Estimated Monthly Payments For New Car Loan Of $20000 By Credit Score

| $373 | $279 |

*Sample Quote For Credit Scores of 730 to 739. Single digit credit score changes dont change the payment, so a 731, 735, 738 and 739 score should all cost the same. Assumes $2,000 down payment. Scores sourced from Nerd Wallet site and are accurate as of 10/8/19. All loan payment amounts are based on a new car loan APR interest rate of 4.56% for prime borrowers with a credit score of 660 to 780. The loan terms included in this chart are for 3 years , 5 years , and 7 years . However, speak to your lender about additional loan options for new, used, or refinancing. Dont forget to ask about their auto loan payment terms that cover 1 year , 2 years , 4 years , 6 years , 8 years , 9 years , and 10 years . This is not an offer for a loan or a loan approval. Rates and stipulations change by state, income, credit score, and a variety of other factors. For informational purposes only.

Soft credit inquiry. Up to 4 offers in minutes.

How To Keep On Track With A Very Good Credit Score

To achieve a 782 credit score, you’re probably disciplined in your financial habits, with solid debt-management skills. You can still increase your score, however, and of course you’ll want to avoid losing ground. To those ends, it’s a good idea to keep an eye on your score, and avoid behaviors that can bring it down.

Factors that affect credit scores include:

. To determine your on a credit card, divide the outstanding balance by the card’s credit limit, and then multiply by 100 to get a percentage. Calculate the utilization for all your cards, and then figure out your total utilization rate by dividing the sum of all your balances by the sum of all your borrowing limits . You probably know credit scores will slip downward if you max out your credit limit on one or more cards by pushing utilization toward 100%. You may not know that most experts recommend keeping your utilization rate below 30% for each of your cards and for all your revolving accounts overall. Credit usage is responsible for about 30% of your FICO® Score.

Timely bill payments. This may seem obvious, but there’s no greater influence on your FICO® Score: Late and missed payments hurt your credit score, and on-time payments benefit your score. Payment history accounts for as much as 35% of your FICO® Score.

. The FICO® scoring system generally favors borrowers with a variety of credit, including both installment loans and revolving credit . Credit mix can influence up to 10% of your FICO® Score.

Excellent Credit Score: 750 850

The prime candidates, the goody-two-shoes, they are considered consistent and responsible when borrowing. They have no history of low balances or late payments. Borrowers in this credit range receive the lowest interest rates on loans, mortgages and credit lines as they pose a low risk to lenders.

Read Also: Credit Score 766 Means

Can I Get A Personal Loan Or Credit Card W/ A 732 Credit Score

Like home and car loans, a personal loan and credit card isn’t very difficult to get with a 732 credit score.

You donât need to apply for a secured card with Discover or Capital One, who may make you pay $500-$1000 just for a deposit.

You can get even better terms on your personal loan or credit card by repairing your credit and waiting a few short months until your score improves.

A 732 score means you likely have a few-no negative items on your report. Removing any outstanding negative items is usually the quickest way to fixing your report.

We recommend speaking with a friendly credit repair expert online to help guide you through this process. Your consultation is completely free, no-pressure, and will set you on the right path toward boosting your score.

How To Improve Your Credit Score:

Another common question when dealing with credit scores is What can I do to improve my score? There are many ways to improve your credit score to the higher end of the scale. Some of these methods include:

- Cleaning up your credit report

- Paying down your balance

- Negotiating outstanding balance

- Making payments on time

Credit.org offers consumers help in managing multiple payments. With a Debt Management Plan, you have the possibility of joining these payments into one lump sum with a lower interest rate. Learn more by reaching out to one of our today!

Recommended Reading: What Credit Report Does Capital One Use

Getting Mortgages With 732 Credit Score

As with personal loans, credit scores in this range tend to produce favorable terms. With 732 FICO credit score an interest rates on a mortgage could be anywhere from four to five percent, often falling somewhere around four to four point five percent. If youre in the market for house, try pushing off your search until your credit slightly improves to lock in a more ideal rate.

Considering these things, your credit score is one of the most important numbers in your life. It can affect every action you take, from the house you live in to the car you drive. Taking steps to improve your 732 credit score is the best way to save money and make your life easier down the road. Theres no excuse to not improve your credit score!

How is a 732 credit score calculated?

The three major credit bureaus rely on five types of information to calculate your credit score. They collect this information from a variety of sources, and compile it to give you an overall score. The score is comprised of 35% payment history, 30% amount owed, 15% credit history, 10% new credit, and 10% credit diversity.

How Long Does It Take To Get A 732 Credit Score

It depends where you started out.

If you had fair credit starting out, this score may be easy to reach, once you remove any bad marks on your credit. Three collection accounts, for example, could drop a 800 credit score well below 600.

If you started out with weak credit , a single negative mark could lower you well below the 500s.

Recommended Reading: Is Creditwise Score Accurate

Your Credit Report Contains The Following Information

Personal Information

- Identity verification

Each of your credit accounts will be given a rating that includes a letter and a number.

Letters

| Installment | Accounts that receive an I are installment style accounts that are paid off in predetermined fixed amounts. For example, a car loan. | |

| Open | Accounts that receive an O are open, which means they can be used up to a preset limit. An example of an open credit account is a line of credit. | |

| Revolving | Accounts that receive an R are considered revolving credit because your payments change based on how much of your limit you borrow. A credit card would receive an R. | |

| Mortgage | Depending on the credit bureau you pull your report from, your mortgage may or may not show up. If it does, it will be represented by an M. |

Numbers

| Account is in collections or bankruptcy |

Did you know that bad credit can affect your daily life? Learn more here.

Dont Apply For Multiple Credit Cards

This is standard advice any time you apply for credit of any type . If you put in multiple applications, you can actually hurt your chance of being approved.

Each lender will have access to your credit report, which will show that youve applied elsewhere. Those applications will show up as inquiries. Too many inquiries can actually drop your credit score. Maybe it wont be by a lot, but it could be enough to put you into a lower credit score range.

Pick the card you want most, and apply for it. If youre turned down, or you dont like the terms, only then should you apply for another card.

You May Like: Does Paypal Credit Report To Credit Bureaus

What Does A 735 Credit Score Get You

| Type of Credit |

|---|

| 31.08% |

*Based on WalletHub data as of Oct. 7, 2016

As you can see, the majority of us are in the top two tiers of the credit-score range. A lot of people dont know where they stand, though, considering that 44% of consumers havent checked their credit score in the past 12 months, according to the National Foundation for Credit Counseling. If youre one of them, you can change that by checking your credit score on WalletHub.

Improving Your Credit Score Range

So now you know where your three-digit number falls in the credit score ranges. If you already have excellent credit ranging from 780 to 850 congratulations.

Your only job now will be to keep doing what youre doing to maintain stellar creditworthiness.

If you have very good credit, you may want to figure out how to optimize your score even more to achieve an even-better three-digit number. Keep reading to learn ways to fine-tune your credit life.

For everyone else, you probably have a little work to do to get into a better credit score range.

Like I said above, dont worry if your credit score has parked itself at the lower end of the spectrum. Ill show you exactly where to start working to achieve the best credit possible.

You can improve your credit score in no time if you dedicate some time to learning about how credit repair works.

Don’t Miss: How To Make Your Credit Score Go Up Fast

Can I Get A Credit Card With A 731 Credit Score

With good credit scores, you might qualify for credit cards that come with enticing perks like cash back, travel rewards, or an introductory 0% APR offer that can help you save on interest for a period of time.

Still, the very best and most-exclusive credit cards may be out of reach to those with merely good credit. You may need excellent credit to be approved for these cards, so theres still room for improvement if thats your goal.

Of course, your credit scores are only one piece of the puzzle. A credit score can be a helpful gauge in measuring your progress, but issuers may also consider other factors before making a lending decision.

For example, an issuer may consider eligibility requirements not accounted for in your credit scores, like your job status or income. Or they may give more weight to one aspect of your credit reports than another. This means its possible that two people with similar credit scores may not be approved for the same offer and even if theyre both approved, their rates and terms may be different.

This can make it difficult to understand why youre not approved but lenders are required to tell you why you were denied credit if you ask. Its illegal for lenders to discriminate against you, and getting an answer as to why you werent approved can be a first step to protecting your rights when it comes to credit and lending.

Compare offers for on Credit Karma to learn more about your options.

What Credit Score Is Needed To Buy A House

Ah, the dreaded . Its one of the biggest criteria considered by lenders in the mortgage application process three tiny little digits that can mean the difference between yes and no, between moving into the house of your dreams and finding yet another overpriced rental. But despite its massive importance, in many ways the credit score remains mysterious. If you dont know your number, the uncertainty can hang over you like a dark cloud. Even if you do know it, the implications can still be unclear.

Is my score good enough to get me a loan? Whats the best credit score to buy a house? What’s the average credit score needed to buy a house? Whats the minimum credit score to buy a house? Does a high score guarantee I get the best deal out there? And is there a direct relationship between credit score and interest rate or is it more complicated than that? These are all common questions, but for the most part they remain unanswered. Until now.

Today, the mysteries of the credit score will be revealed.

Recommended Reading: Ntwk Credit Card

Can I Buy A Home With A 700 Credit Score

Absolutely! A 700 credit score is well within the good category, according to FICO.

In fact, a 700 credit score is high enough for almost any type of mortgage.

So the question really comes down to, which type of loan is best for you? And how can you get the lowest mortgage rate?

Here are a few tips to help you find the best deal.

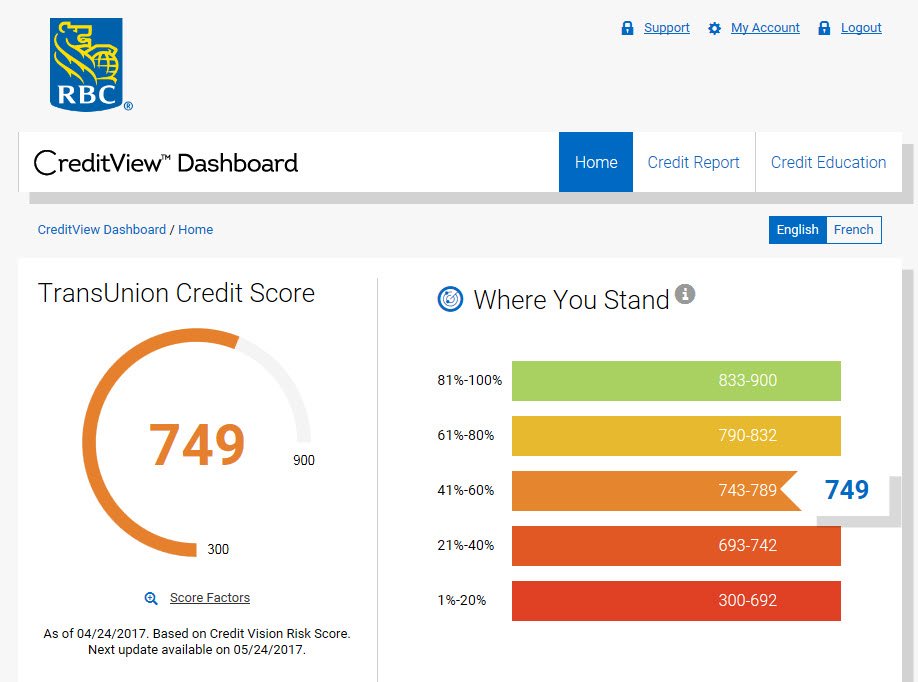

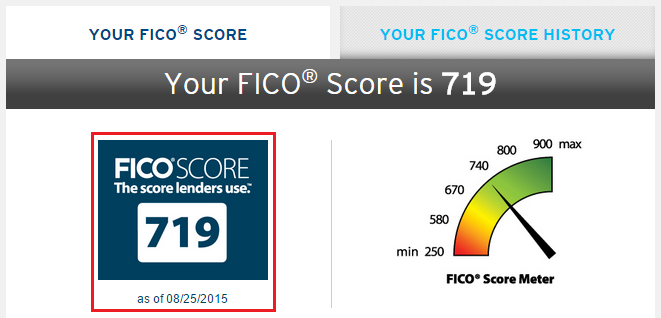

Fico Score Vs Vantage Score

The three major credit bureaus created the Vantage Score back in 2006 to compete with Fair Isaac Corporations FICO credit score model. Since then Vantage Score has released several new credit score models, including Vantagescore 3.0 and 4.0.

While the Vantage Score has grown more popular and is easier to check, thanks to free credit monitoring services like Credit Sesame, both your FICO score and your Vantage Score work to reveal your credit behavior.

The credit score ranges are very similar, although Vantage Score does have a category for perfect credit .

If you earn an improvement within one of these credit score models, you will almost always see the same result with the other model, too especially if you have a shaky credit history and have a couple years of work to achieve a good credit score.

Also Check: How To Report A Death To Credit Bureaus

What Can You Do With A 732 Credit Score

While further improvements need to be made to achieve a Very Good or an Exceptional rating, a credit score of 732 is still sufficient to help borrowers secure a personal or property loan, apartment rental, even one of the best rewards-based credit cards on the market today.

Consult the below information for further details on the opportunities afforded to borrowers with 732 credit scores.

- Rewards-based credit cards can offer benefits to consumers after almost every purchase.

- A credit score of 732 is sufficient to qualify for many but not all of the best available incentive-based credit cards, which allow consumers to earn airline miles, hotel points, cash-back options, and store-specific perks from many of the most popular retailers.

Credit Score: Is It Good Or Bad

A FICO® Score of 732 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, XXX, falls within the Good range. A large number of U.S. lenders consider consumers with Good FICO® Scores “acceptable” borrowers, which means they consider you eligible for a broad variety of credit products, although they may not charge you the lowest-available interest rates or extend you their most selective product offers.

21% of U.S. consumers’ FICO® Scores are in the Good range.

Approximately 9% of consumers with Good FICO® Scores are likely to become seriously delinquent in the future.

Don’t Miss: Opensky Credit Card Delivery

Improving Your 732 Credit Score

A Credit Repair company like Credit Glory can:

An industry leader like Credit Glory can guide you through this process. Give them a call @ 885-2800, or chat with them, today â

Fico Credit Score Ranges

Heres how to find out exactly where your credit score falls in the range of FICO scores.

- Excellent Credit : With an excellent credit score of 780 or higher you will get the best rates available.

- Very Good Credit : In this range you shouldnt have any problems getting good rates.

- Good Credit : This is a good credit range to be in, but you wont get the very best rates on loans or credit cards.

- Average Credit : Your score could use some improvements, but you should still be able to get decent rates. You can still qualify for most FHA mortgage loans, for example.

- Poor Credit : A credit score in this range means youre higher risk and might have trouble finding decent rates. Youll also get turned down on some credit applications. You could still get some USDA and VA loans if you qualify for those programs.

- Very Poor Credit : Anything less than 580 means that youre very high risk for borrowing. Youll get turned down for almost all credit applications. If you do get approved, the interest rates will be staggering. Dont worry though, this can be fixed!

Recommended Reading: How To Remove Repossession From Credit Report