How Do I Start Establishing Credit

If you do not yet have any credit accounts and want to begin building your credit history, here are some ways to get started:

Thanks for asking.

Address Information Does Not Impact Credit Scores

The purpose of this question submission tool is to provide general education on credit reporting. The Ask Experian team cannot respond to each question individually. However, if your question is of interest to a wide audience of consumers, the Experian team may include it in a future post and may also share responses in its social media outreach. If you have a question, others likely have the same question, too. By sharing your questions and our answers, we can help others as well.

Personal credit report disputes cannot be submitted through Ask Experian. To dispute information in your personal credit report, simply follow the instructions provided with it. Your personal credit report includes appropriate contact information including a website address, toll-free telephone number and mailing address.

To submit a dispute online visit Experian’s Dispute Center. If you have a current copy of your personal credit report, simply enter the report number where indicated, and follow the instructions provided. If you do not have a current personal report, Experian will provide a free copy when you submit the information requested. Additionally, you may obtain a free copy of your report once a week through April 2022 at AnnualCreditReport.

Resources

Get the Free Experian app:

Not All Accounts Are Listed On Your Credit Report

In Canada, there are two credit reporting agencies TransUnion and Equifax. While consumers assume that both credit bureaus report identical information, thats not the case. Business arent required to report their information to these agencies, they do so on a voluntary basis.

Some banks and lenders will report to one reporting agency, some to the other, and many to both.

Because of this mismatch in reporting, you need to request both of your credit reports to get a full idea of all of your accounts being reported. Keep an eye out for errors, too you could have settled or paid off a debt only to find its still registering on your report as an account in arrears.

Who Looks At Your Credit Report

When you apply for credit, youll usually be expected to give your permission to the credit provider to check your credit report.

The term credit provider doesnt only include banks and credit card companies. It also includes mail-order companies and, for example, providers of mobile phone services if you have a phone contract .

Employers and landlords can also check your credit report. However, theyll usually only see public record information such as:

- electoral register information

- County Court Judgements .

You May Like: How Do I Unlock My Credit Report

You Made A New Application For Credit

Any time you put in a new application for credit, an inquiry is added to your credit report. Because inquiries make up 10 percent of your credit score, applying for new credit can affect your credit score.

Though inquiries stay on your credit report for two years, they’re only factored into your credit score for one year. After just a single inquiry, your credit score should steadily increase and recover in 12 months, provided you make no other credit mistakes.

Are Credit Report Errors Common

People commonly assume the information on their credit reports is entirely accurate. And if you dont look at your own personal credit report, its impossible to know whats listed there.

According to a study by the Federal Trade Commission , 20% of consumers have an error on one or more of their credit reports. Of these errors, 5% could impact their ability to get credit or a loan or change the loan terms.

Not only do creditors and credit bureaus make mistakes, but its also possible that you have been a victim of identity theft without even knowing it. Thats why its important to review your credit reports regularly.

See also:Best Identity Theft Protection Services for 2022

By law, you are entitled to one free credit report from each of the three major credit bureaus once a year. There are numerous credit bureaus, but Equifax, Experian, and TransUnion are the most recognized and utilized.

Each credit reporting company is independent of the others and may include different information. Creditors arent obligated to report any information to the credit bureaus. Instead, they choose which ones they provide information to.

Don’t Miss: Syncb Verizon

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

How Can You Monitor Your Report And Score For Free

Consumers have not always had access to their scores. Now, however, scores are widely available to consumers for free from a variety of sources. When picking a source of a free score so you can monitor your credit, look for one that includes free credit report information as well, such as NerdWallet, which has scores and reports that update weekly. That gives you a convenient way to check your credit health any time and monitor your progress. It’s smart to choose a particular score and monitor that one, using the same credit bureau and scoring model.

Read Also: What Is Syncb Ppc On My Credit Report

How To Get Proof Of A Debt Collection

Before paying any collection, you should make sure the debt is yours. The Fair Debt Collection Practices Act allows you to request validation of a collection account within the first 30 days of the debt collector’s initial contact.

After receiving your request, the debt collector has to send you proof of the debt. The collector also cannot continue collection efforts on the debt, including reporting the account to a credit bureau, until it has sent you proof of the debt.

If the collector sends you satisfactory proof that the debt actually does belong to you, you can decide whether you want to pay. For debts that appear on just one credit report, you may offer payment in exchange for removing the debt from that credit report. If the account is in pre-collections, paying the debt will keep it from appearing on your credit report.

Paying a debt thats beyond the credit-reporting time limit doesnt benefit your credit rating, but it does get the debt collectors off your back.

Types Of Errors In Your Credit Report

The errors on credit report can be of various types. However, here are some types of common errors in your credit report that you need to watch out for:

However, this is important to note that any kind of information update will take at least two months. So, an account which is not older than 2 months might not reflect in your report. Also, an account might reflect incorrect balances because it has not been updated yet.

Also Check: Care Credit Credit Score For Approval

Do I Need To Get My Credit Score

It is very important to know what is in your credit report. But a credit score is a number that matches your credit history. If you know your history is good, your score will be good. You can get your credit report for free.

It costs money to find out your credit score. Sometimes a company might say the score is free. But if you look closely, you might find that you signed up for a service that checks your credit for you. Those services charge you every month.

Before you pay any money, ask yourself if you need to see your credit score. It might be interesting. But is it worth paying money for?

Are Closed Accounts Still Open

A closed account means you have positively paid back all the loan or credit card dues, and the account is not going to see any future activity. While an open account is an indication that you still have some amount to be paid back or you have the credit line still available to you for use. Having old lines, those which should have been closed otherwise, on your credit report showing as open will show higher number of lines and higher credit amount available to you. This can impact your credit score and therefore your eligibility for a loan. So, if the closed accounts are being shown as open, it is time you report this error with documentary proof so that you can get it rectified at the earliest.

Read Also: Hard Inquiry Fall Off

How You Can Check Your Credit Reports

You can get a free copy of your credit report from each major credit reporting agency every 12 months at AnnualCreditReport.com.

Get Free Weekly Credit Reports During the Coronavirus Crisis

Equifax, Experian, and TransUnion are offering free weekly online credit reports, so that you can manage your credit during the COVID-19 crisis.

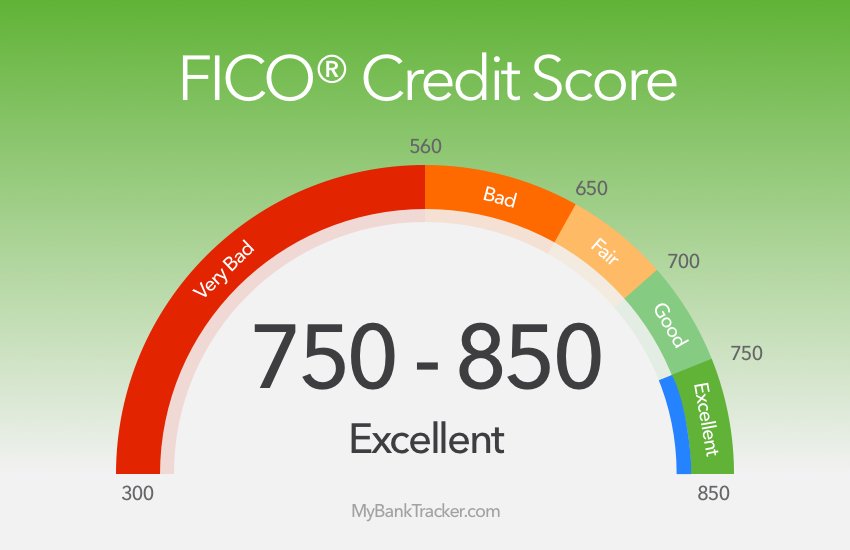

What Is The Difference Between Credit Score & Credit Report

a credit score is a three-digit numeric expression that denotes your creditworthiness while a credit report is a record of your entire credit history.

|

based on the provided information in a credit report. |

|

|

contains details like the loan amount, history of payments, etc. |

only shows your creditworthiness if you are deemed scored more than 760 or above. |

|

equifax, experian, and transunion are credit reporting bureaus. |

sometimes, banks can create their own score, or they can refer it to the commonly availed company. |

|

customers can obtain these reports from any of the mentioned bureaus. |

fico, other credit bureaus, and sometimes lenders give information about the credit score to the customers. |

Also Check: 623 Credit Score Credit Card

Building Up Your Credit Score Takes Time

Your credit score is something which builds up steadily over time. You may not always get to see a satisfying boost month on month.

Lenders tend to prefer to see a long-term pattern of dependable behaviour. All the changes to your report help to build up an overall picture of what kind of borrower you are. You need to consistently show the behaviour to prove itâs not simply a one-off.

So taking steps to improve your score will help to improve the overall health of your credit report and add to your standing with lenders. Lenders will look at your whole report, and not just your score when they are deciding whether or not to lend to you. This means all the positive information on your report can still be worthwhile, even if it doesnât change your score.

How Lenders Use Credit Reports

Be aware that different lenders look for different things when reviewing your credit report and deciding whether to lend to you. They can also take other factors into account.

For example, you might have been furloughed and taken a payment holiday during the coronavirus pandemic. While this won’t directly affect your credit score, it may affect your ability to borrow in the future.

You May Like: How Often Does Bank Of America Report To Credit Bureaus

Length Of Credit History Is Too Short

Many scoring models require that an open and active account be reported for at least three months, and often as long as six months before a . If a VantageScore model is used to calculate your score, it may be able to do so with less history.

If you’ve only recently begun establishing credit in your name, it may just be a matter of time before a score can be calculated.

Once you have ordered a copy of your credit report directly from Experian and you see that there is credit history being reported, you can attempt to order a free credit score yourself. If a score cannot be calculated for you, a reason will be provided.

How Long Can A Debt Collector Pursue An Old Debt

Each state has a statute of limitations about how long a debt collector can pursue old debt. For most states, this ranges between four and six years. These statutes govern the amount of time that a debt collector can sue you, but there is no limit to how long a collector has to try and collect on a debt. If you are being contacted about a debt that you believe is not yours or is outside the statute of limitations, do not claim the debt instead, ask the company to validate that the debt is yours.

Recommended Reading: Carmax Cosigner

How Do I Fix Mistakes In My Credit Report

- Write a letter. Tell the credit reporting company that you have questions about information in your report.

- Explain which information is wrong and why you think so.

- Say that you want the information corrected or removed from your report.

- Send a copy of your credit report with the wrong information circled.

- Send copies of other papers that help you explain your opinion.

- Send this information Certified Mail. Ask the post office for a return receipt. The receipt is proof that the credit reporting company got your letter.

The credit reporting company must look into your complaint and answer you in writing.

Things You Won’t Find In Credit Report

For all of us, credit reports are important, and contain almost all financial related data relevant to us. A credit report consists of data such as loan details, payments made late or not paid at all, and in some case rents paid, etc. But there are still a few items, that lenders or potential lenders cannot see on your report as listed below:

Read More on CIBIL

Also Check: Navy Auto Loans

Review The Claim Results

Reporting agencies and lenders usually take around 30 days to investigate disputes. Once they make a decision, they must notify you within five days of completing their review. The notice will inform you if the disputed item was found to be inaccurate or not.

If the disputed information was, in fact, inaccurate, the bureau must update or delete the item. They should include a free copy of your file if the dispute results in a change.

If the bureau or lender considers the disputed information isn’t a mistake, you can file an additional claim. Review your initial claim for any errors and correct those. If possible, you should include additional documents to support your request as this can help the bureau evaluate any data it might have missed the first time around.

Whats The Best Way To File A Dispute

If you see incorrect information on your credit report, it is possible to dispute it and have it permanently removed.

To do this, send a written request for verification to the credit bureau and send it certified with a notice of receipt. Sending a certified dispute letter ensures you know the agency received your request and you have a paper trail with a date to begin the countdown for removal.

Make sure you send separate dispute letters to each credit bureau reporting the information, even if it is the same.

Not only are all of the credit reporting agencies separate entities, but they also do not share information with each other. Therefore, even if the data is removed from one credit report, it may stay on your other credit reports until you submit another request.

Read Also: Credit Score To Be Approved For Care Credit

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Contact The Credit Bureaus

Both Equifax Canada and TransUnion Canada have forms for correcting errors and updating information. Fill out the form to correct errors:

Before the credit bureau can change the information on your credit report, it will need to investigate your claim. It will check your claim with the lender that reported the information.

If the lender agrees there is an error, the credit bureau will update your credit report.

If the lender confirms that the information is correct, the credit bureau will leave your report unchanged.

In some provinces, the credit bureau is required to send a revised copy of your credit report to anyone who recently requested it.

You May Like: Kroll Factual Data Complaints