Where To Go From Here

Its important to pay down your balances and keep your credit utilization under 30%. Its also wise to have several different types of credit accounts that include a mix of installment and revolving credit.

Of course, you also want to focus on making timely payments from here on out. Even one late payment can be very damaging to your credit.

Length of credit history also plays an essential role in your credit scores. You want to show potential creditors that you have a long, positive payment history.

Building excellent credit doesnt happen overnight, but you can definitely speed up the process by making the right moves.

Give Lexington Law a call for a free credit consultation at and get started repairing your credit today! The sooner you start, the sooner youll be on your way to having excellent credit.

Categories

Fair Vs Good Credit Score

You want to get the highest credit ratings possible, so you can save money when you need a loan or credit. If you have a Fair credit score, lenders will consider you subprime. This means you will likely receive less favorable terms than someone with a higher credit score. This can result in higher interest rates or possibly a rejected application.

Is A 678 Credit Score Good

A 678 FICO®Score is Good, but by earning a score in the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to check your credit score to find out the specific factors that impact your score the most and get your free credit report from Experian.

Read Also: Aargon Com

What Is A Good Credit Score

What is considered a good credit score? :59

Reading time: 3 minutes

-

Theres no magic number to reach when it comes to receiving better loan rates and terms

Its an age-old question we get, and to answer it requires that we start with the basics: What is a, anyway?

A credit score is a number, generally between 300 and 900, that helps determine your creditworthiness. Credit scores are calculated using information in your , including your payment history the amount of debt you have and the length of your credit history.

Its also important to remember that everyones financial and credit situation is different, and theres no magic number to reach when it comes to receiving better loan rates and terms.

There are many different credit score models used today by lenders and other organizations. These scores all have the same goal: to predict a consumers likelihood to pay their bills. There are some differences around how the various data elements on a credit report factor into the score calculations.

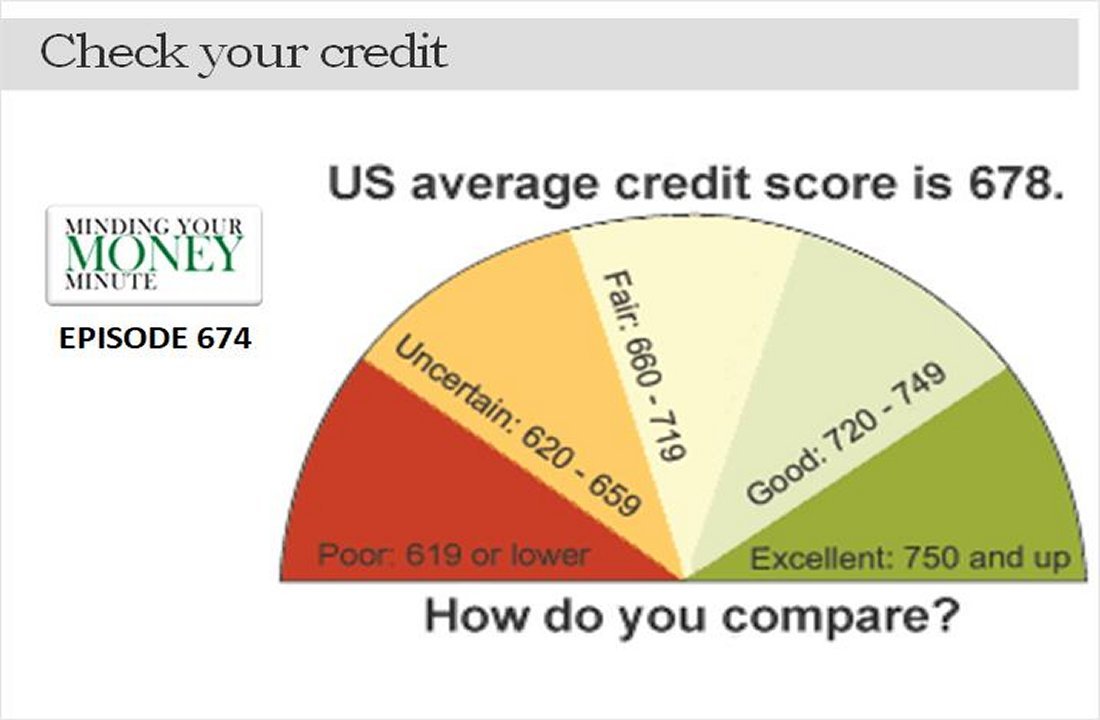

Although credit scoring models vary, generally, credit scores from 660 to 724 are considered good 725 to 759 are considered very good and 760 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behaviour in the past, which may make potential lenders and creditors more confident about your ability to repay a debt when evaluating your request for credit.

How Do Your Actions Impact Credit Scores?

Length Of Credit History

Lenders like to see that you can manage credit positively over a long period of time. This is generally measured by how long your current credit accounts have remained open.

Theres no shortcut to increasing the length of your credit history. But in the long run, keeping your old credit card accounts open, even after you get a new credit card, can help your credit age like a fine wine. At the very least, try to avoid closing your oldest credit account.

As someone with fair credit, you may be in the market for your first credit card. If thats the case, it pays to think ahead. Consider shopping around for a credit card that has no annual fee, so theres no pressure to close it if and when you graduate to a better card. You can compare offers for cards with no annual fee on Credit Karma to explore your options. Many of the cards available to people with fair credit tend to charge annual fees, but you might be able to find one that doesnt.

Don’t Miss: Letter To Remove Repossession From Credit Report

Can You Get A Personal Loan With A Credit Score Of 574

Very few lenders will approve you for a personal loan with a 574 credit score. However, there are some that work with bad credit borrowers. But, personal loans from these lenders come with high interest rates.

Its best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score.

To build credit, applying for a may be a good option. Instead of giving you the cash, the money is simply placed in a savings account. Once you pay off the loan, you get access to the money plus any interest accrued.

See also:8 Best Personal Loans for Bad Credit

Your Credit Report Contains The Following Information

Personal Information

- Identity verification

Each of your credit accounts will be given a rating that includes a letter and a number.

Letters

| Installment | Accounts that receive an I are installment style accounts that are paid off in predetermined fixed amounts. For example, a car loan. | |

| Open | Accounts that receive an O are open, which means they can be used up to a preset limit. An example of an open credit account is a line of credit. | |

| Revolving | Accounts that receive an R are considered revolving credit because your payments change based on how much of your limit you borrow. A credit card would receive an R. | |

| Mortgage | Depending on the credit bureau you pull your report from, your mortgage may or may not show up. If it does, it will be represented by an M. |

Numbers

| Account is in collections or bankruptcy |

Did you know that bad credit can affect your daily life? Learn more here.

Read Also: Paypal Credit Report

Mortgage Rates For Good Credit

Your credit scores are just one factor to consider when youre looking to get a great mortgage rate. Having good credit can help you get a better rate, but so can factors such as

- The type of mortgage loan youre looking for

- The total cost of your home

- Your debt-to-income ratio

- The size of your down payment

The average credit score it takes to buy a house can also vary greatly by location.

Once you have a general picture of your overall credit as well as how much house you can afford and the type of loan you want its a good idea to shop around. This can give you a better idea of what different lenders could offer you.

Compare your current mortgage rates on Credit Karma to learn more.

Shopping For Credit Cards With A 874 Credit Score

When shopping for credit cards, make sure you explore all of your options. In other words, dont just sit down with one potential creditor and decide to accept their deal or not. Sit down with multiple potential creditors and compare and contrast them to find out what works best for you.

If you already have a credit card, but have been shopping for one that is cheaper, you can then go to your existing creditor and request them to either match or beat an offer from another credit card company. Tell them that you believe you are paying too much money in fees and interest, and ask them if they are willing to lower their rates and fees down to the other credit card company that you are thinking about switching to.

If they refuse, then you can switch accounts, but dont close your existing account immediately. You still want to make the minimum payment on. it while you are waiting for your balance to transfer to your new account. You only want to close a credit account when your balance is at zero.

Recommended Reading: When Do Credit Companies Report

Is 666 A Good Credit Score

The average FICO Score is 704, which is somewhat higher than your 666, showing that you have many opportunities for improvement. However, your 666 credit score is almost inside the range of 670-739, which is considered Good. You may be able to get your score up easily just by continuing to pay your bills on time, keeping your credit utilization below 30% across all of your accounts, and establishing a solid credit mix of revolving credit and installment debt.

Regularly Read Your Reports

Since your credit score is based off of the information in your credit report, take time to review your reports regularly. You want to be sure everything is an accurate, true reflection of your financial story. As you become more comfortable reading and understanding the data in your report, the easier it is to identify which information is potentially causing changes in your credit score.

To help you understand your credit report, weve created an interactive guide that breaks down each section and explains how the information may impact your credit score.

Disclaimer: The information posted to this blog was accurate at the time it was initially published. We do not guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit transunion.com. This site is governed by the TransUnion Interactive privacy policy located here.

Read Also: When Does Wells Fargo Report To Credit Bureaus

Is 672 A Good Credit Score

With a 672 credit score, getting a mortgage, vehicle loan, or personal loan is fairly simple. Lenders prefer to work with clients who have Good credit, because it is less risky.

672 is a median score and median scores are classified as Good, so lenders dont consider you a high risk for loans and you shouldnt experience too much trouble qualifying for one. Since a 672 FICO Score is towards the bottom of the Good level, youll want to keep an eye on it to avoid falling into the more restrictive Fair credit score range .

Why Does Your Credit Score Matter When Youre Looking To Take A Loan

Your credit score showcases your creditworthiness and allows your lender to judge your application as a potential borrower. It is a summation of your credit history and how responsibly you have dealt with credit in the past. Your credit score reflects your credibility since it considers things like timely repayment of EMIs, your credit utilisation, your credit inquiries, and your existing debt. A good credit score shows your lender that you are financially stable and responsible with credit.

However, do keep in mind that your credit score is not the only criteria in the process of qualifying for a loan and getting approval on your application. Other factors such as your salary, city of residence, existing debt, employer, etc., also play a part.

While a good credit score is essential irrespective of the kind of financing you are looking to avail, here are the ideal scores that can help you get a better deal on your loan.

Don’t Miss: How To Get Credit Report Without Social Security Number

What Credit Score Is Needed To Buy A House In Az

You must have a credit score of at least 580 on the FICO® scale to get that 3.5% down payment, though. If your score falls anywhere between 500 and 580, you’ll need to make a down payment closer to 10%. Even with the credit score requirement, an FHA loan is one of the easiest federal programs to qualify for.

Getting A Credit Account With A 674 Credit Score

With a credit score of 674, youll have plenty of options when looking for a new credit card. However, you might not qualify for the top rates that card issuers reserve for people in higher credit score ranges.

The types of credit cards you can get with a credit score of 674 generally fall into two categories:

- Secured credit cards: These cards require a security deposit, which your lender will use as collateral. The amount you put down will usually be your credit limit. Secured cards are a low-risk option if you want to build credit while ensuring that you dont spend beyond your means.

- Unsecured credit cards: These cards dont require a deposit. Your card issuer will set your credit limit according to how creditworthy they perceive you to be. In many cases, these cards offer cash back on certain purchases and other rewards.

Which type of credit card is best ultimately depends on your financial situation and your reason for opening a new credit account. If youre good at controlling your spending, then its a good idea to use your good credit score to take advantage of the potential rewards and higher credit limit that come with an unsecured card.

On the other hand, if your main goal is to build credit and youre worried about overspending, then a secured credit card may be your best bet.

Takeaway: 674 is a good credit score, but its not in the top scoring range.

You May Like: Is Carmax Pre Approval A Hard Inquiry

What Credit Score Do You Start With

Credit scores start at 300 sometimes higher, depending on which scoring system is used. According to FICO, you must have at least one credit account that’s been open for at least six months, and one credit account that’s been reported to credit bureaus within the past six months to have a credit score.

What Ages Have The Most Perfect Credit Scores

Achieving a perfect credit score of 850 is a goal for many consumers. After all, it can help them attain better loans, and utility discounts. Roughly 58% of consumers with a perfect credit score of 850 are between the ages of 56 and 74. This score is two steps up from the average FICO® score of 703, which is ranked as good by Experian.

Between 56 and 74, consumers are more likely to have an increased income. This can help them pay off a significant amount of debt and contribute to an increase in their score. Conversely, they may have also already paid off most of their debt and have lowered their , which has a significant impact on credit scores next to payment history.

While achieving a score of 850 is ideal, it isnt needed to get better interest rates or offers. Getting a score of 760 or very good is enough to give you access to better interest rates or options.

Scroll for more

- 13%

Also Check: Syncb Ppc

What Credit Score Do I Need For A Car Loan

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

A better credit score can increase your chances of approval for loans and credit cards and can also get you better interest rates and other terms. With some types of loans, like mortgages and credit cards, you simply cannot get approved if your credit score is below a certain amount.

Auto loans are a different story. There isn’t a set FICO® Score floor for auto lending, and a good percentage of auto loans made in the U.S. are to borrowers with ultra-low credit scores.

With that in mind, here’s a rundown of how to check and interpret your own , what it means to you as a potential auto loan borrower, and a few money-saving tips that you should use in the auto-buying process, regardless of your credit score.

How To Improve A 574 Credit Score

A poor credit score often reflects a history of credit mistakes or errors. Late payments, charges offs, foreclosures, and even bankruptcies. Its also possible that you simply havent built credit at all. No credit is pretty much the same as bad credit.

Its a good idea to grab a copy of your free credit report from each of the three major credit bureaus, Equifax, Experian, and TransUnion to see what is being reported about you. If you find any negative items, you may want to hire a credit repair company such as Lexington Law. They can help you dispute them and possibly have them removed.

Lexington Law specializes in removing negative items from your credit report. They have over 18 years of experience and have removed over 7 million negative items for their clients in 2020 alone.

They can help you with the following items:

- hard inquiries

- bankruptcies

You May Like: Serious Delinquency Credit Report

How Good Is A Credit Rating Of 674

A 674 FICO® Score is Good, but by earning a score in the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to check your credit score to find out the specific factors that impact your score the most and get your free credit report from Experian.

Conventional Loan With 674 Credit Score

The minimum credit score requirement to get a conventional loan is 674. In order to qualify for a conventional loan, you will need to meet all other loan requirements. This includes having at least 2 years of steady employment, a down payment of at least 3-5%, and no recent major credit events .

Would you like to find out if you qualify for a conventional loan? We can help match you with a mortgage lender that offers conventional loans in your location.

Read Also: Is A 524 Credit Score Good