What My Improved Credit Score Allowed Me To Do

In August of 2011, I had to purchase a car so I could switch jobs.

When I filled out the credit application to see if I qualified for lower financing rates, my credit score came back as 731.

In other words, I raised my credit score from 621 to 731 in just five months!

This is a very big deal because, at 621, I would have been denied a loan for the car, or would have had an interest rate that exceeded 9% on the auto loan.

Since I chose to get a secured credit card, I was able to take the car loan on my own and qualify for the low rate of 3.99% financing.

The difference in the loan between the two interest rates would be $750 over the life of the loan, far surpassing the cards annual fee, and the opportunity cost of my secured credit card holding my $1,100 for five months.

Building And Maintaining Good Credit

Paying off a credit card is a milestone to celebrate, as is the bump to your credit score that could result. You can more closely track the changes to your credit scoresand keep an eye on your score moving forwardby signing up for free credit monitoring with Experian. You’ll have access to your Experian credit score and report and can set up alerts to let you know when changes occur to your credit file. Paying down debt, monitoring your credit and using your credit wisely will all help set you on a path toward building and maintaining good credit.

Building Credit Takes Time But Is Worth Doing

Establishing a good credit score can make a big difference in the type of interest rates and APRs you can get, as well as the types of credit you can qualify for. But it takes time to achieve that goal.

As you consider these tips, itâs important to stay focused on the actions you can take rather than the number.

With the right behavior, youâll establish a solid foundation for building your credit to where you want it to be and keeping it there.

Also Check: What Is S Good Credit Score

If I Pay Off My Credit Card In Full Will My Credit Go Up

Yes.

Here’s a short chart showing different methods of paying off credit card debt and how they usually impact your credit score.

| Method used to pay off credit cards | Usual impact on credit score |

|---|---|

| Cash or check | |

| Personal loan, debt consolidation loan | Boost in score |

| Balance transfer credit card | No change |

Note: Depending on your circumstances, you may not see these effects on your credit score. We’ll explain more about how your credit score is calculated below so you can take all factors into account.

Report Rent And Utilities To The Credit Bureaus

Try registering with Rental Kharma to get your rent and utilities reported to the credit reporting agencies. For a small fee, theyll process landlord and utility payment data and inform the credit reporting bureaus each month.

Another option is to register with Experian Boost which is a free service for those with an Experian account. According to Forbes, 86 percent of consumers with a thin credit file who used Experian Boost experienced an instant FICO 8 score increase up to 19 points.

Recommended Reading: When Does Wells Fargo Report To Credit Bureaus

Factors That Affect Your Credit Score

Credit scores are just a numerical representation of how attractive a borrower is to lenders. Lenders use many different formulas to calculate credit scores, but most rely on the same five factors.

The components of a FICO® credit score are:

- Payment history: The more consistent you are about making payments on time and in full, the better your credit score.

- Amounts owed: The lower your outstanding balances, the higher your credit will be. Lenders often consider the amounts owed in relation to your original balance or available credit limit .

- Length of credit history: In general, the longer your credit history, the higher your credit score. For example, lenders prefer someone who shows ten years of good behavior to someone with only ten months.

- New credit: When you apply for new credit, the creditor will most likely pull your credit report. That will trigger a hard credit inquiry. Too many hard inquiries in a short period maylower your score. Tip: Most wont trigger an inquiry.

- Having a healthy mix of accounts, including revolving debt and installment debt, will increase your credit score. Revolving debt includes credit cards, while mortgages and auto loans fall under installment debt.

If you improve your credit report in each of the five factors, your credit scores will go up.

Note that even though you have different credit scores across credit bureaus, theyll usually correlate with each other. What increases one will usually increase the others.

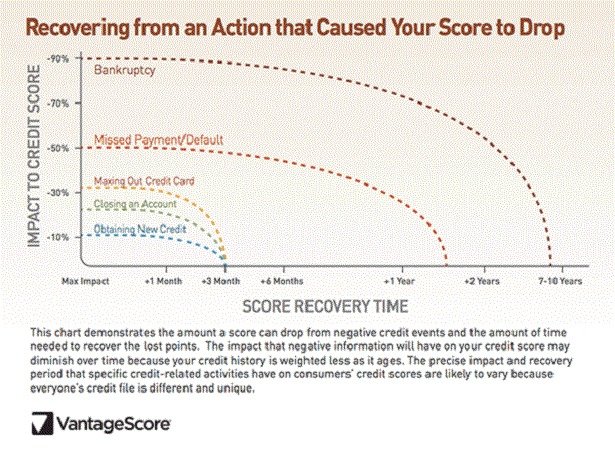

What Impact Do Negative Credit Actions Have On Your Credit Score

The most common events that impact a persons credit score are listed below. Notice how the impact on your credit score depends on the same three factors we discussed above: what happened, how many times it happened, and your initial credit score. Although we used data from VantageScore to compile this table, the impact on a FICO score is comparable.

Don’t Miss: What Credit Score Do Dealerships Use

How Often Does Your Credit Score Update

Your credit score is based on the information in your . Whenever something changes on your credit report, thats when your credit score is usually recalculated, says Grant.

Your credit card company will usually update the credit bureaus once a month with your account details, corresponding with each new credit card statement, he adds. So, if youre working on improving your credit, its a good idea to check your score on a monthly basis.

Improving Your Score On Your Plan

How can you help your credit score return to its original place and then surpass it?

The key is to make consistent, on-time payments. A debt consolidation program will work as its name implies: It combines all of your disparate debts into one, single monthly payment thats easier to track and pay.

If you keep up with your pre-determined payment schedule, youll demonstrate your creditworthiness to both your lender and your various creditors. Over time, they can report your progress and improve your credit score.

How does this work? Your payment history makes up 35% of your overall credit score. The remaining percentages are divided as follows:

- Amounts owed: 30%

- Types of credit utilized: 10%

- New credit pursued: 10%

As your payment history record improves, you cant help but increase your credit score along the way. This is especially the case if you also manage to lower your amounts owed and lower or eliminate any new credit pursued.

On the other hand, if you continue to miss payments or choose to make sporadic ones, youll work against your credit score, lowering it even more.

Also Check: How Can You Get A Credit Report

Know Where To Focus Your Efforts

Not all credit scoring factors are weighted equally. For example, as you can see from the chart below, two factors make up a full 65% of your score:

- Payment history: The most important scoring factor, this is a record of your payments on your credit accounts. If your record shows a lot of late payments or other negative marks, your score will suffer.

- : Your credit utilization represents how much you spend on revolving credit accounts . Keep your credit card spending as low as possible for the best results.

FICO Scoring Factors

Dont waste time focusing on the wrong scoring factors. Follow these tips to quickly and efficiently improve your payment history and credit utilization:

- Ask your creditors to delete late payments: If you have any delinquencies, try negotiating pay for delete or sending a goodwill letter asking your creditor to remove the delinquency from your credit report.

- Lower your spending on credit cards:The easiest way to lower your credit utilization and boost your score is to simply spend less on your cards. Aim to spend no more than 30% of your , and under 10% if at all possible.

- Request a credit limit increase:Getting an increase in your credit limit is another way of reducing your credit utilization rate. With this approach, you could see a quick score increase without changing your spending habits.

What Is A Charge

A charge-off on your credit report indicates that a creditor gave up hopes of getting payment from you after several attempts. The creditor closes your account and marks it as charged off. It will often then sell your outstanding debt to a collections agency, which will then attempt to collect the debt from you. That could result in two derogatory remarks on your credit reportone for a charge-off, and one for collections.

Read Also: Why Is My Credit Score Dropping

Request A Higher Credit Limit

One key move you can make is to request a higher limit on your current card. If youre looking for ideas on how to increase credit scores, this is a good one.

The idea is to up the ceiling on purchase limit, but spend less each month so that credit utilization ratio improves. Note that this may result in a “hard inquiry” of your credit report, which could result in a brief drop of your credit rating. You may find youre on the way to your best credit score ever!

Keep Up The Good Work

A good credit history of on-time payments stays on your credit report forever, as long as the accounts stay open. If you have setbacks with credit over time, don’t worry. You can take steps to rebuild credit and work toward a good score again.

After you build up your score, you’ll be able to take advantage of that offer rewards and incentives to qualified applicants.

Don’t Miss: Is 694 A Good Credit Score

Hard Hits Versus Soft Hits

Hard hits are credit checks that appear in your credit report and count toward your credit score. Anyone who views your credit report will see these inquiries.

Examples of hard hits include:

- an application for a credit card

- some rental applications

- some employment applications

Soft hits are credit checks that appear in your credit report but only you can see them. These credit checks don’t affect your credit score in any way.

Examples of soft hits include:

- requesting your own credit report

- businesses asking for your credit report to update their records about an existing account you have with them

What Credit Score Do You Start With

You don’t start with any credit score, and you won’t get a score until you open a credit account that reports to the credit bureaus. Once you open an account, you will receive a score based on that account. It probably won’t be the best score since you don’t have a long enough credit history, but it won’t be the worst score, either.

You May Like: Does Taking A Loan Payment Holiday Affect Your Credit Rating

How Long It Takes To Raise Your Score

The length of time it takes to raise your credit score depends on a combination of multiple aspects. Your financial habits, the initial cause of the low score and where you currently stand are all major ingredients, but theres no exact recipe to determine the timeline. Thanks to studies done by CNBC and FICO, weve compiled the typical time it takes to bring your score back to its starting point after a financial mishap. The following data is an estimate of recovery time for those with poor to fair credit.

| Event | |

|---|---|

| Applying for a new credit card | 3 months |

Ask For Higher Credit Limits

When your credit limit goes up and your balance stays the same, it instantly lowers your overall credit utilization, which can improve your credit. If your income has gone up or you’ve added more years of positive credit experience, you have a decent shot at getting a higher limit.

Impact: Highly influential, because utilization is a large factor in credit scores.

Time commitment: Low. Contact your credit card issuer to ask about getting a higher limit. See if it’s possible to avoid a hard credit inquiry, which can temporarily drop your score a few points.

How fast it could work: Fast. Once the higher limit is reported to credit bureaus, it will lower your overall credit utilization as long as you don’t use up the extra “room” on the card.

You May Like: Does Having Multiple Credit Cards Affect Your Credit Rating

How To Continue Using Your Credit Card Responsibly

Going forward, the best way to keep the momentum going is to use your credit cards responsibly. That means keeping your spending and debt under control, whether you decide to use them regularly and pay off your balances every month, or keep your cards open but hidden away .

A few tips to consider:

- Use your credit card regularly. Regularly using your credit card demonstrates your ability to manage debt well and ensures the account isn’t closed due to lack of use. A monthly bill as small as a streaming service payment can keep your account open and reflect positively in your credit.

- Always pay your bill on time. As a safeguard, consider setting up your account to make automatic minimum payments right before your due datejust make sure you have enough in your bank account to cover the payments. Payment history accounts for more than a third of your FICO® Score.

- Lock cards you don’t plan to use. Some card companies let you turn your cards “off” through their mobile app as an added security measure. This keeps the account open, but can protect you from credit card fraud that could drive up your balances.

- Make a payoff strategy before you spend. Using your credit cards may earn you rewards or other benefits like extended warranty protection, but these perks lose their luster if you have to pay interest on a balance you’re struggling to pay off. Before you spend, establish a game plan for paying your purchase off over a reasonable period of time.

How Much Will Credit Score Increase After Paying Off Credit Cards

The amount your credit score improves depends a lot on how high your utilization was in the first place.

If you’re already close to maxing out your credit cards, your credit score could jump 10 points or more when you pay off credit card balances completely.

If you haven’t used most of your available credit, you might only gain a few points when you pay off credit card debt. Yes, even if you pay off the cards entirely.

Recommended Reading: Do Debit Cards Affect Credit Score

Get Credit For Rent And Utility Payments

Rent reporting services can add your on-time rent payments to your credit reports. Rent payments are not considered by every scoring model VantageScores include them but FICO 8 does not, for example. Even so, if a would-be creditor looks at your reports, rent records will be there, and a long record of consistent payments can only help.

Experian Boost also can help, but in a more limited way. You link bank accounts to the free Boost service, which then scans for payments to streaming services and phone and utility bills. You choose which payments you want added to your Experian credit report. If a creditor pulls your FICO 8 using Experian data, you get the benefit of that additional payment history.

Impact: Varies.

Time commitment: Low. After initial setup, no additional time is needed.

How fast it could work: Boost works instantly rent reporting varies, with some services offering an instant “lookback” of the past two years of payments. Without that, it could take some months to build a record of on-time payments.

» LEARN:How Canadians can get a better credit score

Ask For A Credit Limit Increase

A higher credit limit is another way to help reduce your credit utilization ratio, which can help raise your credit scores. Keep in mind though that some credit issuers do a hard credit check when you request a credit limit increase, and that can cause your credit to dip. Read up on how to ask for a credit limit increase.

Read Also: Which Credit Report Is Free

Figure Out How Much Money You Owe

Gather all your bills and come up with a plan to pay them off. The snowball method focuses on paying off the lowest balances first, while the avalanche method focuses on paying off the balances with the highest interest rates first. If you have too many credit cards to keep track of, you could also consolidate your credit card debt into one balance transfer card to make it easier to manage your monthly payments.All three strategies could help you pay off your credit card debt more quickly, lower your credit utilization ratio and raise your credit scores. So, choose the plan that works best for you, and stick with it.

Deal With Delinquent Accounts

If you have bad credit, bringing delinquent accounts current and settling accounts that are in collections can also boost your score fairly quickly. Once the creditor or collection agency reports your account update, you should see a positive bump in your score.

Keep in mind, though, that your late payment history will remain on your credit report for seven years. If you have bad accounts that have been on your report for six years or more, you may not want to worry about settling them or bringing them up to date. This can re-age the account, and if you fall behind again, it will stay on your credit report for another seven years.

Make sure you dont re-age these accounts, because theyre going to drop off soon, says Nathan Danus, CDMP and director of housing and community development at DebtHelper in West Palm Beach, FL. Negative information typically falls off your credit report after seven years, so if youre close, its best to just wait it out.

Recommended Reading: What Is Equifax Credit Score