How To Increase Your Credit Score

Now that you know a little bit more about credit scores, you might be motivated to increase yours. Luckily, there are many ways that you can work to improve your score. Dont be discouraged if youre unable to increase your credit score overnight. It will take some time, but it will happen with intentional steps.

Importance Of Keeping Track Of Your Credit Report

We touched on why credit scores are important and Canadas different credit reporting agencies. Now we are going to shift gears. These are things you can do to improve your credit score and save money simultaneously.

You can order free copies of your credit report from TransUnion and Equifax. There is no cost to access these reports and your credit score. However, this next step is very important, so please pay close attention.

When you receive the credit reports, go through each one line by line. If there are any mistakes, you need to document them right away, write down the mistake, and keep it. Then, we are going to show you how to have those mistakes addressed.After you have gone through every line on one credit report, repeat this step with the other and note any mistakes, even if they may seem trivial.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Also Check: Does Les Schwab Report To Credit

How Long Does It Take To Rebuild Credit

It’s hard to say with certainty how long it takes to rebuild credit because each person’s credit history is different. If you’ve had credit difficulties in the past, how long it will take to rebound depends in part on the severity of the negative information in your credit report and how long ago it occurred. While some actions can have an almost immediate effectsuch as paying down credit card balancesothers may take months to make a significant positive impact.

If you’re disputing information in your credit report you believe is fraudulent or inaccurate, the investigation can take up to 30 days. If the credit reporting agency finds your dispute valid, the information will be removed from your credit report, and your score will reflect that change as soon as it’s calculated again.

If you’re making payments or reducing your credit card balances, don’t worry if your credit report isn’t updated right away. Creditors only report to Experian and other credit reporting agencies on a periodic basis, usually monthly. It can take up to 30 days or more for your account statuses to be updated, depending on when in the month your creditor or lender reports their updates.

Avoid Closing Old Accounts

The length of your payment history accounts for 15% of your FICO score the more of it you have, the better, as long as it doesnt include derogatory items like delinquencies, collections, write-offs, bankruptcies, and foreclosures.

FICO examines several aspects of your payment history, including:

- The ages of your oldest and newest credit accounts.

- The average age of all your credit accounts.

- When each specific account was established.

- Any long lapses in the use of certain accounts.

Given these guidelines, FICO advises that you not close old credit card accounts. Rather, use all cards at least once a year, or else some accounts may be considered inactive.

Don’t Miss: How To Get Public Record Off Credit Report

Benefits Of Using Credit Repair Consultants

Most of us are not familiar with the inner workings of Equifax and TransUnion and the laws that govern them. However, a little-known secret to credit rebuilding is to seek out the help of professional credit repair consultants. Yes, not an app, but a person.

These individuals are fully versed in the laws that these credit reporting agencies must abide by. With your permission, the credit repair consultants contact the credit reporting agency and have the incorrect information removed as soon as possible. The experts will go through your report with a fine-tooth com and come up with a plan to improve your credit score. Remember, these credit repair professionals have worked on thousands of accounts and have documented success.

Think about this situation: you are shopping for a mortgage but also have errors on your credit score. If you are in a situation where you need to see quick results but are disputing your score on your own, these experts can really save the day. It may be worth the money to hire help.

However, when using a credit repair consultant, you must provide them with full transparency. Things that seem trivial to you can impact the outcome of your credit rebuilding goals. Be honest about everything.

Keep Your Credit Card Accounts Open

This step may seem counter-productive when weighed up with the need to keep your balances low, but that couldnt be further from the truth. In fact, closing down your credit cards wont help to improve your credit score, and may actually harm it.

Heres the deal:

Carrying maxed-out credit cards might be bad, but having credit card accounts open with little-to-zero balances will show a reliability and safety in handling money that has been lent to you. A low balance shows youre financially responsible and pay back your debts on time.

The best part? Should something go wrong that affects your credit score, cash flow, or your ability to gain finance, having credit cards on hand for a financial emergency could prove invaluable.

- WHILE YOURE HERE:Get out of credit card debt fast with these 5 tips

Don’t Miss: Navy Fed Car Buying Program

How Long Does It Take To Raise Your Credit Score

For the most part, developing a strong credit score takes time. Credit reporting bureaus want to see that you have a history of paying your bills on time, and that you use credit judiciously. A FICO credit score ranges between 300-850. Scores above 670 range from “good” to “exceptional,” while anything below 670 is considered “fair” to “poor.” To get in the “good” to “exceptional” range you need to build a good bill payment and credit history.

Leave Old Accounts Open

Once you finally get rid of student debt or pay off your auto loan, you may be impatient to get any trace of it wiped from your report.

But as long as your payments were timely and complete, those debt records may actually help your credit score. The same is true for your credit card accounts.

An account thats paid in full is a good thing however, closing an account isnt something that consumers should automatically do in the hopes that it will positively impact their credit score, says Nancy Bistritz-Balkan, vice president of communications and consumer education at Equifax. Having an account with a long history and solid track record of paying bills on time, every time, are the types of responsible habits lenders and creditors look for.

Closing a credit card account can actually lower your credit score, as you will now have a lower maximum credit limit. If youre still carrying balances on other cards or loans, your utilization ratio will go up. Youre better off keeping the card with a $0 balance.

Any bad debts that can impact your score negatively are automatically removed over time. According to Ulzheimer, bankruptcies can stay on your credit report no longer than 10 years, while late payments and delinquencies such as collections, repossessions, foreclosures and settlements stay on your report for seven years.

You May Like: Aoc’s Credit Score

How Long Does It Take To Go From A 700 To 800 Credit Score

The amount of time it takes to go from a 700 to 800 credit score could take as little as a few months to several years. While your financial habits and credit history will play a role in how long it takes, there are some factors that have specific timelines. For example, it takes up to 2 years for a hard inquiry to go off your credit report. As hard inquiries are removed, your score can go up. Your score also goes up the longer youve had credit. Each year you have your credit, your credit history gets longer, helping your score improve.

Both of these examples show why its important to consider opening new accounts when building your score. When you open a new account, you put a new hard inquiry on your report and you bring down the average age of your credit. Youll also want to consider the impact closing an account can have on your score, too. Closing an older account can lower the average age of your credit history.

Pay Your Billson Time

Ok, so this one seems pretty obvious.

Its also absolutely crucial.

Bank loans and credit cards arent the only thing that affect your credit score. Your electricity and telephone service providers are also credit providers, and theyll report delinquent accounts to credit bureaus.

Missing your payment deadlines on a few bills is a quick way to put a dent in your credit score. It will indicate that you are not reliable when it comes to on-time payments, so you need to pay them on time.

Also Check: Experian Credit Unlock

Limit How Often You Apply For New Accounts

While you may need to open accounts to build your credit file, you generally want to limit how often you submit credit applications. Each application can lead to a hard inquiry, which may hurt your scores a little, but inquiries can add up and have a compounding effect on your credit scores. Opening a new account will also decrease your average age of accounts, and that could also hurt your scores.

Inquiries and the average age of your accounts are minor scoring factors, but you still want to be cautious about how many applications you submit. One exception is when you’re rate shopping for certain types of loans, such as an auto loan or mortgage. Credit scoring models recognize that rate shopping isn’t risky behavior and may ignore some inquiries if they occur within the span of a couple of weeks.

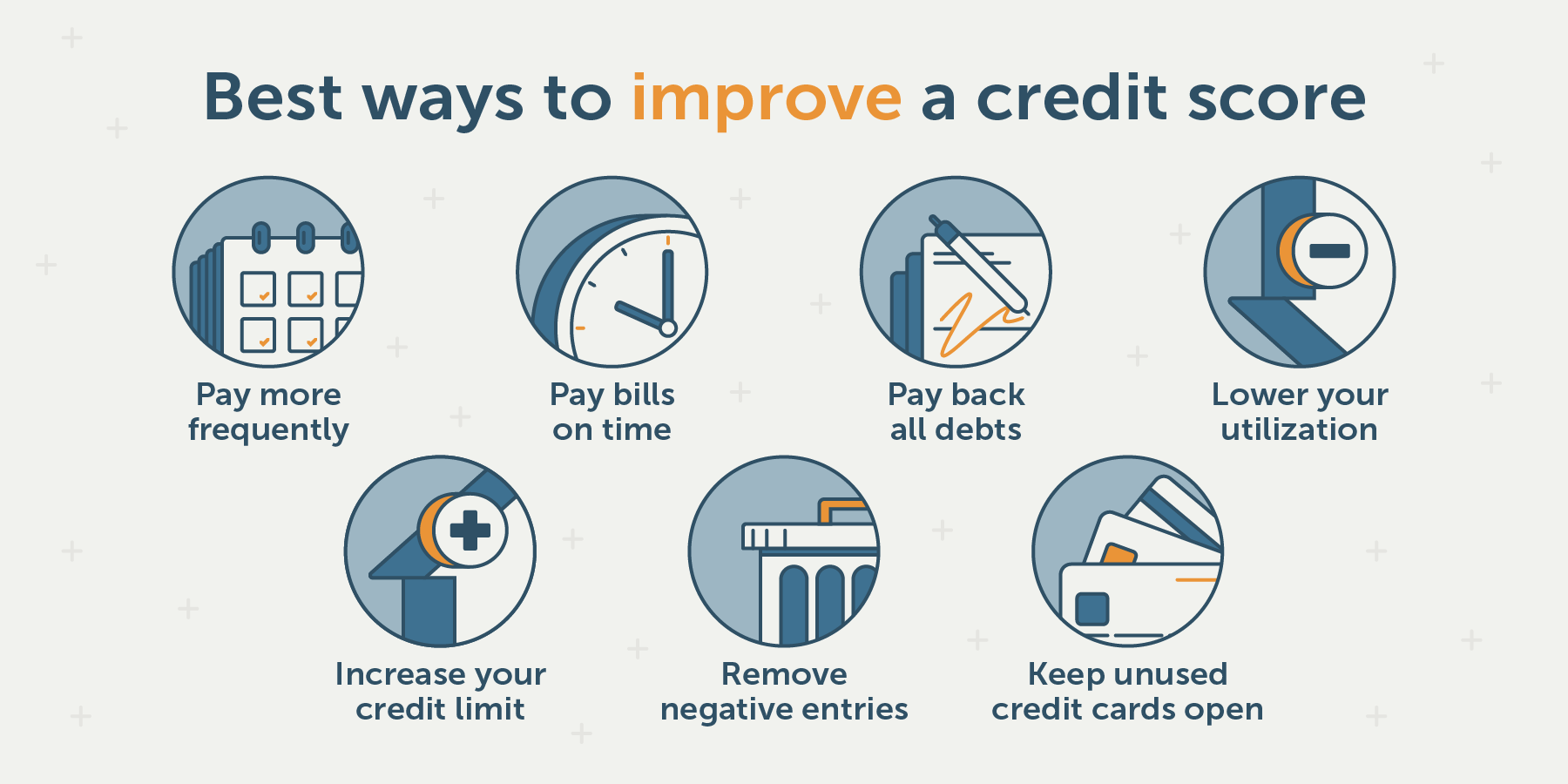

Tips That Can Help Raise Your Credit Scores

Because , building credit takes time. Depending on your individual situation, there may be ways to raise your scores quickly like paying down all your debt in a very short span of time. But if youre starting out with bad credit, even a drastic measure like that may not have the immediate effect youre looking for. No matter what, the most impactful thing you can do for your credit is to create some consistent habits. Here are some tips that can help you raise your credit scores over time.

You May Like: What Credit Bureau Does Paypal Use

Customise Your Credit Limit

Your credit utilisation ratio has a significant impact on your credit score. The more you are able to restrict your credit usage as per the allotted limit, the better it is for your credit score. Reaching the limit has the opposite effect as it lowers your credit score. One way of tackling this is to get in touch with your lender and customise your credit limit based on your expenses.

What Credit Score Do You Start With

You don’t start with any credit score, and you won’t get a score until you open a credit account that reports to the credit bureaus. Once you open an account, you will receive a score based on that account. It probably won’t be the best score since you don’t have a long enough credit history, but it won’t be the worst score, either.

You May Like: How Long Does Car Repo Stay On Credit

How Can I Improve My Credit Score By 100 Points Canada

If you pay your bills on time and use less than you have available credit limits, you can help your credit score rise the fastest. By doing these actions consistently, you may be able to score up to 100 points higher. An electronic payment history is reported to credit bureaus every 30 days resulting in added protection to your credit.

Reducing The Amount Of Debt You Owe

One good step is to start a debt reduction plan to clear up your financesâand set you on the path to a better score. Start by paying off your high interest rate cards: put all your effort into paying off a higher rate card, while maintaining payments on all other cards on auto pay. Once you’ve paid off the balance, don’t cancel your card! Keep it open, even if you don’t use it, so you can boost your credit utilization.

You May Like: Synbc Ppc

Report Your Rent And Utility Payments

If you have a limited credit history, you can use an alternative data reporting service to track metrics of financial responsibility that arent typically reported to the major credit bureaus, such as rent and utility payments.

Experian Boost is one of the most popular alternative data services. If you have cellphone accounts, utilities or streaming services that youre paying for, you can use Experian Boost to add those accounts to your credit history and become credit scorable in a matter of minutes, explains Rod Griffin, Senior Director of Consumer Education and Advocacy for Experian.

How quickly it works: It takes about five minutes for Experian Boost to improve your score, says Griffin. The average credit score increase is around 12 or 13 points. Read our guide to Experian Boost to understand the process step by step.

Indias Growth Outlook Slashed To 66% For Fy202 By Fitch

In its latest global economic forecast, Fitch lowered India’s growth forecast to 6.6 per cent for the current fiscal . It was earlier projected at 6.8 per cent. The growth outlook has been reduced owing to manufacturing and agriculture sectors showed signs of slowing down over the past year. In its latest Global Economic Outlook, the global rating agency retained its GDP growth forecast for the next fiscal at 7.1 per cent and 7.0 per cent for 2021-22. According to Fitch credit rating agency, the governmentâs income support scheme aimed at farmers and easing of regulatory policies and benchmark interest rates by the Reserve Bank of India could help Indiaâs economic growth gain momentum, reported the Mint.

20 June 2019

Read Also: How To Self Report Utilities To Credit Bureaus

Limits Your Requests For New Creditand The Hard Inquiries With Them

There are two types of inquiries into your credit history, often referred to as hard and soft inquiries. A typical soft inquiry might include you checking your own credit, giving a potential employer permission to check your credit, checks performed by financial institutions with which you already do business, and credit card companies that check your file to determine if they want to send you pre-approved credit offers. Soft inquiries will not affect your credit score.

Hard inquiries, however, can affect your credit scoreadverselyfor anywhere from a few months to two years. Hard inquiries can include applications for a new credit card, a mortgage, an auto loan, or some other form of new credit. The occasional hard inquiry is unlikely to have much of an effect. But many of them in a short period of time can damage your credit score. Banks could take it to mean that you need money because youre facing financial difficulties and are therefore a bigger risk. If you are trying to improve your credit score, avoid applying for new credit for a while.

Keep Old Accounts Open And Active

Your credit account age accounts for 15% of your credit score and the history of that account also counts towards your payment history.

Youll want to use your account to make a small purchase like gas or grocery to keep your account active.

Dormant accounts dont have any credit activity on the card in the last six months, and the lenders can close an account for inactivity.

Best for:

This strategy is perfect if you already have one or more accounts greater than nine years old. If you dont have an old account, buying a tradeline could be a great alternative.

Watch Out for:

Your credit card company will send snail mails or emails about inactivity. Sometimes, they send letters in the mail with a warning notice of closing your account if you dont use it.

Also Check: Carmax For Bad Credit

How To Get A Credit Score Of 700 Or 800

5-minute readDecember 21, 2021

Disclosure: This post contains affiliate links, which means we receive a commission if you click a link and purchase something that we have recommended. Please check out our disclosure policy for more details.

A credit score is a three-digit number that can have a big impact on your life. While a good credit score can open many doors, a bad credit score could leave you in a lurch.

Luckily, credit scores arent static numbers, and if you can figure out how to get a credit score of 700 or 800, you can enjoy some of the best rates and terms on financial products like mortgages, car loans, credit cards and personal loans.

If you dont know where to start, were here to help. Read on to learn more about the benefits of knowing how to increase your credit score and the best tips for doing so.

Dont Apply For Multiple New Credit Lines

Opening a new credit line increases your credit limit, but every application for a new credit line creates a hard inquiry on your credit report. Hard inquiry is a detailed analysis of your credit profile to assess how much risk you possess as a borrower.

As hard inquiry is reflected on your credit report for two years, multiple hard inquiries in a short span of time can negatively impact your credit score. Hard inquiry resulting in rejection of loan application is an extremely negative event.

Recommended Reading: Credit Score To Qualify For Care Credit