Understanding Your Equifax Credit Report And Credit History

Reading time: 3 minutes

- Learn what information is on your Equifax credit report

- Hard inquiries on credit reports can impact credit scores

- What to consider before shopping around for a loan

School report cards contain numbers or letters summarizing and evaluating students performance. As they get older, these report cards may be used to help determine students eligibility and acceptance into colleges or other programs.

Your relationship with your Equifax credit report isnt much different. It contains information summarizing how you have handled credit accounts, including the types of accounts and your payment history.

Simply stated, your Equifax credit report is made up of:

-

Personal information such as your full name, address, and Social Security number.

-

as reported to Equifax by your lenders and creditors. This information includes the types of accounts, the date those accounts were opened, your credit limit or loan amount, current balances on the accounts and payment history.

-

Inquiry information. There are two types of inquiries: hard and soft. Read more about inquiries below.

-

Bankruptcies and related details about them, such as the filing date and chapter .

-

Collections accounts. This includes past-due accounts that have been turned over to a collection agency. These can include your credit accounts as well as accounts with doctors, hospitals, banks, retail stores, cable companies or mobile phone providers.

Why inquiries are important

Do your credit homework

Understanding Credit Reports In Canada

Before we go further, lets start things off with a quick review of the basics.

A holds information about how you manage credit. Its the job of credit bureaus, also known as credit reporting agencies, to record how you use and repay credit products such as credit cards and loans. This information is sent from lenders to credit bureaus, then its added to your credit report.

In other words, companies use credit reports to find out more about you then use this information to make decisions.

Best of all, a credit report shows you how your financial behaviour affects your creditworthiness, allowing you to make better financial decisions that ultimately improve your credit. You can also protect against identity theft and fraud.

Check your credit report doesnt affect your .

Can Someone Run A Credit Report Without Me Knowing

It depends. Like we said earlier, there are soft inquiries and hard inquiries. Soft inquiries happen all the time without you even knowinga company might check your credit score if theyre planning on mailing you a promotional offer. These inquiries dont affect your credit score at all.

But hard inquiries require your actual consent before they can happen. These impact your credit score and cant legally be done without you knowing, so breathe easybut dont slack off when it comes to keeping an eye on your credit. Check your credit report at least once a year, and if you notice a hard inquiry you didnt authorize, youll need to dispute it with the credit agency.

Also Check: Which Credit Bureau Does Capital One Pull

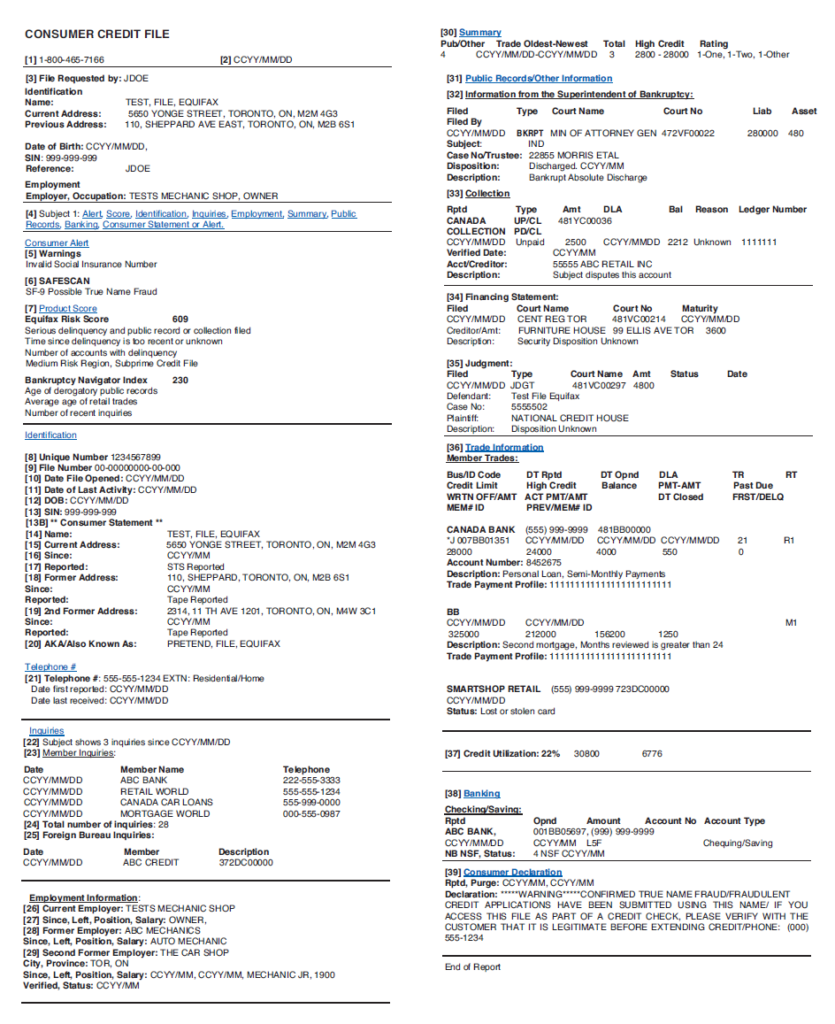

How To Read A Myequifax Canada Credit Report

Lets look at how Canadian Equifax credit reports are displayed and what each section means.

Your Equifax credit report is a record of your financial history, such as open credit accounts, defaulted or closed accounts, missed or late payments, debts sent to collections, court decisions and inquiries from lenders.

A credit report helps you understand how your financial behaviour affects your credit, which allows you to make better decisions.

When you log in to myEquifax, youll see a summary of your credit report:

Choose view your credit report to see the full report. When you do so, youll be able to access a breakdown of your credit report.

What Information Is In A Credit Report

Learn about positive and negative information on your credit report, and how creditors may use this information. 2:21

A credit report is a summary of your credit history. Potential creditors and lenders use credit reports as part of their decision-making process to choose whether to extend you credit and at what interest rate. Its important to check your credit report regularly because creditors and lenders use the information in it, such as your payment history and the number of active credit accounts, also known as tradelines, to evaluate your creditworthiness.

There are two nationwide credit reporting agencies Equifax and TransUnion both of which maintain consumer credit reports containing information reported to them by lenders and creditors. Your credit report may not be identical with each of the two agencies, as some lenders may report information to both of them, just one, or sometimes none at all.

Recommended Reading: Sync/ppc On Credit Report

Also Check: How To Raise Your Credit Score 50 Points

How To Dispute Inaccuracies

Any mistakes on your credit report need to be taken up with the agency that shows the error. Write a letter that lists each incorrect item you found and why youre disputing it.

Lets say you closed a credit card, but it still shows up as an open account on your credit report. Heres what you need to do: Gather up documents and any evidence you have to prove its a mistake. Then, send all of this by certified mail to the credit reporting agencyand dont forget a return receipt! The agency has only 30 days to respond, so you should see some movement pretty quickly.

How To Get A Copy Of Your Credit Report From All Three Major Credit Bureaus

You can order one free copy annually of your credit report from Equifax, Experian and TransUnion by requesting it online with each bureau. Or get your hands on all three reports at once by ordering them at AnnualCreditReport.com.

Youre also entitled to a free copy of your credit report from a credit bureau that provided a report to a creditor that declined your credit application.

Read Also: Carmax Bad Credit Finance

How To Create A Myequifax Account

The first step is to create a myEquifax account. You can do this by registering for an account and supplying some basic information such as your name, date of birth and address.

Entering your Social Insurance Number is optional, but it assists Equifax in locating your credit report and verifying your identity.

How To Get A Credit Report In Canada

There are two major credit bureaus, also known as credit reporting agencies, in Canada: Equifax and TransUnion.

Occasionally, a lender might report to one credit bureau, meaning your credit report might not be the same for each bureau. Thats why its essential to check both.

Both offer a free service that allows you to order a copy of your credit report.

Recommended Reading: What Credit Score Do I Need For Ashley Furniture

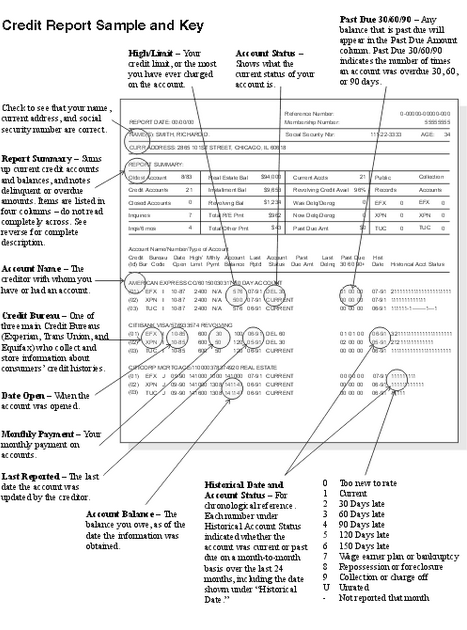

Codes That Describe Inquiries On Your Equifax Credit Report

There are a few other codes you may see in your Equifax credit report. These pertain specifically to soft inquiries made about you by a host of creditors, lenders, insurers, employers and others.

Your existing creditors sometimes initiate inquiries, or reviews of your credit, purely as a way to keep tabs on your credit health. These are known as soft credit inquiries. They do not impact your credit score and other people cant see them only you can.

Your current creditors may be doing soft pulls of your credit report in order to decide whether to increase or decrease your credit line. Alternatively, they may be reviewing your credit files to make you a promotional offer of some kind.

This is also the case with other third-party banks, lenders and additional entities with whom you are not presently doing business. They get your name, address and limited credit information about you but not your full, detailed credit report solely for the purpose of making you a credit offer.

According to Equifax, these are some of the notations you might find related to various soft inquiries made of your credit file.

PRM Inquiries with this prefix indicate that only your name and address were given to a credit grantor so they can provide you a firm offer of credit or insurance. PRM inquiries remain on your credit report for 12 months.

EMPL Inquiries with this prefix indicate an employment inquiry. EMPL inquiries remain on your credit report for 24 months.

Will A Bad Credit Message Stay On My Report Forever

Bad credit on your report can lower your score. If you miss payments or make partial payments, or if there’s been an error, it can leave you with a bad credit message or note. These messages can linger on your credit report not forever, but for years. Bankruptcies and consumer proposals stay on your credit report for up to seven years from the date of discharge for your first occurrence, and even longer for subsequent bankruptcies.

If you think there’s an error on your report or you have the opportunity to fix a situation that’s hurting your credit, ask the lender to report it to the credit bureau. They may be able to help raise your credit sooner.

Read Also: Klarna Walmart

Check And Monitor Your Credit Reports And Credit Scores

Now that you know why your credit is so important, you can see why itâs a good idea to check and monitor your credit. But how do you do it?

How to Request Free Copies of Your Credit Reports

You can get a free copy of your credit report from each of the three major credit bureausâEquifax, Experian and TransUnionâby visiting AnnualCreditReport.com. Youâll need to provide your:

- Legal name.

- Social Security number.

- Current address.

If youâve moved in the past two years, you may need to include your previous address as well. There may be a limit on how often you can obtain your reportâcheck the site for details.

Once youâve provided the information above, youâll pick which credit reports you want before answering a few additional questions that help verify itâs really you. âThese questions are meant to be hard,â according to AnnualCreditReport.com. âYou may even need your records to answer them. They are used to ensure that nobody but you can get your credit information.â

How to Check Your Credit Scores for FreeâWithout Hurting Your Credit

Keep in mind that your credit scores donât actually appear on your credit reports. So what do you do if you want to check your scores?

Depending on your lender, you may be able to find your scores by checking your statement or by logging in to your account online. You can also get your scores directly from the credit bureaus and credit-scoring companiesâbut you might have to pay for them.

Related Content

Consumer Statement And Public Notices

This final section of your report will document any consumer proposals, bankruptcies and other judgments against you on your accounts in the past six years. After the time is up, your job is to make sure the debts are removed from your report and you have a clean slate again.

Consumer statements are any messages youd like to convey on your credit report. You could explain why theres a mark on your report. Your explanations could vary: maybe youve been a victim of fraud, you had a family emergency thats caused your payments to go into arrears a few years ago, or youre in the process of correcting an error, for example.

You could even note that youre in a debt repayment plan and getting back on track with your finances to communicate to them that youre a responsible consumer.

Worried about your credit?

Get answers from an expert.

Whether its about keeping, building, or rebuilding your credit, we can help if youre feeling overwhelmed or have questions. One of our professional credit counsellors would be happy to review your financial situation with you and help you find the right solution to overcome your financial challenges. Speaking with our certified counsellors is always free, confidential and without obligation.

You May Like: Check Credit Score Without Ssn

Negative Codes On An Experian Credit File

For example, here are a variety of negative credit scenarios, and the Experian codes used to describe them:

-

30 Days Past Due: 30

-

60 Days Past Due: 60

-

90 Days Past Due: 90

-

120 Days Past Due: 120

-

150 Days Past Due: 150

-

180 Days Past Due: 180

-

Collection: C

-

Claim filed with government: G

-

Insurance claim: IC

-

Voluntarily surrendered: VS

Again, none of these is a flat-out credit deathblow in and of themselves.

But if your credit reports show a repeated pattern of late payments and an inability or unwillingness to pay your obligations, then banks, credit unions and other financial institutions definitely wont be beating down your door to offer you credit.

Not All Credit Reports Are Created Equally

Be sure to get your reports from each of the three credit bureaus.

A lot of consumers dont know this: The information reported on each credit bureaus report can be very different. Thats because a creditor might report to only one or two of the bureaus.

As a result, one of your three credit reports could be accurate while the other two could have credit reporting errors. If you see only the accurate credit report, you wont know about the inaccuracies on the other bureaus reports.

Since most lenders use your FICO score, which is an amalgamation of your other three reports, you may not know about your bad credit until you apply for a mortgage or a car loan and get quoted an astronomical interest rate.

Only by getting all three reports can you know for sure.

Read Also: Is Ic Systems A Legitimate Company

How Is My Credit Score Calculated

Although it’s hard to find a definite mathematical formula, Equifax reports that several factors contribute to your overall score to some degree. These include:

- Your payment history, including what you’ve paid and how much

- Your credit utilization, which measures your credit balances in relation to your credit limits

- The length of your credit history

- Public records, for example monies owed from civil legal proceedings, liens, unpaid taxes, and so on

- The number of credit inquiries on your account

How Credit Scores Are Calculated

Each credit reporting agency has its unique scoring card. To make things even more complex, each lender will specify what type of credit profile they are looking for in prospective customers. This lack of standardization leads to scoring inconsistencies.

For example, a person could have a credit score of 680 when signing into their Equifax account, but the credit-granting establishment may only see a credit score of 650! What gives? What can you do about it? Since there are no standardized credit scoring models that are universally accepted, it truly is consumer beware. This can be problematic when a consumer has a borderline credit score and is applying for mortgages.

Real estate prices in Canada are at epic highs, and most Canadians do not have the 20% down payment needed for a mortgage. As a result, the only way a person can buy a home is by qualifying for CMHC insurance. The minimum credit score needed to qualify for a CMHC insurable mortgage is 600. You need to be sure that your credit score is correct.

Back to the lack of standardization. The majority of lenders look at credit reports from both Equifax and TransUnion. It is possible a borrower could have a 700 score with Equifax and a 600 with Transunion. These disparities are a cause for some financial anxiety because lenders make their decisions solely on these scores.

You May Like: Remove Repossession From Credit Report

Why You Would Want An Equifax Business Credit Report

Part of the reason you want an Equifax business credit report is the same reason you would want any business credit report: to gain a better understanding of your businesss financial health and appeal to potential lenders and investors.

But an Equifax business credit report has the added benefit of providing credit risk and business failure risk scores, which you dont get with the other credit bureaus. These scores may not be particularly helpful to a small business but can provide valuable insight to lenders. In addition, these scores can come in handy if you are considering buying out a competitor in your industry or merging with another business.

Accessing Your Credit Report

Your credit report is compiled when you or your lender request it. It contains information that is supplied by lenders, by you and by court records.

In order to obtain your credit report, you must provide your name, address, Social Security number, and date of birth. If you’ve moved within the last two years, you should include your previous address. To protect the security of your personal information, you may be asked a series of questions that only you would know, like your monthly mortgage payment.

Since lenders may review your FICO® Scores and credit report from any of the three credit bureaus, it’s suggested that you check your credit report from all three and make sure they’re all accurate.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

Also Check: Usaa Credit Score Monitoring

How Your Credit Report Is Maintained

TransUnion, Equifax and Experian are the three bureaus that maintain credit reports. They issue credit reports to creditors, insurers and others businesses as permitted under law.

When you apply for any new line of credit – for example, a new credit card – the creditor requests a copy of credit report from one or more of the credit bureaus. The creditor will evaluate your credit report, a credit score, or other information you provide to determine your credit worthiness, as well as your interest rate. If you’re approved, that new card – called a tradeline, will be included in your credit report and updated about every 30 days.

Tens of thousands of credit grantors – retailers, credit card issuers, banks, finance companies, credit unions, etc. – send updates to each of the credit reporting bureaus, usually once a month. These updates include information about how their customers use and pay their accounts.