How Can I Reduce The Impact Of A Late Payment

If youve made a late payment, dont panic. Almost everyone has made a late payment, intentionally or not, even if youre just starting to build credit. According to a 2020 Experian study, almost 1.5% of all consumers have a late payment between 30 and 180 days past due on their credit report.

If you have a good track record of paying on time , call your creditor to see if theyre willing to waive the late fee. Many, but not all, creditors are willing to forgive an occasional late payment.

Next, if youre able, pay off someor ideally, allof the late payment thats due. The smaller the amount thats past due, the less impact it will have on your credit score.

If youre not able to pay it off, make sure you at least touch base with your creditor and explain the situation. It may be able to offer a payment plan solution instead of sending your account to collections.

Late Payments Hurt Good Credit Scores The Most

According to FICO, the analytics firm that makes the software that computes most credit scores, late payments hurt good credit scores more than bad ones.

Someone with a 780 credit score who misses a payments due date by more than 30 days can see a 90 to 110 point drop in their credit score. Someone with a credit score of 680 who misses a payment might see their score dip by only 60 to 80 points.

Will One Late Payment Affect Me Getting A Mortgage

A late payment is going to have a negative impact on your credit score, but the severity of the score drop is ultimately going to depend on the type of credit score you have and your credit profile.

When it comes to getting a mortgage, making one late payment is not going to have a negative impact on your credit profile. Neither will it weaken your ability to get a mortgage. That being said, whether or not you can get a mortgage after late payments will all depend on multiple factors, such as how delinquent you are when applying for the mortgage, as well as your overall credit history.

Those who have a strong credit history will fare better at getting a mortgage despite making a few late payments. That said, it is likely you are not going to qualify for the best rates or terms even if you do get a mortgage.

Your payment history is going to be the main determining factor when it comes to getting a mortgage. If you made multiple late payments in the past year, then you can expect lenders to offer you a mortgage with a higher interest rate and a higher down payment.

This is why it is so important to make sure that your payments are on time as if you have a string of late payments under your belt, its going to have a massively negative impact on your overall credit score.

Also Check: How Long Do Late Payments Stay On Your Credit Report

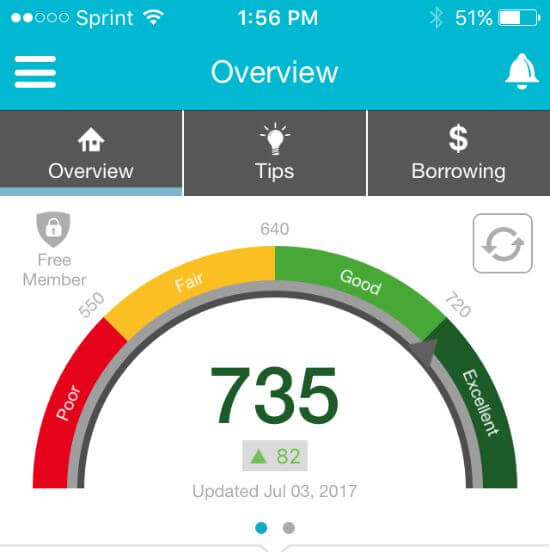

Should You Worry About Changes In Your Credit Score

Changes in your credit score are completely normal, so theres no need to worry about small fluctuations! That being said, its good to check your credit report at least once a month so you can monitor these changes when they occur.

You may want to take note of large changes in your score as they could be an indication that something bigger is happening for example, if you have unauthorized accounts opened in your name, or youve been a victim of identity theft.

Final Thoughts On Payment History And Your Credit Score

Building a great credit score can take time, but almost anyone can improve their credit score with determination and good payment habits.

If your credit score is currently suffering due to a poor payment history, take control of your score and credit life by starting a new pattern of on-time payment today.

One of the best tools available for building payment history is since you can build a solid and long payment history for your credit profile with an installment account that reports your payments monthly to the three major credit bureaus and build your savings at the same time.

Now go out there and transform your life with strong credit!

FICO is a registered trademark of Fair Isaac Corporation. Credit Strong is a registered trademark of Austin Capital Bank. Experian is a registered trademark of Experian and its affiliates.

Recommended Reading: What Credit Score Does Carmax Use

Late Credit Card Payments Can Stay On Your Credit Report For A Long Time And They May Affect Your Credit Score

Late credit card payments, also called delinquencies, generally appear on credit reports for seven years. And in many cases, those reported delinquencies can affect credit scores.

But thereâs plenty more to knowâlike when payments are considered late and when theyâre actually reported. So keep reading to explore some of the details and to learn steps you can take to avoid missing payments.

When Does A Missed Payment Affect Your Credit Score

A missed payment typically affects your credit score when its reported on your credit report. Missed payments are reported to the credit bureaus after the payment is 30+ days late. After your payment is 30 or more days late, the lender updates your account status as 30 days late, prompting the credit reporting bureaus to add a 30-day late payment notation to your account.

Even if you make your payment after the 30-day late payment notation is added to your credit report, the 30-day late payment notation will remain on your credit report for 7 years from the date you missed your payment. After the 7 year period, the late payment will be removed from your credit report. Late payments have the biggest effect on your credit score when theyre first added. As the late payment ages, its impact on your credit score lessens.

Furthermore, if you fail to make subsequent payments, a 60-day late payment, a 90-day late payment, and 120-day late payment notations will be added to your credit report. So, as the delinquency increases, the negative impact on your credit score increases as more late payment notations are added.

So, if youve missed a payment, the best course of action to improve your credit score and prevent further damage is to continue making payments if you can afford to do so. This prevents further damage to your credit.

Also Check: Shopify Capital Complaints

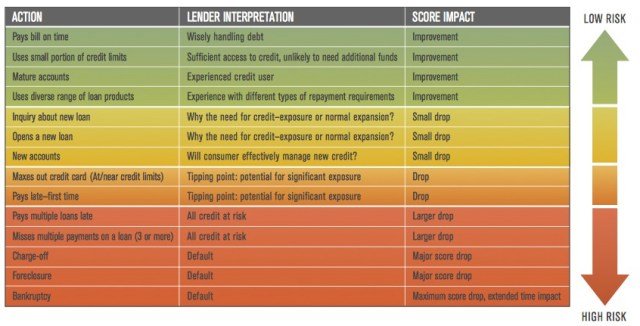

Why Do Late Payments Impact Your Credit

Payment history is one of the key details that banks and issuers consider when deciding whether or not to approve you for credit.

A long-standing history of on-time payments suggests that youre a responsible and reliable borrower a poor history of on-time payments suggests to banks and issuers that you may not repay debts and could result in a costly loss to their business.

Because of this, payment history is one of the most important factors that goes into calculating your credit scores. So when you miss a payment or make a late payment, it can have a more dramatic impact on your scores than something like a hard inquiry.

Will Making A Partial Payment Keep Your Account From Being Reported As Late

Yes, making anything less than the minimum payment on a credit card or making a payment less than the amount due on your loan will result in your payment being reported as late on your credit report. Also, you probably will incur a late payment fee for failing to make the required payment. If you can only make a partial payment, you should contact your lender or creditor and ask them about your payment options.

Read Also: Mprcc On Credit Report

Something Was Recorded On Your Credit Report

Think back on your payment history have you missed a credit card payment in the last few months? Were there any bills that you may have missed in previous months?

Missed payments are typically not reported to the credit bureaus until theyre at least 30 days late, so your score wont be impacted until after that time. Your score will be hurt by a payment thats more than 30 days late, but a delinquency, referring to a payment that is over 30 days late 60, 90, or even 180 days can devastate your score.

Derogatory marks such as tax liens, charge-offs, collections, foreclosures or bankruptcies have drastic impacts on your credit too, and it may take weeks or months for them to show up on your report. If youve experienced any of these, it may take time for your score to change.

Paying Just The Minimum Amount Due

If you are one of those, who believe that if you pay the minimum amount payable, no interest would be charged on your outstandingbill amount, you could be wrong. In reality, you will pay interest on the outstanding amount starting from the payment duedate. The rate of interest cost can be as high as 45% annualized. So, it is always better to clear your entire dues by thepayment due date.

It is always better to be safe than face the consequences of a late credit card payment. How do you go about it?

Stick to the due date. You can set a standing instruction with your bank to clear the outstanding amount on the billing dateso that the amount gets automatically debited from your account on the given date.

You could also set an alarm or a reminder to get a notification before your due date.

have many benefits. Among them is convenience, security, speed and hassle-free operations. have many benefits. Among them is convenience, security, speed and hassle-free operations. Care should be takennot to abuse the instrument, so that the benefits can be enjoyed to the fullest.

Also Check: How To Remove Repossession From Credit Report

Its Easier To Recover From Just One 30

There are many things you can do to mitigate the damage done by a single 30-day late payment, Scanlon said.

One of the most common is to request what is referred to as a courtesy deletion or removal.

In a nutshell, Scanlon said, if you have a good payment history, you bring that to the creditors attention and request that they give you a break for your single oversight, which they just might do if you have a good payment history and ask nicely.

Additionally, writing a goodwill letter can help you avoid further damage to your credit score from a late payment, according to Nathan Wade, managing editor for WealthFit Money, a financial education website that provides advice on investing, entrepreneurship and money.

A goodwill letter is a chance to explain your situation to your creditor and kindly ask them to remove a negative mark from your credit report, Wade said.

And he also noted that although creditors are not obligated to grant your request, a goodwill letter will not hurt your credit score if it is rejected.

Keep in mind that it can be a few weeks before your goodwill letter is accepted or rejected, Wade cautioned.

Some tips for writing a strong goodwill letter are to write in a respectful tone, acknowledge your responsibility in paying off debts on time and be detailed about the negative mark you need removed and from which credit bureaus reports.

What To Do If Youve Made A Late Payment

If your bills are past due, the sooner you can pay the bill, the better. The damaging effect of a late payment on your credit scores can increase the longer you wait.

If youve made a late payment recently, here are some things you can try.

- Request removal of a late payment fee. If youre in otherwise good standing with your bank, or if its your first time missing a payment, consider asking your bank to forgive or remove the late fee.

- Work to reset your penalty interest rate. If a late payment caused your interest rate to increase, your issuer is generally required to reset your interest rate back to the pre-penalty rate if you make six months of on-time payments. If you can, make it a goal to get back on track with on-time payments, which could help you pay less interest on your accounts in the long run.

- Pay all accounts on time. If a late payment caused your credit scores to drop, the best thing you can do is to continue making on-time payments on all of your accounts. After a few months of consistent on-time payments, your credit scores could slowly improve. An easy way to prevent late payments is to set up automatic payments and email or text reminders on your financial accounts.

Also Check: Check Credit Score With Itin

Late Payments And Your Credit

All creditors want to know that a borrower will pay his or her debt as agreed. They use credit reports and scores in a backwards-looking fashion to assess how much of a risk a consumer is likely to pose. If a person has established a pattern of paying their bills on time, they are viewed as a responsible user of credit and not likely to cause the creditor any financial losses. Having a history of late payments, on the other hand, signals unreliability, financial instability, and greater financial risk.

The consequences of late payments escalate in severity as the account becomes more and more delinquent. The consumers credit report shows payment history with degrees of lateness: on-time, 30 days late, 60 days late, 90 days late, 120 days late. Each degree of lateness causes incrementally greater damage to the credit score than the previous one.

Collection, repossession, charge-offs, bankruptcy, and other notations that signify a failure to fulfill a financial obligation may also be listed, and they result in an even greater blow to the consumers score than late payments.

As mentioned earlier, a cable or other utility bill will generally not be reported at all unless it is seriously delinquent and in collections. That usually happens around the 90-day mark after a missed payment. Before that, the consumer is likely to be hit with late fees and ultimately a suspension of service.

The longer you fail to pay a bill, the more damage it can do to your credit score.

How 180 Day Late Payments Affect Credit Scores

Once late payments hit the 180 day point, they are generally turned over to a collection agency. Having an account turned over to collections drops a 900 point credit score by 165 to 185 points. It will only drop a 760 point credit score by 105-125 points. If the debt goes unpaid, it will continue to damage the persons credit score for seven years, though the effect of the damage will gradually lessen over time.

You May Like: Credit Score 672

Does Paying Rent Late Affect Your Credit Score

Federal law dictates that a late payment can only be reported to credit reporting bureaus after 30 days. So, it wont hurt your credit if you pay before the thirtieth day. However, you might have to pay a late fee.

Unfortunately, paying rent late will be reflected in your credit report If you miss the 30-day deadline. This can have significant consequences for your credit score.

A late rent payment can affect your credit score so much that it can prevent you from getting loans, credit cards, and future housing. If you have any option to avoid a late payment, you should try.

What Should You Do If Youre One Day Late On Making A Payment

If you have missed your payment and youre only one day late on making it, you should immediately login into your online banking portal and submit the payment. By doing so, you will avoid any negative impact to your credit. If you dont have access to online banking, call your lender or creditor and ask them to schedule your payment.

In the event that you dont have money to make the payment, you should call your creditor or lender and ask them about your options for repaying the money that you owe them.

Also, if you incurred a late fee for submitting the payment late, you should call your creditor and lender and ask them about waiving the late fee that you incurred. Most creditors and lenders will be more than happy to waive the late fee for you, especially if you had been making your payments on time in the past.

If you want to avoid making your payment on day late, you should sign up for automatic bill pay, this will insure that your minimum payment is made on time every month.

Recommended Reading: Does Zebit Report To Credit Bureaus

Impact Of Late Payment On Credit Score

It is important to note that any late payment gets recorded in your credit report as well which makes your credit score to fall further and making it difficult for you to qualify for best terms and interest rate on loans and credit cards from the lenders.

Late payment of dues and your credit score go hand in hand. Here is the breakdown of the impact of late payment on your credit score based on the number of days you have got late in making your payments.

Hire A Professional To Remove Late Payments

To make this process easier, you can work with that will help you to challenge inaccuracies on your credit report. Credit repair professionals have the expertise, knowledge and, most importantly, the time available to help you through the dispute process from beginning to end.

You have the will, we have the way. Let us help you fix your credit. Call today to get started

Also Check: How To Get Credit Report With Itin Number