and not reality. Although bankruptcy will damage your credit in the short term, its impact will absolutely be gone from your credit report after no more than ten years. And there are opportunities to practice good financial habits along the way, such as paying bills on time and avoiding purchases you do not have the income to pay for, which will make your credit stronger than ever.

You May Like: Speedy Cash Change Due Date

What Bankruptcy Will Affect While On Your Credit Score

Your payment history, on-time payments, and recent credit reporting can all affect how lenders work with you.

Once you file bankruptcy and businesses see your credit report’s negative information, you may have concerns about:

- Getting a car loan

- Getting loans without a qualified co-signer

- Adding authorized users to some credit cards

- Security deposits and returns of safety deposits

You have options regarding all these concerns if you are having credit or debt issues. There are ways to address each concern by yourself or with professional help. Getting a fresh start is possible, especially after filing bankruptcy.

Evaluating Credit Card Offers

You will typically begin to receive new offers for credit after bankruptcy. However, be aware that many new credit card offers will have low limits, high-interest rates, and high annual fees. Reviewing the offer terms carefully before signing up for a new credit card after bankruptcy is essential. The goal is to accept a credit card with the highest possible limit because credit reporting agencies rate you based on your total available credit. Not only can lower limits can harm your score, but youll want to pay off the majority of your balance each month.

If you dont qualify for a typical, unsecured credit card, you might want to start rebuilding your credit by getting a secured credit card from your bank. Youll deposit a certain amount of money in the bank as collateral for the card. In exchange, you have a line of credit equal to the amount in the account. A secured credit card rebuilds credit because the creditor typically reports payments on your credit reportyoull want to be sure that will happen.

Also Check: What Is Syncb Ntwk On Credit Report

Does Bankruptcy Wipe Your Credit Report Clean

Myth: All bankruptcy debts will be wiped clean from your credit report.

The truth: While bankruptcy may help you erase or pay off past debts, those accounts will not disappear from your credit report. All bankruptcy-related accounts will remain on your credit report and affect your credit score for up to seven years or as long as they normally would, though their impact will diminish over time.

How Bankruptcy Is Removed From A Credit Report

When people file Chapter 7 and 13 bankruptcies, theyre usually focused on filling out all of the necessary paperwork and after all is said and done, on rebuilding their credit. They rarely think much about when and how the bankruptcy falls off their credit report. Its been almost 10 years since I filed Chapter 7. What do I need to do to get it removed from my credit on the 10-year anniversary?

In the above situation, usually the debtor doesnt need to do anything to have their Chapter 7 bankruptcy removed from their credit report. Why? Because, Chapter 7 and 13 bankruptcies and all of the included or discharged debts are deleted automatically after a specified period of time passes.

Don’t Miss: What Is Syncb Ntwk On Credit Report

Building Credit After Chapter 7 Bankruptcy

Most can rebuild their credit rating and have a better score than ever within 1 – 2 years after they file Chapter 7 bankruptcy. But, you canât take this for granted. To get the full benefit of your bankruptcy filing, youâll have to make an effort to improve your credit score.

Getting new credit after filing bankruptcy – itâs easier than you might think!

One of the biggest surprises for many bankruptcy filers is the amount of car loan and credit card offers they receive – often within a couple of weeks of filing their case. Itâs a lot! Why?

Filing Chapter 7 bankruptcy makes you a low credit risk

The Bankruptcy Code limits how often someone can file a bankruptcy. Once you get a Chapter 7 bankruptcy discharge, youâre not able to get another one for 8 years. Banks, credit card issuers and other lenders know this.

They also know that, with the possible exception of your student loans, you have no unsecured debts and no monthly debt payment obligations. This tells them that you can use all of your disposable income to make monthly payments.

Beware of high interest rates

Pay close attention to the interest rates in the new credit offers you receive. Credit card companies and car loan lenders have the upper hand here. They know you want to build your credit rating back to an excellent FICO score. And they know that youâll be willing to pay a higher interest rate than someone with perfect credit and no bankruptcy on their record.

Shop around

Ask The Credit Bureaus How The Bankruptcy Was Verified

If the bankruptcy is verified by the , you will next need to send them a procedural request letter asking them who they verified the bankruptcy with.

In some instances, they will claim it has been verified with the courts, even if it is not. In most cases, the courts do not verify bankruptcies for the credit bureaus.

If the credit bureau claims it was verified with the courts, then proceed to step 4.

Read Also: What Is Syncb Ntwk On Credit Report

How Does A Consumer Proposal Affect My Credit Rating

When you file a consumer proposal, you are telling your creditors you can no longer make the required payments on what you owe them. And, yes, filing a consumer proposal will affect your credit rating but theres more to the story.

If you file a consumer proposal, your credit score will be negatively affected, just as it would be if you simply ceased to make your payments. Filing a consumer proposal will typically result in an R7 rating for 6 years from the date the proposal is filed, or three years from the day the proposal is complete, whichever comes first.

However, keep in mind that if youve been experiencing financial stress, your credit score may already have been damaged by unpaid, late or delinquent accounts on your file. Before we explore how a consumer proposal affects the credit rating, lets briefly examine the meaning of consumer proposal and how it works.

It is important to remember that filing a consumer proposal is a positive step, and the effect on your credit rating can be temporary.

Questions about consumer proposal? A Licensed Insolvency Trustee can answer your questions and help you explore your options. Contact a Trustee today for a free consultation.

Dont Miss: What Is Epiq Bankruptcy Solutions Llc

Removing Bankruptcy From Your Credit Report

The economic fallout from the COVID-19 pandemic looked like it was going to cause a flood of bankruptcy filings in 2020, but just the opposite occurred. Filings dropped from 774,940 cases in 2019 to only 544,463 in 2020, a 29.7% decline. That was the lowest since 1986.

Still, half a million filings represent a lot of financial pain and hardship and the pain could grow. Bankruptcy filings tend to escalate gradually after an economic downturn. Following the Great Recession of 2008, bankruptcy filings increased for the next two years, peaking in 2010 at 1.5 million.

If youve been forced into bankruptcy, you are far from alone. More than 500,000 Americans declared bankruptcy in 2020, some because of the fallout in the economy from the COVID-19 pandemic, others for the usual difficulty of managing personal finances.

One thing they all have in common: They want to get this financial red flag off their credit reports as soon as possible.

Can this be done? Eventually. But, its neither quick nor easy.

Assuming that the bankruptcy is legitimate rather than the result of identity theft or a clerical error, it will remain on your credit report for seven to 10 years. However, desirable it may seem to be, getting bankruptcy off your credit report shouldnt be the overriding concern.

Think of it as one part of repairing your credit and recovering from the financial damage related to it.

Also Check: Ccb/mprcc On Credit Report

Bankruptcy And Your Consumer Credit Report

Chapter 13 does not remain on your credit report as long as Chapter 7. Generally, Chapter 13 is considered a less harsh remedy as it remains on your credit report for only seven years from the filing date. Chapter 7 has a more harsh effect as it remains on your credit report for 10 years. In some instances, a Chapter 13 that is later dismissed or not completed can also remain on your credit report for 10 years.

How Long Does A Chapter 13 Bankruptcy Stay On Your Credit Report

A Chapter 13 bankruptcy stays on your credit reports for up to seven years. Unlike Chapter 7 Bankruptcy, filing for Chapter 13 bankruptcy involves creating a three- to five-year repayment plan for some or all of your debts. After you complete the repayment plan, debts included in the plan are discharged.

If some of your discharged debts were delinquent before filing for this type of bankruptcy, it would fall off your credit report seven years from the date of delinquency. All other discharged debts will fall off of your report at the same time your Chapter 13 bankruptcy falls off.

Also Check: Unlock My Experian Credit Report

But Ive Never Missed A Payment I Just Have No Hope Of Ever Paying Off My Debt

If youâre one of the few that has been able to stay current with all debt payments, but need to reorganize your financial situation through a Chapter 13 bankruptcy, your credit score will go down initially.

But, thatâs not the end of the story. Once your bankruptcy discharge is granted, your debt amount will go down significantly! And guess what helps build and maintain good credit? A low debt-to-income ratio.

Debt-to-income ratio?!

Put differently, the best credit rating is possible only if your total unsecured debt is as low as possible. A bankruptcy discharge eliminates most, if not all of your debt. Itâs the one thing you can do that your current debt management methods canât accomplish.

Doesnât bankruptcy stay on your record for 10 years?

Well, yes, under federal law, the fact that you filed bankruptcy can stay on your credit report for up to 10 years. This is true for all types of bankruptcy. But, Chapter 13 bankruptcy stays on your credit report for only seven years from the filing date.

According to Experian, thatâs because unlike a Chapter 7 bankruptcy, Chapter 13 involves a repayment plan that pays off some amount of debt before a bankruptcy discharge is granted.

How Long Does Chapter 7 Stay On Your Credit Report

How long will bankruptcy stay on your credit report? If you file a Chapter 7 bankruptcy, youll probably have to wait the full ten years the maximum timeframe for record of the bankruptcy filing itself to disappear from your credit report.

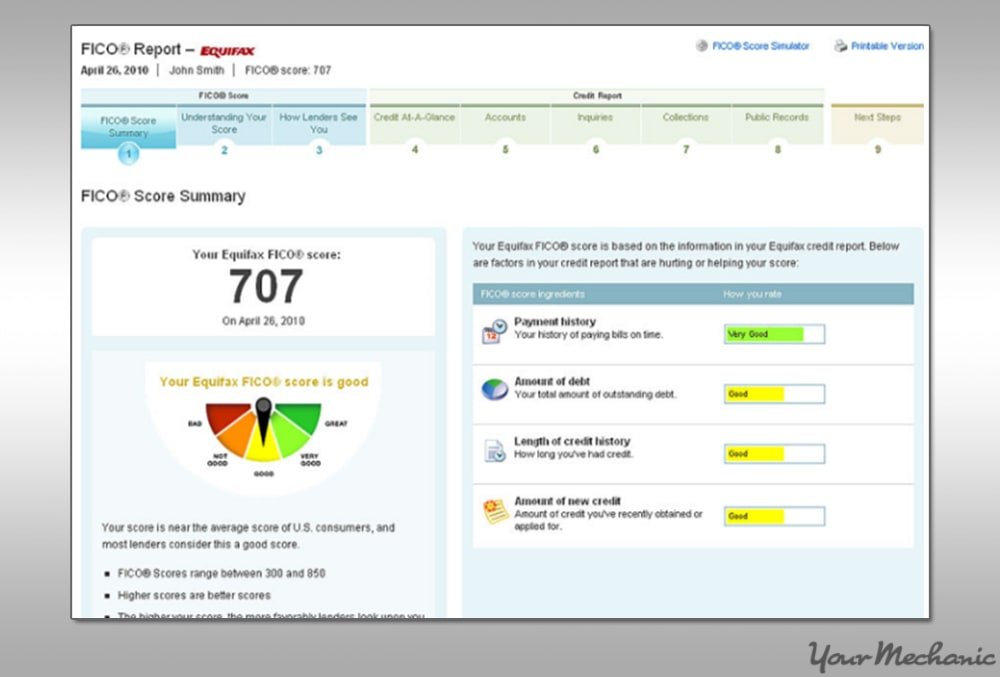

Individual debts included in the bankruptcy, however, may disappear sooner. You can look for these in your credit reports from one of the three bureaus Experian, Equifax or Transunion all of whom are legally required to provide you a copy of your credit report upon request under the Fair Credit Reporting Act . These agencies can tell you what your credit score is after bankruptcy.

Looking closely at the data on the reports, your individual debts may be listed as included in bankruptcy or discharged with a zero balance. In a Chapter 7 bankruptcy, the debts should fall off the sooner of either seven years from the date delinquency on each account began, or seven years from the date you filed for bankruptcy.

Read Also: Cbcinnovis Credit Report Inquiry

How To Reestablish Your Credit

After declaring bankruptcy, you’ll want to look at ways you can earn a score in a range that will qualify you for better financing options and that begins with rebuilding your credit.

You may not be able to immediately qualify for the best credit cards, but there are others that apply to people with less-than-stellar credit.

Secured credit cards require a deposit that acts as your credit limit. If you make your credit card payments on time and in full on this new secured card, you then have a greater chance at qualifying for an unsecured credit card in the near future.

The Capital One® Secured has no annual fee and minimum security deposits of $49, $99 or $200, based on your creditworthiness. Those who qualify for the low $49 or $99 deposits will receive a $200 credit limit. Cardholders can obtain a higher credit limit if they make their first five monthly payments on time.

The Citi® Secured Mastercard® is another option with no annual fee. There is a $200 security deposit required, which would mirror your credit limit. Cardholders can also take advantage of Citi’s special entertainment access, which provides early access to presales and premium seating for concerts and games.

Once you add this new credit car, make sure you pay your monthly bills on time and in full to quickly work your way toward better credit.

Editorial Note:

Why Bankruptcy Doesnt Ruin Your Credit In Athens Ga

A persistent myth about bankruptcy is that a bankruptcy filing ruins your credit. This myth is untrue. First, if you are considering bankruptcy, your credit score is probably quite low already, because it is riddled with late payments and other negative information. Second, the overall effect of bankruptcy is often minimal. Third, if you take full advantage of bankruptcys fresh start, you can quickly erase the negative effects.

An Athens bankruptcy lawyer does much more than file paperwork. Only a lawyer can evaluate your financial situation and give you solid advice as to which form of bankruptcy is best. Then, a bankruptcy lawyer stands with you throughout the process, and helps you put credit problems behind you.

Read Also: What Is Synchrony Bank Ppc

Sign Up For A Secured Credit Card

Getting approved for a traditional credit card can be difficult after bankruptcy, but almost anyone can get approved for a secured credit card. This type of card requires a cash deposit as collateral and tends to come with low credit limits, but you can use a secured card to improve your credit score since your monthly payments will be reported to the three credit bureaus Experian, Equifax and TransUnion.

What Is Discharge In Athens Ga

Discharge eliminates the legal requirement to pay a debt, but not the debt itself. Assume Alex owes money to Dr. Z, and Alex files bankruptcy. Medical bills are usually dischargeable debts, so more than likely, Alex wont have to pay the bill. But Dr. Z can still refuse to treat Alex until the obligation is paid or an Athens bankruptcy lawyer makes other arrangements.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Bankruptcy & Your Credit Score

Unlike what you may have heard – filing bankruptcy does not ruin your credit forever! Itâs one of the biggest myths about bankruptcy.

In reality, many people see their credit score go up almost immediately after filing bankruptcy. If you need debt relief but are worried about how a bankruptcy affects your credit rating, this article is for you. Letâs start at the very beginning…