How Many Points Off Is Credit Karma

The only possible answer is, a few if any. Your credit score can vary every time it is calculated depending on whether the VantageScore or FICO model is used, or another scoring model, and even on which version of a model is used. The important thing is, the number should be in the same slice of the pie chart that ranks a consumer as bad,fair,good,very good, or exceptional.

Ways To Help Maintain And Improve Your Credit Scores

Remember: Itâs normal for your credit scores to fluctuate a little. And credit scores can change significantly over time. But you can maintain good credit scores and even improve your scores by regularly practicing responsible financial habits.

Here are some ways you can maintain and improve your credit scores:

Speaking of applying for credit: Want a better idea of whether you might be approved? Pre-approval or pre-qualification can help you find out whether you might be eligible for a credit card or a loan before you even apply.

With Capital Oneâs pre-approval tool, for example, you can find out whether youâre pre-approved for some of Capital Oneâs credit cards before you submit an application. Itâs quick and only requires some basic information. And checking to see whether youâre pre-approved wonât impact your credit scores, since it requires only a soft inquiry.

Why Can I See My Fico Score But Others On My Account Cant See Theirs

You can see your FICO® Score because you are the primary account holder of an eligible account.

Others may not be able to view their scores if:

- They recently opened a new account

- Theyre an authorized user on someone elses account

- They have a billing statement in someone elses name

- They do not have an eligible account in Wells Fargo Online®

Recommended Reading: Minimum Score For Care Credit

Get Your Credit Score Improved Professionally

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. Its so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If youre looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

Pay Down Your Credit Card Balances

Paying down credit card balances is an actionable way to potentially raise credit scores. FICO bases 30% of your score on factors pertaining to the amount of money you owe to creditors on your credit report. Your has a big influence over this credit score category.

When you lower your credit card balances, your scores are likely to benefit. But youll have to wait until the next time your card issuer updates your account with the credit bureaus to find out if your strategy worked. At the worst, paying down credit card debt can save money in interest fees. So, its a low-risk move, even if you dont see the improvement you hope for when you recalculate your credit scores.

Also Check: Unlocking Credit Freeze

How Can I Raise My Credit Score 20 Points Fast

4 tips to boost your credit score fast

How Often Does My Credit Score Update

Theres no single formula for how often a credit score updates. Your score can change within days or hours as new data is reported to the credit bureaus. The three major credit bureaus, Equifax, Experian and TransUnion receive data from lenders on different days throughout the month.

Your credit reportand credit scoreis constantly being updated by new data, such as account balances or late payments.

Our guide will explain the process behind updating credit scores and how quickly you can expect to see changes.

Also Check: How To Raise My Credit Score 50 Points

Why Do Fico Scores Fluctuate

There are many reasons why your score may change. The information on your credit report changes each time lenders report new activity to the credit bureau. So, as the information in your credit report at that bureau changes, your FICO® Scores may also change. Keep in mind that certain events such as late payments or bankruptcy can lower your FICO® Scores quickly.

FICO® Scores consider five main categories of information in your credit report.

- Your payment history

- Types of credit in use

While These Score Migration Insights At A Macro Level Are Interesting What Insights Do They Provide To Individuals About Their Own Fico Scores

-

Your FICO® Scores are dynamic – they change as the underlying information in your credit report changes based on your evolving credit-related actions and behaviors.

-

A low score doesn’t have to haunt you forever. Access your FICO® Scores and learn what negative factors are impacting them the most. Focus on addressing those behaviors to help improve your FICO® Scores over time.

-

If you have a higher score, monitor and protect that credit rating you’ve worked so hard to get. A single missed payment can result in a substantial point drop.

-

If you are planning on applying for credit in the near term, access and check your credit reports and FICO® Scores several months in advance to ensure the information in your credit reports is accurate and to get insights on how to potentially increase your credit scores before you apply for credit.

myFICO has a community where you can discuss the changes in your FICO® Scores with peers. Join the myFICO Forums now.

The original research discussed here can be found here :

Tom Quinn

Tom Quinn is the Vice President of Business Development for myFICO and has over 25 years of experience working with consumers, regulators, and lenders regarding credit related questions and initiatives.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

Also Check: How To Get A Car Repossession Off Your Credit

Your Credit Scores Can Change Frequently Thats Why Credit Karma Is Now Providing Daily Updates To Your Transunion Credit Score

But now that you can get an update on your TransUnion score every day, youll be able to keep a closer eye on your progress as you build credit. Daily updates could also help you make more-timely decisions when it comes to applying for new auto loans, credit cards and mortgages.

Also Check: How To Get Car Repossession Off Credit Report

How Credit Karma Makes Money

Credit Karma’s business model is not entirely altruistic. It is a for-profit business that makes money by giving you a free credit score in exchange for learning more about your spending habits and charging companies to serve you .

Credit Karma places advertisements in front of its users, hoping that they will respond to them by clicking on them. Many of these advertisers are lenders, and Credit Karma may earn a fee if you apply through one of its links.

Your personal data is valuable stuff to advertisers, and they pay more to target it. With more than 100 million users, this is a healthy revenue model for Credit Karma.

You May Like: How To Get A Repossession Off My Credit

How Much Is Your Fico Score Changing Over Time

The change depends entirely on what is going on in your life. If you are in a comfortable position and not buying on credit, applying for credit or a mortgage, your FICO score may not change at all. If you want to buy a new car on a loan or get a mortgage, your score may change more.

Lenders are not required to report all of their transactions to FICO, but most do. It is in their interest to keep the data as accurate as possible as they use this to assess your creditworthiness. You may find that minor changes dont affect your score at all, and thats normal.

How Credit Updates Work

The businesses you have accounts withcredit card issuers and lenderssend your updated account information to the at different times throughout the month based on their own schedule. Information in your account updates includes your current balance, payment status, and credit limit. New inquiries to your credit stemming from any applications youve submitted are also reported to the credit bureaus. After receiving updates, credit bureaus compile that information and adjust your credit report accordingly.

You can dispute inaccurate or incomplete information to remove it from your credit report. If you dispute an item, the results of a dispute will update as soon as the credit bureau completes the investigation. This credit bureau has 30 days to complete its investigation and, in some cases, may have an extra 15 days to investigate.

Recommended Reading: Transunion Account Locked

Make Your Credit Score Work For You

Your credit score affects so many different parts of your life. You want to make sure that your credit score has the most accurate and updated information to improve your chances to get approved for a loan.

How often does your credit score update? Thats an important question that depends largely on your lender or credit card company. When you work hard to improve your score, you want the changes to appear right away.

You can expect that it will take about a month for the changes to appear, though it may be sooner or later than that.

Do you want more financial tips? Visit this site often for more helpful personal finance articles.

How And When Are Credit Scores And Reports Updated

Normally, you can expect your credit score and credit report to be updated about once a month. Sometimes it can even take days. However, it will depend on the lender and the credit bureau youre with, as some organizations may operate on a slightly different timeline.

Will a debt consolidation loan look bad on your credit report? Read this.

Generally, your credit score wont change Credit report and credit scores are usually updated when credit card companies and other lenders report new information to the credit bureaus. Most often, lenders will work with one of the two main Canadian bureaus. These bureaus will then share a borrowers credit-related information at the request of each lender.

You May Like: Does Paypal Credit Report

Your Fico Score Can Change Every Day

Did you know that your credit score is different day-by-day?

Many U.S. consumers believe that credit scores are assigned and do not change. The reality is that FICO scores are fluid.

FICO credit scores are a snapshot of your credit record at the exact moment your credit report is pulled. Your scores, therefore, fluctuate as the information within in your credit report changes.

From day-to-day and week-to-week, there are a number of factors which affect your FICO score which, in turn, affects the mortgage rates you get from a bank.

The largest influencers are discussed below.

How Often Does Experian Update Your Credit Score

- Banks Editorial Team

If you check your credit score often, you may notice that it hardly remains the same. But what causes the frequent changes? It boils down to when lenders and creditors report new information to the three major credit bureausExperian, TransUnion and Equifaxthat ends on your credit report. Each time new data is reported, your score could change. Heres why.

Don’t Miss: How Do I Unlock My Credit

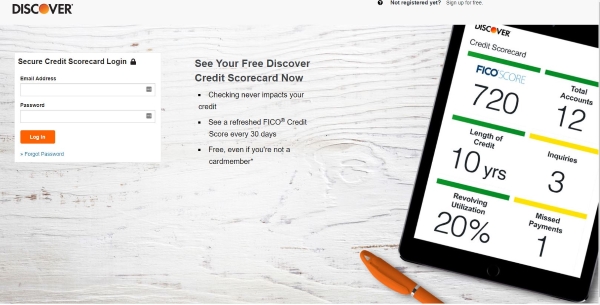

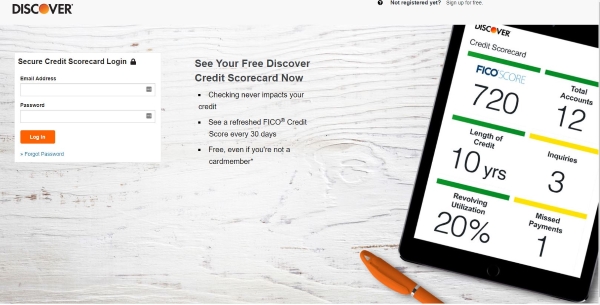

How To Check Your Credit Score For Free

There are dozens of resources available for you to check your credit score for free, but the type of score you receive varies between a FICO Score and VantageScore. While both are helpful for understanding the key factors that influence your credit history, FICO Scores are used in the majority of lending decisions.

The simplest way to access your free credit score is through your credit card issuer. Many card issuers provide their cardholders with free access to their FICO Score or VantageScore. Beyond your bank, consider free resources from Experian, Discover and Capital One.

How Does Applying For New Credit Impact My Fico Score

Applying for new credit only accounts for about 10% of a FICO® Score. Exactly how much applying for new credit affects your score depends on your overall credit profile and what else is already in your credit reports. For example, applying for new credit may have a greater impact on your FICO® Scores if you only have a few accounts or a short credit history. That said, there are definitely a few things to be aware of depending on the type of credit you are applying for. When you apply for credit, a credit check or inquiry can be requested to check your credit standing.

If you don’t see the answers to your questions:

You May Like: Can A Public Record Be Removed From Credit Report

How Often Do Credit Scores Update

As soon as credit bureaus receive your information from your creditors, they update your credit report. The information on your credit report influences your credit score. As soon as your credit report is updated, your credit score will change and reflect the new information.

However, if you miss a payment and your creditor reports your payment as more than 30 days late, you might see a drop in your credit score. This late payment will stay on your credit report for seven years and will keep on having a negative effect. Another factor that can cause your credit score to take a significant hit is using more and more of your credit and increasing your . If you suddenly have a spike in credit card debt, you can expect to see a knock in your credit score.

How Long Will Negative Information Remain On My Credit Reports

It depends on the type of negative information. Heres the basic breakdown of how long different types of negative information will remain on your credit reports:

- Late payments: 7 years from the original delinquency date.

- Chapter 7 bankruptcies: 10 years from the filing date.

- Chapter 13 bankruptcies: 7 years from the filing date.

- Collection accounts: 7 years from the original delinquency date of the account

- Public Record: Generally 7 years

Keep in Mind: For all of these negative items, the older they are the less impact they will have on your FICO® Scores. For example, a collection that is 5 years old will hurt much less than a collection that is 5 months old.

Also Check: How To Get A Repossession Off Your Credit

When Do Creditors Report To Credit Bureaus

Most creditors send information like a large purchase, opening a new credit card, applying for a mortgage, making a late payment, etc., to the bureaus once a month.

But not all creditors report to all bureaus, and they might report at different times during the day. Some credit card companies that handle millions of accounts may only send over information in batches, once or twice a month.

Thats one reason why moving the needle from poor to excellent credit wont happen overnight. Your score can move a bit in one day, but it can take a while to make a real change for the better.

How Quickly Can You Earn A Higher Credit Score

Lets talk about what most people really want to know when they ask the question, How often do credit scores update?

Youve been working hard to improve your credit scores. How long will it take for your credit improvement efforts to pay off?

There are many variables that can affect the answer to that question. To keep the answer as simple as possible, Ill just say the following. Its often possible to earn a higher credit score in 30 days or less.

Its important to understand that the accounts on your credit reports dont update in real time. The credit card balances on your credit reports, for example, wont move up or down as you make charges or pay your bill. Instead, your credit card company will update the credit bureaus once a month with your new account details, as they appear on your statement.

You have hundreds of credit scores, not just one. The credit scoring model a lender uses to evaluate your credit report has a big affect on the credit score you receive.

Read Also: How To Get Credit Report Without Social Security Number

You May Like: Walmart Affirm Apply

How Often Are Credit Scores Updates

Typically, your credit score is updated every 30 days, but, this largely depends on the creditor and how often they report your information to the credit bureaus. Lenders generally report both negative and positive information to at least one of the credit bureaus on a monthly basis. Creditors generally report information such as account activity, account balance, payment history, and credit inquiries to the bureaus. Some lenders may only report to one or two of the bureaus. Other lenders, such as large banks and major credit cards, typically report to all three credit bureaus. Each lender decides which and how many bureaus they want to report to. This can lead to a slight fluctuation of your credit score between all three bureaus.

How Long You’ve Been Trying To Improve Your Credit Score

Although time is of the essence to improve payment history, there are some very powerful moves you can make to see noticeable signs of improvement within weeks:

- Checking your credit report for errors and disputing them

- Paying down a balance on a credit card to zero

- Improving your utilization ratio by paying all balances down to less than 30% of credit limit

You May Like: Notify Credit Bureaus Of Death