Home Purchase Mortgage Pre

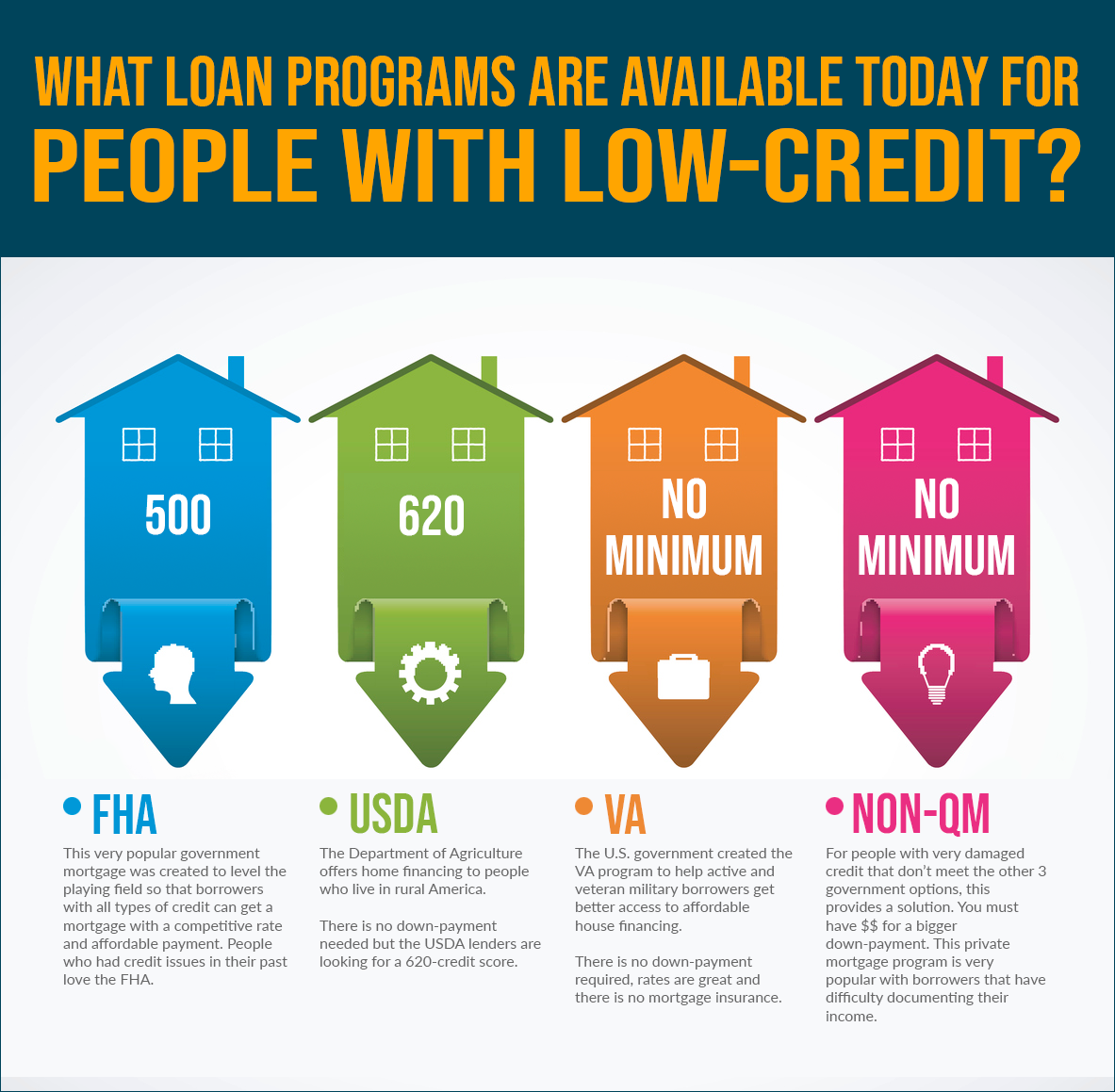

If youre looking to buy a home and you have bad credit, there are several options.

Its extremely important the obtain your pre-approval before you start house hunting so that you know what options are available. Knowing that you qualify for the home youre seeking will relieve you of a great deal of stress. Youll have the confidence you need when its time to make an offer.

FHA As low as 500 credit score

Without question, the most popular mortgage for bad credit is an FHA loan.

FHA loans for bad credit allow for as little as 3.5% down payment , and 10% down payment .

These loans are government backed and have competitive pricing. Not all lenders allow them below 580 credit. But we do.

There maximum are loan limits in every county. Check your FHA county loan limit here.

More on FHA loans for bad credit here.

VA As low as 500 credit score

If youre a veteran of the US military, its likely that a VA loan will be a great option to look into.

VA loans allow you to put 0% down and the interest rates are competitive.

There is also no monthly mortgage insurance premium on VA loans, which is a nice savings to take advantage of if eligible.

VA loans are a lifetime benefit, and can be used an unlimited number of times .

To all the veterans, thank you for your service to our country.

Check your VA eligibility here.

Alternative Financing Portfolio Loans

With a portfolio loan, there is a bit more of a common sense approach to the loan approval process.

At Cls Money We Specialise In Securing Home Loans For People With Adverse Credit

We know that, if you have a history of bad credit, securing the right mortgage can feel like a daunting task. Theres so much to consider, especially when it comes to taking the right steps to maintain a better credit score and prove to lenders that youre a responsible borrower.

Our specialist bad credit mortgage broker understands the obstacles youre facing. But perhaps more importantly, they have the knowledge, the experience and the contacts to greatly improve your chances of finding a mortgage that will support your longer term goals.

We have access to the whole of the market, which means we can source mortgage offers from niche lenders with more flexible eligibility criteria than many of the High Street banks. We also have an innate understanding of what these specialist lenders are looking for, and well be able to help you optimise your application to give you the best possible chance of success. Whatever your situation or bad credit history, CLS can find a solution.

You will also get access to our CLS portal, which allows you to quickly and conveniently upload any documents that support your case, as well as stay up to date with the progress of your application.

Contact us today to book your free, no-obligation consultation at a time that suits you. Evening and weekend appointments are available.

No matter your circumstances, we are here to get the right mortgage for you.

What Is Considered A Good Credit Score

Since different credit agencies use different rating systems, a good score will vary from one agency to the next. For Experian, a score of 881-960 is considered good, and a score of 961-999 is considered excellent. For Equifax, a score of 420-465 is considered good, and a score of 466-700 is considered excellent. For TransUnion , a credit score of 604-627 is considered good, and a score of 628-710 is considered excellent.

Also Check: How To Remove Hard Inquiries In 24 Hours

How Do I Know If I Have Bad Or Adverse Credit

There are lots of ways you can unintentionally damage your credit score. Thats why its always a good idea to have a look at your credit report before you apply for any kind of mortgage bad credit or not.

But there are also some clear reasons why you might have a bad credit rating. These include:

-

Having been declared bankrupt, or having had a debt management plan, IVA etc

-

Missing credit card, loan or mortgage payments

-

Having County Court Judgements against your name

-

Had a home repossessed in the past

The good news is there are also lots of ways to improve your credit rating – check out our tips below.

Types Of Mortgage Loans You Can Get

There are types of mortgage loans you can get, even with poor credit. In fact, lenders typically offer loans designed specifically for people with low to moderate income levels. Here are a couple types of mortgage options available to you if you have bad credit:

Government-backed loans. Government-backed loans are commonly available for anyone with poor credit. These types of loans are typically underwritten and given by approved lenders, yet are still government guaranteed. Since these mortgages are not as risky for lenders, they have lower credit score requirements.

Special Homebuyer Programs. Some of the more popular homebuyer programs include the Neighborhood Assistance Corporation of America and Habitat for Humanity. There are also smaller local, regional, and state-level programs that will help qualified first-time homebuyers or anyone who has fallen within specific income limits. While these programs usually offer down payment or closing cost assistance, they usually provide services, or mortgages, to borrowers with poor credit.

You May Like: Care Credit Pulls From Which Bureau

Rebuild Your Credit Score

Once youve assessed your credit problems, you can work on fixing them.

Anything from a single missed payment to bankruptcy can affect your ability to get a mortgage. You should start pushing up your credit score well in advance of a mortgage application by making all repayments for bills and credit on time.

One way to do this is with a , but only once you feel able to handle the responsibility and repayments.

The Role Your Credit Score Plays In Getting A Mortgage

Whats the most important piece of information about you when it comes to getting a mortgage? Is it your age? Your income? Your debt load? Your taste in architecture? All are important , but theres one thing that rules them all: your credit score.

Lenders use your credit score to gauge what kind of risk you pose as a borrower. The higher your score, the lower the risk you present to lenders, and the likelier it is youll be offered a mortgage with an attractive interest rate. And a low interest rate matters a difference of only 0.5% in your interest rate can add up to thousands of dollars over the term of your mortgage, so it pays to have a high score!

While there are other methods for calculating credit scores, FICO is the method used by most financial institutions and credit bureaus. According to myfico.com, 90% of top lenders use FICO scores to make decisions about credit approvals, terms, and interest rates, so thats what well be focusing on. You can learn more about how your FICO score is calculated here.

When its time to get a mortgage, there will be different credit score requirements depending on the type of mortgage you can get. Lets take a look at the different requirements.

Donât Miss: Does Chase Allow Mortgage Recast

Also Check: Public Records On Credit Report

Should You Get A Mortgage Or Increase Your Credit Score First

Should you take out a mortgage now, or increase your credit score before you apply for financing? The best answer is to plan ahead. Credit scores continually fluctuate, so its worth taking steps to improve your score before embarking on a home purchase.

A small increase can make a big difference. For example, even if you only raise your credit score to 665 or so from 650, you might be able to cut your mortgage costs significantly. Over the course of a 30-year mortgage, for instance, your monthly payment will be lower, and you would save more than $24,000, based on the above example from myFICO.

With additional reporting by David McMillin

Can I Remortgage With Bad Credit

If you already have a mortgage and you want to remortgage or refinance with bad credit, the first step is to keep up to date with your monthly payments, to prove to the lender that youâre a responsible borrower.

The lender will also want to see how your repayments impact your outgoings in general, and what percentage of your income it is. They may also look at how much of your home youâve paid off so far.

Also Check: How To Get Rid Of A Repo On Your Credit

Besides Credit Scores What Else Do Mortgage Lenders Look At

Your credit score is a main factor that lenders look at when qualifying you for a mortgage, but itâs not the only one. Other factors mortgage lenders consider when approving you for a mortgage include:

-

Your income

Your current sources of debt include:

-

Student loan payments

-

Open lines of credit

Youâll also need to pass the mortgage stress test. The mortgage stress test proves to the lender that you can afford higher mortgage payments if and when higher mortgage rates arrive.

A mortgage lender will take all of these factors into account when deciding whether to approve your mortgage application. You donât have to be perfect, although if youâre strong in all or most of these areas, it can help make the mortgage approval process go much smoother.

Itâs a good idea to get pre-approved with a mortgage broker before looking at properties. If youâre not qualifying for the purchase price that you want, the mortgage broker can make suggestions to help you qualify, such paying down debt or bringing on additional income via a co-signer.

Reducing And Eliminating Debt

Another point to consider when looking at how to get a mortgage with bad credit but good income is the reduction or elimination of debt. In todays society, most people have to deal with different types of debt, such as student loans or overdue credit card payments. This type of debt can influence a credit score and statistics indicate that approximately 35% of the credit score comes from this payment history.

To help improve the chances of gaining a mortgage loan, it is recommended that you focus on reducing existing debt. If you are seen to be making a concerted effort to repay debts and late payments, a lender is more likely to approve your application for a mortgage. One must remember that if the credit report shows an old unpaid bill, you should not make a repayment unless it is in full. Partial payments may seem to reduce debt, but they will make the debt more relevant thereby making them more obvious and hurting the credit rating.

You May Like: What Credit Score For Care Credit

Why Were You Turned Down For A Loan

If you are still having trouble getting a loan, ask your lender why. Bad credit is just one of many reasons you may be denied a loan. Other reasons you may be denied a home loan include:

- Overextended credit cards: If you miss payments or exceed your limit, thats a red flag to lenders.

- Failure to pay a previous or existing loan: If you have defaulted on other loans, a lender will think twice.

- Bankruptcy: Filed for bankruptcy in the past seven years? You might have trouble getting a loan.

- Overdue taxes: Lenders check your tax payment record.

- Legal judgments: If you have a judgment against you for such things as delinquent child support payments, it could harm your credit.

- Collection agencies: Lenders will know if collection agencies are after you.

- Overreaching: You might be seeking a loan outside what you can reasonably afford.

How Your Credit Score Can Help You Get A Mortgage

Before you apply for a mortgage, you can get an idea of how lenders may see you by checking your .

Itâs based on information in your Experian Credit Report, which is one of the factors lenders can use to decide whether to accept you or not.

Lenders like to see someone who can make monthly repayments on time, and who can keep control of their overall debt. Successfully managing simple credit accounts like a credit card, a mobile phone contract and some household bills should help your credit score go up over a short period of time. Remember, not every lender uses the exact same factors, and they may score based on different factors.

To help put yourself in a better position for lower interest rates and better mortgage conditions, see what you can do to improve your credit score.

Don’t Miss: Does Zebit Report To Credit Bureaus

Knowing What A Bad Credit Score Is

It is important to understand what qualifies as a bad credit rating to know if your credit score is positive or not. Typically, lenders are willing to approve mortgages to people with credit scores of at least 620. The ideal credit score is between 800 and 850 however, this can be difficult to achieve and particularly if you are in the young adult age bracket. If your credit rating is below 600, it is unlikely that you will qualify for a mortgage. This does not mean you will not qualify for specific loans as banks will often offer people in these situations special types of loans.

Can I Get A Mortgage If Im On A Debt Management Plan

Yes but you will need to be able to prove that you can afford your mortgage repayments on top of any outstanding debts.

If your debt management plan has been in place for some time, and you have been successfully meeting all your payment obligations since it began, many lenders will consider you to be a lower risk candidate, as you have already proven that you have the means to satisfy the plans terms. If you have taken out the DMP in the last six months, however, your options may be more limited.

Your case will also depend on what these debts were relating to. For example, if you are on a plan to pay off unsettled store credits, lenders will be likely to look at your situation more favourably than if you are still tackling a credit card overdraft.

Bear in mind that if you are planning to get a mortgage on a debt management plan, your income multiples may be affected and its these multiples that ultimately determine how much you can borrow. Somebody with a clean credit file and no DMP may be able to obtain up to five times their income, whereas an individual on a DMP may only be offered four times this total.

You may also find that you need to enter into a mortgage deal with higher interest rates, and/or you need to put down a higher deposit to satisfy the lenders risk mitigation criteria.

Also Check: Unlock Transunion Account

Private Mortgage Lenders For Bad Credit

There are plenty ofprivate mortgage lendersthat offer bad credit mortgages in Canada. A few examples include Alpine Credits, Prudent Financial, Clover Mortgage, Canadalend, and Guardian Financing. Forprivate mortgage lenders in Ontario, a few examples include Castleton Mortgages, MortgageCaptain, and MortgageKings. You might be required to go through a bad credit mortgage broker in order to access some private lenders, as some may only work through brokers.

Some private lenders have no minimum credit score requirements, and some even allow you to make interest-only payments on your mortgage. This can help you keep up with your payments if you are having cash-flow issues. Making regular mortgage payments to a private lender can also help improve your credit score, making it easier to eventuallyrefinance your mortgageat a lower mortgage rate with another lender.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Credit Wise Is Not Accurate

What Is Bad Credit

If you have bad credit, or a poor credit rating, it usually means that you have missed some payments in the past. This could be payments on utility bills, loan repayments or any other situation where you failed to pay on time or in full.

Another thing that can harm your credit record is applying for credit a lot, or being ordered to pay someone money as the result of legal action. Ironically, never applying for credit can also damage your rating . Find out more about what can harm your credit score.

Your credit history is one of the key factors that lenders use to assess whether or not theyll give you a mortgage, and how generous that mortgage deal may be. The good news is that lenders do offer mortgages for first-time buyers and homeowners with bad credit, and the process for getting one is similar to a regular mortgage application.

How Much Can I Borrow With A Bad Credit Mortgage

As with standard mortgages, the amount you can borrow on a bad credit mortgage will depend on your income, for example your salary, and how much of that goes towards paying for essentials such as utility bills and food, as well as any other debt repayments.

Find out how lenders decide how much you can borrow with our quick guide.

You May Like: How To Self Report Utilities To Credit Bureaus