Fico Credit Score & Auto Loans

FICO Credit Score & Auto Loans

If you are considering buying or leasing a new vehicle, you may be paying close attention to your credit score. This number determines what your car loan interest rate will be, and will also determine your eligibility for loans. So what what exactly is a credit score and how does it impact the car buying process?

The three major credit bureaus are Experian, TransUnion and Equifax. The two big credit scoring models used by auto lenders are FICO® Auto Score and Vantage. Were going to take at look at FICO® since it has long been the auto industry standard.

FICO is an acronym that stands for: Fair Isaac Corporation, the company that developed the FICO® credit scoring.

FICO® credit scores are the auto industry standard for determining a potential buyers creditworthiness. Using a variety of factors, the company will give you a three digit score ranging from 300 to 850 .

Though FICO keeps the specifics of their credit scoring algorithm a secret, there are certain known factors that weigh into determining a persons credit score.

Many people are surprised when they arrive at the dealership, and find that their FICO credit score is not the same three-digit number they saw on the credit monitoring service that they have used.

If you want to know your exact score before you begin car shopping, simply visit myfico.com

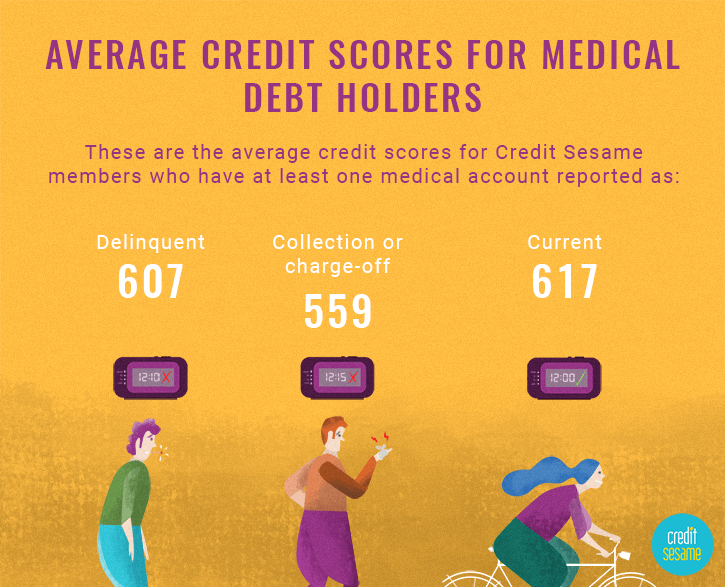

Generally speaking, banks require a minimum credit score of 600 to give an auto loan without any down payment.

Why Paying Off Your Auto Loan Early Can Actually Hurt Your Credit

A lotta folks see their credit score as a sort of financial responsibility report card.

Its a reflection of your fiscal responsibility, sure, but theres much more to it.

To explain why your credit score drops for doing something good like paying off a loan, we first need to recap how credit really works.

How Does Getting An Auto Loan Affect Your Credit Score

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

Opening any type of loan, including an auto loan, will typically result in a slight dip in your credit score. But know that its only temporary and as you make payments in a timely manner, your credit score should recover quickly.

However, its important to understand why your score drops if you get a new car loan and know that theres no reason to panic.

Recommended Reading: Does Klarna Improve Your Credit Score

Will Refinancing My Auto Loan Hurt My Credit

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

Refinancing an auto loan likely will temporarily lower your credit score, but that’s a small price to pay if the new loan saves you money or helps you avoid car payments you can no longer afford. Here’s what you need to know.

Getting Your Credit In Shape For Auto Refinancing

When seeking auto refinancing or applying for any credit or loan, it’s wise to review your credit reports and check your credit score to know where you stand as an applicant. You can get a free credit report from all three consumer credit bureaus by visiting AnnualCreditReport.com. You can also get a free copy of your Experian credit report every 30 days.

As you research your loan options, you can also take steps to increase your credit score quickly, with the best tactics for fast improvement being:

- Paying down high credit card balances, ideally getting all balances down to 30% or less of the cards’ borrowing limits.

- Consider enrolling in Experian Boost, which applies your record of cellphone, cable and other utility payments to your Experian credit report and can help increase FICO® Scores based on Experian data.

- Continuing to make all your debt payments on time.

Refinancing a car can save you money over the long term, reduce your monthly payments to ease your household budget. Experian partner RateGenius can help you better understand your auto loan refinance options. Shop around for lenders and do your best to put forward the best credit scores you can get, and you could drive home a great deal.

Also Check: How To Get Rid Of Repo On Credit

You Can Apply For As Many Loans As You Want

It’s a popular misconception that every time you apply for a loan, it dings your credit score. In fact, my wife and I are in the car-buying process right now, and after I told her that I applied with four different lenders to compare the interest rates I can get, she asked why I’d do that when it would be terrible for my credit score.

To be fair, this misconception is based partly in truth. The FICO credit scoring formula counts hard credit inquiries in the “new credit” category, which makes up 10% of your score, and too many credit inquiries can seriously lower your score. Even one can lower your credit score, but only by a few points in most cases.

However, there’s a provision in the FICO® Score rules that encourages you to shop around for the best auto loan: So long as all of your auto loan inquiries take place within a “normal shopping period,” which is defined as 30 days, only one inquiry will affect your credit score. In other words, it doesn’t matter if you apply for one car loan or a dozen the effect will be the same.

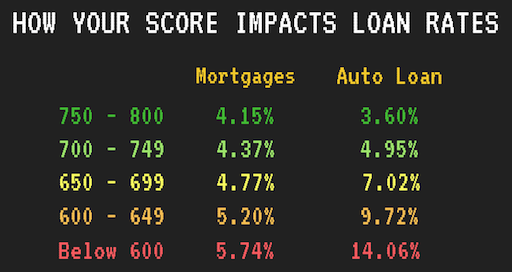

Shopping around can be a big money-saver. Of the four lenders I applied with, the difference between the lowest and highest APRs I was offered was nearly 3 percentage points. That can make a big difference over the term of a five-year car loan.

How Much Will Credit Score Increase After Paying Off My Car

Your credit score will not increase after paying off your car loan. Oftentimes, paying off a car loan will results in a decrease in your credit score because when you pay off your car, youre essentially closing an installment loan, which often lowers your credit score, especially if the installment loan was in good standing and substantially paid off. So, before you pay off your car loan expecting your credit score to increase, think again. That said, the decrease in your credit score is temporary, your credit score will bounce back in a few months so long as you continue to make timely payments on all of your other accounts.

Paying off your car can decrease your credit score because slightly because youre decreasing your credit mix by closing off an installment loan that is in good standing. Typically, you want to have a diverse mix of credit accounts for the best impact on your credit score. So, if youre thinking about paying off your car loan early to boost your credit score, think again because it often results in a slight but temporary decrease in your credit score.

After you pay off your car loan, if youve never missed any payments, the car loan installment account will appear on your credit report for 10 years from the date your account was closed and it will continue to help your credit score.

You May Like: Who Does Aargon Agency Collect For

When Is It A Good Idea To Refinance A Car Loan

It makes sense to refinance a car loan under the following circumstances:

- Your car is holding its resale value. Before applying to refinance your auto loan, check valuations from Kelley Blue Book, Edmunds.com or the National Association of Auto Dealers to determine your car’s approximate resale value. If your car is worth less than what you owe on it due to age, mileage crashes or other issues, refinancing may prove difficult.

- Interest rates are dropping fast. If changing economic conditions have significantly brought down the cost of borrowing, you may qualify for a new loan at a lower rate. The average interest rates on a new car loan in the U.S. was 5.76% in the fourth quarter of 2019, according to Experian datadown from the prior year. With Fed rates slashed to near-zero in 2020, it’s possible you’ll continue to see a greater difference in your new interest rate as time goes on.

- Your credit score is higher. If you increase your credit score significantly in the 12 months or so after taking out a car loan, you may qualify for loan offers with better interest rates.

- You need to cut expenses. Extending your car loan repayment period may make sense if you need to reduce monthly expenses, even if it means paying more over the course of the new loan.

Cons To Paying Off Your Auto Loan Early

- It can hurt your credit. Paying off an auto loan early eliminates a healthy line of open credit, potentially hurting your credit score.

- You might be subject to penalties. Check your loan agreement if you try to repay your principal your lender may charge you all or some of your unpaid interest, or at least a flat fee. If your fees are high, a prepayment may not make fiscal sense.

- It might be better to hold onto that money. If you have to dig into a savings or emergency fund to pay off your auto loan, you might want to reconsider staying liquid in case you need that money. Also, if the difference between paying off and keeping your loan is under $100, you might keep your loan and invest your payout money instead.

It can be hard to predict exactly how a prepayment will impact your credit . So instead, educate your decision by carefully reviewing your prepayment clause and doing the math to see precisely how much money youd save by prepaying .

Don’t Miss: Aargon Agency Settlement

How An Auto Loan Affects Your Credit Score

Multiple factors go into deciding your FICO score, such as the average age of your various accounts, the length of your credit history, and your borrowing and spending habits.

For example, taking out a new car loan or signing up for a credit card lowers the average age of your accounts. But depending on whether you’ve held different accounts for a longer or shorter period, the change in your score could be small or more significant.

One area that remains unaffected by an auto loan is your credit utilization. Credit utilization is the amount of revolving debt you carry month to month compared to your credit limits. Your credit card balance is an example of this.

Owning a car brings many additional expenses like fuel, maintenance, and insurance premiums. Saving money where you can on automotive-related costs keeps extra cash in your bank account for essential obligations. One way to do this is to secure an advantageous car loan. But applying for and finding one can be a hassle. Shift works with a network of trusted lenders who compete for your business, so you get the best deal on financing. And applying for financing with Shift is quick and easy, with no cost or obligation.

An Auto Loan Will Not Impact Your Credit Utilization

is the amount of revolving debt youre carrying on a monthly basis relative to your credit limits. For example, if you have a credit card with a credit limit of $5,000 and your balance is $2,500, your credit utilization is 50%. Experts recommend keeping your utilization well below 30% to protect your credit score.

The good news is that only revolving credit accounts, such as credit cards, impact credit utilization, which accounts for 30% of your credit score. Loans, including auto loans, are not calculated into credit utilization and, therefore, will not impact this scoring factor.

Read Also: Usaa Credit Repair

Why Did My Credit Score Go Down

After you get approved for the loan and get the keys to your car, your credit score drops again. Why? Its because your credit score is determined by five different factors:

- 35% is payment history: whether or not payments were made on time.

- 30% is amounts owed: how much you owe across all credit types and your credit utilization ratio.

- 15% is length of credit history: factors in the oldest account on your credit reports, as well as the average age of all accounts.

- 10% is credit mix: how many different types of credit accounts you have.

- 10% is new credit: the number of credit inquiries and new accounts.

Because you just started a new installment loan, you have new credit, which also lowers your credit score slightly. Making your payments on time can bring your score back up quickly. Be sure to keep any other amounts you owe in check, such as credit cards.

What Effect Will Shopping For An Auto Loan Have On My Credit

Shopping for the best deal on an auto loan will generally have little to no impact on your credit score. The benefit of shopping will far outweigh any impact on your credit.

In some cases, applying for multiple loans over a long period of time can lower your credit score. Generally any requests or “inquiries” by these lenders for your credit score that took place within a time span ranging from 14 days to 45 days will only count as a single inquiry, depending on the credit scoring model used. You can minimize any negative impact to your credit by doing all of your shopping in a short amount of time. You could save hundreds or even thousands of dollars by shopping for the best rate and terms on a loan.

For example, let’s say you are looking around for an auto loan and you authorize five lenders to check your credit score within a 14 day time span. All those inquiries should count as one inquiry. If you shop for a mortgage loan at the same time you are shopping for an auto loan, the shopping you do for those two loans should count as two separate inquiries.

And don’t worry about all those promotional offers for credit cards impacting your credit score. These promotional offers do not affect your credit score.

You May Like: Does Aarons Help Build Credit

One Email A Day Could Help You Save Thousands

Tips and tricks from the experts delivered straight to your inbox that could help you save thousands of dollars. Sign up now for free access to our Personal Finance Boot Camp.

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms & Conditions.

Will Paying Off Car Improve Credit

A car payment can be a substantial financial stressor in your life, especially if you have other types of debt at the same time. Between student loans, credit card payments, and other bills, such as your auto insurance, it’s easy to start to feel the stress. For this reason alone, many people aim to pay off their debts to free up money for their savings and other life goals.

However, while paying off your debt is an admirable goal, it can lead to some concerns when it comes to your credit score. Since your credit score depends on the types of debt you have and your payment history, many people may be surprised to see a sudden change in their numbers after paying off a substantial debt like their car. So, will paying off a vehicle improve your credit?

Don’t Miss: Unlock Experian Account

A New Auto Loan May Lower The Average Age Of All Your Accounts

The length of your credit history and the average age of your accounts make up 15% of your FICO score.

When you open a new loan or credit card, the average age of your accounts will fall slightly. If you have multiple accounts for decades, the hit will be very slight. But if you only have one or two accounts, it could have a bigger impact.

For instance, lets say youve held two credit cards for 20 years, and three others for 18, 16, and 15 years. You also took out a mortgage 17 years ago. The average age of your accounts is 17.6 years . When you open a new car loan, that average will drop to about 15 years still well over a decade.

But if youre new to credit and only have two credit cards that you opened a year ago, and you get an auto loan, the average length of your accounts drops in half, from one year to six months.

You Applied For Another Car Loan

As we mentioned earlier, applying for a car loan will cause a temporary dip in your score. By applying for a loan, you are agreeing to a hard inquiry, and most inquiries will have a negative impact on your score, even if they are soft credit checks. Soft credit pulls may not last as long as the effects of hard credit pull, but they still cause your score to drop even if only by a few points.

You May Like: Who Is Syncb/ppc

Car Loan Rates By Credit Score

The table below shows the average auto loan rate for new- and used-car loans based on credit scores, according to Experian data from the second quarter of 2020.

| 6.05% | 4.08% |

As you can see, having a good credit score will give you a lower interest rate on your loan than an average or lower credit score. And having poor credit means youll pay high interest rates.

A few extra percentage points may not seem like a big deal but when that percentage is applied to the thousands of dollars that car loans typically amount to, it adds up quickly.

Heres how this plays out in reality. Lets say two borrowers one a prime borrower and the other subprime want to finance $10,000 for a used car. They both have a 60-month loan term. The subprime borrower is offered a 17.78% rate the average for borrowers in this range in the second quarter of 2020, according to Experian. The prime borrower is offered the average 6.05% rate.

Over time, the subprime borrower will pay back $15,164, or $5,164 in interest. The prime borrower will pay about $1,614 in interest, for a total cost of $11,614. Thats a difference of $3,550 in interest paid and in this case, it all came down to credit scores.

Taking steps to improve your credit could increase your chances of getting approved for a loan with better terms, keeping more money in your pocket in the long run.