Can I Get A Free Credit Score Too

Unfortunately, the law does not mandate that credit reporting agencies give you a free credit score with your free credit reports. However, Lexington Law Firm offers a free FICO credit score as well as a free credit repair consultation. You can get that by visiting their site or calling .

There are also several credit card companies that offer a free credit report.

You can often order your credit score alongside your free credit report for an additional fee as well from the credit reporting agencies. However, these scores are considered FAKOs as they are not real FICO credit scores .

While the VantageScore is used by some businesses and institutions, the vast majority still rely on FICO scores to make credit decisions. So before you pay for any credit score, make sure that its one that will be useful to you.

If you want to monitor your credit reports and credit scores monthly, you might want to consider a credit monitoring service.

How To Find Out Your Credit Score In Canada

As was previously mentioned, you can pay Equifax or TransUnion to get your credit score . However, if you don’t want to pay and you only want a rough idea of what your credit score might be, you can try out this to get a free credit score. This calculator also comments on your credit score and tells you how good it is. You can then play with the calculator to come up with some ideas of how you may be able to improve your score, or you can learn more by .

Generate Your Credit Report Online

You can save reports to your desktop or print them out so youll have access later.

If you need to request a report or reports by mail, send a request form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

Your report or reports should be sent within 15 business days.

You can also get your credit reports by calling 877-322-8228. Visually impaired consumers can also call this number to request audio, large-print or Braille reports.

Don’t Miss: Can Landlord Report To Credit Bureau

Get Your Credit Score

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

How Can You Get A Free Annual Credit Report

You have three options for requesting your free annual credit report:

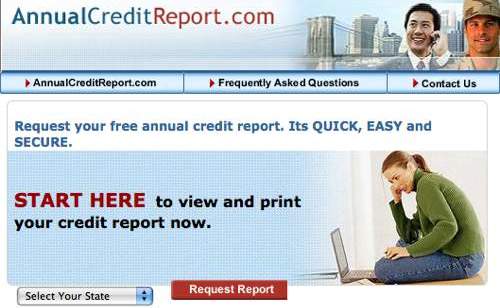

- Online: You can request a copy directly from AnnualCreditReport.com

- Phone: Call 322-8228

- Mail: Download and mail the complete the Annual Credit Report Request form to: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281

Read Also: Does Paypal Bill Me Later Report To Credit Bureau

How Many Free Credit Reports Can You Get Per Year

The number of credit reports you can get for free depends on where you get them from and whether youve placed a fraud alert on your credit reports.

For example, the Fair Credit Reporting Act entitles you to receive one free credit report from each major credit bureau a year. In most cases, this means you can view all your credit reports for free once per year through AnnualCreditReport.com. However, due to Covid, you can receive free weekly credit reports from all three credit bureaus through AnnualCreditReport.com until April 20, 2022.

In addition, some credit reporting companies and personal finance websites allow you to check one or more of your reports for free. For example, if you sign up for myEquifax, you can get six free Equifax credit reports per year through 2026. Experian also allows you to view your Experian credit report for free 12 times a year.

You can also get an additional free copy of your report from each credit bureau if you suspect fraud and place a fraud alert on your credit reports. To do this, you must contact one of the credit bureaus.

If youve been a victim of identity theft and filed a report, you can get an additional six free credit reports per year, two from each credit bureau.

Understanding Your Credit Report And Correcting Mistakes

Once you receive a copy of your credit report, it will contain explanations to help you understand the details of your credit report. It should also let you know how to correct mistakes or dispute information that you think is incorrect. The Government of Canada has also published a guide called Understanding Your Credit Report and Credit Score to help Canadians understand how the credit reporting system works in Canada. It contains all sorts of helpful info including how long information stays on your credit report.

Recommended Reading: How Long Before Repossession Is Off Credit

How Often Should You Check Your Credit Report

Experts recommend that you check your credit report at least once a year. Taking a full deep dive with a credit report to ensure no inaccuracies, make sure you know where you stand and use a monitoring service that keeps you informed. We can help you stay informed with a credit monitoring service. Sign up for Chase Credit Journey to help monitor your credit.

If you’re planning to make a major purchase soon, or even in the somewhat distant future, you should regularly check up on your credit report. You want to make sure your report is as accurate as possible to get the best interest rates.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

What Should You Look For On Your Credit Report

When you receive your reports, check each section carefully and determine whether you believe the information is correct. Your report could alert you to fraudulent activity being carried on in your name by an ID thief or other inaccurate information that could affect your ability to obtain a loan. Your credit reports may include:

- A list of businesses that have given you credit or loans

- The total amount for each loan or credit limit for each credit card

- How often you paid your credit or loans on time, and the amount you paid

- Any missed or late payments as well as bad debts.

Your credit reports may also include:

- A list of businesses that have obtained your credit report within a certain time period

- Your current and former names, address and/or employers

- Any bankruptcies or other public record information.

Be sure to review that all of the above that appear on your credit reports are accurate, and check the accuracy of:

- Your personal information: are there addresses or variations on your name that are wrong?

- Potentially negative entries: are there unpaid debts listed on accounts you never opened?

- Public record information: is this information accurate?

You May Like: Speedy Cash Collection Agency

Why You Could Have Different Credit Reports From Different Bureaus

The credit bureaus can only report on the information thats provided to them. Since lenders are not required to report to all three major credit bureaus, you might find information about certain accounts on one credit report, but not others.

Even when lenders do report information to all three major bureaus, they may report that information at different times. Given all the credit information included in a typical credit report, its perfectly normal to observe some minor differences between your credit reports.

Mistakes do happen from time to time. If you think your credit reports are different due to legitimate errors, you can dispute those errors with each credit bureau.

Identifying Credit Report Errors

Flubs occur because of human error or incomplete information being provided to a credit bureau. Errors can include:

- Reports of something you didn’t buy or a purchase you didnt authorize

- Reports of amounts differing from what you actually paid

- Inaccurate purchase dates

- Missing payments or credits to your account

- Accounts mistakenly attributed to you

- Reports of applications you didn’t fill out

The other credit report error is fraud, in which someone intentionally and illegally tries to mess with your financial statusfor example, by opening an account in your name.

In either situation, the best way to correct an issue is to find the source of the error. Of course, you wont know there is an error unless you check your report regularly. So, request a copy of your report and carefully review all the information it contains. Look for any entries that are mistakenly attributed to you because of confused names, addresses or Social Security information. Check for mixed account information that could be due to identity theft, incorrect payment status, an ex-spouses information mixed with yours, outdated information or remedied delinquencies not being reported.

Once you’ve discovered a possible problem, make sure to gather proof supporting your position that there is an error before you officially dispute it.

Read Also: Does Eviction Show On Credit Report

What Is The Fair Credit Reporting Act Or Fcra

The Fair Credit Reporting Act is an important law that gives you the right to know the information that the credit bureaus keep on you and how that information informs your credit scores.

This law includes a number of consumer rights and protections. For example, under the FCRA you have the right to dispute incomplete or inaccurate information on your credit reports. In most cases, the credit bureau must investigate your case and correct or remove any inaccuracies within 30 days.

Why Is It Important To Check My Credit Report

Its important to check your credit report because credit reporting mistakes happen. They can be the result of a creditor reporting inaccurate information or a sign of identity theft. If the error lowers your , it can decrease your approval odds when applying for a loan and it could prevent you from securing the best rate.

Also Check: Does Student Loans Fall Off Your Credit

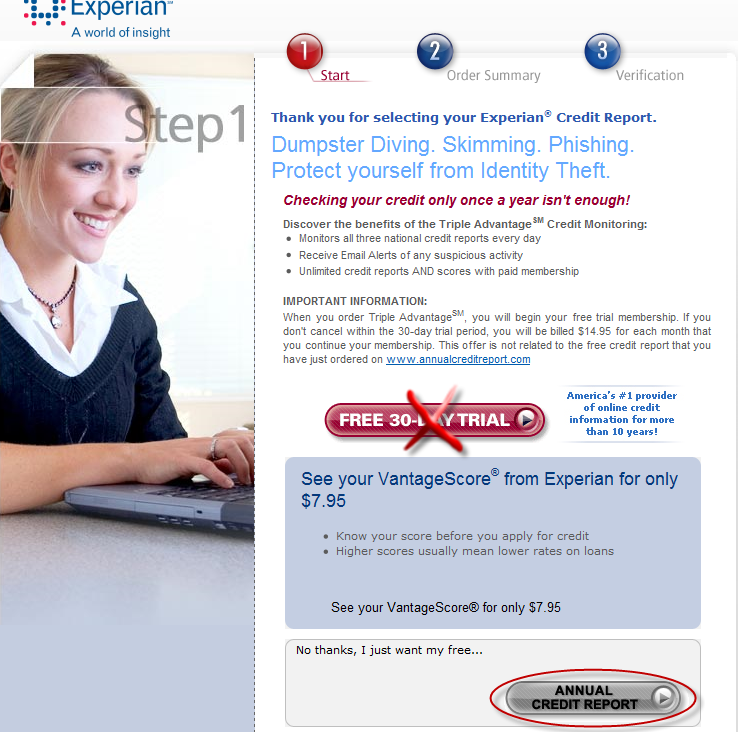

*warnings When Ordering Online:

Misspelling the annualcreditreport.com site or using another site with similar words will take you to a site that will try to sell you something or collect your personal information. Even one mistyped letter could take you to a fraudulent website that looks and feels like a place to order credit reports but in fact has been set up by ID thieves to steal your information. Other sites with similar names exist and may try to sell you credit monitoring services.

Remember, only one website is authorized to fill orders for the free annual credit report you are entitled to under lawannualcreditreport.com. Other websites that claim to offer free credit report,, free credit scores, or free credit monitoring are not part of the legally mandated free annual credit report program.

Beware of emails, banner ads, pop-up ads, and telemarketing calls that promise to obtain your free annual credit report on your behalf. In particular, beware of email messages or internet ads claiming to be from annualcreditreport.com.

Also beware of any free offers for your credit score. One wrong click on an enticing ad for a free look at your credit score may have you signed up for costly or unnecessary credit monitoring or sharing your personal information with a thief.

Annualcreditreport.com will not send you an email asking for your personal information do not reply or click on any link in the message. Its likely a scam, leading to potential ID theft. Forward scam emails to the FTC .

Repeat The Process At Regular Intervals

Once you know how to request and read your credit report, it’s crucial to repeat the above steps at regular intervals in order to continuously monitor the state of your credit. In addition to giving you a means of tracking how your credit is growing, this practice will also enable you to better keep an eye out for potential problems or mistakes. As previously mentioned, this can easily be achieved by spacing out your free annual credit report from each of the three major credit reporting companies throughout the year.

Also Check: Usaa Free Credit Report

How To Check Your Credit Score In Canada

With Borrowell, you can get your credit score in Canada for free! Signing up takes less than 3 minutes, and no credit card is required. Once you’ve signed up for Borrowell, you can download your Equifax credit report for free AND check your credit score at any time without hurting it. Plus, you’ll receive weekly updates on how your score has changed. Stay on top of your credit health with Borrowell.

How Do I Get A Copy Of My Credit Reports

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies . You can request a copy from AnnualCreditReport.com.

You can request and review your free report through one of the following ways:

- Mail: Download and complete the Annual Credit Report Request form. Mail the completed form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

You can request all three reports at once or you can order one report at a time. By requesting the reports separately you can monitor your credit report throughout the year. Once youve received your annual free credit report, you can still request additional reports. By law, a credit reporting company can charge no more than $13.00 for a credit report.

You are also eligible for reports fromspecialty consumer reporting companies. We put together a list of several of these companies so you can see which ones might be important to you. You have to request the reports individually from each of these companies. Many of the companies in this list will provide a report for free every 12 months. Other companies may charge you a fee for your report.

You can get additional free reports if any of the following apply to you:

You May Like: Credit Score For Paypal Credit

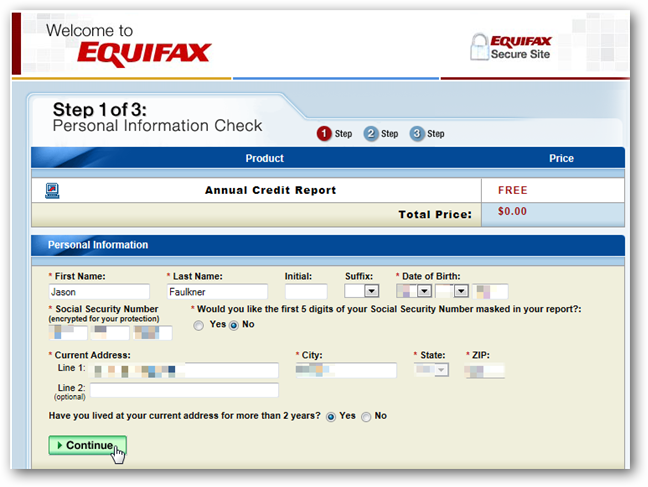

Submit Your Request In Person:

Equifax has four office locations where you can request a free copy of your Equifax credit report in-person and receive a printed copy of your credit report after your identity is confirmed. Copies of the request form you will need to complete are available onsite.

You need to bring with you at least two forms of identification, including 1 photo identification and proof of current address. Also, you must provide the original copies of your chosen identification – photocopies and electronic versions are not accepted at the office. Examples of acceptable documentation include:

- Driver’s License

- Utility Bills

Acceptable Supporting IDs:

- Birth Certificate Issued in Canada

- T4 slip

- Citizenship and Immigration Canada Document IMM1000 or IMM1442

- Social Insurance Number Card issued by Canadian Government

- Certificate of Naturalization

Providing your Social Insurance Number is optional. If you provide your S.I.N., we will cross-reference it with our records to help ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

Why Get Your Free Experian Credit Report

Gain credit insights

View the same type of information that lenders see when requesting your credit. See whoâs accessing your data and get tips on how to improve your financial health.

View your score factors

Your credit score is calculated from the information found in your credit report. See the positive and negative factors that impact your FICO® Score.

Raise your credit scores instantly

Get credit for your phone and utility bills by adding positive payments to your Experian credit file.

Average users who received a boost improved their FICO® Score 8 based on Experian Data by 12 points. Some may not see improved scores or approval odds. Not all lenders use credit information impacted by Experian BoostTM.

Also Check: Is 575 A Good Credit Score

Why Are Your Credit Score And Report So Important

Your credit report is like your financial report card, and your credit score is like your final grade. In Canada, banks and lenders review your credit when you apply for financial products. Your credit report can also be pulled by car dealerships, insurers, cell phone companies, landlords, and future employers to determine your ability to manage debt and meet financial obligations. Because of this, it’s important to know your credit.

Is Your Personal Information Correct

If there are errors here, you can change and update your information. One big error that can cause issues are aliases that you dont use. Aliases are variations of your name that you may have used to open an account. For example, you may have used your middle initial to open an account, which would generate an alias if you dont typically do that.

The issue is with aliases that youve never used. This could mean that youve been confused with another consumer and could have collection accounts that are not yours.

Also Check: Affirm Credit Score Needed