Tips To Increase Your Credit Score

Now that you understand the importance of credit scores in purchasing a home, its time to improve them. So, what are the best ways to go about getting your credit score to increase quickly? Here are some sound tips for upping your credit score:

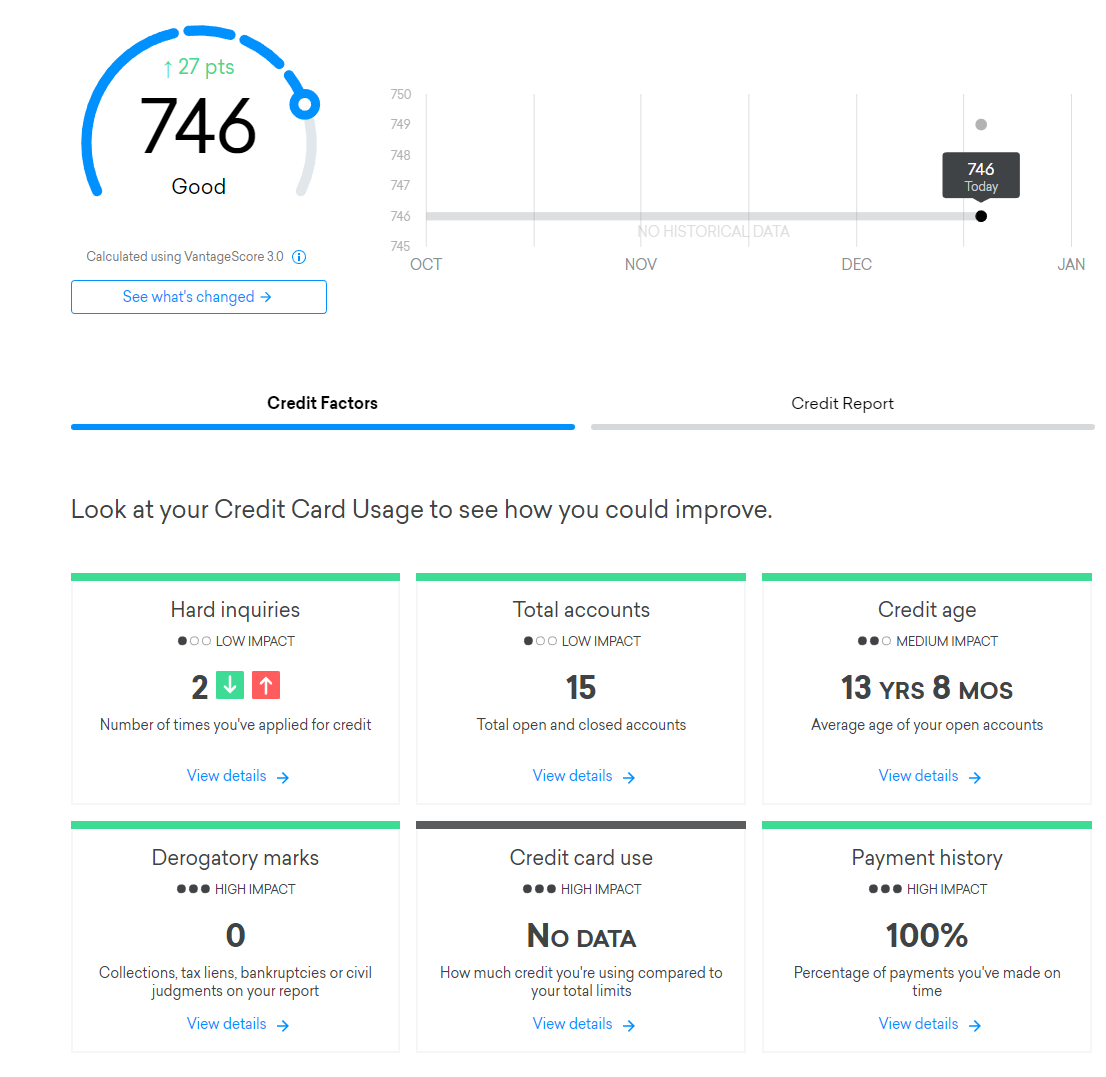

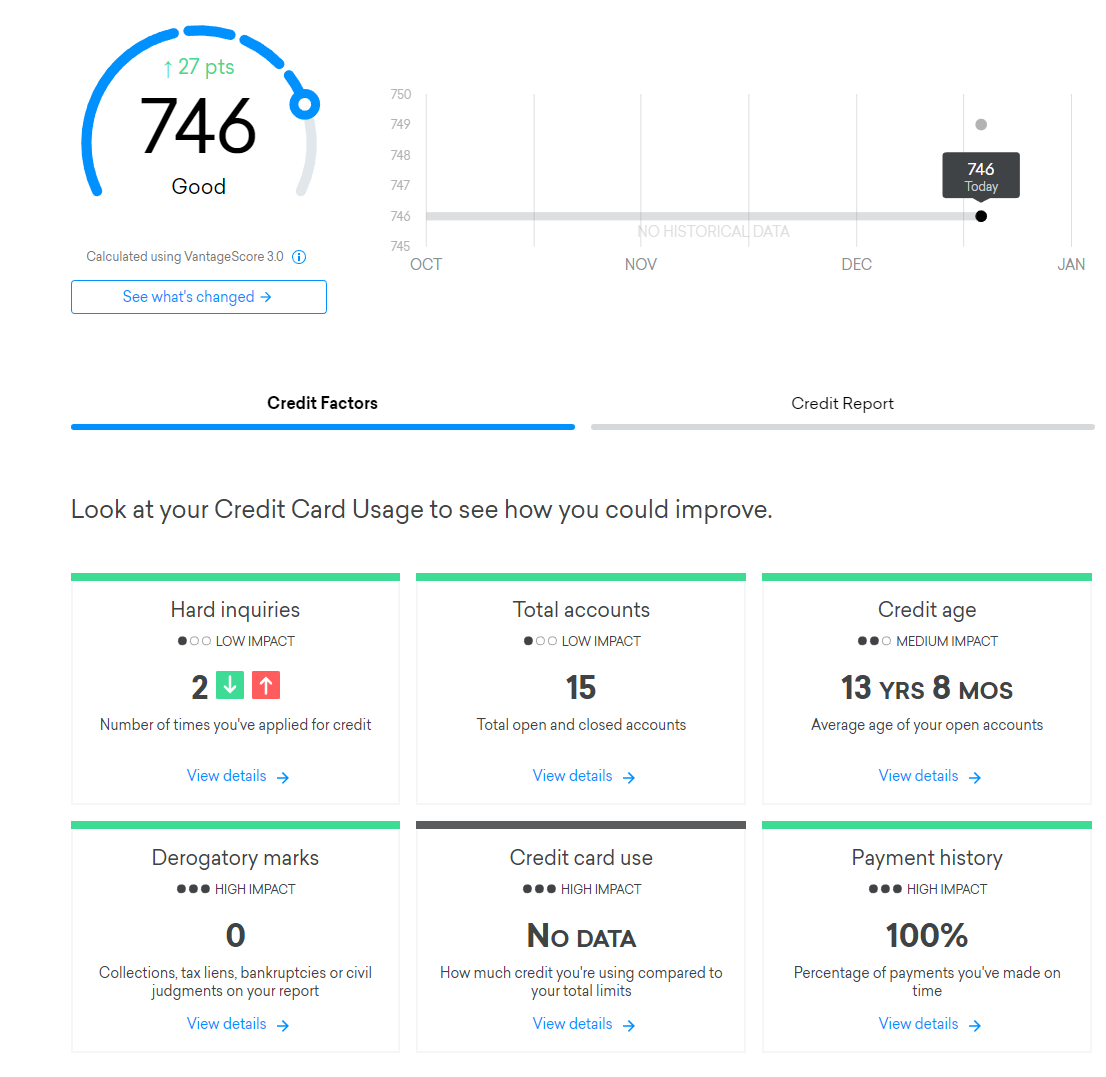

It would help if you strived to get your credit score above 740, especially when buying a home will be in your financial future. A credit score above 740 is considered very good. Lenders see borrowers above this amount as being dependable. Get your score above 800, and you will be regarded as one of the cremes of the crop. You will be considered a minimal risk to mortgage lenders.

Will Credit Karma Work If I Have No Credit

4.5/5Youâvegethave no credit

Hereof, can I use credit karma if I have no credit?

Youâve just signed up for to get your free scores, but thereâs one problem: You have no credit scores. Because your scores are based on information in your reports, your reports might not contain enough history for the bureaus to score.

Similarly, can you get a mortgage with no credit history? Borrowers without a strong often use FHA mortgages, backed by the Federal Housing Administration. FHA loans allow lenders to use nontraditional histories to qualify borrowers. Successful applicants must be able to show at least one year of: No delinquency on rental payments.

Similarly, it is asked, what is your credit score if you have no credit?

No credit, on the other hand, means you havenât had any recent activity that the bureaus can use to generate a . No one actually has a of zero, even if they have a troubled history with . The FICO scoring model, for instance, ranges between 300 and 850.

Why do I not have a credit score?

In a nutshell: If you donât have a credit score, itâs usually for one of two reasons: 1) you donât have a credit history or 2) your history is too old. reference agencies donât usually disclose under 18âs reports, either. accounts include current accounts, cards and loans.

So read on and find out the best credit cards to get if you donât have any credit.

Donât Miss: How To Fix A Repo On Your Credit

Why Is My Credit Karma Score Different From Experian

Credit Karma generates a Vantage Score while Experian issues the FICO score.

The most influential elements in the calculation of a Vantage score are the persons payment history and the age and type of Credit. Other elements are the amount consumed from the credit limit, the current debt, recent credit inquiries and available Credit.

Vantage Score is different from the FICO score, which requires a calculation based on more than one account and six months. Vantage Score is updated weekly and can use data from one month. The Credit Karma website issues Credit reports belonging to TransUnion and Equifax bureaus. Credit Karma, however, doesnt issue the FICO score. Credit Karma also does not give Experian Credit reports.

- New credit: 10%

You May Like: Is Credit Wise Score Accurate

Which Credit Score Is More Important

No one credit score holds more weight than the others. Different lenders use different credit scores. Regardless of the score used, making on-time payments, limiting new credit applications, maintaining a mix of credit cards and loans, and minimizing debt can help keep your credit in good shape.

Ready to help your credit go the distance? Log in or create an account to get started.

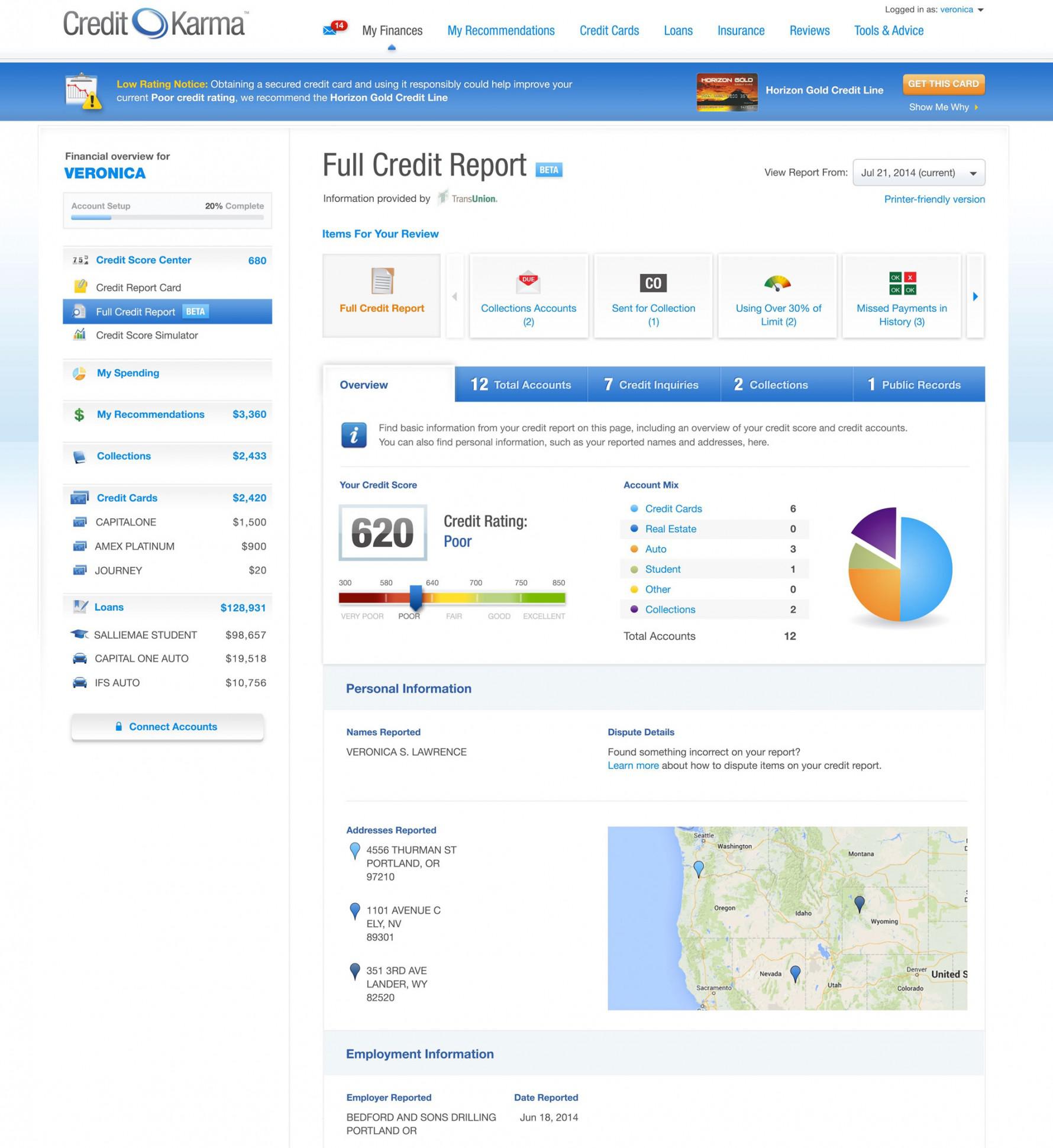

An Easy Way To Get Your Credit Report

The three major credit reporting bureaus, TransUnion, Equifax, and Experian, are required to give you a free credit report once a year by federal law. You have to apply for your reports through AnnualCreditReport.com.

While these reports are handy to see what lenders have reported to the credit reporting agencies and find inaccuracies to correct and improve your credit they do not include your actual credit score.

Since you need to know your credit score to get an idea of where you stand when applying for credit, the reports lack of a credit score is problematic. The reporting agency provided a less than an adequate solution offering to sell you your score for a steep price.

In 2007, Credit Karma came on the scene with a better option. They partnered with Equifax and TransUnion to give members ongoing access to their credit reports and credit scores.

Instead of having to wait once a year to check your reports or being price gouged to get your actual credit score, you could sign up for Credit Karma and get what you needed. This is how Credit Karma works and one of its best features.

So, to be crystal clear the company offers a free service where youll have access to your credit profile.

You May Like: Does Wells Fargo Business Credit Card Report To Bureaus

What Is A Good Credit Score And Why Does It Matter

So, whats a good credit score? Though it varies across credit scoring models, a score of 670 or higher is generally considered good. For FICO, a good score ranges from 670 to 739. VantageScore deems a score of 661 to 780 to be good.

A credit score that falls in the good to excellent range can be a game-changer. While financial institutions look at a variety of factors when considering a loan or credit application, higher credit scores generally correlate with a higher likelihood of getting approved.

A good credit score can also unlock the door to lower interest rates and more-competitive terms. And if you have excellent credit scores, you have an even better chance of being offered the best rates and terms available.

On the other hand, if you have poor or bad credit scores, you may be able to get approved by some lenders, but your rates will likely be much higher than if you had good credit. You may also be required to make a down payment on a loan or get a cosigner.

Heres The Backstory On The Score

To understand the intricacies of the differing results, you must understand how the scores are calculated. Throughout the U.S, there are several types of credit scores, but most people will be familiar with the FICO Score.

FICO is used by 90% of banking institutions and has been incorporated into the lending business since 1986. While FICO Scores range between 300 to 850, a good score is between 670 and 739. This will get you better mortgage rates and lower interest.

Its undoubtedly a veteran in the field, but a new system arrived on the market in 2006: VantageScore, created by Equifax, Experian, and TransUnion.

Recommended Reading: How To Get A Repossession Removed From Your Credit Report

What Credit Scores Do I Need To Get Approved For A Credit Card

Theres no universal minimum credit score needed to get approved for a credit card. Credit card issuers have different score requirements for their credit cards, and they often consider factors beyond your credit scores when deciding to approve you for a card.

In general, if you have higher scores, youre more likely to qualify for most credit cards. But if your credit is fair or poor, your options will be more limited and you may receive a lower credit limit and higher interest rate.

What Is Experian Boost

If youve been regularly checking your Experian credit score, you may have come across Experian Boost.

Experian Boost isnt a model used to calculate a credit score. Rather, its an offering that goes beyond the traditional credit score factors to incorporate your payment history from common bills for things like cell phone service, popular streaming services and other utility bills.

Keep in mind that not everyone sees a credit score increase with Experian Boost, and a lender may use a different credit score that isnt affected by Experian Boost when deciding whether to approve you for a loan.

You May Like: How To Check Hard Inquiries Credit Karma

Does Credit Karma Offer Free Fico Credit Scores

The VantageScore and FICO modelsdiffer in several ways, but that doesnt mean one is better or more accurate than the other. Lenders may rely on different scoring models when evaluating an application, and other considerations can factor in, too.

We recommend looking at your credit scores as a guide to your credit health rather than as a definitive number that determines whether youll be approved or denied for credit.

Most Important: Payment History

Your payment history is one of the most important credit scoring factors and can have the biggest impact on your scores.

Having a long history of on-time payments is best for your credit scores, while missing a payment could hurt them. The effects of missing payments can also increase the longer a bill goes unpaid. So a 30-day late payment might have a lesser effect than a 60- or 90-day late payment.

How much a late payment affects your credit can also vary depending on how much you owe. Dont worry, though: If you start making on-time payments and actively reduce the amount owed, then the impact on your scores can diminish over time.

If youre having trouble making payments at all, you could also wind up with a public record, such as a foreclosure or tax lien, that ends up on your credit reports and can hurt your scores. Sometimes a single derogatory mark on your credit, such as a bankruptcy, could have a major impact.

Don’t Miss: How To Get Rid Of Repossession On Credit Report

Does Credit Karma Offer Free Fico Scores

You may have read reviews that say the credit scores you see on Credit Karma are useless because theyre not FICO® scores. Though Credit Karma does not currently offer FICO® scores, the scores you see on Credit Karma provide valuable insight into your financial health.

Its important to keep in mind that no one credit score is the end-all, be-all. There are dozens of different FICO® scoring models alone. Even if youre confident in a specific FICO® score, it may not necessarily match the scores a lender pulls when you apply for a loan.

At Credit Karma, we believe that because you can have so many different scores, the exact number you get at a given time isnt of foremost importance. Whats more important are the changes you observe over time in a single score, and where that number puts you in relation to other consumers.

Why Credit Scores Can Vary

- Information may be incorrect on a credit report. If information is wrong on your credit report, it will affect your score. Fortunately, you can dispute inaccurate information using the . Getting incorrect information fixed on any credit report is vital, especially if you purchase a home shortly. You can learn how to dispute errors in a credit report in this helpful article from Norton.

- Some lenders do not report to all three major credit report companies. If a lender does not report to a credit report company, that companys score for you will be different from the score you have at a credit report company with that lenders info.

- Scoring models differ among credit reporting companies. Each credit reporting company has its own scoring model the model they use to weigh the importance of different aspects of your credit. Since they use different models, they can come up with different scores using the same information. You will notice that all credit agencies have slightly different scores.

So, hopefully, you now have a better understanding of Credit Karma accuracy.

Recommended Reading: What Credit Score Does Navy Federal Use For Auto Loans

Is My Actual Credit Score Higher Than Credit Karma

You can find your Equifax and TransUnion VantageScore 3.0 credit scores on Credit Karma.

You have many different credit scores, so some of your credit scores might be higher than the TransUnion and Equifax scores you see on Credit Karma, while others might be lower.

But as long as youre looking at the same version of the same score, the TransUnion and Equifax credit scores you see on Credit Karma should be the same as the Equifax and TransUnion credit scores you find on other websites.

Why Is Credit Karma Free

One minor complaint from some users is that the dashboard has many ads and offers from third parties maybe too many for some.

Of course, these ads and offers are how they make money and can provide members with a free credit score. However, you shouldnt take out a credit card or loan that you dont need just because they offer you what seems like a good deal.

Because Credit Karma has access to so much of your personal and financial information, they can make highly targeted individualized offers to each member.

Be sure to use your judgment wisely before committing to any product Credit Karma offers you. But hopefully, if youre using Credit Karma, youre already determined to use your credit responsibly so you can achieve all of your financial goals.

Don’t Miss: Usaa Credit Check And Id Monitor

You Dont See Your Fico Score

The credit scores you see in the platform are your TransUnion VantageScore and your Equifax VantageScore.

Some lenders will use FICO scores and that means the score you see elsewhere may be somewhat different than the score you see in your Credit Karma account.

Generally, thats not a problem unless you are trying to get a mortgage. In that case, lenders almost always use FICO scores.

Thats why it is important to look at your FICO score and check your Experian credit score as well as the credit scores shown in Credit Karma.

Why Are My 3 Credit Scores Different

Your score differs based on the information provided to each bureau, explained more next. Information provided to the credit bureaus: The credit bureaus may not receive all of the same information about your credit accounts. Surprisingly, lenders aren’t required to report to all or any of the three bureaus.

Read Also: What Does Serious Delinquency Mean On Credit Report

A Different Scoring Model

There are several credit scoring models, and good examples are Vantage 3.0 and FICO. Credit Karma usually uses the Vantage 3.0 credit scoring model, although almost 90% of home mortgage lenders prefer using the FICO model.

Knowing the scoring model your lender will use to gauge your creditworthiness is usually crucial. FICO and Vantage 3.0 scoring models have different algorithms and score ranges.

Even a few points can impact your creditworthiness. Therefore, you should ensure you view the same score as your creditor. Since most lenders use the FICO score model, possibilities are your Credit Karma score may vary with the lenders if theyre using the FICO score.

But overall, Credit Karma scores are correct metrics you can use to keep a close eye on your credit history. In order to be safe, its always best to request for credit score from both FICO and Credit Karma, as you may never know which model the lender will use.

Here Is Why Your Credit Karma Score Can Be Misleading

A lot of customers do not realize two important things:

1-Each of us has many credit scores, not just one.

2-Different data can be used to calculate scores from different bureaus.

Both of these factors can lead to variations.

Although many credit scores exist, the most important ones are FICO and VantageScore.

Credit Karma itself has attempted to explain the differences between FICO and VantageScore credit scores here.

On that page, Credit Karma says, The model used for credit scores on Credit Karma is VantageScore® 3.0, adding, While VantageScore® credit scores arent used as widely as FICO® scores for credit decisions, they can still give you a good idea of where your credit stands.

Indeed, when you apply for a mortgage, it is your FICO score, not your VantageScore, that lenders will look at to make their decisions.

Another factor that is helpful to know about is the difference between how credit unions and banks handle credit scores versus how mortgage brokers do.

If you try to apply for a home loan through a bank or credit union, they will often require that your score be 660 or above.

But if you apply through a mortgage broker, you may have an easier time qualifying, since many lenders are willing to offer customers loans who have credit scores below 660.

Read Also: Does Kornerstone Credit Report To The Credit Bureaus

Is It Safe To Check My Credit Score For Free

Checking your free credit scores on Credit Karma wont affect your credit, and any attempts to monitor your credit with Credit Karma will not appear on your credit reports.

If you want to learn more about how Credit Karma collects and uses your data, take a look at our privacy policy.

You can also read Credit Karmas security practices to learn more about Credit Karmas commitment to securing your data and personal information as if it were our own.

Ready to help your credit go the distance? Log in or create an account to get started.

Alternatives To Credit Karma To Check And Monitor Your Credit Score

You can check your credit score in a variety of ways. For example, your credit union, bank or credit card issuer might offer a free credit score. Other third-party sites besides Credit Karma also provide credit scores.

Credit bureaus also offer credit scores, but there may be a fee. You can pay to get your VantageScore from Equifax or TransUnion. MyFICO.com offers FICO Scores for a fee. Experian provides your FICO Score 8, the score the majority of lenders use, for free.

Monitoring your credit can alert you of suspicious activity and show you how your use of credit affects your score. TransUnion and Equifax offer paid credit monitoring services. Experian Creditworks is free and gives you monthly access to your Experian credit report and FICO Score. Theres also a paid version that includes access to FICO Scores and credit reports from all three credit bureaus monthly, and to Experian credit reports and FICO Scores daily.

Recommended Reading: Does Aarons Report To Credit Bureaus