Leave Old Accounts Open

Once you finally get rid of student debt or pay off your auto loan, you may be impatient to get any trace of it wiped from your report.

But as long as your payments were timely and complete, those debt records may actually help your credit score. The same is true for your credit card accounts.

An account thats paid in full is a good thing however, closing an account isnt something that consumers should automatically do in the hopes that it will positively impact their credit score, says Nancy Bistritz-Balkan, vice president of communications and consumer education at Equifax. Having an account with a long history and solid track record of paying bills on time, every time, are the types of responsible habits lenders and creditors look for.

Closing a credit card account can actually lower your credit score, as you will now have a lower maximum credit limit. If youre still carrying balances on other cards or loans, your utilization ratio will go up. Youre better off keeping the card with a $0 balance.

Any bad debts that can impact your score negatively are automatically removed over time. According to Ulzheimer, bankruptcies can stay on your credit report for no longer than 10 years, while late payments and delinquencies such as collections, repossessions, foreclosures and settlements stay on your report for seven years.

Ask For A Credit Limit Increase

A higher credit limit is another way to help reduce your credit utilization ratio, which can help raise your credit scores. Keep in mind though that some credit issuers do a hard credit check when you request a credit limit increase, and that can cause your credit to dip. Read up on how to ask for a credit limit increase.

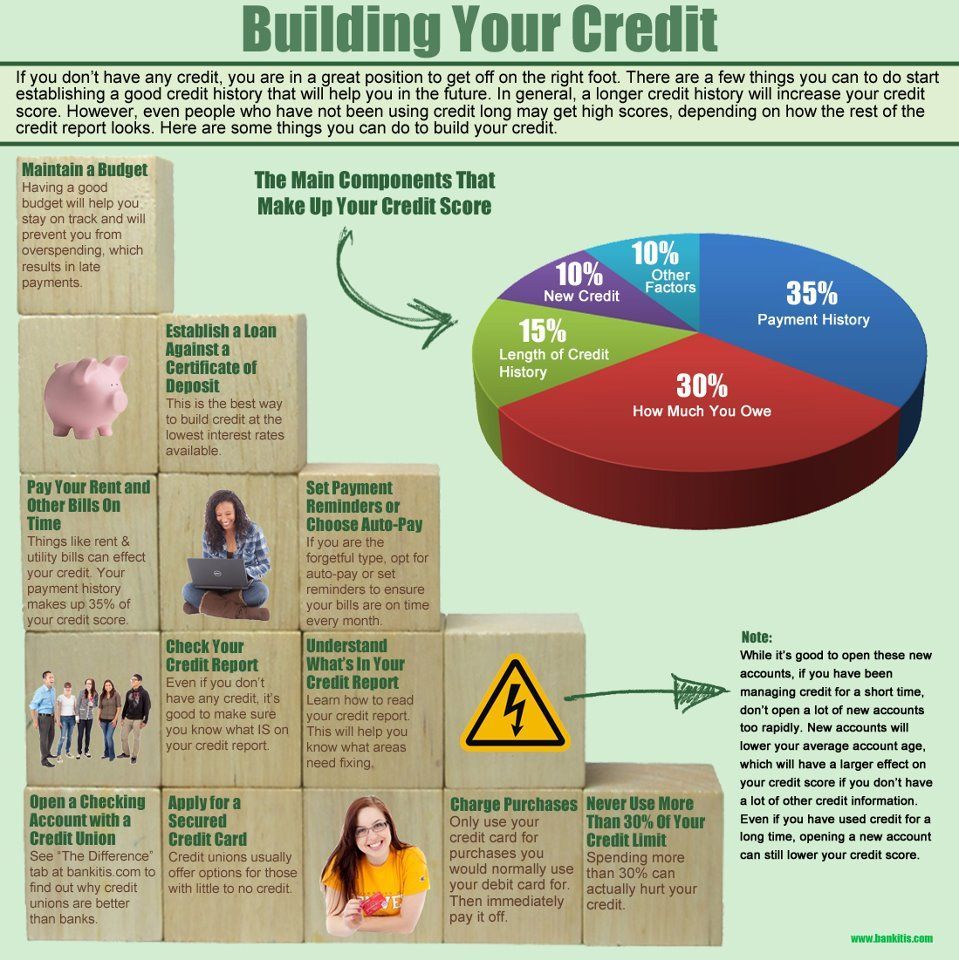

Get A Head Start On A Great Credit Score By Starting Early

Whether you’re heading off to college in the fall or recently graduated and set off into the world of work, it isn’t too early to start building a strong credit history. Your credit score, which is based on that history, carries a lot of weight when it comes to some of life’s biggest milestones and by starting now, you can ensure you’ll be on the right side of the equation when the time comes. Here are some ways you can earnand keepa high credit score.

Don’t Miss: Can I Check The Credit Report Of A Deceased Person

Dont Close Any Card Accounts

When you are new to credit and building a score from nothing, time is your friend. Even if a year from now, you have a card you no longer want or use, keep the account open unless it charges an annual fee. The length of your credit history directly affects your FICO score, so the longer your accounts are open, the better your credit score.

Check Addresses On Old Accounts

This may sound bizarre, but a wrong address can have a disproportionate impact. If you had, for example, an old mobile phone contract or credit card that you don’t use any more, but is technically still listed as active on your credit reference files, then check the address is your current one.

If the account is still listed as open, and it lists you as being at a different address, this can stymie applications due to ID checks. Check your file and go through every active account’s address to ensure it’s up to date.

We’ve known people being rejected for mortgages because of this. Worse still, they didn’t know the exact reason why as that’s a nightmare to find out.

You May Like: Is Kornerstone Credit Legit

Become An Authorized User On Someone Elses Card

While you might not be approved for a regular credit card, you could become an authorized user on someone elses account, like your parents or spouses account.

If you go this route, the account needs to be in good standing, with a low balance and a history of on-time payments. If not, being an authorized user wont help you build a good credit score.

Becoming an authorized user is a way to jump-start credit score growth and is not a long-term fix. Real credit score growth will come from building your credit history, not piggybacking on someone elses. Think of this option as a stepping-stone to get you to your next credit tool, whether thats your credit card or a small personal loan.

Cant I Just Pay Someone To Remove Information From My Credit File

The short answer? No.

While it may seem like a quick solution, dont be fooled by companies that promise they can do this for you.

Information contained within your credit report is only ever removed if its proven to be incorrect, or if its out of date. As weve explored above, disputing errors in your credit report is a good practice to follow, and shouldn’t cost you a cent.

Recommended Reading: Bestbuy/cbna

Easy Ways To Increase Your Credit Score Fast In Canada In 2021

An excellent credit score is your key to lower rates and easy approval for credit cards and loans. If your credit score has taken a hit, there are some simple strategies you can implement to improve your credit score quickly, starting today.

How long does it take to improve your credit score? It varies and will depend on how bad your credit score is to start with. With the right approach, you can start seeing significant improvements in your credit score in as little as 30 days.

No matter how bad your credit score is, following the right strategy can increase it by 100 to 200 points in no time at all.

Get Credit For The Bills You Pay

Rent-reporting services such as Rental Kharma and LevelCredit take a bill you are already paying and put it on your credit report, helping to build a positive history of on-time payments. Not every credit score takes these payments into account, but some do, and that may be enough to get a loan or credit card that firmly establishes your credit history for all lenders.

Experian Boost offers a way to have your cell phone and utility bills reflected in your credit report with that credit bureau. Note that the effect is limited only to your credit report with Experian and any credit scores calculated on it.

Also Check: Does Titlemax Report To The Credit Bureau

What Determines Your Credit Score

Equifax and TransUnion are the two credit reporting agencies in Canada, and they each track your score separately. Your score might not be exactly the same between the two, but it should be close. Both organizations use various factors to determine your creditworthiness, including:

- The length of your credit history

- Whether you carry a balance on your line of credit or credit card

- How often you miss payments

- If your credit tools are close to their limits

- How frequently you apply for more credit

- The types of credit you have

- If you have debts that have been sent to collections

- Whether you have declared bankruptcy

Think Carefully Before Applying For Any New Credit

Whether you get approved or not, the fact that you applied for a new credit or loan product will show up on your credit report, which in turn may affect your credit score. If you make multiple applications for credit within a short space of time, this can flag to lenders that you are in credit stress and may have a negative impact on your score.

That being said, applying for credit to replace or better structure a credit product such as taking out a credit card with a balance transfer offer or a personal loan to consolidate debt may ultimately help you get on top of your debt, improving your credit score in the process. However, this would require you to genuinely pay down your debt, and not simply move it around. Be careful with this strategy, as each credit application is recorded on your credit report and lenders may still view it as a red flag if they see a pattern of lending applications.

Recommended Reading: How Long Does A Voluntary Repossession Stay On Your Credit

What Lenders Don’t Know Ignore Conspiracy Theories

Many people believe every element of their life is on their credit reference files, but actually it’s mainly just a strict set of financial data. Though over recent years, the information contained on them has grown.

So let’s debunk some myths. Here are a few of the more common things people think are on their files, but aren’t.

Race, religion, ethnicity. These personal details about you are not held.

Salary. How much you earn isn’t on your file either, though you’ll usually be asked on the application form.

Savings accounts. As savings are not a credit product, they don’t appear on credit files. This data is therefore only available to banks you hold savings accounts with. However, when you apply for a savings account, the provider might do a soft search of your credit report to check your ID, and do anti-money-laundering checks.

Medical record. Medical problems you may have had in the past aren’t listed.

Criminal record. No criminal convictions are listed.

There are a host of other things that aren’t held on your credit report, including:

How Often Should You Check Your Credit Score

You should check your credit score regularly to check for errors, but make sure that you are doing so through soft inquiries so that your score isnt dinged. Many banks offer free credit monitoring to their customers check with yours to see if you can enroll in their service and get alerts whenever your score changes.

Also Check: Can A Closed Collection Account Be Reopened

Can Lenders Find Out About Coronavirus Payment Holidays

At the start of the coronavirus pandemic, lenders were offering coronavirus-related payment holidays on mortgages, credit cards, loans and more to customers struggling to make repayments. If you applied for one, here’s how taking one might have impacted your credit file:

For more information on the help currently available, and whether it’ll affect your credit file, see our Coronavirus finance & bills help guide.

How To Report And Fix Any Errors On Your File

If you do spot any mistakes, challenge them by reporting them to the credit reference agency.

They have 28 days to remove the information or tell you why they dont agree with you.

During that time, the mistake will be marked as disputed and lenders arent allowed to rely on it when assessing your credit rating.

Its also best to speak directly with the credit provider you believe is responsible for the incorrect entry.

Negative information in your name usually stays on your credit report for six years and cant be removed sooner if its accurate. However, if there were good reasons why you fell behind with payments that no longer apply, such as not being able to work during a period of illness, you can add a note to your credit report to explain this. This note is called a Notice of Correction and can be up to 200 words long

Read about notices of correction on the Experian website

Find out more about correcting personal information on your file on the Information Commissioners Office website

Recommended Reading: Does Comenity Bank Report To Credit Bureaus

Contact Your Credit Provider Or A Financial Counsellor If You Need Help

If you are finding it difficult to manage your repayments or bills, you can ask your credit provider or service provider for financial hardship assistance. You might also want to contact a financial counsellor for help. Financial counsellors provide a free, independent and confidential service, and they can help you with things like developing a budget and negotiating with your creditors.

Be careful of companies that charge you to repair or clean your credit report. You cannot pay to remove information on your credit report that is correct, even if it is negative.

Only Borrow What You Can Afford

A credit card isn’t a permission slip to buy things you can’t afford. This is the quickest way to get into debt and credit trouble.

The best way to build good credit is to create the habit of charging only what you can afford. This habit lets future lenders and creditors know you’re a responsible borrower. You’ll find it easier to borrow money and get new credit when you show that you have the discipline to borrow only what you can afford to repay. Not only that, only charging what you can afford helps you avoid excessive debt.

The same rules applies to loans. Regardless of what the lender says you qualify for, you should only borrow what you can pay back. Before you shop for a loan, review your budget to see what monthly payment you can afford. Make sure your loan payment doesn’t exceed the amount you’ve come up with.

You May Like: Les Schwab Credit Score Requirement

Pay Existing Loans And Debts On Time

A record of consistent and punctual payments can contribute to a stronger credit score. Since the introduction of comprehensive or positive credit reporting, positive data can now be included on credit reports. On the flipside, if you miss your repayments this can also be recorded and can have a negative impact.

Increase Your Credit Limit

You can increase your credit limit one of two ways: Either ask for an increase on your current credit card or open a new card. The higher your overall available credit limit, the lower your credit utilization rate . Before asking for a credit limit increase, make sure you won’t be tempted to spend more than you can afford to pay off.

If you are considering opening a new credit card, do your research beforehand. How often you apply for and open new accounts gets factored into your credit score. Each application requires the card issuer or lender to pull your credit report, which results in a hard inquiry on your report and dings your credit score a few points.

“Usually the negative impact of those factors is much less than the benefit to your score of reducing your credit utilization ratio,” Triggs says. Just make sure you don’t apply to too many credit cards over a short amount of time and send a red flag to issuers.

It’s more important now than ever to do your research before applying for new credit because issuers may have stricter terms and requirements in wake of the economic fallout from coronavirus. Check to see what your credit score is beforehand.

You May Like: How Long Does Car Repossession Stay On Credit

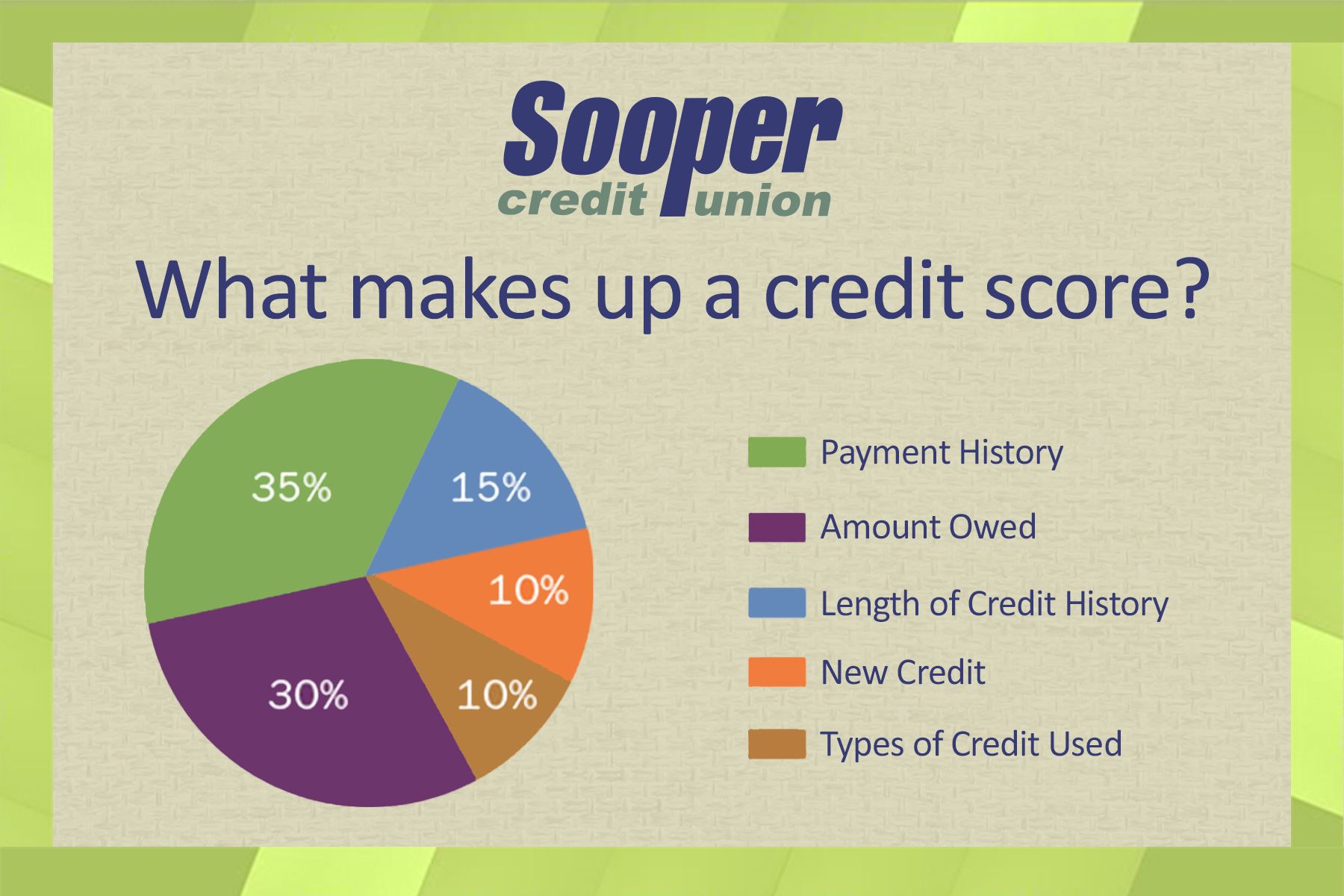

What Is A Fico Score

A FICO score is a created by the Fair Isaac Corporation . Lenders use borrowers FICO scores along with other details on borrowers to assess and determine whether to extend credit. FICO scores take into account data in five areas to determine creditworthiness: payment history, current level of indebtedness, types of credit used, length of credit history, and new credit accounts.

How Long Does It Take To Rebuild A Credit Score

There’s no set timeline for rebuilding your credit. How long it takes to increase your credit scores depends on what’s hurting your credit and the steps you’re taking to rebuild it.

For instance, if your score takes a hit after a single missed payment, it might not take too long to rebuild it by bringing your account current and continuing to make on-time payments. However, if you miss payments on multiple accounts and you fall over 90 days behind before catching up, it will likely take longer to recover. This effect can be even more exaggerated if your late payments result in repossession or foreclosure.

In either case, the impact of negative marks will diminish over time. Most negative marks will also fall off your credit reports after seven years and stop impacting your scores at that point if not sooner. Chapter 7 bankruptcies can stay for up to 10 years, however.

In addition to letting time help you rebuild your scores, you can follow the steps above to proactively add positive information to your credit reports.

Read Also: Afni Pay For Delete

Pay Bills On Time And In Full

“Making payments on time and keeping your balances low are the two most important factors when it comes to building credit,” Griffin says.

In fact, payment history is the most important factor making up your credit score. Your credit score considers whether you make payments on time or late and if you carry a balance month to month or pay it off in full.

It’s a good idea to pay off your bill in full each month to avoid potential late payment fees, penalty and interest charges that often result from carrying a balance.

“Before you open a credit account, you should know why you’re opening the account, what you will use it for and how you will pay the balance off,” Griffin says.

As a rule of thumb, set up autopay for at least the minimum payment, so you can avoid unnecessary mishaps. You can also schedule email, text or push notifications through your card issuer.