What Does A Lender Look For

Lenders want to know that you will pay back your loan. The best predictor of your future behavior is your past behavior. So, the underwriters will look at your past spending habits. If your patterns reflect the current models that predict bankruptcy or repossessions as likely, you will not get a loan. People with six inquiries or more on their credit reports can be up to eight times more likely to declare bankruptcy than people with no inquiries on their reports.

In addition to your report, the market changes can affect whether you will get loans in the future. If bankruptcy rates are high and even good credit risks are getting into debt trouble, you are less likely to get a loan regardless of your credit pulls.

How To Remove Hard Inquiries From Your Credit Report

Paul SisolakArticle Summary:

Hard credit inquiries are a part of determining your creditworthiness. A single inquiry is no big deal expect a drop of around 5 points but multiple hard credit inquiries can cause real damage to your credit score. Also, if youre trying to build your credit or seeking a loan, even the smallest changes to your FICO score can make a big difference.

Noting that, its important to know when a hard inquiry of your credit is being carried out, and how long they remain on your credit report. More important is knowing if a hard credit check is legitimate. Erroneous hard inquiries or mistakes on your credit report could be signs of identity theft.

Heres what you need to know about what credit inquiries are, the effects they have on your credit, and when you can remove them from your credit report.

Examples Of Hard Credit Inquiries And Soft Credit Inquiries

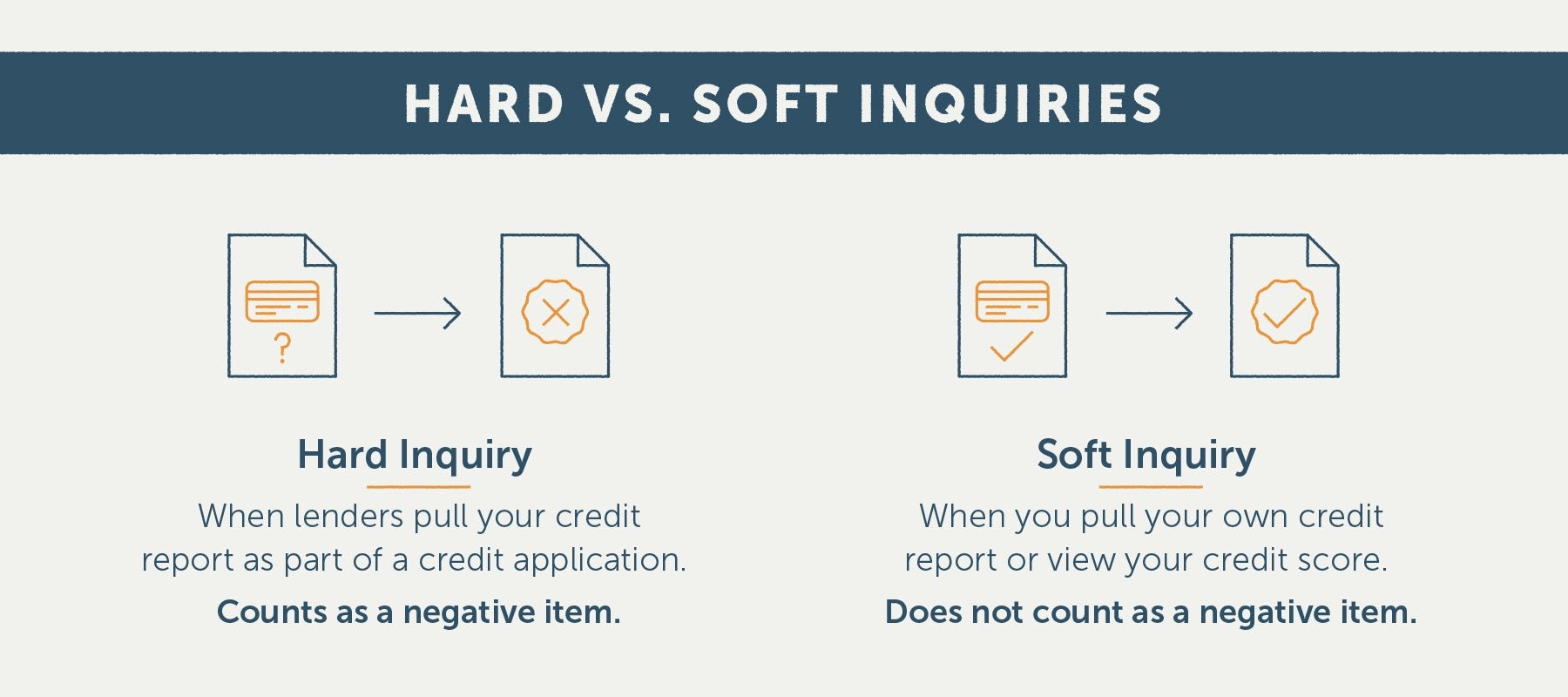

The difference between a hard and soft inquiry generally boils down to whether you gave the lender permission to check your credit. If you did, it may be reported as a hard inquiry. If you didnt, it should be reported as a soft inquiry.

Lets look at some examples of when a hard inquiry or a soft inquiry might be placed on your credit reports. Note: The following lists are not exhaustive and should be treated as a general guide.

You May Like: How To Get Credit Report With Itin Number

Combining Multiple Inquiries For Auto Mortgage And Student Loans

When you shop around for a mortgage, auto, or student loan, you may end up with multiple hard inquiries. However, youre not looking to take out 10 loans. Youre rate shopping for the best deal on one loan.

For this reason, credit scoring models are designed to include special rules for these certain types of loans in an effort to prevent your scores from being penalized for multiple inquiries for the same loan.

With FICO scoring models, all auto, mortgage and student loan inquiries that are fewer than 30 days old are completely ignored. After 30 days, the model breaks those three types of inquiries into a 45 day de-dupe period. Multiple inquiries during a 45 day period are grouped together and counted as one inquiry. This process is called collapsing.

Hard Inquiries Vs Soft Inquiries: Whats The Difference

Theres a myth out there that shopping around for the best rate hurts your credit score but this is only partially true. There are two types of credit inquiries hard inquiries and soft inquiries and only hard inquiries impact your credit score. In this article, well clarify the difference between hard inquiries and soft inquiries, how they impact your credit score, and how you can protect your credit score when you shop for the best rate or apply for credit.

Don’t Miss: What Credit Score Does Carmax Use

How Hard Inquiries Impact Your Credit Score

Hard inquiries may, but do not always, impact your credit scores, Ulzheimer said, noting that one of the most common misconceptions about credit inquiries is that they always have a negative effect on your credit score. If a hard credit inquiry does negatively impact your credit score, it is likely to drop by no more than 10 pointsand the damage should last no longer than a year. Hard inquiries automatically fall off your credit report after two years.

The impact, if any, will last 12 months, Ulzheimer advises. Once an inquiry becomes older than 12 months, they are not seen by either FICO or VantageScores credit scoring models.

What A Credit Check Entails

You most likely know that a credit check is an examination of your credit history, usually conducted by your bank, lender, or a service provider. What you might not be familiar with is the exact information they look at.

One of their main concerns is looking into whether you make your payments on time. If you do, theyll move on to reviewing your accounts or, in other words, assessing if youre capable of handling additional financial obligations.

Seeing as how hard credit checks remain recorded on your credit reports, lenders will be able to find out just how many times youve been assessed in the last few months. Too many hard inquiries are a red flag, as this indicates that you arent a very desirable borrower.

Lastly, the person in charge of conducting a credit check on you will go over your public records. In this category, some of the things that you wouldnt want showing up in your credit history include bankruptcies, foreclosures, as well as civil suits and convictions.

Read Also: Does Speedy Cash Report To Credit Bureaus

How Many Points Will A Hard Inquiry Cost You

According to FICO, one new inquiry will generally lower a credit score by less than five points. As that inquiry grows older, the impact on your score should be less until it no longer counts at all. Of course, the real credit scoring process is a bit more complicated when you break it down.

Hard credit inquiries dont count toward your credit score calculation nearly as much as other factors. With FICO scoring models, for example, credit inquiries influence 10% of your credit score. By comparison, your payment history is worth 35% of your FICO Score. Hard inquiries matter even less under VantageScore credit scoring models. VantageScore calculates just 5% of your score based on hard inquiries.

Individual credit inquiries dont have a specific point value across the board. For example, you cant say that a new hard inquiry will lower your credit score five points. Thats not how credit scoring works.

Instead, a credit scoring model considers the total number of inquiries that appear on your credit report along with the age of those inquiries. The rest of your credit information matters too. A new hard inquiry might have a bigger score impact for people with little credit history versus those with older, more established credit reports.

Can You Dispute Hard Inquiries

If you do not recognize a hard inquiry for your credit history, you might be a victim of identity theft, and you should contact the credit bureaus right away. The credit bureaus are required by law to inform you if a hard inquiry is made in your name. A hard pull that you dont know about could mean someone is trying to take out loans using your identity.

Otherwise, if a hard inquiry is legitimate, i.e., you know you approved the request, there is no way to dispute it.

Also Check: How To Remove Inquiries Off Credit

Can Inquiries On My Credit Report Be Disputed

Legitimate inquiries can’t be disputed or removed from your credit report until the two-year time period is up.

A hard inquiry from a company you don’t recognize doesn’t necessarily indicate a case of identity theft. When you shop around for a mortgage or car loan, websites, brokers or dealerships may send your information to multiple lenders, who will each check your credit. If you don’t recognize the name of the company that performed the hard inquiry, you can often find contact information for the company listed in the entry on your credit report or online, so you can call to verify.

If it turns out that a company pulled your credit report in error, you can ask the company to contact the credit bureau to have the inquiry removed. If someone is fraudulently applying for credit in your name, you can contact the credit bureau to dispute the inquiry and ask to have it taken off your credit report.

How To Dispute Hard Credit Inquiries

We recommend checking your credit reports often. If you spot any errors, such as a hard inquiry that occurred without your permission, consider disputing it with the credit bureau. You may also contact the Consumer Financial Protection Bureau, or CFPB, for further assistance.

This could be a sign of identity theft, according to Experian, one of the three major credit bureaus. At the very least, youll want to look into it and understand whats going on.

Keep in mind, you can only dispute hard inquiries that occur without your permission. If youve authorized a hard inquiry, it generally takes two years to fall off your credit reports.

Don’t Miss: What Credit Score Does Carmax Use

Soft Inquiries Or Soft Credit Pulls

These do not impact credit scores and dont look bad to lenders.

In fact, lenders cant see soft inquiries at all because they will only show up on the credit reports you check yourself . A soft inquiry happens when there is no credit decision being considered. For example, its a soft inquiry when you check your own credit report or an existing lender checks your credit in a context where youre not applying for new credit .

The next time you get a copy of your , look for the section labeled requests for credit history or something similar. This part of the report will list the names of all of the companies that have recently requested a copy of your credit report.

Equifax, like Experian and TransUnion, used to count phone and internet service inquiries as hard inquiries. But, effective April 6, 2020, inquiries on Equifax credit reports for wired and wireless phone, internet, and pay TV accounts can be counted by service providers as soft inquiries. By June 30, 2020, Equifax will automatically classify those new accounts as soft inquiries.

A Soft Credit Check Vs A Hard Credit Check

Although both soft and hard credit inquiries appear on your credit reports, a soft check doesnt impact your credit score and, aside from a few exceptions, you are the only one who sees them in your file. Soft credit inquiries are reserved for prequalified insurance quotes and credit card offers, employers performing a background check on prospective hires, or you checking your own credit.

Hard pulls, on the other hand, are visible to anyone with access to your credit reports. They are implemented when you apply for a personal loan, mortgage, auto loan, apartment renting, student loan, or credit cards.

Read Also: Why Is There Aargon Agency On My Credit Report

What A Credit Card Issuer Or Lender Thinks When They See A Hard Inquiry On Your Credit Report

Hard inquiries fall under the “less influential” category when calculating credit scores using the VantageScore model, and they make up only 10% of a FICO score calculation. But they play a big part when it comes to credit card issuers and lenders assessing your potential risk.

Lenders pull your credit report to see how credit worthy you are, but finding a bunch of inquiries on your credit report will show them you may be financially stressed and a bigger risk for borrowing in the future.

According to FICO, “Statistically, people with six inquiries or more on their credit reports can be up to eight times more likely to declare bankruptcy than people with no inquiries on their reports.”

But while these hard inquiries do show risk, lenders also consider other factors when making approval decisions, such as your income and payment history.

How Long Do Hard Inquiries Stay On Credit Report

by Whoosh Agency | Apr 20, 2021 |

If you take out a loan for a car or get a new credit card, these credit pulls are reported as hard inquiries by the lender to the credit bureaus. If you have too many hard inquiries on your credit report, you are more likely to be turned down for a mortgage or other loans. So, it is crucial to know how long hard inquiries stay on your credit report.

In general, hard inquiries will fall off your credit report after two years. However, many lenders will not care about hard inquiries after the one-year mark, even if they are still on your report.

Read Also: When Does Capital One Report To Credit

How Do Hard Inquiries Affect Your Credit

The problem is, although hard credit inquiries are a normal, required step in the world of lending, they can ding the youve worked hard to earn. And they show up on your credit report, too.

And this can seem a bit unfair. To put your excellent credit at risk just to prove to a lender that your credit is excellent seems like a bit of a paradox.

The truth is, a hard inquiry doesnt affect your credit all that much. A single credit pull can ding your FICO score only about five points. However, if youre monitoring your credit every month, with a goal of reaching the coveted 800 Club, every point counts. That credit score impact usually falls away after 12 months, and you can expect it to disappear from your credit report after about two years.

Find out how long it takes to improve your credit score.

How Long Do Hard Pulls Stay On Your Credit Report

Your credit score is an important number that can have a major effect on your life.

Your score is what lenders use to decide whether or not to approve you for credit, including some the most coveted credit cards.

Besides that, your credit score also affects your interest rates. The higher your score, the better the odds of getting a low APR.

- How much debt you owe

- Your total credit limit

- The number of accounts you have

- The types of credit youre using

- How long youve been using credit

- How often you apply for new credit

Each of these factors affects your credit score in different ways. Positive information–like on-time payments–help your score. Negative information, such as late payments, can knock points off.

Hard credit pulls are one of those things that can cause your credit score to be dinged temporarily.

If youre not sure what a credit hard pull is, or just how much it can affect your credit score, we cover everything that you need to know.

Read Also: Paypal Credit Soft Or Hard Pull

Check Your Credit Report Regularly

It isn’t common to find inaccurate information on your credit report, but it can happen. To avoid letting fraudulent and other erroneous information go unchecked, make it a goal to check your credit report regularly. Review what’s listed and watch out for anything you don’t recognize.

Also keep an eye on your credit score , and watch out for sudden drops that could indicate fraudulent activity, such as a bogus account opened in your name that’s gone unpaid.

It’s not always possible to prevent identity theft, but as you keep track of your credit history, you’ll be in a better position to stop a difficult situation from getting much worse.

Hard Inquiries Or Hard Credit Pulls

These can potentially have a negative impact on credit scores.

A hard inquiry usually happens when a lender is checking your credit in order to make a lending decision, such as a bank deciding whether to approve you for a credit card. Hard inquiries may occur when other types of companies check your credit as well, like a cell phone company deciding whether to give you a cell phone contract or a collection agency checking your credit for skip tracing purposes.

Don’t Miss: What Credit Score Does Carmax Use

Why Hard Inquiries Matter

When a lender pulls your credit report, theres a potential for your credit score to decline. The reason why comes down to simple math. Statistics show that consumers who apply for new credit are riskier compared with consumers who do not.

According to FICO, consumers with five or more credit inquiries in the past 12 months are six times more likely to become 90+ days past due on a credit obligation than consumers with zero inquiries. People with six or more credit inquiries may be eight times more likely to file bankruptcy compared with zero-inquiry consumers.

Lenders and other companies use credit scores to help predict the risk of doing business with you. Both FICO and VantageScore credit scores predict the likelihood that a consumer will default on any credit obligation within the next 24 months.

If something on your credit report shows youre more likely to default on a credit obligation, your score could decline. This is true of hard credit inquiries and any other actions that increase your credit risk, such as high , late payments and other derogatory credit information.

Does Applying For A Credit Card Hurt Your Credit Score

The short answer is YES, it can. But, if it does damage your score, one credit inquiry usually wont impact credit scores very much or for very long.

According to Fair Isaac Corporation, which administers the FICO credit score, most people who have one hard credit inquiry will see a reduction in their credit scores of less than five points. Some may not see any score reduction at all .

But FICO doesnt disclose its exact algorithm. So, there is a risk that a new hard credit inquiry on your credit report could reduce your credit score slightly. Plus, when you have many hard inquiries , it can become problematic when applying for new credit cards due to certain card issuer qualification standards.

If you apply for many accounts all at once or over a short period of time, theres a risk you could see your credit scores drop significantly. And, if you have relatively few credit accounts or a short credit history, the impact of hard inquiries could be more significant.

Hard inquiries impact FICO scores for one year, even though they stay on credit reports for two years.

Its important to remember that credit decisions are not always based entirely on a credit score. There are other factors that can be considered in a lending decision, like the number of hard inquiries youve had in the past two years, even though theyre no longer factored into your credit scores.

Insider tip

Read Also: What Score Do You Need For Care Credit