How Often Does Wells Fargo Update Credit Score

Wells FargoWells FargoFICO 9mortgageFICO 9Steps to Improve Your Credit Scores

The Amount Of Credit Youre Using Has Changed

Your credit utilization ratio the percent of available credit youre actually using has a major impact on your score. So, your score may drop if you put a big purchase on a credit card. And you may see a bump in your score when you pay down debt or spend less than usual.

Plus, timing matters in terms of when your score is calculated. Even if you cover your balances each month, your score can look lower if you check it before you actually pay the bill when youre using more credit. Even after youve paid the bill, there may be a timing gap in which you may not see your score change automatically.

Automatic Credit Limit Increases

In some cases, Wells Fargo might automatically increase your credit limit without you having to request one. If you demonstrate a good payment history and are a reliable customer, the issuer will occasionally award you with more credit. There is no designated timeline for this process, and you have to be targeted, but keep an eye on your account nonetheless.

Read Also: Does Speedy Cash Report To Credit Bureaus

Does A Fico Score Alone Determine Whether I Get Credit

No. Most lenders use a number of factors to make credit decisions, including a FICO® Score. Lenders may look at information such as the amount of debt you are able to handle reasonably given your income, your employment history, and your credit history. Based on their review of this information, as well as their specific underwriting policies, lenders may extend credit to you even with a low FICO® Score, or decline your request for credit even with a high FICO® Score.

Getting Your Free Credit Report

Federal law allows consumers to get a free credit report from each of the three reporting bureaus once each year. In most cases, you can also get a copy of your report through one of the free credit monitoring services. The catch is that the information it displays is limited to a single reporting bureau, so unless you’re registered with multiple services, it’s a little tougher to pick out inaccuracies from one report to the next.

Recommended Reading: What Is Syncb Ntwk On Credit Report

What Credit Score Do I Need To Get The Wells Fargo Reflect

To qualify for the Wells Fargo Reflect card, youll need a good to excellent credit score, which generally means a score of 670 or higher.

Its important to note that your credit score isnt the only factor that determines whether you qualify for a card. Someone with a credit score that exceeds 670 could still be denied for the card based on other factors of their credit score.

That being said, having a credit score above 670 likely means youve got a decent shot at qualifying, assuming the rest of your credit report is in decent shape.

How Does Credit Karma Work

When you sign up for , you will be asked to provide a variety of personal information. Although it will only take a few minutes to sign up for a free account, it will help to have your personal information ready. For example, you will need to provide the last four digits of your Social Security number so make sure to have that handy.

Once Credit Karma has your information, they will find your credit reports on TransUnion and Equifax. With the information from your credit reports, the company will provide your credit score for free. You can check back for your credit score whenever youd like. However, the company typically sends out emails to alert you if there is a major change that you should be aware of.

You May Like: Does Paypal Credit Check Your Credit

Are There Secured Business Card Alternatives If I Can’t Afford To Pay A Security Deposit

There’s a couple of ways to work around the security deposit. You could start with a small deposit and credit line of $500, for example. Make small purchases and pay your card on time to establish a positive track record. Over time, you may qualify for a credit limit increase without having to pay another security deposit.

Or you could apply for a business card that uses your personal credit score to approve you for a card. However, all usage will affect your personal credit history — even if it’s business-related.

Other Differences To Recognize

In addition to differences between VantageScore and FICO credit score calculations, each major player in the consumer credit scoring market has had several versions designed and implemented over the years. FICO has developed no less than 56 versions of its credit score one for each of the three major credit bureaus along with one for each specific industry that may use it.

For instance, auto loan lenders have an Auto Score available from FICO that uses the same credit information to determine specific risk factors a borrower may show as it relates to defaulting on a new car loan. The same is true for credit card issuers , mortgage lenders, and general credit inquiries.

While VantageScore does not have as many iterations of its credit scoring model, there are at least two versions still in use today by consumers and some lenders. The differences between these credit scoring versions might be subtle, but the details used to calculate an individuals credit score are varied enough to create multiple scores for a single person at any given time.

If youre ready to use Credit Karma to monitor your credit score, check out its website by clicking below.

Read Also: How To Check Your Credit Score With Itin

How To Qualify For A Wells Fargo Loan

Wells Fargo doesn’t publicly disclose many of its borrower requirements. Borrowers with good and excellent credit scores will likely qualify for the lowest rates. To apply, youll need to provide:

-

Personal and contact information.

-

Employment and income information documentation may be required to verify this information.

-

Desired term and amount to borrow.

Loan example: A four-year, $12,000 loan with a 15.5% APR would cost $337 in monthly payments. You would pay $4,176 in total interest on that loan.

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page.

Recommended Reading: Cbcinnovis Credit Inquiry

Wells Fargo Mortgage Review For 2021

Wells Fargo is not only a mega-bank, but also a mega-mortgage lender. Learn why so many people choose Wells Fargo Home Mortgage here.

Advertising Disclosure

Our #1 priority is that our readers make great financial decisions. That’s something we don’t compromise on even if we make less money because of it. While we are compensated by our lending partners, and it may influence which lenders we review, it does not affect the outcome. It’s our mission to give you accurate, transparent information so you can make the best choice of lender or service on or off our site.

3%

- Competitive rates and closing costs

- Online tools make it easy to compare loans and find the lowest-cost mortgage

- Branch locations nationwide make face-to-face interactions possible

Drawbacks

- Customer satisfaction scores are average, but improving year to year

- The bank is in the process of recovering from past failings

- Not taking new HELOC applications during the pandemic

Are Fico Scores Unfair To Minorities

No. FICO® Scores do not consider your gender, race, nationality or marital status. In fact, the Equal Credit Opportunity Act prohibits lenders from considering this type of information when issuing credit. Independent research has shown that FICO® Scores are not unfair to minorities or people with little credit history. FICO® Scores have proven to be an accurate and consistent measure of repayment for all people who have some credit history. In other words, at a given FICO® Score, non-minority and minority applicants are equally likely to pay as agreed.

You May Like: What Is Syncb Ntwk On Credit Report

Wells Fargo: Rates And Fees

Wells Fargo advertises daily refinance and purchase rates for 15-year loans, 30-year loans, 20-year loans, VA loans, and jumbo loans. These rates can change every day and may include discount points, which are fees you can pay at closing in exchange for a lower interest rate. To receive the best mortgage rates, you may need good to excellent credit.

The lender also offers a mortgage calculator that lists some of the closing costs youll pay according to your location. Some of those costs may include:

- Processing fees

- State and local statutory fees

- Recording fees

- Title costs

The minimum credit score required by Wells Fargo varies depending on the type of loan. According to a company representative, borrowers may qualify for certain loans with a credit score as low as 620. If your credit score is lower, talk with a loan officer to understand your options.

Wells Fargo doesnt charge prepayment penalties on any of its loans. There can be late fees, which vary depending on how late the payment is. For a complete breakdown of the closing costs, including lender fees and discount points, youll need to submit an application.

You can lock in your interest rate for 45 to 720 days, depending on the program, and you may pay a fee upfront. The longer rate locks may help if youre building a new home or if youre buying a condo that needs board approval. And if your loan isnt ready to close by the time the lock expires, Wells Fargo may extend your rate lock for free.

Boost Your Chances Of Preapproval

If you have your eyes set on a specific Wells Fargo card, and the Wells Fargo preapproval tool says that you arent qualified, dont fret. You can still take steps to improve your chances of being approved. Its possible to increase your odds of being preapproved for a credit card and the good news is that it requires the same good habits that you might already have.

Make sure that you pay your bills on time each and every month and keep your low. Dont keep applying for new credit cards, either, since each hard inquiry will lower your credit score by a few points.

See related: How many credit cards is too many?

Don’t Miss: How To Remove Repossession From Credit Report

Plot The Effect On Your Credit Score

Before closing your Wells Fargo account, you should try to determine the effect it will have on your credit score. As previously mentioned, closing a credit card could lower your score, so it wouldnt be wise to do so if youre planning to apply for another type of credit product in the near future, such as a car loan or mortgage. You might also want to hold off on closing the account if youre expecting an upcoming for other reasons, such as renting an apartment or applying for a new job.

Also, if you missed any payments on this account, remember that canceling it doesnt mean your payment history falls off your credit report right away. Under the Fair Credit Reporting Act, late payments can stay on your credit report for up to seven years, even if you close the account that had the late payments.

Wells Fargo Business Secured Credit Card Review 2021

The Wells Fargo Business secured credit card guarantees applicants approval — without a personal credit check — as long as your business banks with Wells Fargo and you’re able to pay a security deposit.

| Topic:

Business credit is difficult to get until a company is well established. In most cases, business founders need to put up their personal assets to get approved for a business line of credit. Entrepreneurs may not want to risk their personal credit for their company — or may not even be able to, due to poor credit. The Wells Fargo Business Secured Credit Card is one of the few card options available for small businesses wanting to build credit while supplementing cash flow.

To understand how a secured credit card works, consider that card providers require some sort of guarantee that you’ll repay your outstanding balances. Most credit cards use a credit score as the gauge of how likely you are to repay your bills. When your credit score isn’t up to par, something else has to take its place to lower a card provider’s risk.

Recommended Reading: Mprcc On Credit Report

Wells Fargo Personal Loan Requirements & Application Info

Category Rating: 3.8/5

- Minimum credit score: Not disclosed, though multiple third-party sources report that youll need a score of at least 660.

- Minimum income: Wells Fargo does not disclose minimum income requirements.

- Age: You must be at least 18 years old.

- Citizenship: You must be a U.S. citizen or permanent resident.

- Identification: You must have a Social Security number or Individual Taxpayer Identification number.

- Pre-qualification: Wells Fargo does not allow you to pre-qualify for their personal loans. However, Wells Fargo offers a calculator to estimate your potential rates and payments based on your home state, loan amount, loan length and credit standing.

- Joint loans: Wells Fargo allows you to add a co-applicant to your loan application.

- Ways to apply: You can apply for a Wells Fargo personal loan online, by phone , or by visiting one of Wells Fargos 4,900 U.S. branches.

- Application timeline: It can take up to 3 business days to get a decision and 1 business day to receive your funds after youre approved, according to representatives.

Before You Request A Credit Limit Increase

Once you feel good about your chances of scoring a higher credit limit, there are still a few steps to take to make sure you are ready to make the call. Most importantly, collect all the information you can before you make a request.

First and foremost, you should have a number in mind. Decide what credit limit youd like to have, considering how much you can pay off. We recommend against asking for too much all at once lest it seem you are planning to spend more than you can feasibly pay back.

Consider how much higher of a limit you need to either better your credit utilization ratio or pay off a large purchase over time. Requesting a 10 to 50% increase is usually a good place to start.

Additionally, if youve been carrying a balance and only making minimum payments on your credit card, consider switching up your strategy for a few months. If you can prove you can pay back what you borrow, Wells Fargo will be more likely to grant you more credit.

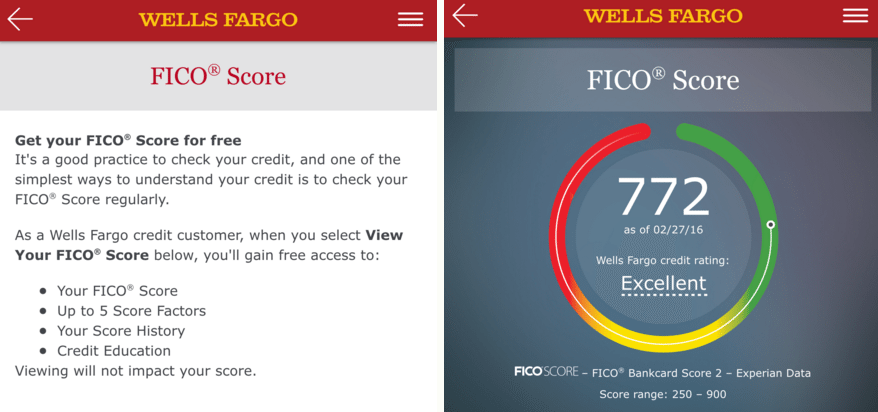

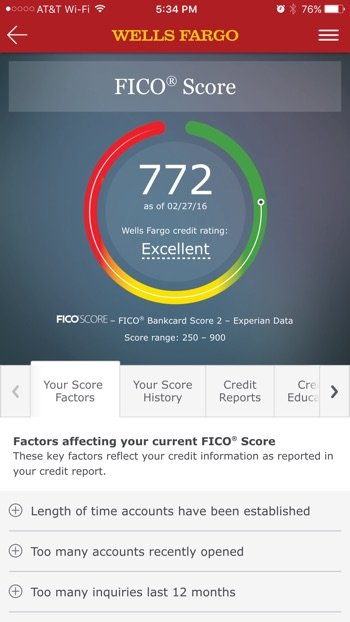

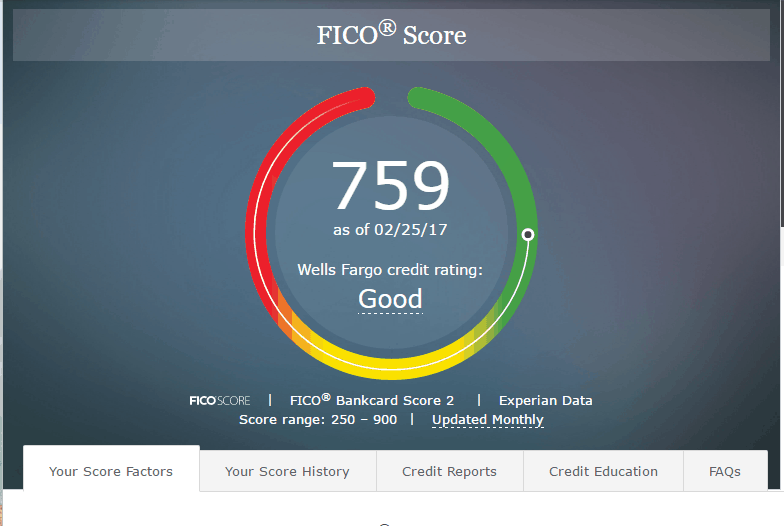

Finally, it is a good idea to pull your credit report and know your credit score. These help to show your creditworthiness to card issuers, so it is good to see how you look to lenders before asking for more credit. You can pull one free credit report per year from each of the three major credit bureaus at AnnualCreditReport.com. Wells Fargo also provides all credit card holders with their FICO score for free on their online accounts.

Also Check: Unlock My Experian Account

Fico Scores Are Commonly Used By Lenders To Assess Your Credit Risk But Other Credit Scores Can Also Give You A Good Idea Of Where You Stand

In other words, your FICO® scores are just one type of credit score you can get. This is because FICO is a company that creates specific scoring models used to calculate your scores. But there are other companies that use different scoring models to determine your credit scores, too.

VantageScore is an example of one of these companies. Both FICO and VantageScore offer credit-scoring models to evaluate the information in your credit reports and issue a corresponding credit score. These scoring models evaluate many of the same factors when looking at your credit reports and calculating your scores, but they differ very slightly.

Thats why you may see different credit scores depending on which scoring model is used. Your scores can also differ depending on which consumer credit bureau report Equifax, Experian or TransUnion the scoring model pulls your information from.

Wells Fargo Loan Types And Products

Wells Fargo offers a full lineup of conventional and government-backed loans, jumbo mortgages, refinance loans, construction loans, and renovation loans. It doesnt offer home equity loans or home equity lines of credit. Heres whats on the menu right now:

The bank offers a choice between fixed-rate and adjustable-rate mortgage loans on most of its products. With an ARM, the rate is fixed for the first five, seven, or 10 years. After the fixed period ends, the rate may go up or down periodically.

Qualified borrowers can take out a large amount through a jumbo loan, and the lender says existing Wells Fargo customers may even qualify for a discount on these mortgages.

The bank also offers a specialized loan product, the Union Plus mortgage. This loan is designed for active and retired union members and comes with a gift card up to $500. Borrowers are eligible for interest-free loans and grants to cover mortgage payments in case of disability, job loss, a lockout, or a strike. The first $1,000 of the loan or grant doesnt need to be repaid.

Wells Fargo also recognizes many borrowers struggle to come up with the funds to cover a down payment or closing costs, so Wells Fargo can connect borrowers with state or local assistance programs.

Recommended Reading: Syncppc