Keep An Eye On Your Credit Score

You can keep tabs on your credit report by visiting AnnualCreditReport.com to get a free copy of your credit report from each credit reporting agency once every 12 months . In addition to monitoring your credit report, make it a habit to check your credit score before applying for any credit or at least once a year.

Your credit score can affect your ability to get loans and credit cards, the interest rates youll pay, and the credit limits youll enjoy. A good credit score can even make it easier to get car insurance, a job, or an apartment. Keep your credit score healthy, and youll make your life much easier.

Which Credit Bureau Is The Most Important

In another attempt to potentially game creditors, consumers often wonder which credit reporting bureau they should most concern themselves with.

For the record, the three major are Equifax, Experian, and TransUnion.

And the words bureau and agency are used interchangeably, so dont fret about those details.

This also explains why there are 3 credit scores, one from each of these bureaus.

Take Advantage Of Your Good Credit

Once your scores near 700 or so, youre considered a good risk. When theyre over 760, youre golden. You should expect the best rates and terms lenders have to offer, since theyll be competing hard for your business.

Reconsider your auto insurance as well, especially if your credit has improved substantially since your policy was set up. Your current insurer may not check your credit at renewal time ask it to re-run your rates. Its a good time to shop around as well.

With all the money you save, you can make progress on important financial goals such as saving for retirement, boosting your emergency fund or getting out of debt faster.

Thats the real power of great credit scores. Instead of begging for loans, paying too much and trying to make do with whats left over, youll finally have some options to get ahead.

Liz Weston is a certified financial planner and columnist at NerdWallet, a personal finance website, and author of Your Credit Score. Email: Twitter: .

This article was written by NerdWallet and was originally published by The Associated Press.

About the author:Liz Weston is a columnist at NerdWallet. She is a Certified Financial Planner and author of five money books, including “Your Credit Score.”Read more

Read Also: How To Get Credit Report With Itin Number

Types Of Credit Scores

Different types of scores can exist for various lending purposes. For example, FICO offers specialized scores for financing a vehicle, obtaining a mortgage, and qualifying for a credit card.

Both FICO and VantageScore are constantly refining their models, and the exact model used can have an effect on your score. FICO Score 9 is the latest version of the FICO model, although FICO Score 8 is still used more frequently. The latest version of VantageScore is VantageScore 4.0.

FICO 9 makes a distinction between unpaid medical bills and other types of debts.

Seek Authorized User Status

Its no secret that credit cards for good credit and excellent credit tend to be the most compelling types of credit card offers. So, if you dont want to settle for a fair credit credit card while youre working to improve your credit score, you might consider becoming an on a loved ones existing account.

There are several potential benefits to being an authorized user including the possibility of:

- If a loved one adds you to a well-managed credit card with no late payment history and a low , the account might help you when the card issuer asks the credit bureaus to add it to your credit report.

- Higher reward-earning potential. Are you in a position to share a credit card with someone with whom you can also share rewards ? If so, putting your spending on a solid rewards card on which youre an authorized user might make sense. Lets say your spouse holds a credit card that earns 3% cash back in certain categories, but you can only qualify for a card with 1.5% cash back. You could get more bang for your buck by becoming an authorized user and sharing the more competitive rewards card until your credit is in better shape.

Also Check: Cbcinnovis Hard Inquiry

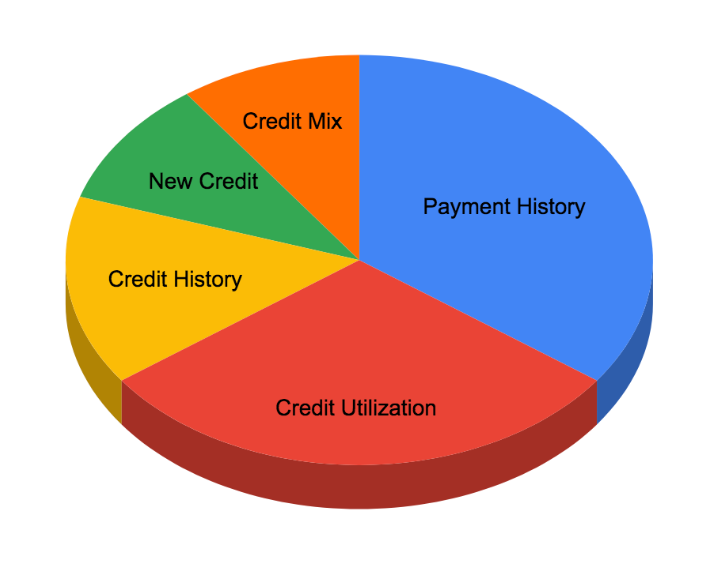

How Is My Credit Score Calculated

To see how it all breaks down, here’s an example of how most scores are calculated. Your payment history generally makes up 40% of your score, while credit utilization is 20%. The length of your credit history contributes 21%, and total amount of recently reported balances 11%. Finally, new credit accounts are responsible for 5% while your available credit makes up 3%. All of these values are then broken down into a credit score, which typically ranges between 300 and 850the higher the number the better. TransUnion’s credit score check can let you know where your score falls.

Cs Of Credit Capacity

A borrowers capacity to repay the loan is a necessary factor for determining the risk exposure for the lender. Ones income amount, history of employment, and current job stability indicate the ability to repay outstanding debt. For example, small business owners with unsteady cash flows may be considered low capacity borrowers. Other responsibilities, such as college-bound children or terminally ill family members, are also factored in to evaluate ones future payment obligations.

An entitys Debt-to-Income RatioDebt-to-Income RatioThe debt-to-income ratio is a metric used by creditors to determine the ability of a borrower to pay their debts and make interest payments, the ratio of its current debt to current income , may be evaluated. Collateral is not considered a fair metric for quantifying ones capacity because it is only liquidated when the borrower fails to repay the principal amount of a loan, i.e., in the worst-case scenario of a credit transaction. Moreover, no collateral is declared in cases of unsecured loans such as credit cards.

Read Also: Can I Get A Repossession Off My Credit

You Dont Have To Stress About The Differences In Your Scores

If youâre worried about whether one lenderâs wonky formula could end up costing you more in interest or lead to a denied loan, the simple answer is no. âDespite the slight differences, major scores are relatively the same,â Gonzalez said. Just 1% to 3% of consumers surveyed had significant differences between their FICO and VantageScore credit scores, according to a Consumer Financial Protection Bureau study.

If you do have a big variation, with a discrepancy of more than 30 points, this could be a cause for concern because it may mean that scorers could be seeing different information on different credit reports.

But before you panic, check the scale being used. If one score is reported on a scale that goes up to 850 and the other on a scale that goes up to 900, your numbers could be off by a wider margin. As long as your score is higher on the scale that goes up to 900, you should be okay.

Employers Can Check Your Credit

An increasingly common and somewhat controversial practice is taking place as employers check the credit of prospective new employees. The argument for doing this is that employers believe they can use credit history to determine responsibility. Clearly, there are situations where a bad credit history may be due to something completely out of an individuals control, but this is still something to keep in mind.

You May Like: Synchrony Bank Ppc

Identify Your Credit Score

Lenders use a score to determine your creditworthiness. There are various scores that a company may use, and the scores range from 300-850. Various services like and WalletHub offer free credit score and credit monitoring services. These services will notify you of your score and provide you periodic updates on any changes to your score, both positive and negative.

Fico Scores Are Evolving To Keep Up With Modern Behaviors And Needs

Think of how people use different versions of computer operating systems or have older or newer generations of smart phones. They all share the same base functionality, but the latest versions also have unique updated features to meet evolving user needs.

The same goes for FICO Scores.

The various FICO Score versions all have a similar underlying foundation, and all versions effectively identify higher risk people from lower risk people. Every time the FICO Score algorithm is updated it incorporates unique features, leverages new risk prediction technology, and reflects more recent consumer credit behaviors.

The end result is a more predictive score that helps lenders make more informed lending decisions, which ultimately makes the credit process easier, faster and fairer.

Recommended Reading: How To Unlock Your Credit

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Does A Fico Credit Score Accurately Predict A Borrower’s Future Ability To Repay Debt

FICO did a study on how well its credit scores mirrored borrowers’ risks for defaulting on their debt, and according to an analysis for the Federal Reserve, it looks like its credit score does correlate with a borrower’s ability to repay debt in the future. It looked at the actual performance of borrowers between 2008 and 2010, relative to their credit scores and found this:

|

FICO® Score |

|---|

Also Check: How To Unlock My Experian Credit Report

How Many Credit Scores Are There

There are many. And knowing which credit score is the most accurate can make a big difference when you’re applying for credit. On its face, a credit score is merely a numerical representation of the data in your credit reports held by the three major credit bureaus, TransUnion, Experian, and Equifax. So, that’s at least three potential credit scores right there.

Plus, there are two main credit scoring models that those credit bureaus use FICO and VantageScore. Not to mention the credit scores that are available for educational purposes only.

Different creditors might report your activity to one or all three of these bureaus. This is another reason your credit score could vary among different providers.

Further, each company provides a credit score using its own formulas to calculate scores using the data in your credit reports.

It gets worse:

Each score can emphasize different aspects of your credit behavior.

For example:

One credit scoring company might give more weight to late payments, while another might focus more on your auto loan history or a mixture of credit.

Essentially, this means that your score can not only be confusing but also that there is no such thing as an “accurate” credit score.

Each formula uses factual information from your credit history. However, each weighs and calculates that information differently.

Now what?

Why Your Credit Score Matters

You can leverage great scores into great deals on loans, credit cards, insurance premiums, apartments and cell phone plans. Bad scores can hammer you into missing out or paying more.

The lifetime cost of higher interest rates from bad or mediocre credit can exceed six figures. For example, according to interest rates gathered by Informa Research Services:

-

Someone with FICO scores in the 620 range would pay $65,000 more on a $200,000 mortgage than someone with FICOs over 760.

-

On a five-year, $30,000 auto loan, the borrower with lower scores would pay $5,100 more.

-

A 15-year home equity loan of $50,000 would cost a low scorer $22,500 more than someone with high scores.

Since credit scores have become such an integral part of our financial lives, it pays to keep track of yours and understand how your actions affect the numbers. You can build, defend and take advantage of great credit regardless of your age or income.

Recommended Reading: Why Is There Aargon Agency On My Credit Report

How To Find Your Credit Score

You can request a free copy of your credit report once a year.

Its important to have a general understanding of your credit score since it impacts all types of lending. If you plan on buying a car with an auto loan or taking out a mortgage to buy a home, having an idea of what your credit score is can help you determine what your loan may look like and how much you can afford to borrow.

You can request a free copy of your credit report once a year from each of the major credit bureaus. If you check your report and see any incorrect information, you can contact the credit bureau directly to have it removed.

Understanding Your Credit Score

Your credit report is an essential part of getting your credit score, as it details your credit history. Any mistake on this document could lower your score. Its easy to check your credit score, and youre entitled to a free credit report from all three major credit reporting agencies once a year.

Its good practice to stay on top of your credit score and check it often for any errors to ensure youre in the best possible position. From there, you can assess your options for a conventional or government-backed loan and, when youre ready, apply for a mortgage.

Also Check: How To Unlock My Experian Credit Report

What Was New With Fico Score 9

While the underlying foundation of FICO Score 9 is consistent with previous versions, there are several unique features that make up FICO Score 9:

- Any third-party collections that have been paid off no longer have a negative impact.

- Medical collections are treated differently than other types of debt. Unpaid medical collections will have less of a negative impact on FICO Score 9.

- Rental history, when it’s reported, factors into the score. This may be especially beneficial for people with a limited credit history.

What Is A Fico Credit Score

FICO, or the Fair Isaac Corporation, determines the creditworthiness of an individual with a number, typically between 300 and 850. This FICO credit score is the lending industry standard for making credit-related decisions.

FICO scores are calculated from information pulled from the 3 major credit bureaus in the United States: Experian, TransUnion, and Equifax. These bureaus, in turn, gather information from lenders like credit card companies, student loan lenders, and banks.

A score above 670 is generally considered good, and a score above 800 is considered exceptional. Only 21% of Americans have exceptional scores, while another 46% have scores above 670 but under 800.

Your personal credit score can have a large impact on your ability to get a business loan, too. Banks typically want applicants to have credit scores above 800, but there are other options.

FICO determines your credit score based on 5 factors, but each factor is weighted differently. Your repayment history and overall credit utilization are the main components of your score.

Also Check: How To Get Credit Report Without Social Security Number

Did You Know You Have More Than One Fico Score

Since FICO Scores were introduced to lenders over 25 years ago, they have become the best-known and most widely used credit score. But quite a bit has changed since lenders first started using FICO Scores in 1989. Lender credit-granting requirements, data reporting practices, consumer demand for credit and consumer use of credit have all evolved.

To help lenders make more informed credit-granting decisions, and to help ensure you get access to the credit you need, the FICO Score model has been updated periodically over the years. As an example, we use credit much more frequently than we used to. FICO Scores have been updated to reflect this change in behavior. If we didn’t, seemingly normal credit usage today would be considered a higher risk than in years past.The result is that there are multiple FICO Score versions available, in addition to the most widely used version, FICO Score 8.

| Experian |

| FICO Score 10T |

Fico Score Vs Credit Score

The three national credit reporting agencies Equifax®, ExperianTM and TransUnion® collect information from lenders, banks and other companies and compile that information to formulate your credit score.

There are lots of ways to calculate credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models. Many lenders look at your FICO® Score, developed by the Fair Isaac Corporation. VantageScore® 3.0 uses a scoring range that matches the FICO® model.

The following factors are taken into consideration to build your score:

- Whether you make payments on time

- How you use your credit

- Length of your credit history

- Your new credit accounts

- Types of credit you use

Also Check: Do Credit Scores Combined When Married

Tips For Improving Your Credit Report

Look to keep very few accounts open. For example, keep a credit card for daily use which is paid off in full regularly . You can also have a line of credit , and keep a low balance. So with that, CLOSE the accounts you don’t use.

If you’re VERY good with your money, ask for. ***Careful though, if you aren’t good with money, this can be a double-edged sword.

Second, work to pay off your balances as fast as possible. Credit cards, car loans, student loans, etc. As these are paid down, your credit score should rise.