How Long Do Consumer Finance Accounts Stay On My Credit Report

Typically, reports from agencies such as Experian and Transunion will retain the fact that youve owned a consumer finance account in your credit report for 7-10 years.

This retention period will begin from the moment the balance has been paid in full and the account is closed.

The agencies will report that You have a consumer finance account on your credit report, but this will only have minimum impact on your credit score.

If you have been diligent with the repayments associated with your consumer finance loans, your ability to dramatically improve your credit score should not be limited.

Who Generates Credit Scores

Credit scores dont just appear out of thin air. Theyre calculated using the information in your credit report. The FICO score, originally developed by the Fair Isaac Corporation, is the most popular. This score ranges from 300 to 850, with 850 considered to be the perfect score. The VantageScore is another credit-scoring model.

While the FICO and VantageScore models use different algorithms to generate credit scores, they both rely on for information. Understanding how to read your credit report is the first step to better credit health.

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

You May Like: What Does Leasing Desk Score Mean

What Is A Consumer Credit Report

A consumer credit report is a statement that depicts the credit activity and most recent credit profile of an individual. It shows the status of an individual’s credit accounts, whether open, closed, or delinquent, credit limits, account balances, payment history, personal information such as name and Social Security number, and public records, such as liens, collections, and bankruptcies.

Disadvantages Of Consumer Credit

The main disadvantage of using revolving consumer credit is the cost to consumers who fail to pay off their entire balances every month and continue to accrue additional interest charges from month to month. The average annual percentage rate on all credit cards was 14.75% at the end of Q1 2021 according to the Federal Reserve. A single late payment can boost the cardholder’s interest rate even higher.

You May Like: Does Bank Of America Report Authorized Users To Credit Bureaus

How The Fcra Protects Non

In addition to consumer credit information, the FCRA also regulates dissemination and use of consumer information. When applying for a job looking for an apartment to rent or applying for school a consumer report may be sought to determine qualifications. When this information is inaccurate, it can prevent consumers from qualifying for a job, or securing a place to live. The consequences can be debilitating when inaccurate information is contained within a consumer report.

That is precisely why the FCRA seeks to protect consumers by requiring that anybody requesting a background check obtain the express and written consent of the consumer, and provides the required disclosures so that a consumer is aware of the inaccurate information.

Your Credit Billing And Electronic Fund Transfer Statements

It is important to check credit billing and electronic fund transfer account statements regularly because these documents may contain mistakes that could damage your credit status or reflect improper charges or transfers. If you find an error or discrepancy, notify the company and dispute the error immediately. The Fair Credit Billing Act and Electronic Fund Transfer Act establish procedures for resolving mistakes on credit billing and electronic fund transfer account statements, including:

- charges or electronic fund transfers that you or anyone you have authorized to use your account have not made

- charges or electronic fund transfers that are incorrectly identified or show the wrong date or amount

- math errors

- failure to post payments, credits, or electronic fund transfers properly

- failure to send bills to your current address provided the creditor receives your change of address, in writing, at least 20 days before the billing period ends

- charges or electronic fund transfers for which you ask for an explanation or written proof of purchase along with a claimed error or request for clarification.

Don’t Miss: Paypal Credit Affect Credit Score

Building A Credit History

Building a credit history is important. A consumers credit history can affect their insurance, ability to rent an apartment, get a job, or get a cell phone plan. Credit history is needed to get all types of loans, from mortgages to department store cards.

To start building a positive credit history, individuals should acquire and positively manage small lines of credit. The following are credit options for individuals who need to begin building a positive credit history:

Tip: Before applying for credit, call and ask what the minimum requirements are.

Sec Office Of Credit Ratings

The SEC Office of Credit Ratings is charged with protecting investors and maintaining fair and efficient markets through oversight of credit rating agencies. It issues information that educates investors on the risks involved with investing in debt securities like bonds, notes and asset-backed securities. Credit ratings also are assigned to companies and governments.

The SEC Office of Credit Ratings was created as part of the Dodd-Frank Act to help oversee credit rating agencies.

You May Like: Can Overdraft Affect Credit Score

Financial Information On Your Credit Report

Your credit report may contain the following financial information:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a lien on a car that allows the lender to seize it if you dont make payments

- remarks, including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if you made your payments on time

- if you missed payments

- if your debt has been transferred to a collection agency

- if you went over your credit limit

- personal information thats available in public records, such as a bankruptcy

What Is A Consumer Statement And Should I Have One

Time to read: 4 minutes

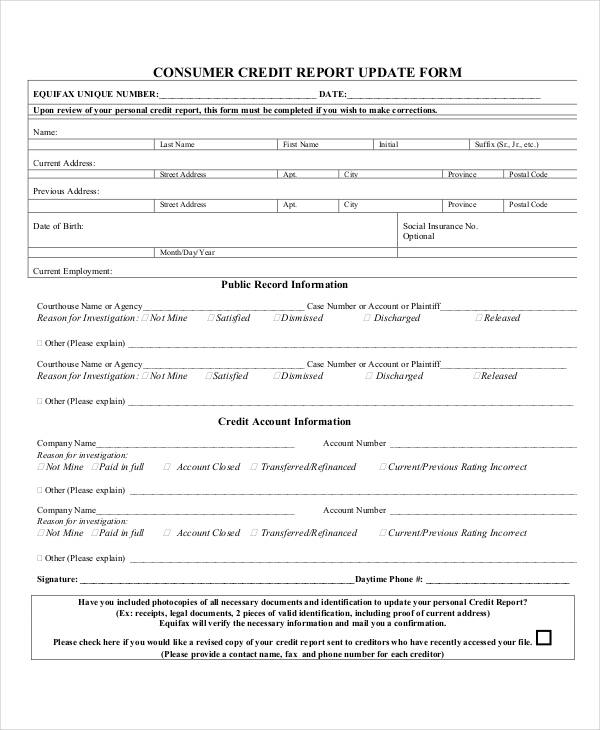

A Consumer Statement is an optional statement of up to 475 characters that you can add to your Equifax credit report. The Consumer Statement can be added to explain a disagreement with the outcome of a dispute investigation or provide additional information about items on your Equifax credit report. Potential lenders and creditors will see your Consumer Statement when they view your Equifax credit report. A Consumer Statement will not change accurately reported information and is unlikely to impact your credit scores however, providing details for a lender or creditor to see may help them better evaluate your credit behavior.

There are several reasons you may want to add a Consumer Statement to your credit le:

Equifax Information Services LLCPO Box 740256Atlanta, GA 30374-0256

Don’t Miss: Capital One Authorized User Removal

How Often Should I Check My Credit Report

You should review your credit report at least once a year to make sure the information is accurate. If you are planning important financial transactions over the next few months, you should review your report well before you expect these transactions to occur. That way, you have enough time to contact the credit reporting agency if you have questions or need amendments.

Would you like to see your credit score now?

*Quebec Residents:

In order to comply with the Quebec Credit Assessment Agents Act effective February 1, 2021, consumers who reside in the province of Quebec are entitled to see their credit score and score factors on their consumer disclosure. Therefore all consumer disclosures issued to Quebec residents have a score and score factors integrated as part of the consumer disclosure.

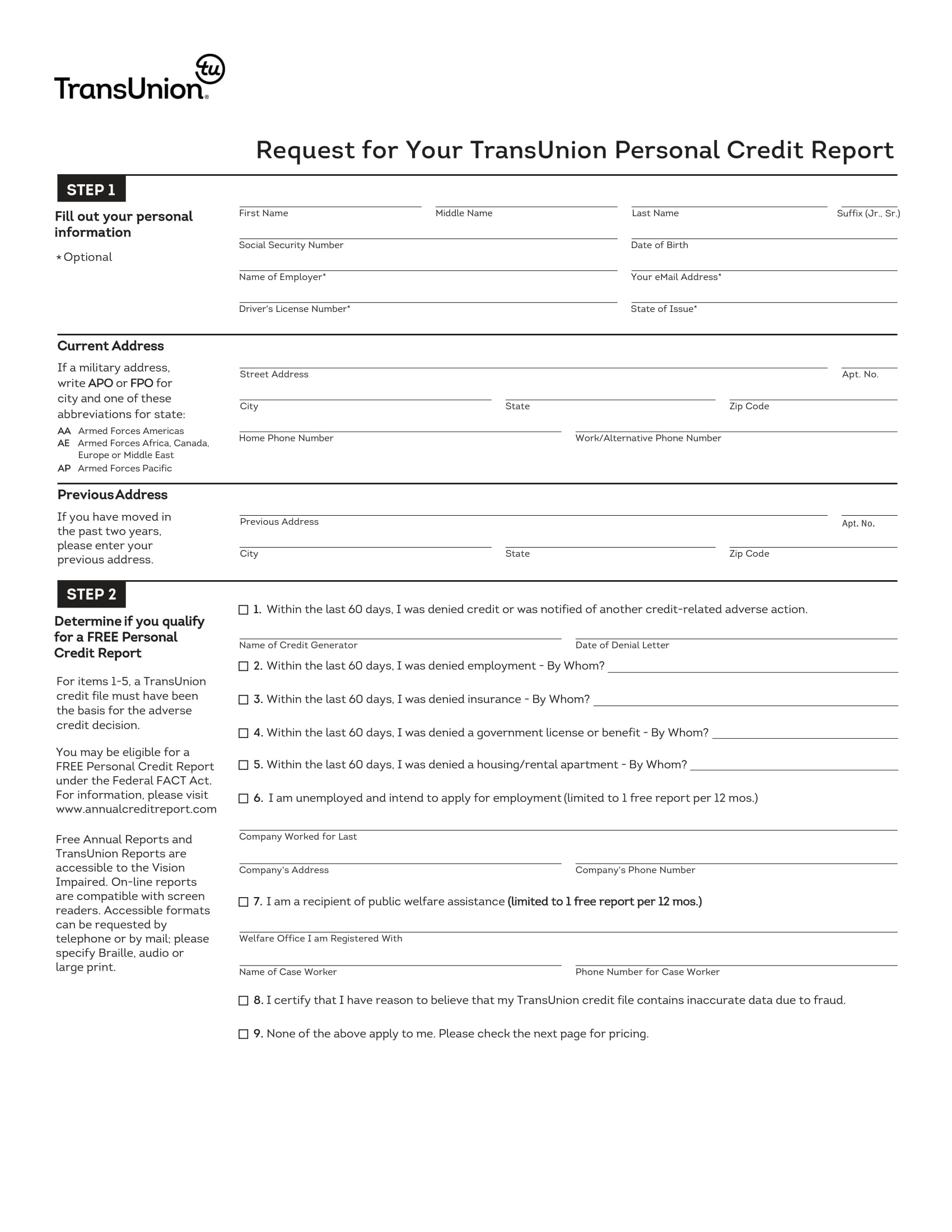

Disclaimer: The information posted to this blog was accurate at the time it was initially published. We do not guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit transunion.com. This site is governed by the TransUnion Interactive privacy policy located here.

Cfpb Releases Report Detailing Consumer Complaint Response Deficiencies Of The Big Three Credit Bureaus

Equifax, Experian, and TransUnion routinely failed to fully respond to consumers with errors

WASHINGTON, D.C. A new analysis by the Consumer Financial Protection Bureau reveals how changes in complaint responses provided by nationwide consumer reporting companies resulted in fewer meaningful responses and less consumer relief. In 2021, Equifax, Experian, and TransUnion together reported relief in response to less than 2% of covered complaints, down from nearly 25% of covered complaints in 2019.

Americas credit reporting oligopoly has little incentive to treat consumers fairly when their credit reports have errors, said CFPB Director Rohit Chopra. Todays report is further evidence of the serious harms stemming from their faulty financial surveillance business model.

Consumers submitted more than 700,000 complaints to the CFPB regarding Equifax, Experian and TransUnion from January 2020 through September 2021, which represented more than 50% of all complaints received by the agency for that period. Consumers submit more complaints about inaccurate information on their credit and consumer reports than about any other problem. Consumers most frequently assert that the inaccurate information belongs to someone else, and consumers often describe being victims of identity theft.

Equifax, Experian, and TransUnion Fail to Meet Statutory Obligations

Medical Debt Mistakes

Don’t Miss: What Credit Score Do I Need For Klarna

Solving Your Credit Problems

Your credit report can influence your purchasing power, as well as your opportunity to get a job, rent or buy an apartment or a house, and buy insurance. When negative information in your report is accurate, only the passage of time can assure its removal. A credit reporting company can report most accurate negative information for seven years and bankruptcy information for 10 years. Information about an unpaid judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. There is no time limit on reporting information about criminal convictions information reported in response to your application for a job that pays more than $75,000 a year and information reported because youve applied for more than $150,000 worth of credit or life insurance. There is a standard method for calculating the seven-year reporting period. Generally, the period runs from the date that the event took place.

If you are having problems paying your bills, contact your creditors immediately. Try to work out a modified payment plan with them that reduces your payments to a more manageable level. Dont wait until your account has been turned over to a debt collector.

Here are some additional tips for solving credit problems:

How To Read A Consumer Credit Report

A good can impact your finances in more ways than one, so its vital that you know how to read your consumer credit report. When attempting to qualify for loans, credit cards, or lines of credit, lenders take your into account. Your score determines in part whether youre approved for new credit and what interest rate you’ll receive on money that you borrow.

Don’t Miss: Minimum Credit Score For Amazon Visa

Title 15 Of The United States Code

|

- 15 U.S.C.ch. 6Weights and Measures and Standard Time

- Subchapter IWeights, Measures, and Standards Generally

- Subchapter IIIStandard Gauge for Iron and Steel

- Subchapter IVScrew Threads

- Subchapter VStandard of Electricity

- Subchapter VIStandard Barrels

- This page was last edited on 22 October 2021, at 05:06 .

- Text is available under the Creative Commons Attribution-ShareAlike License additional terms may apply. By using this site, you agree to the Terms of Use and Privacy Policy. Wikipedia® is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization.

What Is A Credit Report And What Does It Include

Reading time: 3 minutes

Highlights:

- A credit report is a summary of how you have handled your credit accounts

- It’s important to check your credit reports regularly to ensure the information is accurate and complete

A credit report is a summary of how you have handled credit accounts, including the types of accounts and your payment history, as well as certain other information thats reported to credit bureaus by your lenders and creditors.

Potential creditors and lenders use credit reports as part of their decision-making process to decide whether to extend you credit and at what terms. Others, such as potential employers or landlords, may also access your credit reports to help them decide whether to offer you a job or a lease. Your credit reports may also be reviewed for insurance purposes or if youre applying for services such as phone, utilities or a mobile phone contract.

For these reasons, it’s important to check your credit reports regularly to ensure the information in them is accurate and complete.

The three that provide credit reports nationwide are Equifax, Experian and TransUnion. Your credit reports from each may not be identical, as some lenders and creditors may not report to all three. Some may report to only two, one or none at all.

Your Equifax credit report contains the following types of information:

- Identifying information

- Inquiry information

There are two types of inquiries: soft and hard.

- Bankruptcies

- Collections accounts

You May Like: Does Paypal Credit Help Your Credit Score

Your Debts And Debt Collectors

You are responsible for your debts. If you fall behind in paying your creditors, or if an error is made on your account, you may be contacted by a debt collector. A debt collector is any person, other than the creditor, who regularly collects debts owed to others, including lawyers who collect debts on a regular basis. You have the right to be treated fairly by debt collectors.

The Fair Debt Collection Practices Act applies to personal, family, and household debts. This includes money you owe for the purchase of a car, for medical care, or for charge accounts. The FDCPA prohibits debt collectors from engaging in unfair, deceptive, or abusive practices while collecting these debts. Under the FDCPA:

- Debt collectors may contact you only between 8 a.m. and 9 p.m.

- Debt collectors may not contact you at work if they know your employer disapproves.

- Debt collectors may not harass, oppress, or abuse you.

- Debt collectors may not lie when collecting debts, such as falsely implying that you have committed a crime.

- Debt collectors must identify themselves to you on the phone.

- Debt collectors must stop contacting you if you ask them to do so in writing.

Tips For A Positive Credit Report

- Pay your loans and other bills on time. Even if you fell into trouble in the past, you can rebuild your credit history by beginning to make payments as agreed. Paying your debts on time will have a positive effect on your credit score and can improve your access to credit.

- To help show that you have not borrowed too much, try to minimize how much you owe in relation to your credit limit. Don’t automatically close credit card accounts that have been paid in full and haven’t been used recently because that may lower your available credit. However, you may want to close a card with a zero balance if you pay a monthly fee for the card.

- If you believe you cannot repay your creditors, contact them immediately and explain your situation. Ask about renegotiating the terms of your loan, including the amount you repay. Reputable credit counseling organizations also can help you develop a personalized plan to solve your money problems, but less-reputable providers offer questionable or expensive services or make unsubstantiated claims.

Don’t Miss: Can A Repossession Be Removed From Credit Report