Where To Send A Goodwill Letter

Since goodwill letters arent considered an official way to communicate with a creditor, you wont find a specific department to send your letter to. Instead, you should look for a customer service address for the creditor in question, then send your letter there.

This information is typically easy to find online, but you may also be able to find a customer service address on your monthly bill.

Late Payments And Goodwill Adjustments

Maybe paying bills has been difficult or youre looking for information on fixing bad credit. We know financial stress can be tough. And we want to help.

If you have one late payment or some other negative mark on your credit report, you may have heard that a can quickly fix bad credit. Were required to report complete and accurate information, and thats why we arent able to honor requests for goodwill adjustments. The best way to address negative credit history is to rebuild your credit by moving forward and establishing a solid history of on-time payments.

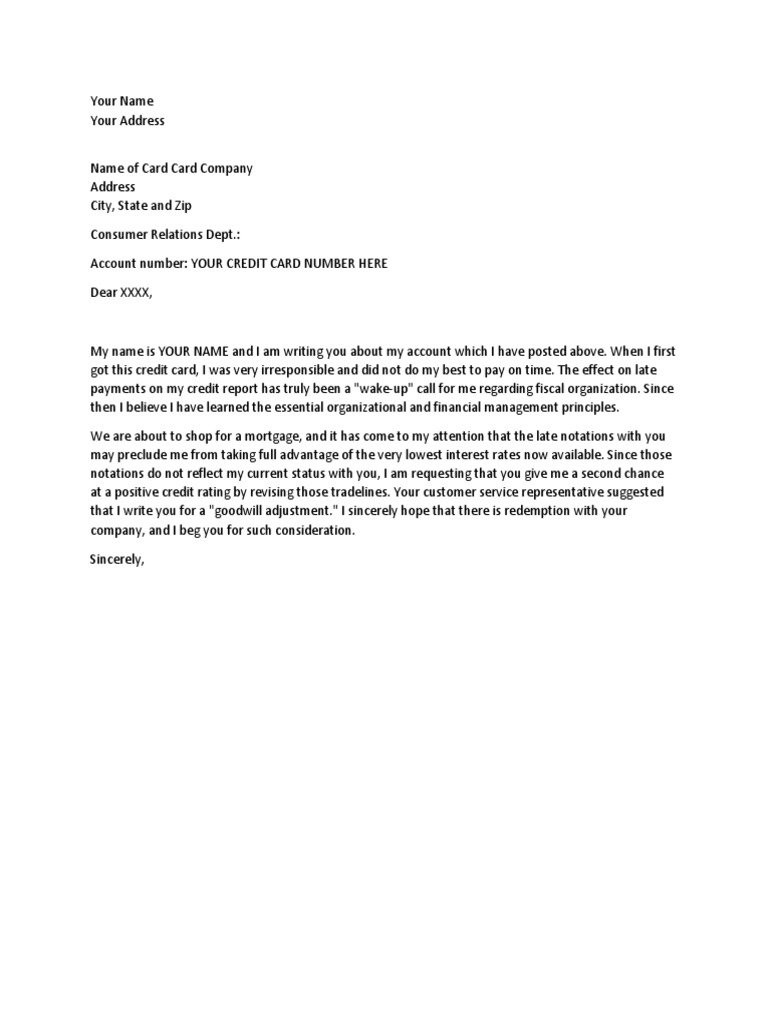

Missed Or Late Payment Goodwill Letter Template

Heres a template goodwill letter for missed payments on a credit card:

To Whom It May Concern:

Thank you for taking the time to read this letter. Im writing because I noticed that my most recent credit report contains reported on for my account.

I want you to know that I fully understand my financial obligations, and if it werent for , Id have an excellent repayment record. I made a mistake in falling behind, but since then, . Since then, Ive had a spotless record of on-time payments.

Im planning to apply for , and its come to my attention that the missed payment on my record could hurt my ability to qualify. I truly believe that it doesnt reflect my creditworthiness and commitment to repaying my debts. It would help me immensely if you could give me a second chance and make a goodwill adjustment to remove the late on .

Thank you very much for your time and for your consideration, and I hope youll approve my request.

If you have any questions regarding this incident, please feel free to reach out to me.

Best,

Read Also: Will Getting Married Affect My Credit Score

The Late Payments Dropped My Credit Score By 80 Points

Thats right my FICO score dropped 80 points! Although I really didnt care as much as I usually would, I just bought a new house and car. I wasnt going to be using my credit file again for a while. I knew whenever I needed my credit I could probably get them deleted.

Before I wrote this article, I wanted to try the methods I posted here to see if I could get my own late payments removed from my credit report.

Step : Engage The Creditors Executive Resolutions Dept Or Office Of The Ceo

Most lenders have such a high level customer resolutions department, which goes by different names, depending on the lender. Capital One has an executive resolutions department and so does Chase, Bank of America, Amex and virtually every major lender.

Just do a google search to either find the phone # to this department or google for the email address.

If all else fails, simply find out the headquarters address of the lender and send an overnight letter with signature required addressed to the CEO. Include your phone # and email, and chances are very high that youll get a response back.

Recommended Reading: What Is Synchrony Bank Ppc

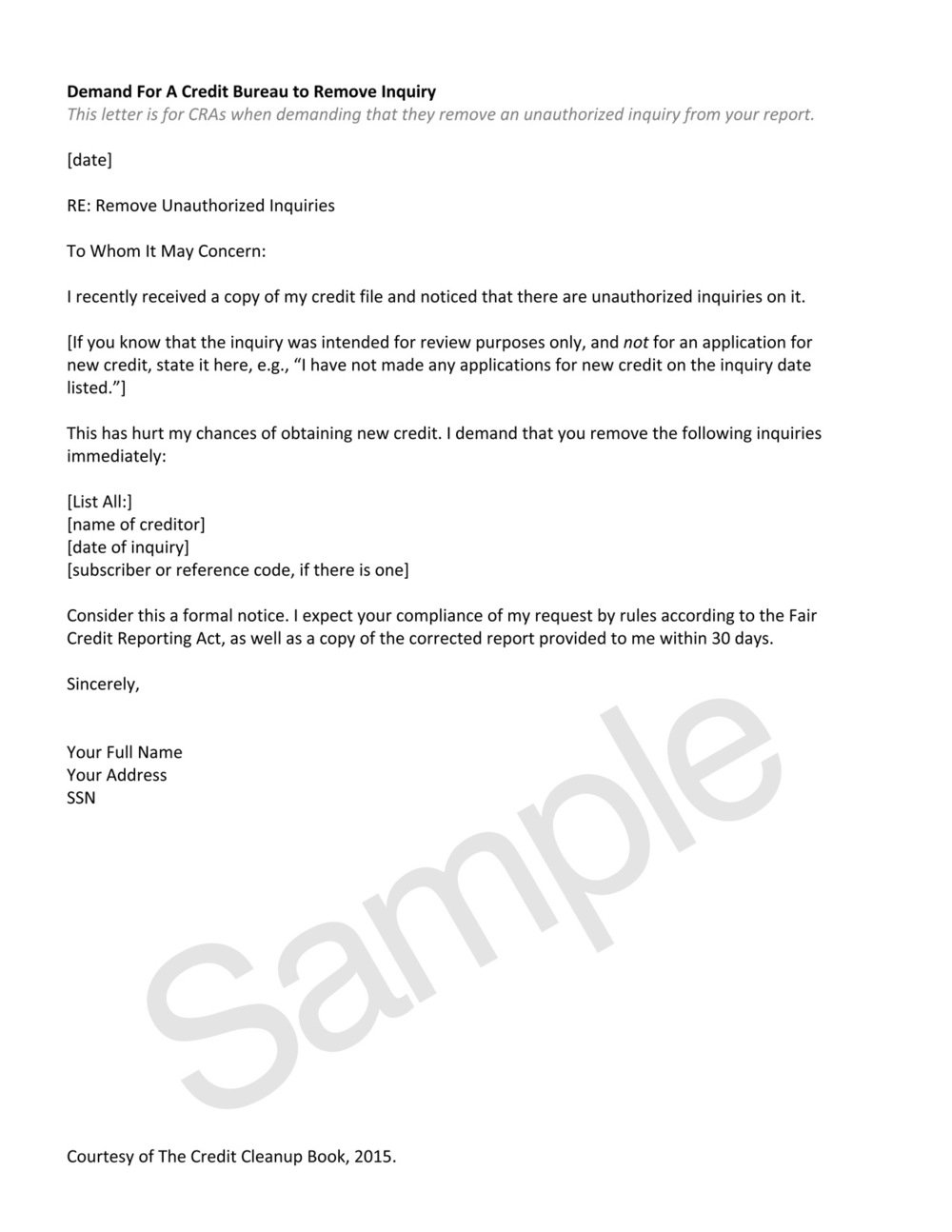

Knowing Your Rights Can Help You Negotiate Late Payments

Congress has passed several laws to help consumers negotiate with credit reporting agencies and creditors.

The Fair Credit Reporting Act, for example, gives you access to your credit file for free every year.

Visit annualcreditreport.com to get your free credit reports from the three credit reporting bureaus.

If you discover inaccurate information, the law requires the bureaus to fix this information or remove it.

Be sure to file a complaint with the Consumer Financial Protection Bureau if your attempts to remove inaccurate negative information get no response.

What Makes A Goodwill Letter Great

An effective goodwill letter will include all the key components we discussed earlier. They will flow logically from start to finish. The introduction should be an effort to establish a friendly and familiar connection:

- appreciate the quality products and services they provide

- value the relationship

In the body of the letter, you should include the relevant facts in context using a relatable story:

- paid the balance in full, but did not anticipate a finance charge

- did not check the statements due to inaccurate assumptions about the recent payoff

As you prepare to ask for the goodwill adjustment, highlight any mitigating facts that you think they should consider:

- was the first late payment on record

- reestablished timely payments in a reliable and responsible manner

Take Ownership of Your Mistake

Remember to take ownership of your mistake. Provide any evidence you can think of to support the notion that this was a one-time incident and is not likely to happen again. Show them that you learned from your mistake.

Avoid faxes and email. Put the letter on professional-grade paper with letterhead if possible, and send it through snail mail. This conveys an image of professionalism and makes it clear that you really care about making things right.

About Rick Miller

Rick is a former US Army Aviator, West Point graduate, and Darden MBA. He owns and operates a successful Real Estate Investment firm, and he enjoys spending time with his wife and three children in Hartford, CT.

Don’t Miss: Cbe Group Verizon

Negotiate Removal By Offering To Sign Up For Automatic Payments

I have never actually tried this method myself, but from what I understand creditors frequently offer to remove late payment entries if you, in exchange, agree to sign up for automatic payments.

This strategy works well for both parties: the creditor can ensure future on-time payments will be made, and you dont have to worry about remembering to make payments or being charged late fees if you forgot to pay by the due date.

Of course, automatic payments are only good when you have the money in your bank account to cover the transaction.

I would love to hear from those of you who have succeeded with this method!

UPDATE: Several readers have verified that this method did work for them, so try this next if a goodwill letter doesnt work.

Start Writing Your Goodwill Letters Now

Writing a goodwill letter doesnât guarantee a negative mark will be removed from your credit reports.

But itâs a simple exercise that doesnât take much time and doesnât have any major downsides.

Whatâs more â having a goodwill letter can raise your score by as much as 110 points.

This could help you save money on interest rates or get approved for a loan youâd otherwise be denied from taking out.

Donât put it off.

Start writing your goodwill letters today to fix your credit score fast.

Don’t Miss: Carmax Lenders

Why Late Payments Matter

Your payment history is the most significant factor in your FICO credit score, with a 35% weighting. Even if your credit reports are in good shape, one late payment can damage your credit.

The impact of one late payment depends on several factors, including whether or not your lenders ever report late payments to credit bureaus.

What Happens After Sending A Goodwill Letter

Unlike with a credit dispute, the law does not protect your right to a goodwill forgiveness removal. The creditor or collection agency has no requirement to even respond to your letter.

But most creditors and collection agencies respond in some way. In most cases, you should get a letter back within three to four weeks.

The letter should let you know whether the creditor made a goodwill adjustment in your account.

Its possible you may get a phone call in response to your letter.

Remember that goodwill adjustments are much more likely to happen when you have one or two blemishes such as late payments or missed payments.

If you have a long history of continuous late payments, the creditor will be less likely to make a goodwill adjustment.

But if your late payments are an anomaly on your credit report, a goodwill letter may be just what you need to remove the negative items.

Don’t Miss: How To Get A Timeshare Off Your Credit Report

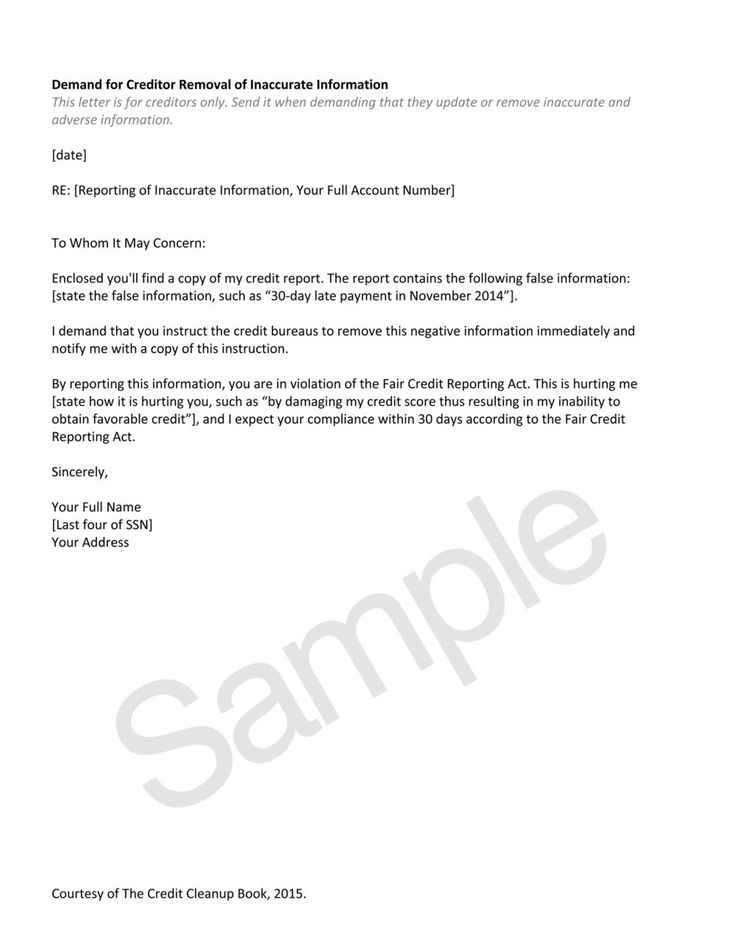

Goodwill Deletion Request Letter Template

A goodwill deletion letter should include the following:

- Your name and address, the date, and the recipients name, department, and address

- Any account or reference numbers

- The late payment date

- Acknowledgement of the late payment and the circumstances that caused it

- Your recently improved credit management practices

- The problem the derogatory information is causing

- Request for deletion

- Thanks for consideration/closing salutation

The following outline contains the key elements of a student loan goodwill letter sent to an original creditor regarding a missed payment that is harming the borrowers credit score.

John A. Smith

RE: Credit Account # 10003455

To Whom It May Concern:

Upon reviewing my Transunion credit report, I observed that my missed monthly payment from January 2021 is listed as a negative paid collection entry.

In December 2020, I endured an abrupt loss of employment that was related to devastating financial hardships that the organization experienced resulting from the COVID-19 pandemic.

My account history indicates that the past due balance was paid as well as the resulting late fee approximately 15 days later. Further, I have since made timely monthly payments and my account remains in good standing.

My purpose in writing is that I have encountered difficulties in securing financing from mortgage lenders, largely the result of a diminished FICO score.

Thank you for your consideration,

John A. Smith

Proof This Process Workscheck Out These 4 Deletion Letters:

The process is only as good as the results it yields. Fortunately, I have the results to prove the process.

These are 30-day, 60-day, and 90-day late payment deletions that I achieved for my clients with Macys, Barclaycard, Capital One, and Chase credit cards just this year

Over the years, I have helped countless individuals remove late payments from their credit records. To find out if my services are right for you, click the link below to book your free consultation.

Now that we know the process works, let me clear up some misconceptions about missed payments.

Also Check: What Card Is Syncb/ppc

How Much Does A Late Payment Hurt My Credit

If you have perfect or near-perfect credit, a late payment could knock upwards of 100 points off your FICO score.

As you can see, a single late payment can have a bigger impact on your credit file than you may think.

Thats because payment history comprises 35% the biggest chunk of your credit score.

When you already have excellent credit, you have more room for one negative item to take a big hit.

A single late payment will have a smaller impact if your credit file already has some problems such as multiple late payments or a charge-off or collection account.

What To Do If Youre Not Able To Make Your Future Upcoming Credit Payments

In this case ,you not only want to get the late payment removed, but also want to get future payments deferred. This is possible! Youd need to call your lender to get a deferment.Just make sure to ask the phone represented one very important question: Is my credit going to be harmed if I get into a deferment? The major banks are offering deferments for 30-90 days, without your score being impacted. However, if youre dealing with a lesser known institution, you want to find out their specific policy on deferments and credit reporting

Read Also: Removing A Repossession From Credit Report

Step : File A Cfpb Complaint Against The Creditor

Ive found this to be a highly effective strategy over the years. Consumer Financial Protection Bureau is the government agency whose purpose is to protect consumer rights in the financial sector. Their website , has an online complaint portal, where you can simply have to do two things, state what happened and what resolution you seek. Once you file this complaint, the CFPB forwards the complaint to the creditor, wholl be required to respond back in about 15 days with a resolution.

How To Use Donotpay’s Sample Letter For Removing Late Payments From Credit Scores

DoNotPay was designed to level the playing field and make things like sample letters for removing late payments from a credit report fast and easy.

How to clean up your credit report using DoNotPay:

If you want to clean up your credit report but don’t know where to start, DoNotPay has you covered in three easy steps:

And that’s it. DoNotPay will be hard at work on your behalf to begin cleaning up any discrepancies on your credit report, including sending those Goodwill Letters to remove late payments and begin raising your credit score.

Also Check: How To Get Charge Offs Removed

Why Creditors Do Not Want To Help You Fix Your Payment History

At this point, you may be asking, Ali, its just one stinking, lousy, ten-dollar 30-day late payment, and Ive always been on time and have been a loyal customer. Why wouldnt the creditor just not remove it?

Heres what you need to know The regulatory agencies constantly audit creditors.

If they find a company reporting their consumers as current despite them being late, then this can be interpreted as the company trying to conceal the defaults from shareholders. This may lead to a heavy regulatory fine for your creditor.

Unless youre avictim of fraud and or identity theft, the only way to remove a recent late payment from the credit report is by getting the original creditor to agree to remove the late payment.

And remember, will not work for late payments unless the late occurred over 4 years ago on a closed account.

Luckily there is a way around this! I have had tremendous success in getting creditors, even stubborn ones like Barclays, JP Morgan Chase, and Capital One, to remove 30, 60, and even 90-day late payments.

I have done this by providing the creditors with a chronological letter, backed with proof, which explains the following:

1. Why the late payment occurred in the first place.

2. Why the consumer was not aware the bill was due.

3. What extenuating circumstances interfered in the situation.

4. Proof that the consumer had the financial capability to pay the bill.

Fortunately, I have laid out my strategy to remove late payments from your records below.

Request A Goodwill Adjustment From The Original Creditor

The idea is simple, and it works surprisingly well.

Many times creditors are happy to grant goodwill adjustments if your previous payment history is relatively good and you have established a good relationship with the creditor.

This is probably the easiest and surest way to get a late payment removed from your credit report.

The process involves writing the creditor a letter explaining your situation and asking that they forgive the late payment and adjust your credit report accordingly.

The easiest way to get started is to use this goodwill/forgiveness letter template that I created. This method might not work if you have multiple late payments.

Recommended Reading: Does Applying For Paypal Credit Affect Credit Score

Step : Hiring Help: How To Pick The Right Credit Repair Company

Unfortunately, despite running a myself, I have to say that the credit repair industry is riddled with unscrupulous business, in-fact even the most successful credit repair companies, Lexington Law and Creditrepair.com were sued by the government consumer protection agency for charging illegal upfront fees and using deceptive marketing tactics.

So how do you pick the right company? There are 3 things to look into.

First is check their yelp page for reviews and read through them. Most other review sites, like google reviews, make it easy for anyone to leave a review, whereas yelp is very intelligent in filtering fake reviews. Back in the day the BBB used to be a credible source, but unfortunately, theyve been known to list businesses in a better light which pay them.

Second, make sure they dont charge any upfront fees and charge you only if and after your credit is repair. Yes, that means no monthly fees or any fees until you see results produce.

Lastly, in your state if there are licensing and registration requirements for credit repair companies, and make sure the company youre dealing with is properly licensed in your state. For example, in California, credit repair companies are required to be registered with the California Attorney Generals Office and post a bond for $100,000 with the secretary of state.

If you find a company that satisfied these 3 requirements, then you should be good to go!

Have A Professional Remove The Late Payments

We understand that credit repair can be overwhelming.

If youd rather have a professional credit repair company help, I suggest you check out Lexington Law.

will typically charge a monthly subscription fee while you work with them but theyre also easy to cancel and theres no long-term commitment.

For someone with items that can be challenged, most times, progress can typically be made in 45 or 90 days.

You May Like: Credit Score Needed For Comenity Bank