What Accounts Are Included In Bankruptcy

Usually, a person declaring bankruptcy is having serious difficulty paying their debts and their accounts are often significantly delinquent.

If an account was delinquent when it was included in the bankruptcy, it will be deleted seven years from its original delinquency date, which is the date the account first became late and was never again brought current. Declaring bankruptcy does not alter the original delinquency date or extend the time the account remains on the credit report.

If the account was never late prior to being included in bankruptcy, it will be removed seven years from the date the bankruptcy was filed.

S: How To Remove Bankruptcy From Credit Reports

Do you feel overwhelmed by your past financial decisions? Do you wish you knew how to remove bankruptcy from your credit report?

Understanding . Let’s make it simple. So, are you ready to take the next steps to help your credit get healthy?

We have talked to multiple friends and family who have struggled with bankruptcy. It has become a widespread occurrence in today’s society.

Let’s make your experience with credit accessible and straightforward.

We have gathered the best tips and tricks on how to remove bankruptcy from credit reports so you can improve your credit and improve your life.

Review Your Credit Reports

Monitoring your credit report is a good practice because it can help you catch and fix credit reporting errors. After going through bankruptcy, you should review your credit reports from all three credit bureausExperian, Equifax and Transunion. Due to Covid-19, you can view your credit reports for free weekly through April 20, 2022 by visiting AnnualCreditReport.com.

While reviewing your reports, check to see if all accounts that were discharged after completing bankruptcy are listed on your account with a zero balance and indicate that theyve been discharged because of it. Also, make sure that each account listed belongs to you and shows the correct payment status and open and closed dates.

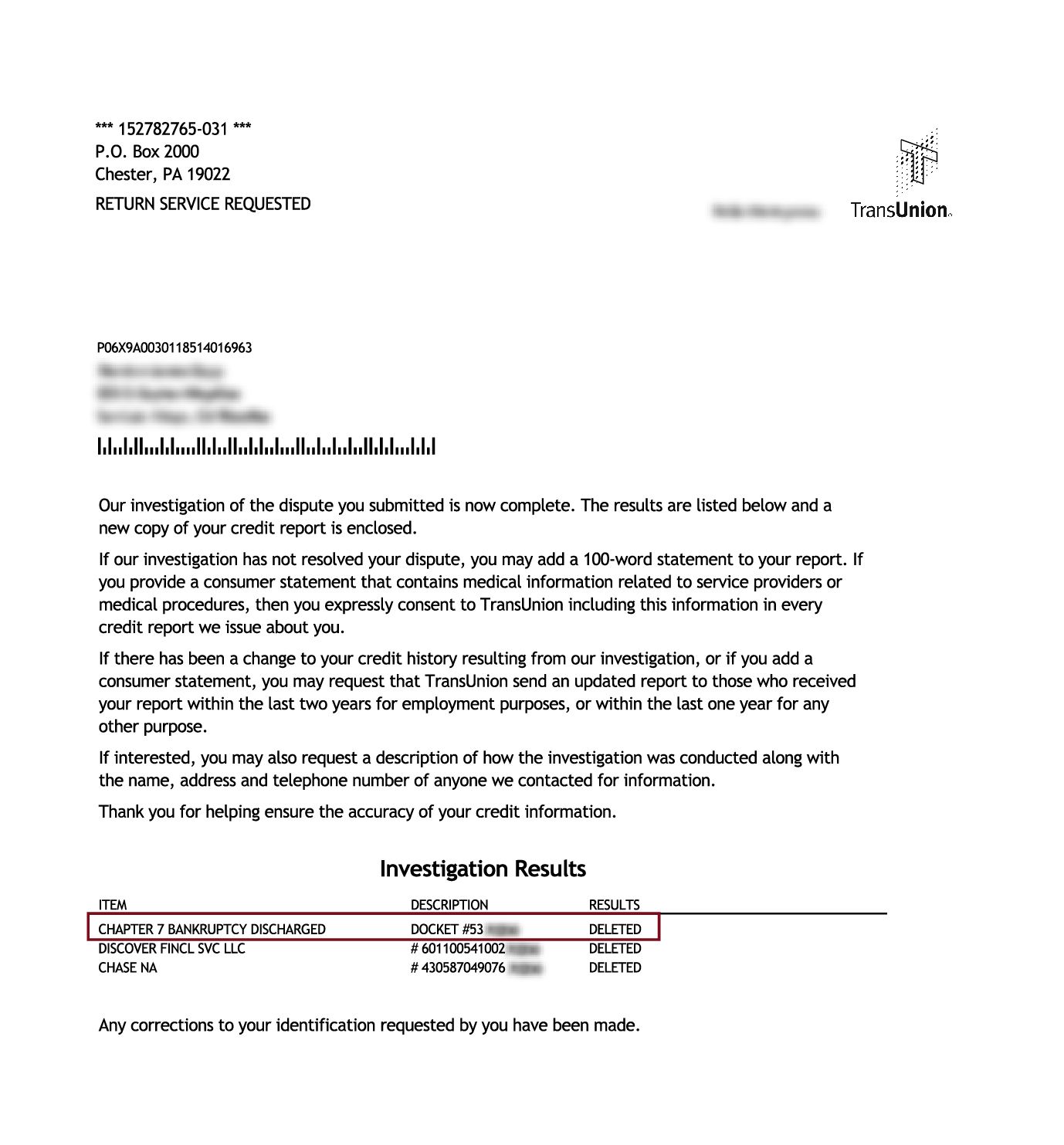

If you spot an error while reviewing your credit reports, dispute it with each credit bureau that includes it by sending a dispute letter by mail, filing an online dispute or contacting the reporting agency by phone.

You May Like: When Does Capital One Report To Credit

Get Your Credit Report Fixed

So, what to do next?

Youve gotten your reports and check them for these errors and youve found one or more of them . No worries, get free help drafting written disputes to your creditors and the bureaus and set your problem up to get fixed as soon as possible!

If it takes a lawsuit to fix it, remember, the law requires that the Credit Bureaus pay the costs and attorneys fees for that .

Youve done the work of going through bankruptcy make sure you get the Fresh Start that you deserve!

More on life after bankruptcy

Negative Credit Report Entries That Impact Your Score The Most

Accurate items will stay on the credit report for a determined period. Fortunately, their impact will also diminish over time, even if they are still listed on the report. For example, a collection from a few years ago will bear less weight than a recently-reported collection. If no new negative items are added to the report, your credit score can still slowly improve.

Recommended Reading: Does Paypal Credit Report To Bureaus

Returning To Good Credit After Bankruptcy

A personal bankruptcy filing will affect your credit report for a certain amount of time depending on how you file:

- Chapter 13 bankruptcy stays on your credit report for 7 years after final discharge

- Chapter 7 bankruptcy stays on your credit report for 10 years after final discharge

Having a bankruptcy on your record for 7-10 years does not mean it will take you this long to repair your credit score or get out of debt.

Right away, the “final discharge” releases you from personal liability in most debts. You need this bankruptcy discharge before you can take steps to build toward better credit, otherwise, you will continue to have large debts.

Once the process starts, you can decide what choices to make to rebuild your credit.

If You Discharged Debts In Bankruptcy Here’s How They Should Be Listed On Your Credit Report

Updated By Cara O’Neill, Attorney

In short, yes. Not only will a bankruptcy filing remain on your credit report for seven to ten years, but you can expect information about the debts discharged in bankruptcy to continue to appear on your credit report, too. In this article, you’ll learn what shouldand should notshow up on your credit report after you receive a bankruptcy discharge, and what to do if your credit report contains incorrect information.

Also Check: How Can Personal Responsibility Affect Credit Reports

Make Sure The Right Accounts Were Reported

After your debts are discharged, review your credit reports to make sure that only the accounts that were part of your bankruptcy are reported by the as discharged or included in bankruptcy on your reports. If you find mistakes, notify the credit bureaus and dispute the errors on your credit reports .

How Does A Bankruptcy Affect My Credit Score

A bankruptcy is one of the financial situations that can have the most negative effect on your credit scores. A legitimate bankruptcy can decrease a credit score by anywhere from 130 to 240 points, depending on the original score range.

If you have an average score of 680, for example, your score will drop by between 120 and 150 points following a bankruptcy. But if your score is 780, it will drop by between 220 and 240 points.

Thus, the higher your original score, the farther it will drop after filing for Chapter 7 or Chapter 13 bankruptcy. If your score starts out in the “good” range, it could immediately drop to “poor” following a bankruptcy.

Related Content:

Read Also: Is Chase Credit Score Accurate

Accounts Included In The Bankruptcy

After youve filed for bankruptcy, the accounts included in your bankruptcy will show up as included in bankruptcy on your credit report. Most of them will remain on your credit report for seven years. These include accounts like charge offs, collections, repossessions, and judgments. They can also potentially be removed from your credit report before the reporting limit of seven years.

Where Does Bankruptcy Appear On Your Credit Report

Regardless of the type of bankruptcy you file for, youll want to know where exactly it shows up on your credit report. Your bankruptcy status will appear in conjunction with any debts or accounts that will get addressed throughout your bankruptcy proceeding. For instance, if Loan A was discharged as a result of your bankruptcy, then youll still see the debt appear in your credit report. It will say something like Loan A: Discharged in bankruptcy.

Prior to your bankruptcy, these debts will either show current, meaning youre keeping up with the payments, or delinquent if youve fallen behind on them. Each time a potential lender looks into your report, theyll see those accounts, which means theyll know you filed for bankruptcy in the past. We know what youre thinking How long does bankruptcy last on my report?. This answer depends on the type of bankruptcy you file for.

Don’t Miss: What Is Syncb Ntwk On Credit Report

How Long Does Chapter 13 Stay On A Credit Report

A Chapter 13 bankruptcy helps you get most of your debts discharged, but you are still expected to pay off a portion of your debts. How so? Youll get ordered to participate in a repayment plan that will last about three to five years. So long as you adhere to the plan, the rest of your debt will get discharged once your plan ends.

In a nutshell, your partial repayment means the bankruptcy will fall off your report faster than if you filed for a Chapter 7 bankruptcy. With a Chapter 13 bankruptcy, you can expect it to remain on your credit report for seven years from the date on which you filed for bankruptcy.

Do I Still Have To Pay The Debt

If youre wondering how long something stays on your credit report, its important to keep this in mind: Your debt isnt simply erased once it falls off your credit reports. If you never paid off the debt and the creditor is within the statute of limitations, they may try to collect the money. The creditor can call and send letters, sue you or get a court order to garnish your wages.

Even outside the statute of limitations, collection companies can still try to collect the debt. Stale debts represent a thriving business, as they are often sold and resold for pennies on the dollar. Even a partial payment makes a call or letter worthwhile for the collector.

The only sure way to get rid of a debt is to pay what you owe, or at least an agreed-upon part of what you owe. If youre looking to put your debt behind you and move on with a clean slate, contact the collectors listed on your credit report. Before making the phone call, make sure you know:

- The debt is legally yours.

- How much you owe the creditor.

- What you can realistically afford to pay per month or in a lump sum.

If you negotiate a payment for less than the full amount owed, be sure to get the payment agreement in writing from the collector before you send in any payment.

Recommended Reading: What Is Syncb Ntwk On Credit Report

How Long Does Chapter 7 Stay On A Credit Report

If youre an individual who has taken on way too much debt and you know you cant pay it off, then a Chapter 7 bankruptcy may be exactly what you need. With these plans, you wont have to repay your debt, but you may have to sell off some of your assets. Some assets, like your home or car, may be exempt from getting sold off. You may not be able to file for Chapter 7 bankruptcy if you make a higher-than-average income.

So, when does bankruptcy come off a credit report if you file a Chapter 7? Because you arent expected to repay the debt at all, this type of bankruptcy will remain on your report for ten years from the date you filed for a Chapter 7 bankruptcy.

Reporting Debts As Discharged In Bankruptcy

While it might be daunting to think about a bankruptcy filing showing up on your for ten years, it might not be as bad as you think. A bankruptcy discharge can help you clean up debt much faster than you’d be able to do yourself.

For instance, instead of a delinquent or unpaid debt lingering on your report for years, it will show as being discharged as part of your bankruptcy. In fact, creditors won’t be able to report your debt in a variety of ways that could cause your credit to suffer, such as allowing the obligation to show as:

- currently owed or active

- having a balance due, or

- converted to a new type of debt .

Such reporting labels are often the reason creditors deny applicants credit. In some cases, applicants must pay off such debt as a condition of loan approval. Instead, when you pull your report, each qualifying debt should be reported as:

- having a zero balance, and

- discharged, “included in bankruptcy,” or similar language.

Unfortunately, some creditors don’t update information to the credit reporting agencies. This tactic could be a way to get you to pay up, even though you no longer legally owe the debt. If your credit report shows an improperly labeled discharged debt, you’ll want to take steps to correct the problem.

You May Like: Credit Report With Itin

How To Remove A Bankruptcy From Credit Report

*This is not a financial advice article. Speak to a professional financial advisor if needing financial assistance.

Your credit report is a valuable tool that lenders and other financial entities use to determine your financial responsibility. Unfortunately, filing for bankruptcy can negatively impact your credit report and knock your credit score down by several hundred points.

In most cases, a bankruptcy will remain on a credit report for several years following the filing date, continuing to affect your credit score for about a decade. However, if your bankruptcy record has mistakes, due to identity theft, or is an error, you may be able to have it removed from your credit report early.

Continue reading to find our step-by-step guide to attempt to remove a bankruptcy from your credit report, then read our tips about how to potentially rebuild your credit following a bankruptcy filing.

How To Build Credit After Bankruptcy

You can start rebuilding your credit score after the bankruptcy stay stops creditors from taking action. Bankruptcy will show on your record for 7-10 years, but every year you work to improve your credit, the less it will affect you and the financing you seek.

You need to wait 30 days after you receive the final discharge. This means most of your accounts will be at a zero balance, and creditors must stop calling you about debts.

To rebuild your credit score, you should:

Don’t Miss: How Do I Unlock My Experian Credit Report

Rebuilding Your Credit After Bankruptcy

You don’t have to wait until your bankruptcy is removed to begin rebuilding your credit history. The good news is that as time goes by and you begin to reestablish your credit, the bankruptcy notations will begin to affect you less and less.

Here are some ways to help your credit recover from bankruptcy:

Thanks for asking.

Here’s How Bankruptcies Impact Your Credit Score

While bankruptcies on your credit report will always get factored into your credit score for as long as they are on there, the impact on your score lessens with each year that passes. So, you may see a dramatic drop in your score in the first month immediately following your bankruptcy filing, but by the end of the first year it could have less weight, and certainly less in later years compared to year one.

Your own credit profile will also play a part in how much your credit score is affected when you declare bankruptcy. Similar to how having a higher credit score can ding your more points if you miss a credit card payment, so, too, is the case if you file for bankruptcy. According to FICO, someone with good credit may experience a bigger drop in their score when a bankruptcy appears on their report than someone with an already poor credit score.

Estimates we found online from places like Debt.org show how people with different credit scores would be impacted by a bankruptcy filing. Someone with a credit score of 780 or above would be dinged between 200 and 240 points, while someone with a 680 score would lose 130 to 150 points.

Whatever the case, no one really benefits from filing for bankruptcy. It’s an option of last resort that sometimes even those with good credit find themselves making.

Recommended Reading: When Does Usaa Report To Credit Bureaus

How Can I Get A Copy Of My Credit Record

There are two ways to get your credit report : either through the mail or via the internet. If you want to obtain your credit report for free, you must use the mail. It is also important to do what you can to make sure your credit report shows a history of reliable credit repayments, and as few unfavorable repayment incidents as possible.

For more detailed information related to credit reporting, visit Equifax Canada or Trans Union website. Talk to a licensed trustee today. We have trustees everywhere from Calgary to Montreal and more. Get a free consultation today!

Send A Request For Goodwill Deletion

Like pay-for-delete, writing a goodwill letter seems like a long shot, but its an option for borrowers who want to exhaust every possible alternative. Write to the creditor and ask for a Goodwill Deletion. If you have taken appropriate steps to pay down your debts and have become a more responsible borrower, you might be able to convince the creditor to remove your mistake.

There is no guarantee that your plea will get a response, but it does get results for some. This strategy is most successful for one-off problems, such as a single missing payment, but it may be futile for borrowers with a history of missed payments and credit mismanagement.

When writing the letter:

- Assume responsibility for the issue that caused the account to be reported to begin with

- Explain why the account was not paid

- If you can, point out good payment history before the incident

Recommended Reading: How To Remove Repossession From Credit Report