What Other Features Are There

As I stated, Credit Lock is a new feature provided in TransUnionss credit monitoring service. On top of being able to lock/unlock your credit report, you can also monitor your credit and get an analysis of how youre doing. Its important to know whats happening with your credit, especially with all of the rampant identity theft going on around this country and the world. Here are the other features you get when you sign up for TransUnions Credit Monitoring service on top of their new Credit Lock feature. These are essential to keeping your credit profile safe.

You get access to your TransUnion VantageScore every time you log in. This provides a glimpse into what other institutions will see when they use TransUnion to check your credit. The higher the score, the better!

Instant Alerts I like this feature. TransUnion will immediately contact you via email when a credit inquiry has been made in your name. If youre not the one who authorized the inquiry, then you can report it quickly.

Internet Watch This is slightly scary, but a necessary evil these days. Internet Watch will track your personal data to see if its being bought or sold online. The system alerts you if your information might have been jeopardized.

You get direct access to a credit restoration specialist who can act as a Power of Attorney for you in order to restore your credit.

Hello, I’m Grayson!

$75,000 in debt

Why Is My Credit Locked

A report lock or has the same impact on your reports as a security freeze, but isn’t exactly the same. A report lock generally prevents access to your reports to open new accounts. If you want to apply for , you must unlock your report to allow a check.

What is an excellent credit score? For a score with a range between 300-850, a credit score of 700 or above is generally considered good. A score of 800 or above on the same range is considered to be excellent. Most credit scores fall between 600 and 750.

How To Unfreeze A Transunion Report

You can lift a credit freeze with TransUnion one of the following ways:

For digital unfreezing, you may be prompted to sign up for a new TransUnion account. If youre a returning user, simply log in with your username and password. You can also perform the move by downloading the myTransUnion app, available in the Apple or .

The app gives you the ability to Temporarily Lift Freeze yourself. You just enter the dates you want the lift to happen, so the report can be accessible to lenders.

Over the phone, a customer service representative can help you with the process at 888-909-8872. Or, you can mail your removal requests to the agency directly.

Contact info: TransUnion TransUnion LLC, P.O. Box 2000, Chester, PA 19016.

You May Like: What Is Synchrony Bank Ppc

When Should I Freeze My Credit

If youve been a victim of identity theft, you have more than one option to consider when it comes to protecting your credit. In many cases, a security alert may be sufficient.

When you place a security alert, also known as a fraud alert, you can add a telephone number so lenders can call you when they receive an application and verify that its you who is applying. You also can request additional free credit reports when you add an initial security alert or victim statement. Reviewing your report can help you determine whether or not you are a victim and help you take appropriate action.

In more extreme cases in which youre experiencing ongoing fraud attempts, you may feel a security freeze is necessary.

Its worth considering taking action to protect your credit if:

- Unexplained bills or collection notices are mailed to your address, in your name or under anothers name.

- New inquiries or credit accounts appear on your credit report, indicating activity with lenders or other companies you dont recognize.

- Your bank or credit union notifies you about fraudulent activity on an account.

- You receive notification that you are or could be the victim of a data breach.

Before you proceed with a credit freeze, however, you should know that a better solution for many victims of identity theft may be to enact whats called a fraud alertmore on that later.

Heres what you know about how to freeze your credit, and how to decide whether or not you should.

How Do You Know If Your Transunion Credit Report Is Frozen

If youre applying for credit but for some reason youre not getting approved even though you have no debts and you always make timely payments, then maybe your credit report is frozen. TransUnion cant freeze your credit report without your permission so its best to check it yourself.

Always remember that companies cannot perform a credit check, which is crucial when applying for a new loan if you placed a freeze on it. Fortunately, your credit score wont take a hit because your credit file cant be accessed, and therefore, no hard inquiries were made.

With TransUnion, its easy to check whether your credit report is frozen or not. You can call 833-395-6933 or log in to your TransUnion online account to verify the status of your credit report.

Don’t Miss: Credit Report With Itin Number

How To Freeze Your Credit Report After Identity Theft

Freezing your credit report is sometimes necessary. It can help prevent identity thieves from opening new lines of credit and other accounts in your name. Its often recommended when youre dealing with the ramifications of identity theft.

A credit freeze allows you to restrict access to your credit report. When you freeze your credit file, you prevent potential creditors from accessing certain financial and personal information. Creditors are unlikely to let you or an identity thief open, say, a new credit card, if they cant access your credit report. Thats because they wont be able to assess your creditworthiness.

If you need to freeze your credit, you can get a free credit freeze by requesting one at each of the three major credit reporting agencies. More on that later.

How To Freeze Your Credit With Experian

If you want an easy and free way to minimize your chances of identity theft, you should freeze your credit. Once you do, only companies with which you already do business will be able to view your credit files, and it will be nearly impossible for someone else to open a new account in your name.

The drawback to freezing your credit is that you wont be able to open a new account either. This can be a big problem when youre trying to buy a car or a house, or even to get a new cellphone or cable-TV contract. Because of this, the credit bureaus make it easy to temporarily or permanently unfreeze your credit.

Unlike fraud alerts, you have to set up a credit freeze with each of the Big Three credit-reporting agencies Equifax, Experian and TransUnion individually. Fortunately, freezing and unfreezing your credit is now free across the United States thanks to a law that went into effect one year after 2017s massive Equifax data breach.

Unlike Equifax or TransUnion, Experian doesnt require you to set up an account with it to freeze your credit. You simply verify your identity, and then youll create a 5-to-10 digit PIN with which you can temporarily or permanently lift the freezes.

You can set the dates and duration for temporary thawing periods. Experian also lets you create a one-time PIN that you can give to a potential creditor such as a company offering you a car loan so that it can see your credit file just once.

You May Like: Does Paypal Credit Report To Bureaus

Should I Freeze My Credit Report

A credit freeze is a free tool available to help victims of identity theft protect themselves and their credit. But it is an extreme step, and there are some drawbacks. When you have a freeze on your credit report, you will need to remember to lift the freeze prior to applying for credit.

If you have had your personal information compromised and are concerned about credit fraud, there are some other free fraud tools to consider:

- An initial security alert: This alert is also called a temporary security alert or temporary fraud alert. It lets lenders know that someone may be trying to apply for credit fraudulently and asks them to take extra steps to verify your identity before extending credit. Initial alerts are automatically removed after one year.

- A fraud victim statement: Also called an extended fraud alert, this alert also lets lenders know that you have been a victim of identity theft and asks them to contact you at the number you provide if someone applies for credit in your name. To add an extended alert, you must submit a copy of your police report or identity theft report. Extended fraud alerts remain on credit reports for seven years.

- An active-duty alert: Members of the armed forces on active duty can add an active-duty alert to their credit report to help protect themselves from fraud and identity theft while deployed. Active-duty alerts remain on the credit report for one year.

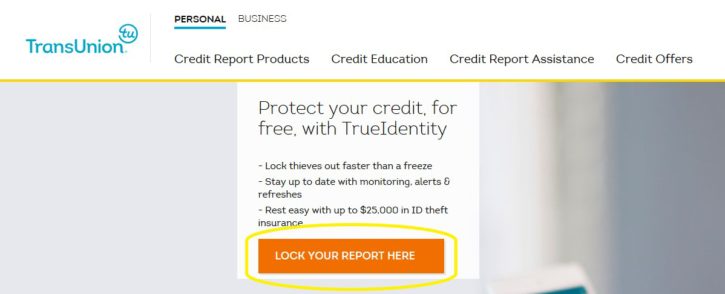

Pros Of Locking Your Credit

- A credit lock can reduce your chances of becoming an identity theft victim, since lenders cant check your credit reports while theyre locked.

- You can lock and unlock your reports yourself at any time, making it faster than a freeze if you need to authorize a legitimate credit check.

- TransUnion and Equifax allow you to lock and unlock your credit for free.

Recommended Reading: How To Remove Child Support From Credit Report

How Can I Lift A Credit Freeze

The same webpages used to set up credit freezes can be used to remove or suspend them. All three bureaus also provide instructions for lifting a freeze by phone, using the password or PIN connected to your freeze at each bureau.

In addition to your ability to permanently unfreeze your credit, you may have the option to lift the freeze temporarily, either by granting one-time access to a specific creditor, or by indicating a length of time you want the freeze to be suspended. Policies vary by bureau so make sure you understand what your options are before you begin the process.

When you enter your password or PIN online or by phone, your credit will be thawed within one hour. If you lose your password or PIN, the credit bureaus will need to verify your identity, which will delay the process.

You May Like: What Is Factual Data On Credit Report

Reporting Problems With Your Credit Freeze

All three credit reporting bureaus are legally required to freeze your credit report at your request, at no charge. However, you can submit a complaint if you believe one of these agencies is not placing the credit freeze properly. Complaints can be registered with the Consumer Finance Protection Bureau online or by calling 855-411-2372.

You May Like: Opensky Credit

How To Unfreeze Credit If You Lose Your Pin

Also prevents most lenders from accessing your credit reports until you unlock them. The big differences, A credit freeze is always free. It may take more steps

A credit freeze allows you to restrict access to your credit report. It can help if youve been a victim of identity theft.

Dont Miss: What Does Charged Off Account Mean On My Credit Report

Building On Your Good Credit Habits

Protecting your information, like using a credit freeze, puts you in control of your credit health and data identity. Its a great safeguard for when youre not actively house or car shopping or seeking other credit opportunities.

Now that youve taken that responsible step of protecting your information, consider building on that good habit by regularly monitoring your credit reports. A subscription to TransUnion Credit Monitoring can further help you manage your data identity with confidence. It provides daily refreshes of your credit report and alerts you to critical account changes to any of your 3-bureau credit reports. Continuously practicing good habits will help you build a healthy credit profile and allow you to capitalize on opportunities you deserve.

Disclaimer: The information posted to this blog was accurate at the time it was initially published. We do not guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit transunion.com. This site is governed by the TransUnion Interactive privacy policy located here.

What You Need to Know:

*Subscription price is $24.95 per month .

Recommended Reading: Is Klarna A Hard Pull

What Credit Card Can I Use At Costco

Category: Credit 1. What credit cards does Costco accept? CNBC Since Costco has a contract with Visa, shoppers cant use credit cards backed by the other three main networks, American Express, Mastercard or Discover, at Costco shoppers can only use Visa credit cards in-store. Here are the best credit

Triple Check Your Personal Information

It may be simple, but scanning through the personal information section is crucial. Make sure your full name, address, and date of birth is accurate, along with your social insurance number.

There may be a risk that your information could be linked to another person, especially if you share an identical name or a common name.

There could be two reports out there tied to you and you dont know which one is making its way into your bankers hands.

Your employment is listed, too. Anytime you apply for a credit product, youre asked about your employment and income.

Also Check: Does Speedy Cash Report To Credit Bureaus

Temporary Credit Lift Vs Permanent Credit Lift

When lifting a credit freeze, you have a choice between a temporary lift and a permanent lift.

- Temporary A temporary lift allows creditors or companies access to your credit reports within a specific date range. This range is determined by you. This option is a smart choice because you can set it and forget it. Once the temporary lift expires, the credit freeze goes into effect again. This method will help keep you protected without you having to do anything else.

- Permanent A permanent lift will end your credit freeze for good. As a result, your secure credit reports will be more vulnerable. A permanent credit lift is not recommended if you have any reason to be concerned about the security of your information. Obviously, something caused you to feel threatened enough to initiate a credit freeze. A permanent lift should only be considered if that threat been resolved. Otherwise, a temporary lift may be a better option.

You Can Now Freeze Your Credit For Free Heres Why You Should Do It

Jon Byman

Thereâs no sure-fire way to prevent someone from stealing your identity and damaging your credit in the process. But freezing your credit will go a long way toward making sure youâre protected and giving you peace of mind. And you can freeze your credit for free. You may want to consider doing it as doing so will mean that even if a criminal gets your information, it will be difficult or impossible for that person to open a fraudulent account in your name.

In 2018, a new law made it free to freeze your credit. Prior to the new law, each of the three credit bureaus could charge you if you wanted to put a freeze in place . Then, you often had to pay again to unfreeze or thaw your credit if you wanted to do something that required a credit check, like applying for a new loan. However, after the massive Equifax data breach in 2017, consumer advocates called on Congress to provide free access to credit freezes.

Also Check: Does Paypal Credit Report To Credit Bureaus

How To Unfreeze Your Credit Report With Transunion

Similar to Equifax®, you can create an online account, which allows you to freeze and unfreeze your credit with TransUnion®. You will need to create a PIN during the credit freezing process, but you only need your PIN if you want to lift your freeze by phone. If you lose your PIN, you can still unfreeze your report online as long as you have the password and name connected to the account. You can create a new PIN online for an added layer of security, and won’t need the old PIN to set up a new one.

What Does Freezing My Credit Do

When you freeze your credit, the credit reporting bureaus canât give any information to anyone who makes an inquiry about you. Typically, businesses inquire about your credit when you are trying to, for instance, open a new credit card, buy a car or rent an apartment. The credit check helps the business determine if they want to lend or rent to you, and it can help set your rates and lending terms for loans and credit cards.

When your credit is frozen and the business canât get any information about you, it typically stops the process â which means a fraudster will be unable to open an account while using your identity.

Also Check: How Accurate Is Creditwise Credit Score

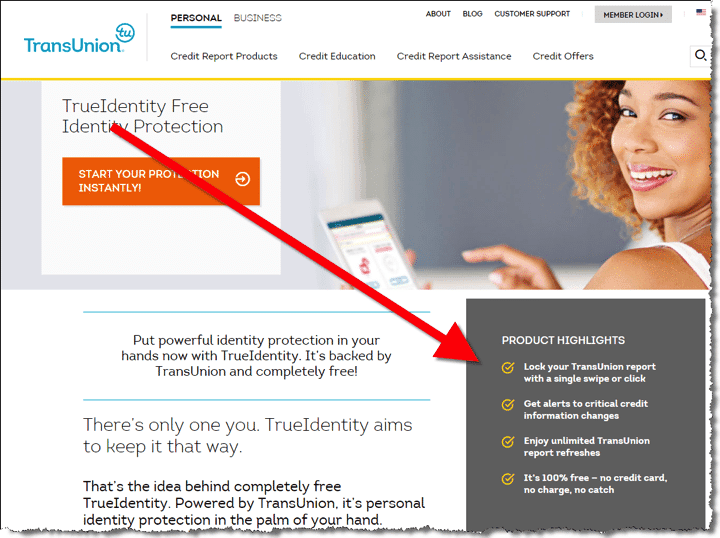

How Credit Lock Helps Prevent Credit Fraud

When identity thieves access your personal data, like your Social Security number or bank account numbers, they can use this information to apply for credit cards or loans in your name. Typically, when a bank or credit card company gets that application, one of the first steps they take is to pull your credit report.

Based on your credit report, the application is approved or denied. Financial institutions attempting to view your TransUnion credit report will be unable to do so, which would likely mean that the application would be denied. This stops thieves before they can commit credit fraud.