Monitor Your Credit Report To Stay In The Right Credit Score Range

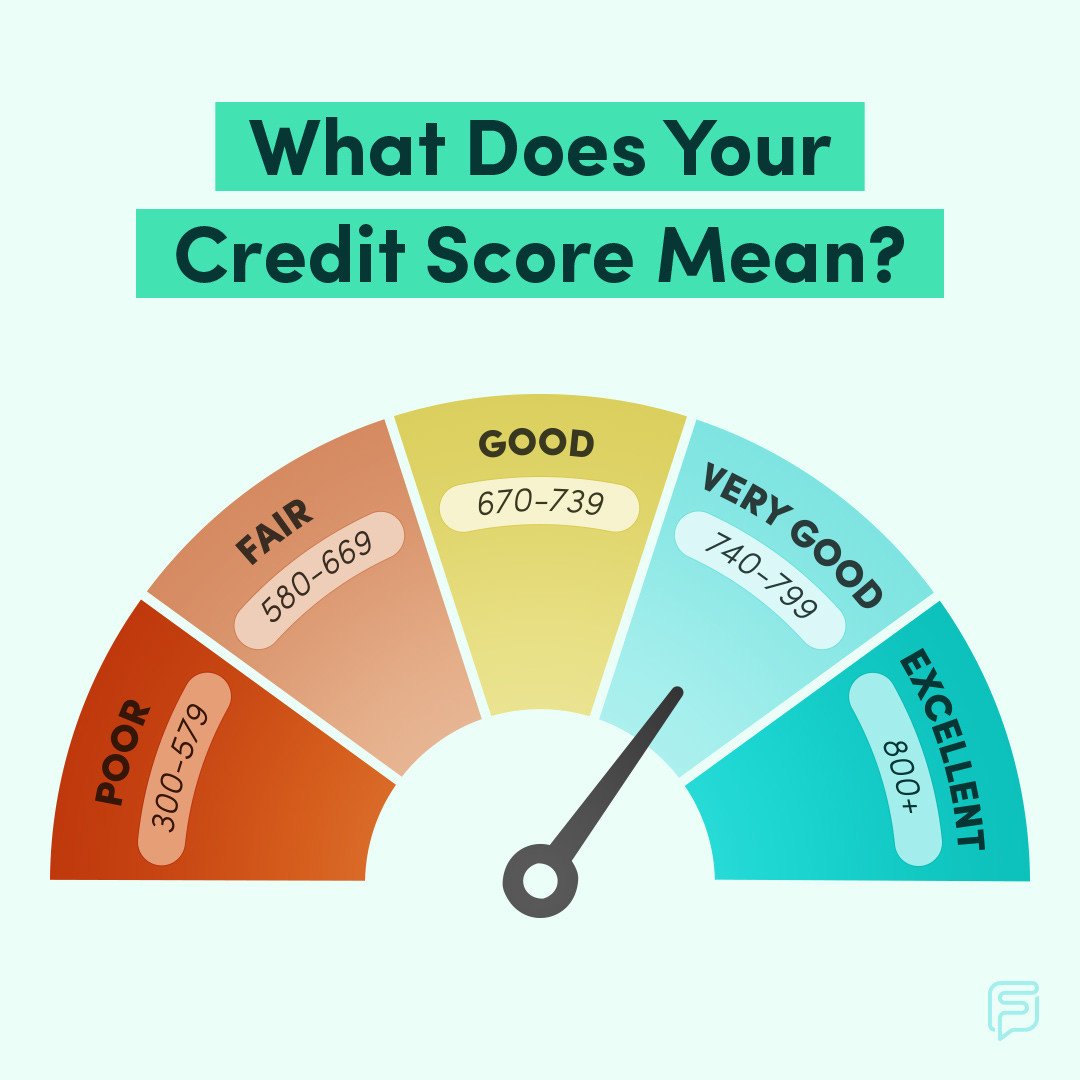

The data in your credit report directly affects your FICO® Scores and its a good idea to check your credit report once per year through the free resource, AnnualCreditReport.com. Similarly, if you have signed up for a service to check your credit score or you are provided your score by a lender, for example, youll know where you stand. And when you know more about your score, you can find out where you fall on this credit score chart.

Legal Disclaimer: This site is for educational purposes and is not a substitute for professional advice. The material on this site is not intended to provide legal, investment, or financial advice and does not indicate the availability of any Discover product or service. It does not guarantee that Discover offers or endorses a product or service. For specific advice about your unique circumstances, you may wish to consult a qualified professional.

What’s A Good Credit Score To Have How To Get It

Advertiser Disclosure

Advertiser Disclosure: ValuePenguin is an advertising-supported comparison service which receives compensation from some of the financial providers whose offers appear on our site. This compensation from our advertising partners may impact how and where products appear on our site . To provide more complete comparisons, the site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, approved or otherwise endorsed by the credit card issuer. This site may be compensated through a credit card issuer partnership.

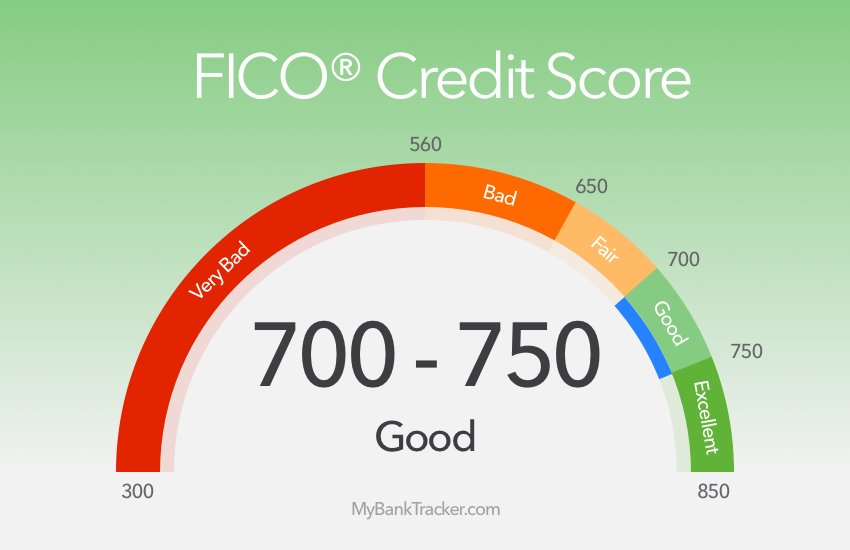

A good typically ranges between 680 and 750. Consumers who fall within this spectrum tend to qualify for excellent interest rates, and loans. However, what constitutes a good credit score is far more nuanced. In reality, the range of scores will depend on both the exact credit scoring model being used and its purpose.

Types Of Credit Scores

It is important to know that you do not have just one credit score and there are many credit scores available to you as well as to lenders.

Any credit score depends on the data used to calculate it, and may differ depending on the scoring model, the source of your credit history, the type of loan product, and even the day when it was calculated.

FICO and Vantage are frequently used credit score models.

Recommended Reading: Can A Public Record Be Removed From Credit Report

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired.

What A Good Credit Score Can Get You

Having good credit matters because it determines whether you can borrow money and how much you’ll pay in interest to do so.

Among the things a good credit score can help you get:

-

An unsecured credit card with a decent interest rate, or even a balance-transfer card.

-

A desirable car loan or lease.

-

A mortgage with a favorable interest rate.

-

The ability to open new credit to cover expenses in a crisis if you don’t have an emergency fund or it runs out.

A good credit score helps in other ways: In many states, people with higher credit scores pay less for car insurance. In addition, some landlords use credit scores to screen tenants.

So having a good credit score is helpful whether you plan to apply for credit or not.

If your credit score is below about 700, prepare for questions about negative items on your credit record when shopping for a car. People with major blemishes on their credit are routinely approved for car loans, but you may not qualify for a low rate. Read about what rates to expect with your score.

You dont need flawless credit to get a mortgage. In some cases, credit scores can be in the 500s. But credit scores estimate the risk that you wont repay as agreed, so lenders do reward higher scores with lower interest rates. Read about your mortgage options by credit score tier.

Landlords or property managers generally aren’t looking for immaculate scores, they are interested in your credit record. Learn more about what landlords really look for in a credit check.

Read Also: How To Get A Repossession Off Your Credit

Length Of Credit History

The remaining three pieces are not weighted as heavily, but they are still important. At 15% for FICO and considered less influential with VantageScore is credit history, which is not to be confused with your payment history. This measures the length of your oldest credit line and the average age of your accounts, so try to keep your oldest accounts open if possible.

Different Credit Score Calculations

Your FICO Score is determined by a combination of five credit factors. These factors include amounts owed, credit mix, new credit, length of credit history, and payment history.

FICO assigns a percentage to each of these factors to determine how much weight they carry in your credit score calculation:

- Payment history: 35 percent

- Length of credit history: 15 percent

- New credit: 10 percent

FICO has also recently introduced modifications to its score calculations. The modifications are a part of the FICO Score 10 Suite. The suite includes two new scoring models, FICO 10 and FICO 10T.

FICO 10 is most similar to the current FICO 9 model, while FICO 10T includes trended data, or how you manage your credit accounts over time. Its meant to give lenders insight into how you manage payments and whether you reduce or increase your debt over time.

VantageScore calculates your credit score using similar factors as FICO, though VantageScore weights factors differently. Payment history is still the most influential factor for VantageScore. However, your credit mix and credit history carry more weight in the VantageScore rankings. Instead of exact percentages, VantageScore offers a hierarchy of its scoring factors:

- Payment history: Extremely influential

Don’t Miss: Removing Inquiries From Transunion

How To Maintain Your Credit Score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. Thats the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 Thats because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

Legal

Why Credit Scores & Credit Score Ranges Matter

If youre applying for credit, the range and category your FICO Score or VantageScore falls within could affect you in the following ways:

Don’t Miss: Carecredit Score Needed

Make The Most Of A Thin Credit File

Having a thin credit file means that you dont have enough credit history on your report to generate a credit score. An estimated 62 million Americans have this problem. Fortunately, there are ways to fatten up a thin credit file and earn a good credit score.

One is Experian Boost. This relatively new program collects financial data that isnt normally in your credit report, such as your banking history and utility payments, and includes that in calculating your Experian FICO credit score. Its free to use and designed for people with limited or no credit who have a positive history of paying their other bills on time.

UltraFICO is similar. This free program uses your banking history to help build a FICO score. Things that can help include having a savings cushion, maintaining a bank account over time, paying your bills through your bank account on time, and avoiding overdrafts.

A third option applies to renters. If you pay rent monthly, there are several services that allow you to get credit for those on-time payments. For example, Rental Kharma and RentTrack will report your rent payments to the credit bureaus on your behalf, which in turn could help your score. Note that reporting rent payments may only affect your VantageScore credit scores, not your FICO score. Some rent-reporting companies charge a fee for this service, so read the details to know what youre getting and possibly purchasing.

Consumer Credit Card Debt Showed Biggest Decrease

- 75% of U.S. adults have a credit card balance greater than $0.

- The average FICO® Score for someone with a credit card balance in 2020 was 735.

- The percentage of consumers’ credit card accounts 30 or more DPD decreased by 29% in 2020.

In 2020, credit card balances saw the most drastic change of any debt type, reversing a nearly and decreasing by 14%. Credit cards are the most popular form of debt: More than 90% of U.S. adults have a credit card account listed in their credit report.

Generally speaking, revolving debt carries more weight than installment debt in FICO® Scores. The trend of lower credit card balances is also driving lower revolving utilization ratios, which is having a positive effect on average FICO® Score results.

Read Also: Does Kornerstone Credit Report To The Credit Bureaus

Why There Are Different Credit Scores

For example, VantageScore creates a tri-bureau scoring model, meaning the same model can evaluate your credit report from any of the three major consumer credit bureaus . The first version was built in 2006. The latest version, VantageScore 4.0, was released in 2017 and developed based on data from 2014 to 2016. It was the first generic credit score to incorporate trended datain other words, how consumers manage their accounts over time.

FICO® is an older company, and it was one of the first to create credit scoring models based on consumer credit reports. It creates different versions of its scoring models to be used with each credit bureau’s data, although recent versions share a common name, such as FICO® Score 8. There are two commonly used types of consumer FICO® Scores:

- Base FICO® Scores: These scores are created for any type of lender to use, as they aim to predict the likelihood that a consumer will fall behind on any type of credit obligation. Base FICO® Scores range from 300 to 850.

- Industry-specific FICO® Scores: FICO® creates auto scores and bankcard scores specifically for auto lenders and card issuers. Industry scores aim to predict the likelihood that a consumer will fall behind on the specific type of account, and the scores range from 250 to 900.

Ways To Improve Your Credit

Now that you know more about the benefits of good credit, you may want to work on improving yours. These seven steps for improving your credit could help:

Don’t Miss: How To Remove Serious Delinquency On Credit Report

How To Build Good Credit

Approximately 62 million Americans have no credit data to score or are considered thin files . When just starting your credit score journey, it can be difficult to access financial products to build credit if you dont even have a credit history established.

Some easy ways to establish a credit history include:

- Get a secured credit card. With a secured credit card, you put up a deposit and the issuer gives you a credit line based on your deposit. Then you use the credit card as normal, making payments and charging purchases on a rotating basis while the issuer reports to all three credit bureaus Equifax, Experian and TransUnion.

- Use non-bureau reporting information such as utility payments, rent payments or bank account history with a program like Experian Boost or UltraFICO to supplement the data in your file.

- Become an authorized user on a trusted persons credit card. If you have a strong enough personal relationship with someone like a family member, ask them if they could add you as an on their account. You dont even have to use the card, as long as the primary account holder uses the card and pays it on time, youll build credit history.

Helocs One Of Only Two Debts To See Balances Decrease

- 12% of U.S. adults have a HELOC.

- The average FICO® Score for someone with a HELOC in 2020 was 777.

- The percentage of consumers’ HELOC accounts 30 or more DPD decreased by 26% in 2020.

Consumers’ HELOC debt was one of only two debt types that saw balances decrease in 2020. HELOC balances shrank by 7% compared with 2019, when these balances saw a 4% reduction. The average credit score among consumers with HELOCs was the highest of any debt typenearly 70 points higher than the average FICO® Score in the U.S.

In line with most other debts, HELOC delinquencies shrank by 26% in 2020. Compared with 2019when the ratio dropped 6%the percentage of accounts 30 or more DPD dropped by 20 percentage points more in 2020.

Read Also: When Do Things Fall Off Your Credit Report

What To Do If You Don’t Have A Credit Score

For FICO® Scores, you need:

- An account that’s at least six months old

- An account that has been active in the past six months

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

If you aren’t scorable, you may need to open a new account or add new activity to your credit report to start building credit. Often this means starting with a or secured credit card, or becoming an .

What Affects Your Credit Scores

Common factors can affect all your credit scores, and these are often split into five categories:

- Payment history: Making on-time payments on your credit accounts can help your scores. But missing payments, having an account sent to collections or filing bankruptcy could hurt your scores.

- : How many of your accounts have balances, how much you owe and the portion of your credit limit that you’re using on revolving accounts all come into play here.

- Length of credit history: This category includes the average age of all your credit accounts, along with the age of your oldest and newest accounts.

- Types of accounts: Also called “credit mix,” this considers whether you’re managing both installment accounts and revolving accounts . Showing that you can manage both types of accounts responsibly generally helps your scores.

- Recent activity: This considers whether you’ve recently applied for or opened new accounts.

FICO® and VantageScore take different approaches to explaining the relative importance of the categories.

Also Check: Afni Subrogation Department Bloomington Il

Why Does A Good Credit Score Matter

A good or excellent credit score will save most people hundreds of thousands of dollars over the course of their lifetime. Someone with excellent credit gets better rates on mortgages, auto loans, and everything that involves financing. Individuals with better credit ratings are considered lower-risk borrowers, with more banks competing for their business and offering better rates, fees, and perks. Conversely, those with poor credit ratings are considered higher-risk borrowers, with fewer lenders competing for them and more businesses getting away with criminally high annual percentage rates because of it. Additionally, a poor credit score can affect your ability to find rental housing, rent a car, and even get life insurance because your credit score affects your insurance score.