Dispute Late Payments With Transunion

You can also dispute late payments with TransUnion online or by mail. You can begin an online dispute with TransUnion by completing their 3-step Online Consumer Dispute Service. This includes providing your full name, date of birth, street name, and social insurance number. Once youâve submitted this initial form, you will gain access to their Online Disputes platform to continue your dispute.

If you prefer mailing your dispute, you can print and complete a TransUnion . You can mail the completed form, along photocopies of the necessary supporting documentation, to the following address:

TransUnion Consumer Relations Department 3115 Harvester Road, Suite 201 Burlington, Ontario L7N 3N

How To Dispute Inaccurate Information On Your Credit Report

You can also dispute any inaccurate information on your credit reports with the appropriate credit bureaus. Once a dispute is filed with the bureau, it will reach out to the creditor that supplied the information and ask them to verify it and respond to your claim.

If the creditor makes a change in response to your dispute, it must notify all other consumer reporting agencies to which it reported the information of the change.

Because each bureau handles disputes independently, you should check your report with each to make sure the changes have been made. If they haven’t, contact each of the credit reporting companies that are reporting the information separately to initiate a dispute with them.

Experian has an online portal you can use to submit a dispute, or you can file a dispute by phone, mail or fax if you prefer. Equifax and TransUnion have similar systems and options.

Filing a dispute is free, and you can attach or send copies of supporting documentation to verify your claim. However, some items that appear on your credit report typically aren’t disputable, such as correct legal names and addresses.

Once a credit bureau concludes its investigation, it may verify, update or delete the item in question. Disputes are generally resolved in 30 daysalthough they may be completed even sooner.

Borrowing With Poor Credit

Your scores will be lower if late payments remain on your credit reports, but that doesnt mean you cant borrow money. The key is to avoid predatory lenders who charge high fees and interest rates.

A cosigner may be able to help you get approved for certain types of loans. Your co-signer applies for a loan with you and promises to make the payments if you stop paying on time. Lenders evaluate their credit scores and income to determine their ability to repay the loan. That may be enough to help you qualify, but its risky for the co-signer, because their credit could take a hit if you make late payments.

Also Check: Can A Repossession Be Removed From Credit Report

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

How Long Does A Skipped Payment Stay On Your Credit

If you miss a payment today, and its reported 30 days late on your credit report, then

Get ready for this

The late payment will become part of your credit payment history and stay on your credit report for 7 years.

And worse, even paying off or closing the account will not remove the late payment any sooner. The so-called pay for deletesonly works with collection accounts.

At this point, you may be wondering if you should remove your late payments yourself or hire me to remove them for you.

To answer this question, I have created a quiz to help you find the right solution for you.

Recommended Reading: Does Capital One Report Authorized Users To Credit Bureaus

How Does A Late Payment Impact My Credit Score

If youve recently missed your payment, you still have some time before it affects your credit score. Late payments arent reported on your until theyre at least 30 days past due. After that, itll be placed into one of these buckets:

- 30 days past due

- 150 days past due

- Charged-off

If youre late on making a payment, your provider will report it based on this schedule. The later it is, the more damage it will cause to your credit score. For example, a 150-day late payment will drop your credit score more than a 30-day late payment. This is why even if youre late, its best to pay it off as soon as possible so that it doesnt harm your score more.

In addition to how late your payment is, a few other factors related to late payments can affect your credit score, including the:

- Balance you owe with each late payment

- Number of late payments on your report

- Time elapsed since you made the late payment

- Number of other on-time payments youve made

Related:How To Review Your Credit Report

Use A Goodwill Letter To Remove Late Payments From Your Credit Reports

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Late payments on a credit card or other loan can have a widespread financial impact beyond triggering late fees and higher rates. Payments made more than 30 days past due can ding your credit score, making it harder to qualify for future loans and get good interest rates.

One possible solution: You may be able to remove late payments on your credit reports and start to improve your credit with a goodwill letter. A goodwill letter wont always work, but some consumers have reported success. It’s worth trying because these derogatory marks on your credit can last seven years.

You May Like: Does Paypal Credit Report To Credit Bureaus

Dispute Late Payments With Equifax

With Equifax, you can either dispute your credit report online or by mail. With either method, Equifax requires 2 pieces of documentation to verify your name and address:

-

One government-issued ID

-

One supporting document

You can submit an online dispute with Equifax by providing your full name, email address, phone number, and reason for the dispute. Once youâve submitted this initial form, you will receive an email confirming that a ticket has been opened and from there, you will need to submit an online Consumer Credit Report Update Form.

You can also mail Equifax a completed Consumer Credit Report Update Form, along with photocopies of the necessary IDs and supporting documents related to your dispute. You can mail documents to the following address:

Equifax Canada Co. Consumer Relations Department Box 190 Jean Talon Station Montreal, Quebec H1S 2Z2

How To Correct Mistakes In Your Credit Report

Both the credit bureau and the business that supplied the information to a credit bureau have to correct information thats wrong or incomplete in your report. And they have to do it for free. To correct mistakes in your report, contact the credit bureau and the business that reported the inaccurate information. Tell them you want to dispute that information on your report. Heres how.

You May Like: How To Remove Verizon Collection From Credit Report

How Does A 30 60 Or 90

Simply put, if you have a good credit score, a new delinquent payment will affect your credit score far more negatively than someone who already has a poor score.

Here are the facts:

If you have a good score of 680 or higher, a new late payment is going to sting badly. A 30 day late may drop your score by around 80 points.

A 60 to 90 day late will drop your Fico score 80 to 120 points!Ouch.

You may be wondering how long it will take for your credit score to recover after the late payment.

The saddest part about a late payment is, your credit score will only increase by 1-2 points per month. There will be a slight increase once you bring a delinquent account to current, but after that, your credit score will recover extremely slowly.

As a result, you wont be able to get approved for any good credit cards, loans, and mortgages for years to come.

What Is A Credit Score

The credit reporting agencies use your financial information to calculate a between 300-900, giving you a rating from poor to excellent. Credit providers use this information, along with their own slightly different calculations to determine whether you are a good risk or not. Generally, a score higher than 650 will get you approved. If your score is lower, you might be seen as high risk. Exact numbers will vary, and lenders may look at factors other than your credit score.

Its important to note that your payment history carries a lot of weight up to 35% of your credit score.

To learn more about your .

Recommended Reading: What Credit Score Does Carmax Use

File A Dispute With The Credit Reporting Agency

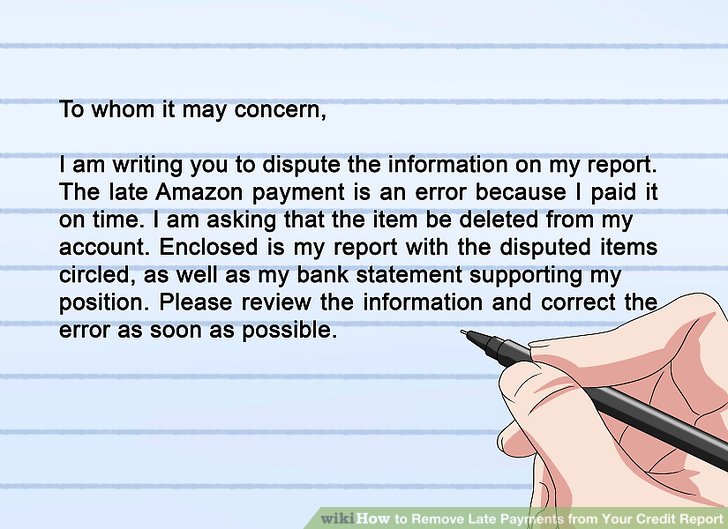

Initiate a claim directly with the credit bureau by writing a dispute letter. The purpose of this letter is to notify them that you believe certain information in your credit file is inaccurate.

The Fair Credit Reporting Act requires creditors to report accurate information about every account. This means they have a legal obligation to review, investigate, and respond to your claim. This process is free and can take up to 30 days to complete.

You can begin a dispute with any one of the credit bureaus through their websites or via mail. The leading credit reporting agencies are Equifax, Transunion, and Experian. Its essential to have documentation and to be precise about the information you are challenging.

Each of the three major credit bureaus has an online section dedicated to walking consumers through the process of disputing a claim online. It would be best to dispute the entry with each credit bureau to make sure the removal is complete across the board. After receiving the initial claim, the credit bureau will contact the source of the erroneous information and dispute it on your behalf.

How to file a dispute letter:

Communicate With The Credit Issuer

Its tempting to ignore past due bills, especially from credit card companies that cant turn off your utilities or repossess your car. But try to avoid this temptation.

A lot of credit accounts offer payment flexibility you should take advantage of if youre struggling to make on-time payments.

Some companies will let you skip a payment so you can get your personal finances back on track.

But you wont know about these possibilities if you dont get in touch with your creditor.

So dont ignore their phone calls or emails, especially when youre still not 30 days late.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Check Your Credit Reports

In order to stay on top of your history of credit payments and credit score, itâs essential to check and monitor your credit on a regular basis. Canada has two main credit bureaus, Equifax and TransUnion. Itâs smart to regularly monitor your credit report with both agencies. You can get your credit report for free from both agencies.

While there is no set rule about how often creditors have to send updates to credit bureaus, creditors tend to update payment status reports approximately every 30 days . However, for smaller creditors, such as those who might not have entire departments devoted to updating a customerâs profile, it could take two or three months for the late payment to appear on your report. The important thing is to be as vigilant as possible about monitoring your credit report. By catching mistakes early, you have a much better chance of correcting them quickly and successfully before they have an indelible effect on your credit score.

How To Correct A Late Payment Record On Your Credit Report

Your credit report sums up your credit history of the past 36 months, indicating your ability to repay lenders and financial institutions, who often refer to your credit report before sanctioning a loan. Making sure your credit report is accurate, which also helps ensure your credit score is accurate, can help you get faster approval on a personal loan and other loans.

With late payment records on your credit report, your credit score is impacted and you are likely to face credit rejection from most lenders. Some lenders may offer you loans despite the late payment record however, the interest on these loans may be higher than normal. Apart from this, a few studies have also shown that a 30-day delay can bring your credit score down by almost 100 points. While it is important to remember to never miss your EMIs and pay them on time, here is what you can do about late payment records that are already on your credit report.

Also Check: How Bad Is A 500 Credit Score

Bonus Tip Report Your Old Rental Payments

Do you rent? If you do, there is almost zero chance that your landlord is reporting those payments to the credit bureaus.

This means you do not get any credit for making those payments on time each month unless you pay a rent reporting company to do it for you.

It is super inexpensive to have your payment reported each month and well worth it because creditors will see another tradeline with payment made on time.

The great thing about rent reporting is that the credit bureaus actually want this information and will allow the rent reporting company to report up to 24 months of previous payments.

For a minimal sum of money, you can have 24 payments reported along with your ongoing monthly payment.

Experian has a free rent reporting program they offer through Experian Boost.

Obviously, this will help further dilute your payment history and poor, more clear water into that glass, like the authorized user tradelines.

You can learn more about how rent reporting works in our top 10 rent reporting companies article.

File A Credit Dispute

If you find any errors on your credit report, you can file a dispute with the credit bureau that generated the report. You can also with the creditor.

You can start this process by sending a dispute letter to each credit bureau that reported the mistake. The dispute letter should clearly state the negative information youre disputing, include any documentation of the inaccurate information, and request that the item is corrected or removed.

After receiving your dispute letter, the creditor or credit bureau has 30-45 days after receiving your dispute to investigate the claim. You should be notified of the results after the creditor or credit bureau has finished their investigation.

If the creditor or credit bureau has proof that the information they are reporting is correct, it will stay on your credit report. However, if they agree that the information is incorrect, they must remove it from your credit report.

Read Also: Does Paypal Credit Report To Credit Bureaus

How To Avoid Late Payments

Some , like the Petal® 2 “Cash Back, No Fees” Visa® Credit Card. But a late payment still puts you at risk of hurting your credit score. Card issuers report your payment to the credit bureaus if it’s 30 or more days late, regardless if they waive late fees.

To prevent negative information appearing on your credit report, learn how to avoid late payments by following these steps.

When To Consider Using A Goodwill Letter

When you send a goodwill letter to a creditor, youre asking them to do you the favor of removing accurate information from your credit reports. Your only hope is that the creditor will want to stay in your good graces and be willing to extend this courtesy. A goodwill letter also shows that you are willing to take some initiative when it comes to your credit health, and thats generally a good sign.

Typically, you should consider sending a goodwill letter to a creditor when youve made a late payment and have a good excuse. For example:

- You thought your bill was set up for automatic payment, but you were mistaken

- You switched banks and your payment was accidentally forgotten during the transition

- You moved and your bill never arrived at your new address

- You were in the midst of a balance transfer and you didnt realize your old balance wasnt paid off

- A financial crisis temporarily impacted your ability to cover your bills

In any case, your goodwill letter should ask for mercy and relief from an accidental late payment, but you should also be able to confirm the same mistake will not happen again. As a result, you should consider sending a goodwill letter when you are truly ready to take your credit seriously and never miss a payment again.

Also Check: How To Get Credit Report Without Social Security Number