How To Report Your Rent To Credit Bureaus

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

A lot of people who dont have much of a credit history do have a history of paying rent on time. But that information doesn’t show up on their credit reports, and doesn’t help their .

You cant report rent payments yourself. But rent-reporting services can get your credit reports to reflect your rent payments fairly easily, at a cost that ranges from free if your landlord pays it to more than $100 a year.

To use a rent-reporting service effectively, youll need to know which credit bureaus it will report your payments to and which credit scores take those payments into account.

It’s also important to understand that this may not be the most cost-effective way for you to build your credit with all three credit bureaus and to understand your alternatives.

Why Report Rent Payments

Good credit is the cornerstone of financial health.

All of that is about to change. The major credit bureaus now accept rent payment history from landlords and include that history on the individual renters consumer credit report. This means you can now add rent to credit reports. This is a game-changer for tenants, who can now see improvement in their credit reports. That unlocks a multitude of savings and benefits, allowing access to the best financing rates and the best amenities. It is no wonder that 68% of renters surveyed would choose a landlord who reports rent payments.

Landlords Who Report Rent See Fewer Delinquencies

Good credit builds over time and requires a mixture of credit accounts. The traditional way to build credit is to take out a credit card, springboard that into a car loan, and eventually take the step of securing a long-term mortgage. As credit matures, consumers benefit by qualifying for the best interest rates and financing terms, making it easier to build wealth.

But more tenants today are staying in the rental market, either as a lifestyle choice or because mortgages are more difficult to obtain and housing is becoming more expensive. Over time, those renters fall behind homeowners who benefit from making monthly mortgage payments, forcing tenants into a downward spiral of spending more of their income on interest and fees to access credit lines.

California To Extend Eviction Ban Pay Back Rent For Tenantsyour Browser Indicates If You’ve Visited This Link

California will extend its ban on evictions and cover back rent and utility payments for people who fell behind during the pandemic under a $7.2 billion plan announced Friday that Gov. Gavin Newsom called the “largest and most comprehensive renter protection deal in the United States.

The Middletown Press

Read Also: Syncb/ppc Credit Card Login

What Is Rental Exchange

The Rental Exchange scheme was launched by credit reference agency Experian and The Big Issue Group in March 2016 as a way of allowing tenants to build up a credit history and ultimately improve their credit rating by paying their rent on time each month.

The scheme uses rental payment data in the same way it would mortgage payment data, so if you’re signed up, your payments will be recorded and added to your credit file.

Before Rental Exchange, some renters were unable to show they could meet regular payments, particularly if they didn’t already have a traditional credit product.

More than 150 social housing providers, local authorities and letting agents are reporting data into the Rental Exchange scheme with more expected to come on board – though you can opt to do it yourself now if yours hasn’t signed up yet. If you rent from a private landlord, you’ll most likely need to ask to join the scheme.

It’s worth noting you can’t add your monthly payment data retrospectively as it’s only collected from the point you sign up and it starts to be shared so the sooner you join the scheme, the better. However, the account will show the start date of your tenancy, which, if you’ve been in the property a while, could show longevity and stability two big positives for lenders.

Which Bureaus Account For Rent Payments

All three credit bureaus will include rent payment information in your credit report if they receive it.

However, credit bureaus dont automatically receive your rental payment history. And despite services that simplify rent payment data reporting, that information wont automatically translate into changes in the credit score potential lenders see when you apply for a loan or new credit card.

Commonly-used versions of FICOs scoring model do not include rental payment data when calculating your credit score, though VantageScore models do consider rent payments when calculating your credit score.

Also Check: What Is Syncb Ntwk On Credit Report

But When It Comes To Your Future As A Tenant Its Always Best To Be Prepared For What To Expect When It Comes To Your Rental History

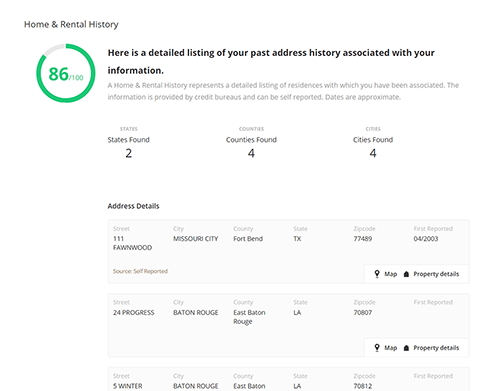

Just what is rental history? Its essentially information on your past rental arrangements, which includes the likes of former addresses, late rent payments and evictions, as well as criminal history, your credit score and other data to help a landlord judge whether or not youre a good fit as a tenant.

And thats the value of pulling a rental history report yourself well before you apply for residency in that dream apartment complex youve been eyeing. After all, your would-be landlord will certainly be pulling your rental history report to judge your liability as a tenant wouldnt you rather be prepared for the information it reveals now rather than when your landlord sees it? That way, not only can you see for yourself if there are any negative items on your report, but you can also take measures to have certain ones removed.

Yes, a rental history report is key. Essentially, it is to renting what your credit score is to getting financing for a loan. If your rental report is positive, youll likely be approved no problem for your apartment lease. But if there are a lot of negative marks on your report, your application may be denied.

This all circles back to the question at hand how to find your rental history.

Heres a closer look:

How do Apartments Check Rental History?

How Can I Find My Rental History?

I Pulled My Report and Theres a Lot of Negatives on it What Can I Do?

Next Post

What Is The Best Way To Check My Rental History Report For Free

You might be thinking of ways to check rental history for free. Thanks to the Fair Credit Reporting Act, you can review your rental history record once a year for free. All you have to do is visit a list of rental history report companies to learn more about your prior rentals. Once you have finished exploring the rental history report database, you can contact your preferred rental history report firm and get a copy of the report.

You May Like: Is 626 A Good Credit Score

Rejecting A Tenant Because Of A Poor Credit Report

If you do not rent to someone because of negative information in a credit report, or you charge someone a higher rent because of such information, you must give the prospective tenant the name and address of the agency that reported the negative information. This is a requirement of the federal Fair Credit Reporting Act. You must also tell the person that he has a right to obtain a copy of the file from the agency that reported the negative information, by requesting it within 60 days of being told that your rejection was based on the individual’s credit report. The Federal Trade Commission’s website offers helpful tips on how landlords can use consumer reports.

How Can I Obtain My Rental History Report

As a tenant, you can request a free copy of your credit history . You can do this once every 12 month period for free as per the Fair Credit Reporting Act.

There are two different ways to obtain information about anything that may be in your rental history. The first is to use resources that are based just on tenant activity. These would include the following

- Tenant Data: or 800-228-1837

- CoreLogic: or 800-815-8664

- LexisNexis Resident History Report: or 888-497-0011

- RentBureau: www.experian.com/rentbureau/rental-payment.html or 877-704-4519

The other primary way is to check with the three main credit reporting agencies Experian, TransUnion, and Equifax. These companies all operate under the Fair Credit Reporting Act and will be able to give you access to your credit history, which will include any inquiries regarding your rent history.

Also Check: Does Speedy Cash Report To Credit Bureaus

What Do The Lenders Say

We asked some of the biggest lenders how including rental payment information will impact their lending decisions if at all.

Lloyds Banking Group said: “Rent could prove useful in making lending decisions though we would need to further assess how best to use this.”

HSBC said: “We would always encourage people to try to build up a credit history, as this helps us consider the creditworthiness of those looking to borrow money. As a responsible lender, applications are assessed on the affordability of any mortgage, taking into account the income and outgoings of the applicant, including their ongoing financial commitments.”

Santander said: “We assess individuals on affordability, lending criteria and their credit score. As a prudent lender, access to information that supports the application is positive and will help provide a more in-depth picture of a potential borrower.”

We’re still awaiting comment from Barclays.

Tip Email

Services You Can Use To Report Rent Payments

Theres not a direct way for you to report rent payments to credit bureaus yourself. Instead, you can use one of the many reporting services which send information about your monthly payments to credit bureaus. Before signing up for a reporting service, make sure you know how much youll pay and which credit bureaus the service reports to.

Recommended Reading: Does Zzounds Report To Credit Bureau

Why Arent Rental Histories Included In Traditional Fico Scoring Models

The decision to include any piece of credit bureau information in the FICO scoring formula rests on whether the score development process finds such information to be predictive of future risk once vast quantities of it have been studied, Paperno said.

If the information is present, but not predictive , or has simply not been available on a credit report , it’s left out of the formula, Paperno said.

While the FICO scoring models used by most lenders have traditionally ignored rent information even when reflected on a credit report, the latest FICO model FICO 9, released in 2014 incorporates rental data when added to the report being scored, Paperno said.

What Are The Drawbacks

If you’ve struggled to pay your rent in the past, have been late with payments or missed them completely, Rental Exchange won’t be right for you as it could negatively impact your credit file. If you’re in social housing and don’t want to take part in the scheme, as above, you can opt out.

The score you see reflects your file and generally, the lower your score, the harder it will be for you to get any kind of credit.

Recommended Reading: Is 766 A Good Credit Score

Free Tenant Background Check

Want a quick, free tenant background check to get a glimpse into your prospects life?

As a free welcome gift to new members, SparkRental offers a free SSN trace and identity verification, that includes:

- SSN verification

- How long theyve lived there

- Alternate names and aliases

It scours billions of online records to compile an at a glance background check for you phone records, motor vehicle registrations, utility billing history, property registrations, and change of address forms.

Pretty nifty, eh? Its all designed to give you an instant test drive of our larger tenant screening system and online landlord software.

It scours billions of online records to compile an at a glance background check for you phone records, motor vehicle registrations, utility billing history, property registrations, and change of address forms.

Pretty nifty, eh? Its all designed to give you an instant test drive of our larger tenant screening system and online landlord software.

How Do I Request A Copy Of A Tenant Screening Report

If your rental application is rejected due to information in a tenant screening report, this is considered an adverse action. Landlords are required to inform you of this adverse action and you have the right to request a free copy of the report from the tenant screening company the landlord used. Another example of an adverse action includes charging you a higher security deposit if a tenant screening report or credit report was used in that decision. The landlord is also required to tell you:

- The name, address, and phone number of the company that provided the report

- That you have the right to get a free copy of the report if you request it within 60 days of being notified of the adverse action

- That you have a right to dispute inaccurate information.

You can request reports from any tenant screening company. However, there are many tenant screening companies and any report you request from one company might be different than the tenant screening company used by a prospective landlord.

Also Check: Does Snap Finance Report To The Credit Bureau

How To Get Started With Rent Reporting

The first step is to talk to your landlord. They may have a rent reporting process already set up and youll simply have to enroll. If they dont have one, you can try convincing them to implement a rent reporting system.

Even if your landlord doesnt want to take on rent reporting, youll want to make sure theyre willing to respond to a rent reporting companys request for rent payment verification. Many rent reporting services require proof directly from the property manager.

If youre looking into rent payment reporting, take a moment to be honest with yourself. You should only be pursuing this option if you can make all your payments on time. Remember that all of your rent payments are going to be reported, including late and missed payments. If you dont make on-time and full payments, the reporting will actually hurt your score.

After youve implemented rent reporting, check your credit reports to see what shows up. For example, if you ordered the past years rent payments to be included, youll want to make sure all of them are actually reported. Next, monitor your credit score to watch the gradual improvement.

Lastly, if youre going through the effort of improving your credit with rent payment records, look at what else you can do. You can improve your credit in many ways, including making credit card payments on time, reducing debt and maintaining a healthy credit utilization ratio.

Where To Get A Tenant’s Credit Report

Three credit bureaus have cornered the market on credit reports:

- Experian .

As linked above, each of these credit bureaus offers tenant screening services that include credit checks. You can order the reports online and receive them immediately. Fees for the services vary, but usually are no more than $40.

Another popular option is to have a service request a credit and screening report from your tenant. Doing so avoids your having to collect a credit check fee and potentially sensitive information . Most of the time, you simply register an account online with the service, and it will send the applicant instructions for how to order the report and allow you to receive it. The service notifies you when the report is complete and tells you how to access it. Many of the credit bureaus provide this option, as do other landlord-oriented websites such as Cozy and TurboTenant.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

What To Do If Payments Are Inaccurately Reported

If you have reviewed your Experian credit report and believe there is information being reported inaccurately, there are two steps you should take:

- Speak to the lender that is reporting the information. Contact your lender to notify them that you believe they are reporting information incorrectly. If they agree with you, they can contact Experian to correct the information.

- Contact Experian to submit a dispute. The quickest way to dispute information on your Experian credit report is online via Experian’s Dispute Center. Experian will contact the lender on your behalf and notify them of your dispute. The dispute process can take up to 30 days, and you will be notified when the results are ready.

Thanks for asking.

Recommended Reading: How To Remove Repossession From Credit Report

How Do You Add Rent Reporting

Its possible your landlord already makes reports to the credit bureaus. As the concept gains popularity as a selling point in a competitive housing market, you may see more landlords offering rent reporting as an incentive to prospective residents.

In the meanwhile, if you want rent reporting and your landlord doesnt offer it, youll have to pay for it yourself.

Thats right youll very likely need to pay a fee to have your rental payment history sent to the credit reporting bureaus. The size of the fee and how often you need to pay it will vary depending on which service you use.

And there are a lot of options. From research your options and pick the service that best suits your needs. Just be sure you understand what the service costs, how it works, and how easy it is to cancel.

Youll also want to confirm whether or not your information is being reported to all three major credit bureaus. Some may only report to one bureau.