Duration Of Liability For Child Support Arrearages

Any property you have an interest in can be used for satisfaction of your child support obligations.

Your obligation to pay child support terminates when your child reaches the age of 18. Your obligation to pay child support may only be terminated prior to 18 if your parental rights are completely terminated or if your child is deemed an emancipated minor.

Unlike child support obligations, payments for child support arrears only terminate after the entire amount is paid. This means that you are obligated to pay child support arrearages even after your child turns 18 if you still have not provided full payment of past due support.

Unpaid Child Support Investigations

We match data from other sources and act on tip-offs to identify customers whose income doesn’t match their lifestyle. If you’re dishonest about your income, well find out. You may have to pay more child support or pay it back.

We investigate income from the cash economy. For example, cash in hand can be common in building and other industries.

We also investigate income that’s not from salary or wages. For example, situations where companies, trusts or partnerships hide or reduce taxable income and child support.

We also investigate people who legitimately reduce taxable income and fringe benefits to pay less child support. We may use these amounts to calculate a more accurate child support assessment.

In serious cases, we can use optical surveillance to investigate complex avoidance arrangements.

We encourage people to report suspected fraud. We encourage them to let us know if they have information that may help us collect unpaid amounts.

For example if you know:

- a parent with overdue amounts who plans to travel outside Australia

- someone whos earning income we don’t know about.

Solve Your Problem With Evictions On Your Credit Report With The Help Of Donotpay

Removing evictions from a credit report can be daunting. The process is tedious, and it’s pretty easy to give up along the way. Sadly, an eviction in your credit report can get in the way when house hunting. This is the last experience you want to go through. The good news is DoNotPay has you covered.

How to clean up your credit report using DoNotPay:

If you want to clean up your credit report but don’t know where to start, DoNotPay has you covered in 3 easy steps:

You can also check out our other credit products, including Credit Limit Increase, Get My Credit Report, Keep Unused Cards Active, and more!

Don’t Miss: 1?800?859?6412

How To Remove Evictions From Credit Report By Yourself

Removing evictions from credit reports by yourself is a tedious process. If you’d like to do it yourself, below is how to go about it.

| Clear rental arrears | This step applies if you genuinely have outstanding rental debt arrears. Under such circumstances, the best way to remove evictions from your credit report is to clear what you owe your landlord. |

| Remove collections from your credit report | After clearing your rental arrears, you should have collections removed from your credit report. This is because collections don’t go away automatically after clearing the debt. The way to complete freedom is to have collection activity removed from your credit report. |

| Verify your credit report | This step involves verifying your credit report after settling the debt and asking to have collection activity removed from your credit report. This is crucial because you want to ensure your credit report is clean again. |

| Dispute errors | If you find errors during the verification process, the best thing to do is to dispute them. Your efforts shouldn’t go to waste after the hassle. It’s only fair you settle for what you deserve. |

| Involve the court | Lastly, if you can’t agree with the landlord and the debt collection agencies, your next stop should be the courts. Justice is guaranteed when you involve the court provided you have proof. |

Can Child Support Arrears Be Deleted From Credit Reports

Question:Can negative listing due to child support payments be deleted from credit reports

Answer:Child support arrears remain on your credit report for up to seven years, unless you make a deal with the child support enforcement agency. An agency may agree not to report negative information to the credit reporting agencies if you pay some or all of the overdue support.

Your State laws may be different but in some States when child support arrears is unpaid for 180 days or more it will appear on credit reports as a separate collection account. Once a collection account is paid in full, that account will be deleted from the credit reports.

If you owe current support but pay off any past due balance your account will continue to be reported to the credit bureaus, but with a zero balance. If your account was past due before you paid your balance, it will be reported as current from the time of the payment.

Now dont get me wrong, you can dispute anything on your credit reports that is incorrect or inaccurate. You have 3 choices on where you can dispute:

File a consumer dispute directly with the credit bureaus and they will have 30 days to investigate. If the agency reporting the child support on your credit files does not respond, then the account must be deleted.

But accurate information can be re-inserted when and if they do respond to the dispute.

You May Like: Raise Credit Score 50 Points In 30 Days

The Parent Needs To Reach Out To The Court And Request The Termination Of Child Support Payments

How do you remove child support from credit report. Anything that companies may consider a legal liability is a matter of public record. Is it possible to remove a paid child support judgment from your credit report? You cannot remove accurate information from your credit report.

The office of the attorney general enforces the order. Instead, like with most other debts, it will be marked, satisfied. the fair credit reporting act limits how long negative information can remain on a credit report. First, you should contact the credit bureau and ask to put the letter from the child support office on your credit report.

And, having unpaid child support on your record can have a substantial, negative affect on your credit score , according to an email from rod griffin, director of public education for credit bureau experian. They have helped many people in your situation and have paralegals standing by waiting to take your call. When child support payments aren’t made, the office of the attorney general can take many actions to enforce the court order.

As its more than 7 years old cant that be deleted? In the world of credit reporting, public records can include bankruptcy, judgments, liens, lawsuits, and foreclosures. You must complete the jfs 01849, request for an administrative review of the child support order, sign the form, and submit the form and any supporting documents to your child support enforcement agency .

How Does A 609 Letter Work

A 609 letter is based on the credit bureaus responsibility to report only information that is verified. The theory behind the 609 letter is that asking your creditors to produce hard-to-find informationsuch as the original signed copy of your credit applicationwould make it difficult to verify a disputed item.

Under the rights afforded to you by the FCRA, a 609 letter may help you remove erroneous or unsubstantiated information in your credit report. The downside is that if the furnisher does successfully verify its accuracy, the information can be added back to your file.

Of course, youre still obligated to repay any legitimate debts, even if the credit bureaus delete the information from your file.

If the information is true and correct, chances are that it will remain on your credit report. However, you can write to the credit bureau and request disclosure of information under section 609 of the Fair Credit Reporting Act.

Read Also: Is 586 A Bad Credit Score

Property Used As Payment For Arrears

If you have unpaid child support payments, or child support arrears, any property you have an interest in can be used for satisfaction of your child support obligations. This can cause a substantial road block if you are seeking to sell or transfer your interest in any real property. A Wallin & Klarich family law attorney can walk you through the complex steps of a child support arrearages case and can discuss what other options for payment you may have available to you.

Real Property Lien

A lien against any real property you have an interest in can be created if you owe any overdue child support payments. If you have a lien on your property related to child support arrears and you try to sell or refinance the property, the child support arrears you owe must be satisfied from the proceeds of the sale or loan. According to California Family Code section 4011, child support must be paid before almost any other debt or obligation.

Third Party Property

Generally speaking, a third partys property cannot be used to satisfy your child support obligations. However, if you owe child support payments and remarry, your new spouses property may be accessed by creditors as community property to pay the child support debt you incurred prior to the marriage. It is important to note that your new spouse may later have the right to reimbursement for any community property that was used to pay your child support obligation during the marriage.

What If I Owe Support But Pay Off My Overdue Balance

Paying off the balance of unpaid child support will not remove the debt from your credit report. Instead, like with most other debts, it will be marked, satisfied. The Fair Credit Reporting Act limits how long negative information can remain on a credit report.

Generally, negative information should be removed from your credit report after seven years. It is important to check your credit report to make sure that inaccurate information is removed and debts that have been settled are removed after seven years.

Read Also: Aargon Agency Scam

Can I Get Child Support Off My Credit Report

Paying off the balance of unpaid child support will not remove the debt from your credit report. They’ll investigage it and correct any inaccuracies

I Fix Credit Whether Its Late Payments Student Loans Medical Bills Child Support Hard Inquiries Etc It Ca Good Credit Fix My Credit Credit Repair

Child Support And Credit Reports

DH got behind on his child support when he lost his job. Moved to a different state and got a new job. The state where we currently reside is taking the current monthly amount and extra to pay on the arrears. The old state is reporting on his credit report. Can they do this? I am not sure how this child support business works as I have never dealt with it before. Any and all help is greatly appreciated.

Love this forum!

Also Check: Synch Ppc

How To Remove Child Support From Credit Report

Asked by: Andres O’Keefe IVHow to Dispute a Child Support Reporting on a Credit Report

You cannot remove accurate information from your credit reportis sent to a collections agencyup to seven yearsa credit repair secret or legal loophole that forces45 related questions found

Supporting Parents To Support Their Children

The Oregon Child Support Programs goal is to support parents to support their children.

Children have the right to receive financial and emotional support from both parents, even if the parents dont live together or were never married. We strive to make it as convenient as possible for parents to give their children everything they need to grow and thrive.

Recommended Reading: How Do I Notify Credit Bureaus Of A Death

Is Unpaid Child Support A Debt

Unpaid child support is a debt, and like most debts, can appear on your . In most states the child support enforcement agency is required to report unpaid support debts once they reach $1,000. However, enforcement agencies can exercise discretion and report lesser amounts. Many states are also required to notify you before reporting the debt to the credit bureaus. You will then have a reasonable time to dispute the amount of the debt.

If you are notified by your states child support enforcement agency that you have a debt, you should respond as soon as possible. You might be able to work out an arrangement with the enforcement agency to begin paying off the debt in exchange for them not reporting it to the credit bureaus. The child support enforcement agency can assist with a plan that allows you to continue paying and not increase the debt.

A child support debt reported to the credit bureaus can show up on your credit report in a few different ways. First, it might be classified as a collection. Unpaid debts in collection are reported by child support enforcement agencies or when the custodial parent turns to a collection agency for help collecting the past due support.

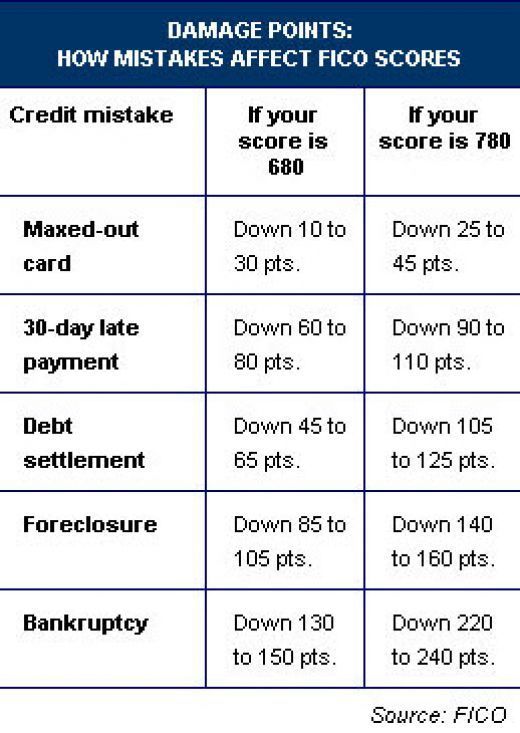

Unpaid child support debts classified as collections or as court judgments will have a negative effect on your . Those kinds of debts can lower your score by as much as 100 points.

What Is The 604 Act

Section 604 of the FCRA prohibits consumer reporting agencies from providing consumer reports that contain medical information for employment purposes, or in connection with credit or insurance transactions, without the specific prior consent of the consumer who is the subject of the report.

Don’t Miss: Affirm Virtual Card Walmart

Do I Need A Lawyer For Help With Child Support Issues

A child support attorney can help you communicate with the child support enforcement agency regarding your unpaid child support obligation. Taking action to avoid negative information on your credit report will benefit you the most in the long term.

A low credit score can affect many aspects of your life, including the ability to acquire loans, take advantage of low interest rates, and get a credit card. An experienced child support attorney can counsel you on the best course of action to manage your unpaid support debt and minimize the damage to your credit.

- No fee to present your case

- Choose from lawyers in your area

- A 100% confidential service

Why Use Donotpay To Remove Evictions On Your Credit Report

The thought of being homeless because of an eviction in your credit report can be frightening. If you’ve cleared all the debt, but your credit report still lists the eviction, DoNotPay is your best chance at having it removed. We’re confident we can help you do. Below is a quick rundown of why you should use DoNotPay.

- Fast You don’t have to spend hours trying to solve the issue yourself. We’ve simplified the process, helping you save time and agony of doing it yourself.

- Easy You don’t have to struggle to fill out tedious forms or keep track of all the steps involved in solving your problem.

- Successful You can rest assured knowing we’ll make the best case for you to get the best results.

Recommended Reading: Does Acima Build Credit

What Happens When You Pay Off A Child Support Account

Paying off a late child support payment wont remove the derogatory mark from your credit report. However, it can help improve your credit score because the account should be marked on your reports as paid in full.

And because lenders care most about your recent credit activity, according to Martin Lynch, director of education and compliance manager at Cambridge Credit Counseling, recent marks showing an account was paid in full can offset the negative impact of older marks showing it was once overdue.

How To Get Late Payments Removed

The simplest approach is to just ask your lender to take the late payment off your credit report. That should remove the information at the source so that it wont come back later. You can request the change in two ways:

If the late payment is accurate, you can still ask lenders to remove the payment from your credit reports. They are not required to do so, but they may be willing to accommodate your request, especially if one or more of the following apply:

- You paid late due to a hardship like hospitalization or a natural disaster

- The late payment was not your fault, and you can document the cause

- You can offer them something in return, like paying off a loan that youre behind on

- You usually pay your bills on time and you made a one-time mistake

Some situations are so complicated or unfair that you need professional help. An attorney licensed in your area can review your case and offer guidance on additional options.

Read Also: Check Credit Score Without Ssn

Also Check: Does Klarna Hurt Your Credit Score