What Does Your Credit Report Show

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

When you’re reading your credit report for the first time, it can be overwhelming, especially if you’ve had a lot of accounts over a long period of time. Knowing what types of things appear on your credit report can make it much easier to read and understand.

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

Who Can See My Credit Report

Most people cant legally use your personal information to access your credit report. However, there are several types of organizations that are allowed to pull your credit: banks, creditors, lenders, insurance companies, potential landlords, collections agencies, potential employers and the government.

The laws about who can access your credit score are different from state to state. If youre worried at all, do some research and find out what the law is where you live.

You May Like: How To Remove Child Support From Credit Report

What Does A U Stand For On A Credit Report

University of Credit Reporting? Nope. The U means unclassified, or that the account hadnt been updated at the time the report was pulled. Its one of many status codes that can appear next to an account on your credit report. Codes like this usually indicate a problem with the account, like it being past due or sent to collections.

You might also see a U if the account is new and you havent made any payments on it yet. It doesnt have a negative impact on your credit score and isnt anything to really worry about.

How Long Does Info Stay On The Record

How long adverse information remains on your credit report depends on what is being reported. Positive information can stay on your report indefinitely. Negative information must be removed in accordance with limits set by the Fair Credit Reporting Act.

According to Experian, adverse information for business credit reports can remain on your report for as little as 36 months, or as long as nine years and nine months. Trade, bank, government and leasing data can remain for up to 36 months. Uniform Commercial Code filings stay for five years. Judgments, tax liens and collections remain for six years and nine months. Bankruptcies remain on your business credit report the longestup to nine years and nine months.

Adverse information generally remains on individual consumer credit reports for seven to 10 years. Bankruptcies remain the longest: up to 10 years from the order date or date of adjudication. If you defaulted on a government-backed student loan, the reporting period can be longer.

Civil suits, civil judgments and records of arrest can remain on your credit report for up to seven years or until the statute of limitations has expired, which ever is longer. Tax liens remain until they are paid, and then remain for seven years thereafter.

Don’t Miss: When Do Companies Report To Credit Bureau

What Are The Top Ways To Rebuild Your Credit Score Quickly

A low score is a result of poor credit management, or life events such as divorce or serious illness. Your credit history reflects that you are missing or have missed payments and/or you have too much debt. These two occurrences will make it very hard to earn a high score because they drive about 65% of the points in your credit scores.

The only way to rebuild your credit scores is to address why they are low in the first place. Sounds obvious but youd be surprised how many people take a shot in the dark approach at rebuilding their credit scores. Or, they are guided by misinformation and/or unscrupulous individuals that promise a better credit score in exchange for a fee. Formulating a plan to rebuild your credit scores is not difficult. Heres how to do it:

Paying Off Derogatory Credit Items

It can be beneficial to pay off derogatory credit items that remain on your credit report. Your credit score may not go up right away after paying off a negative item however, most lenders wont approve a mortgage application if you have unpaid derogatory items on your credit report. Make sure the accounts are valid before sending payment, especially with debt collection accounts.

Recommended Reading: How Long A Repo Stay On Your Credit

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

What Is On A Credit Report

The short answer to that question is: A lot!

The typical credit report will include personal identifying information: a list of credit accounts , type of account , and your payment history on those accounts.

The three major credit bureaus Experian, Equifax and TransUnion compile data from sources that extend you credit. Bits and pieces of your credit history may vary slightly among the three companies because not all businesses supply information to all three agencies. However, the broad picture of your credit history should be relatively consistent.

Each credit report has four basic categories: identity, existing credit information, public records and recent inquiries.

Heres how they break down:

Read Also: Unlock My Experian Credit Report

How To Get Your Free Credit Report Information

You can get free credit report information in two ways:

-

You’re entitled to a free report directly from the three credit bureaus by using AnnualCreditReport.com. Reports had been available annually, but in response to the coronavirus pandemic the site will offer free weekly updates through April 2022.

-

Some personal finance websites, including NerdWallet, offer free credit report information. NerdWallet’s credit report includes a credit score, providing your VantageScore 3.0 using TransUnion data, and updates weekly.

See your free credit reportKnow what’s happening with your free credit report and know when and why your score changes.Get started

Where Can I Find My Credit Score

If you got a free credit report, dont be surprised when it doesnt include your . To see that, youll have to use a free web service or pay for it through MyFico.com or a credit bureau.

But keep in mind, when it all comes down to it, a credit score is really just an I love debt score. Thats right, a good score simply shows how well youve played the debt game. It doesnt reflect your actual net worth or the amount of money you have in the bank. In other words, its nothing to be proud of. The only way to keep your stellar credit score is to live in debt and stay there. No thanks!

It is possible to live life without a credit score, which is exactly what Dave recommends. But that doesnt mean you should trash your credit to lower it! Just start paying off your debt, close your credit accounts once theyre paid off, and dont take on any new debt. If youre following the Baby Steps, you should reach that indeterminable score within a few months to a few years. Remember: No credit is not the same as having a low credit score.

Read Also: Paypal Credit Soft Pull

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

When To Request A Credit Report

Anytime you are considering a major purchase that will require a loan, such as a home mortgage, car loan or home improvement project, you should start by requesting and reviewing your credit report.

The interest rate you receive from any lender is based on your credit score and the information contained in your credit report. If there are mistakes, it could affect the interest rate you receive and cost you thousands of dollars.

A recent government survey says that 20% of consumers found at least one error on their credit report that makes them look riskier than they are. Thats one reason its so important to check your credit report regularly.

Another is to see if you are the victim of identity theft. A survey from Javelin Strategy and Research says that a record 16.7 million Americans were victims of identity theft in 2017, resulting in $16.8 billion stolen. Over 5.5 million were victims of credit card fraud and about two million were victims of bank fraud.

Applying for a job is another reason to review your credit report. A study by the Society of Human Resource Management said that 47% of employers look at a candidates credit report. If there is incorrect information there, it could impact your hiring.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus

Dispute Errors On Your Credit Report

If your credit report has wrong information, you can dispute the error so that it is fixed. Here is how to dispute an error:

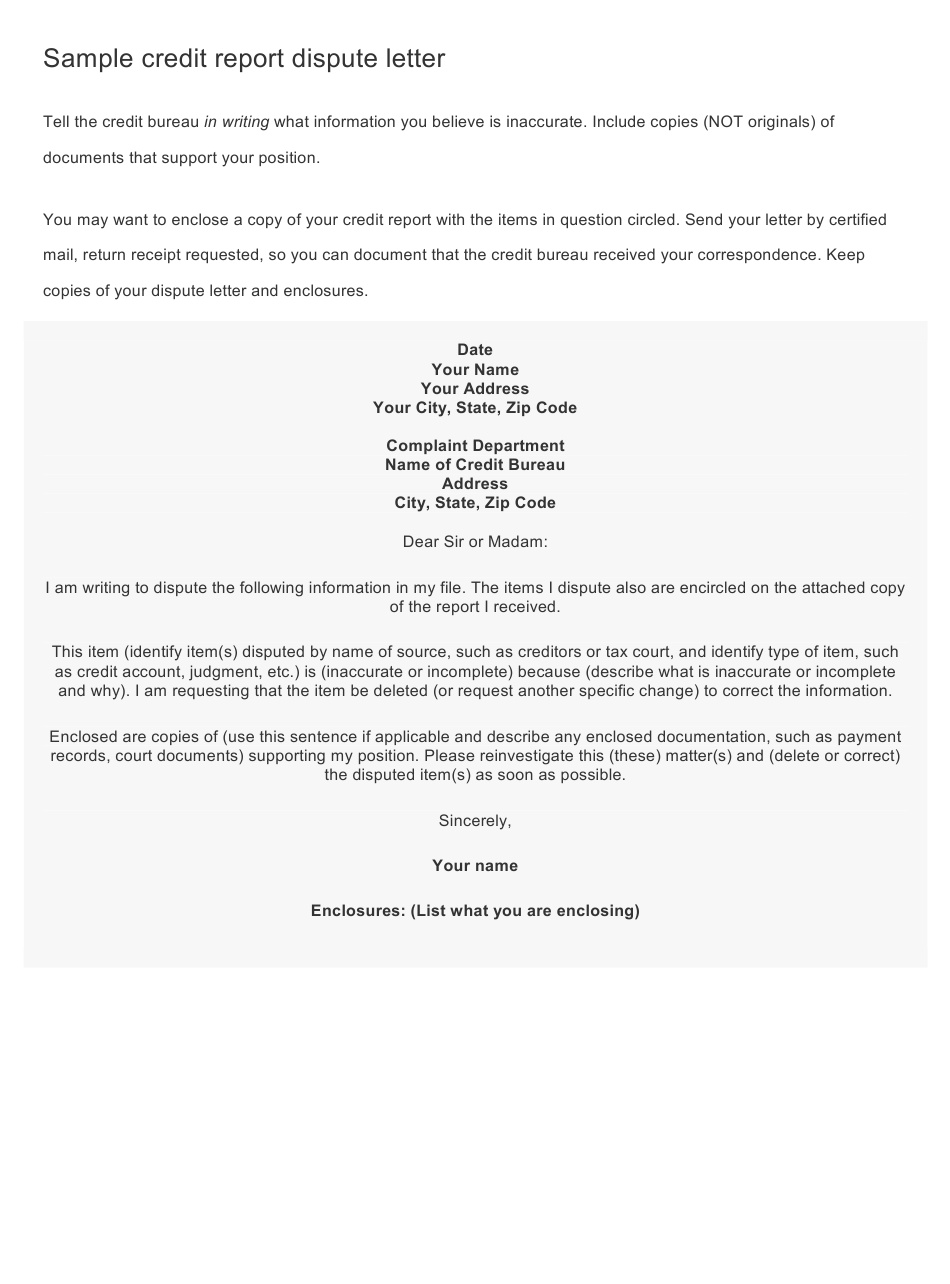

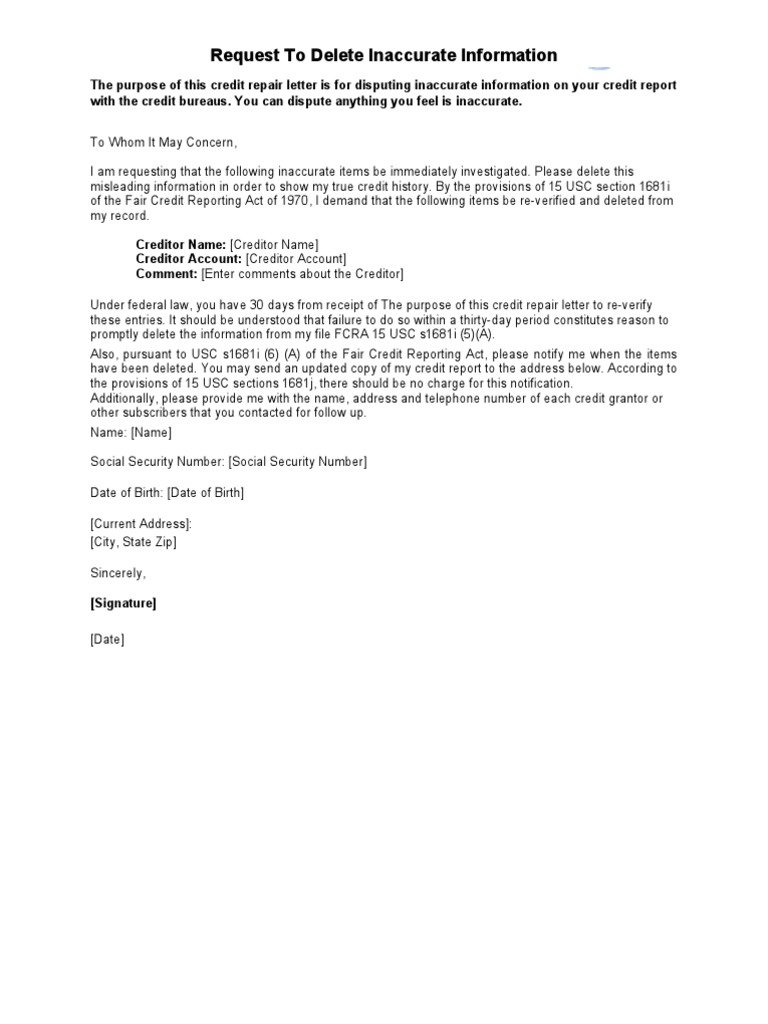

First, write a letter to the credit reporting companies that have the wrong information to ask them to fix the information. Include all of the following:

- Your name and address

- The specific information in your credit report that is wrong

- Why that information is wrong

- Copies of any receipts, emails, or other documents that support why the information is wrong and

- Ask that the information be deleted or corrected.

You may use the Federal Trade Commissions sample dispute letter to credit reporting companies and attach a copy of your credit report with the wrong items circled. Send the letter by certified mail or priority with tracking, and keep a copy of the letter and receipt.

If you cannot get the disputed information corrected or deleted, you may ask the credit reporting companies to add a statement noting your dispute in your file and in future credit reports.

Whats Not Included In Your Credit Report

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

When you apply for a loan or other credit, lenders want to know how you manage debt. Your credit report is meant to provide a detailed record of your relationship with debthow much of it you carry and how well you pay it off. It also includes personal identifying information that helps to verify that the information in the report is yours.

Your credit report does not include your marital status, medical information, buying habits or transactional data, income, bank account balances, criminal records or level of education. It also doesn’t include your . For a bit more detail, let’s unpack a few types of information that don’t appear on your credit report.

Don’t Miss: When Does Capital One Report To Credit

How Many Times Can I Pull My Own Credit Reports Before It Impacts My Credit Score

There is good news. Pulling your own credit report is considered a consumer disclosure request and therefore your scores will never be impacted. In fact, you canget your credit score and credit report card for free right now!. If, however, you are getting your credit reports from a friend at a mortgage company or at an auto dealership your scores will be impacted. The reason is that their credit report access accounts are not setup for consumer disclosure. They are set up as lenders so the hard pull will count against the consumers score.

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Read Also: Why Is There Aargon Agency On My Credit Report

If You See Errors Dispute Them

If you spot inaccuracies that may be lowering your scores, gather documentation to back up your claim. You can dispute credit report errors with the credit bureau showing them. You’ll need to provide copies of documents proving your identity and showing why the item is wrong. The bureau has 30 days to investigate and respond, although the Consumer Financial Protection Bureau has guidance extending that to 45 because of the pandemic

You can request your free credit reports from the three major bureaus or a personal finance site that provides free credit report details, like NerdWallet. Then, review the information and check for inaccuracies.

Credit reports include your personal information, accounts, credit inquiries and any negative marks you may have, such as bankruptcies.

A good credit score is generally between 690 and 719. Learn more about the and how to build credit.

About the authors:Lindsay Konsko is a former staff writer covering credit cards and consumer credit for NerdWallet.Read more

Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

What Does An Open Account Mean On My Credit Report

An open account is any line of credit youve opened and never officially closed. You know, like that paid-off department store credit card you forgot to call about and cancel. Even if you havent used a credit card for a few years, it will still show up as an open account on your credit report until you contact the company to close the account. So, stop having cold feet and just go ahead and close it for good.

You May Like: Is Klarna A Hard Pull

Can You Ask Creditors To Report Paid Debts

Positive information on your credit reports can remain there indefinitely, but it will likely be removed at some point. For example, a mortgage lender may remove a mortgage that was paid as agreed 10 years after the date of last activity.

Its up to the lender to decide whether it reports your account information to the three credit bureaus. That includes your debt thats been paid as agreed. You can call the lender and ask it to report the information, but it might say no. However, you can add positive information to your credit reports by using your existing credit responsibly, like paying off credit card balances each month.

Financial Information On Your Credit Report

Your credit report may contain the following financial information:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a lien on a car that allows the lender to seize it if you dont make payments

- remarks, including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if you made your payments on time

- if you missed payments

- if your debt has been transferred to a collection agency

- if you went over your credit limit

- personal information thats available in public records, such as a bankruptcy

Recommended Reading: Does Paypal Credit Affect Your Credit