What Doesnt Affect Your Credit Score

The following personal and financial information do not impact your FICO or VantageScore credit scores :

- Age, sex, gender, race, nationality, ethnicity or where you live.

- Religious or political affiliations.

- Income, assets, employment status or job title.

- The interest rates on your accounts.

- Whether you receive public assistance or enroll in credit counseling.

- Anything that isnt in your credit report.

Free Credit Scoring Website

One of the best ways to check your credit score for free is by visiting a free credit scoring website. These websites typically offer access to your credit report, score and/or credit monitoring and are updated anywhere from weekly to monthly. Theres no fee to sign up for basic credit score updates. However, some websites offer more advanced services for a monthly fee.

Recommended Reading: Usaa Free Credit Score

How To Check Your Cibil Score

Having a good CIBIL score gives you leverage while applying for a loan as it portrays you as a responsible and trustworthy borrower. This is because it consolidates your past credit history and repayment behaviour and provides a comprehensive picture to prospective lenders. A higher score makes you more creditworthy and vice versa. To understand this score better, learn how your CIBIL credit score is calculated.

Read Also: Does Qvc Report To Credit Bureaus

How Are Fico Scores Calculated

Getting Your Credit Score Is Simple

The CIBC Free Credit Score Service is a feature in the CIBC Mobile Banking App which allows CIBC clients to subscribe to get their credit score from Equifax Canada.

The Equifax credit score is based on Equifaxs proprietary model and may not be the same score used by third parties or by CIBC in certain instances to assess your creditworthiness. The provision of this score to you is intended for your own educational use. Third parties and CIBC will take into consideration other information in addition to a credit score when evaluating your creditworthiness.

You should always get the most up-to-date credit information and credit scores from Equifax Canada to ensure accuracy before making a major financial decision.

Read Also: Does Student Loans Fall Off Your Credit

How Credit Scores Are Calculated

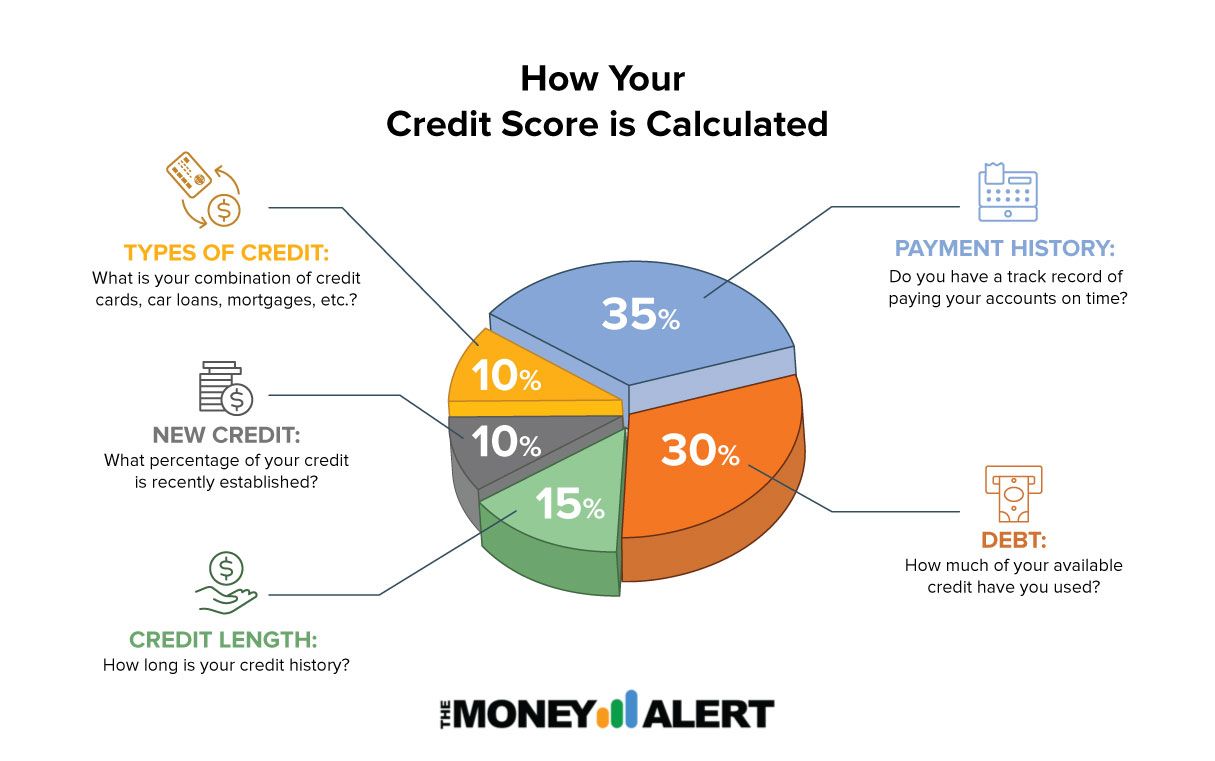

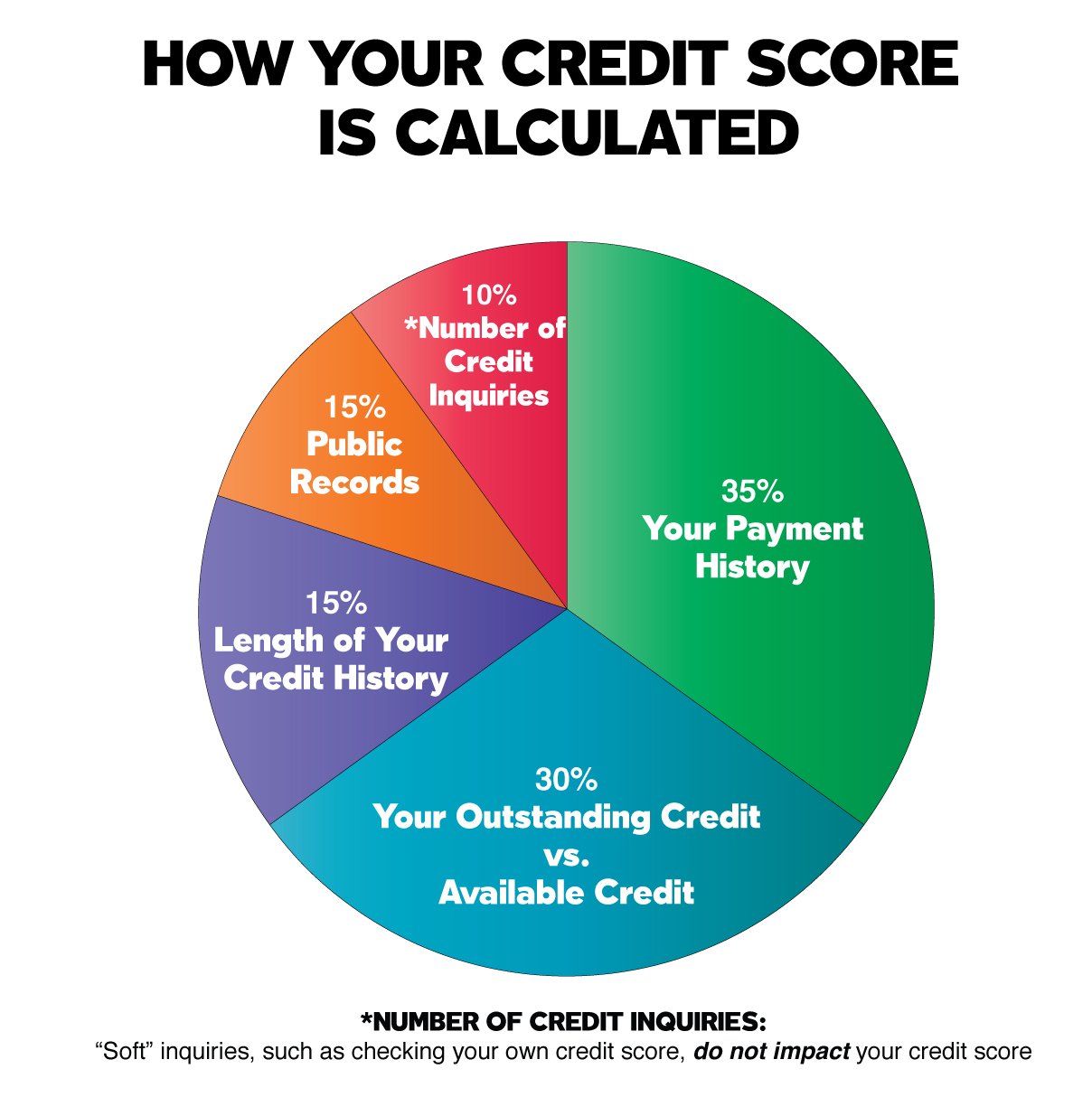

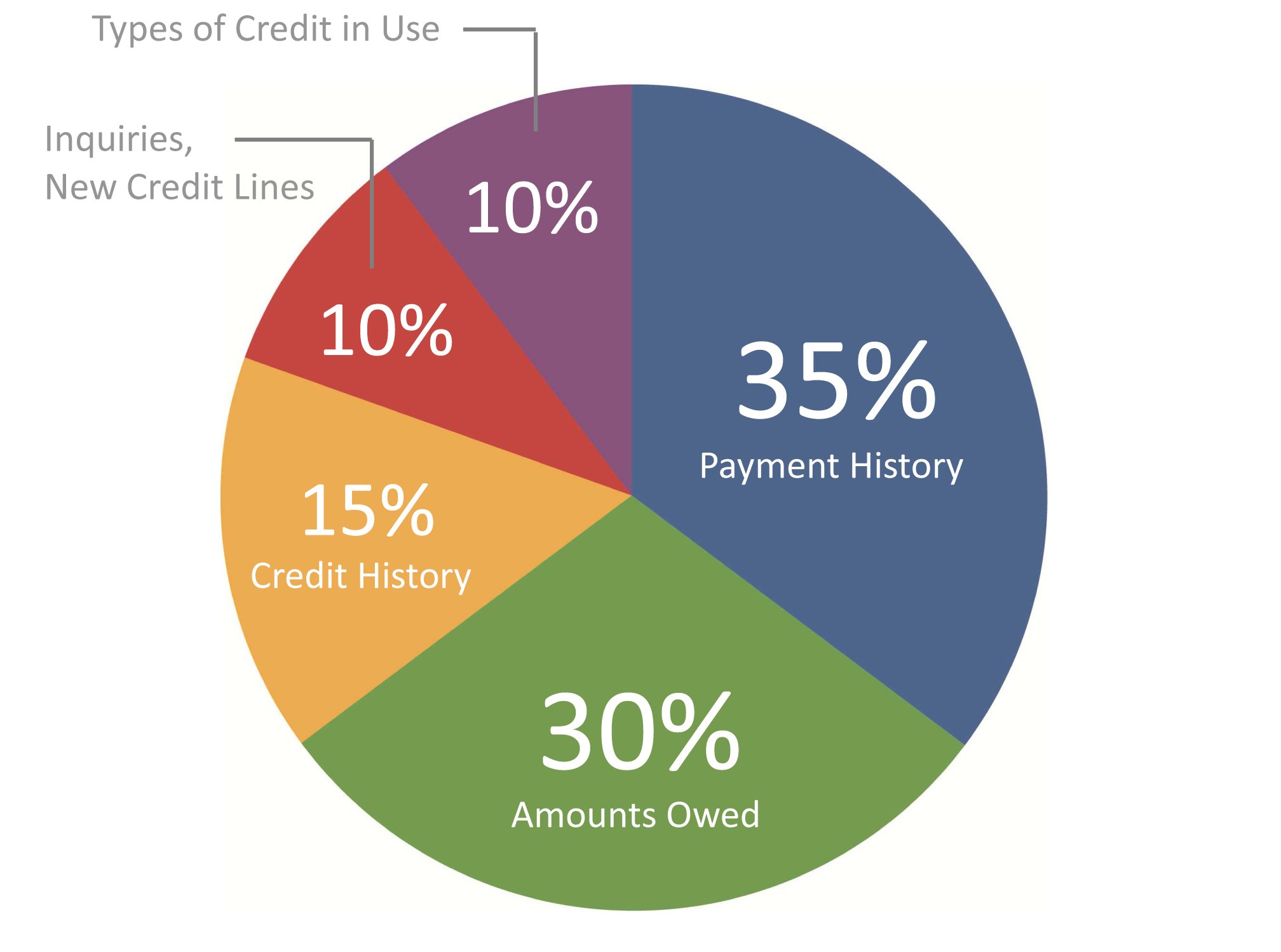

These are typically the multiple factors that affect your credit score in order of importance:

Payment History 35%

Payment history is the most impactful factor in calculating credit scores. It covers all the payments youve made on all your credit accounts in your entire credit history. Late payments and missed payments will hurt your credit, while paying on time helps build credit.

Your total credit owed compared to how much available credit remaining is your credit utilization rate which is an important factor in determining your credit score. You want your credit utilization ratio to be as low as possible so you dont have a disproportionate amount of debt compared to your total available credit.

The credit history portion of your credit score calculation considers how long your credit accounts have been established, including the age of your oldest, newest, and average account. Having a more established credit history is helpful for a good score.

New Credit 10%

All your credit inquiries and the opening of new accounts will be included here. Filling out multiple applications and opening too many new accounts within a short period of time could represent a greater risk to lenders, so it negatively affects your credit score.

Types Of Credit Accounts

Credit scoring models may also look for experience managing both revolving and installment credit accounts. Having a mix of accounts can help your scores.

Some credit scores are built for specific types of creditors, such as credit card issuers or auto lenders. Your experience with the correlated types of accounts could be more important for these types of scores.

Also Check: 688 Credit Score Auto Loan

What Your Scores Mean

Your credit scores will be an important factor in determining what interest rate you receive on a loan or if youre even extended an offer of credit. Typically, the higher your credit scores, the lower the interest rate youll pay.High credit scores can lead to other perks and benefits, such as increased spending limits on credit cards. Higher limits offer additional financial flexibility and can also reduce your total balance-to-limit ratio, also known as credit utilization rate. This is calculated by dividing your accounts outstanding balance by its credit limit. In general, high utilization rates tend to hurt credit scores and can cause lenders to be reluctant to extend additional credit to you.likely you are to see those scores shift.

Disclaimer: The information posted to this blog was accurate at the time it was initially published. We do not guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit transunion.com. This site is governed by the TransUnion Interactive privacy policy located here.

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

You May Like: Sync Ppc On Credit Report

Also Check: How To Unlock My Transunion Credit Report

Know About Credit Score And How Is It Calculated

A credit score can be defined as a 3-digit number between 300 and 900 that describes the credit merit of a credit card holder or of an individual who has taken a loan. In order to grant a loan in India, the potential lenders use the credit scores calculated by CIBIL TransUnion, Experian, Equifax or CRIF High Mark. Several lenders consider CIBIL score to be the benchmark for granting a loan to a borrower. Credit scores help to depict the credit and repayment history, utilization of credit, tenures of previous debts, and so on. Although the banks in India have their individual limit to grant loans, your chances of getting a loan approved is higher if your credit score is 900.

A credit score is a representation of your creditworthiness in a numerical format. It is calculated by the four credit bureaus in the country- TransUnion CIBIL, Equifax, Experian Credit Information Company and High Mark Credit Information Service. Each credit bureau has its own proprietary algorithm they use to compute credit scores. They take into consideration several factors including credit history, repayment behaviour, among others, at the time of calculating the credit score

A credit score falls in the range of 300-900. If your credit score is closer to 900, you will have better chances of getting a good deal at the time of applying for a loan or a credit history. Majority of lenders like banks and non-banking finance companies consider a credit score of 750 and above as ideal.

Vantagescore 30 Credit Score Factors

Different credit scores can have a lot in common under the hood, but each individual scoring modeluses its own combination of factors to determine your score.

Here are the major factors that determine your VantageScore 3.0 credit scores.

Payment history The biggest factor in your scores is your history of paying bills on time. Late or missed payments in your credit history could affect your scores significantly.

Age and type of credit A longer credit history, particularly with the same accounts, shows lenders that youve been able to stick with your accounts over time. Lenders may also consider it a plus if you have a mix of credit accounts with positive use.

Your measures the amount of credit you use relative to the amount available to you. Most experts recommend shooting for a rate below 30%, meaning you use less than 30% of your available credit.

Balances Similar to credit utilization, this factor takes into account your total balances across your accounts but in terms of the dollar amount and not the percentage. If you already owe a fair amount elsewhere, lenders may be less inclined to extend more credit to you.

Read Also: Qvc Collection Agency

Also Check: Is Ic Systems A Legitimate Company

How Often Is Your Credit Score Updated

Your credit scores are always based on an analysis of one of your credit reports. Rather than being updated at specific intervals, a credit score is created when you checks your credit report. New information could be added to your credit report at any time, which means the resulting score could change.

You may also see different scores if you’re checking credit reports from different credit bureaus, as it’s not uncommon for there to be differences between your credit reports. Or, even if you’re checking the same report at the exact same time, you could get different scores depending on which scoring model analyzes the report.

A Note About Credit Scores

Before we get into specifics, there are a few things youll want to understand about your credit score. The first is that you dont have one single credit score. Many folks might find that disconcerting. After all, its called your credit score, not scores. Theres usually no plural mentioned. However, the difference lies in how each credit company does their calculations.

Most of the time theyll use the FICO model or the VantageScore model, which is newer. Know that each model uses its own proprietary calculations. Despite the secretive nature, both still value similar behaviors when calculating your score, even if they weigh those factors differently. You could theoretically have two different scores, stemming from one single behavior pattern. Regardless, your scores should still be fairly close across the board.

Speaking of scores, lets break it down. Poor credit scores are basically anything below a 579, according to Bank of Americas Better Money Habits. Your score is considered fair when its between 580 and 669. If you land anywhere between 670 and 739, your credit ranks good. Those above 740 and up to 799 are labeled very good. Credit scores above 800 are exceptional. But dont stress if youre not there, because the average score is about 700.

You May Like: Can You Get Inquiries Removed

What Other Free Tools Does Credit Karma Offer

Free credit reportsOn Credit Karma, you can check your free credit reports from Equifax and TransUnion. And as with your credit scores, you can check your free credit reports as often as you like.

Free credit monitoringCredit Karmas free credit-monitoring service can alert you to important changes on your Equifax and TransUnion credit reports. Along with checking your credit scores regularly, this feature sends you an alert so you can sniff out any suspicious activity.

Mobile appThe allows you to check your credit scores on the go. The app also features tools ranging from the newRelief Roadmap to opt-in push notifications that help alert you to potential changes on your Equifax or TransUnion credit reports.

Recommended Reading: Does Eviction Show On Credit Report

How Are Credit Scores Calculated For Home Loans

- FICO Score 2 from Experian

- FICO Score 4 from TransUnion

- FICO Score 5 from Equifax

- Equifax Beacon 5.0

- Experian/Fair Isaac Risk Model v2

- TransUnion FICO Risk Score 04

A lender knows if someone has a 760 FICO score, that person is a good lending risk, says mortgage broker Steve Foster, of Vista Financial Advisors in Pasadena.

While you can get a conventional loan with a 620, youre not going to want to, says Thompson, of Memphis-based Good News Lending.

Also Check: Does Uplift Do A Hard Credit Check

Types Of Personal Credit Scores

Generally speaking, there are two major credit scoring companiesFICO and VantageScoreeach with its own scoring models. Score ranges are the same for the most common models, but there are some differences between the criteria considered in each calculation. Likewise, each scoring convention pulls information from a different combination of bureaus and imposes its own minimum scoring requirements.

For example, VantageScore was created by the three major credit bureaus, so each consumer has a single VantageScore. In contrast, FICO has bureau-specific scoring models that can vary depending on the information in a borrowers Experian, Equifax and TransUnion reports.

The two major scoring models also treat new borrowers differently. To generate a score, FICO requires borrowers have an account thats six months or older plus activity on an account within the last six months. VantageScore can calculate a credit score as long as the consumer has at least one accountregardless of its age.

Your Credit Score Is A Major Factor In Your Ability To Get A Loan And How Much Interest You Pay A Good Credit Score Could Save You Thousands Of Dollars Over The Course Of A Mortgage For Instance Understanding How Your Credit Score Is Calculated Can Help You Keep Your Score In A Good Spot

Most lenders report information about their accounts with consumers to three major credit bureaus: Experian, TransUnion, and Equifax. The information reported to a bureau is included in the consumer’s credit report with that bureau. The credit report may include a credit score, which is a three-digit number summarizing an individual’s credit risk. A consumer’s credit score is based on the consumer’s full credit report at the bureau and is calculated using proprietary models developed by private companies such as the Fair Isaac Corporation . Every day, thousands of lenders, landlords, and employers use credit scores to make credit, housing, and employment decisions. Although none of the bureaus share the exact formulas for each of their credit score models, FICO’s website indicates these are the main five categories of information they consider and the approximate weight of each. For more information about FICO and its credit scores, visit myfico.com.

You can check your credit records from each of the three credit bureaus for free annually. To order your free credit report call 322-8228 or visit annualcreditreport.com.

Also Check: What Is Cbna On Credit Report

How Is My Credit Score Calculated

Five factors are used to determine your credit score:

Payment history: Do you usually make on-time payments, or do records show missed payments?

These 5 categories may be weighed differently, depending on the type of score.

What Does A Credit Score Mean

A credit score is a number which can range from a low near 300 to a high of 850 or 900 .

If someones score is 580, it means that 580 people out of 850 are likely to repay their debt. If someones score is 780, it means that 780 people out of 850 are likely to repay their debt.

The number represents the odds that a lender will get the money back that they lend someone. The higher the number, the better the odds.

Don’t Miss: Check Credit Score Without Social Security Number

The Credit Scoring Model

Your credit scores are numeric representations of the risk you could pose to a lender when you borrow money. Your credit scores are intended to reflect the level of risk a lender takes when considering you for a loan. The scores typically range from 300 to 850, with higher scores indicating better credit than lower scores.To calculate your score, the positive and negative information in your credit report is broken down into five scoring categories. Your payment history and the amount of money you owe are weighted most heavily. The length of your credit history carries some weight, as does your mix of credit and the amount of new credit you have applied for or opened.

Length Of Credit History15%

A consumers credit history length accounts for 15% of their credit score, making it the third most impactful factor. To evaluate the length of a borrowers credit history, the scoring models identify the average age of all accounts the ages of the oldest and newest accounts the length of time each account has been open and the date on which each account was last active.

For this reason, its best not to close older accounts in good standingespecially if you plan to apply for a mortgage or other large loan soon. Improving this aspect of your score typically requires time and patience. That said, becoming an authorized user on an older account in good standing may help you boost the age of your credit and improve your score.

Also Check: Does Paypal Credit Affect Your Credit Score