Inaccurate Information On Your Credit Reports

Sometimes creditors make credit reporting errors. Because of this, its a good idea to review each one of your reports from the three major credit bureausEquifax, Experian and TransUnion. You can view all three of your reports for free weekly through April 20, 2022 by visiting AnnualCreditReport.com.

While reviewing your reports, check to make sure your accounts and personal information are correct. If you spot an error, dispute it with each credit bureau that lists it online, by mail or phone. Also, keep in mind that if you see an account that you never opened, it could be a sign you are a victim of identity theft.

If you believe someone has stolen your identity, file a report with the Federal Trade Commission through IdentityTheft.gov and freeze your credit with all three credit bureaus as soon as possible .

Paid Off A Student Loan Or Car Loan

Paying off any loan is an achievement that’s worth celebrating. But the types of credit you have also are considered high impact on your VantageScore® 3.0. This means having a good mix of credit between revolving debt and installment debt . If you pay off the only loan you have, that affects the diversity of your accounts.;

Ask For A Credit Limit Increase

Give your credit card issuers a call and ask them to increase your budget. You might have to provide updated income and personal information.;

This might be difficult if youve missed payments or youve been over the limit within the past 6 months to a year, but if its possible the credit increase can give you some cushion in your credit utilization. Remember, if a credit increase is available to you, this doesnt mean you should push your spending to the limit. Be smart about the increase and your card each month to keep below 30% utilization. Its worth a try!

Also Check: Credit Report Without Social Security Number

Youre Looking At A Different Credit Score Than Usual

The credit score you access through your bank may not be the exact same as another provider, even if you look at them on the same day. If your credit score appears to have taken a hit, youll want to make sure that youre looking at the same score as usual.

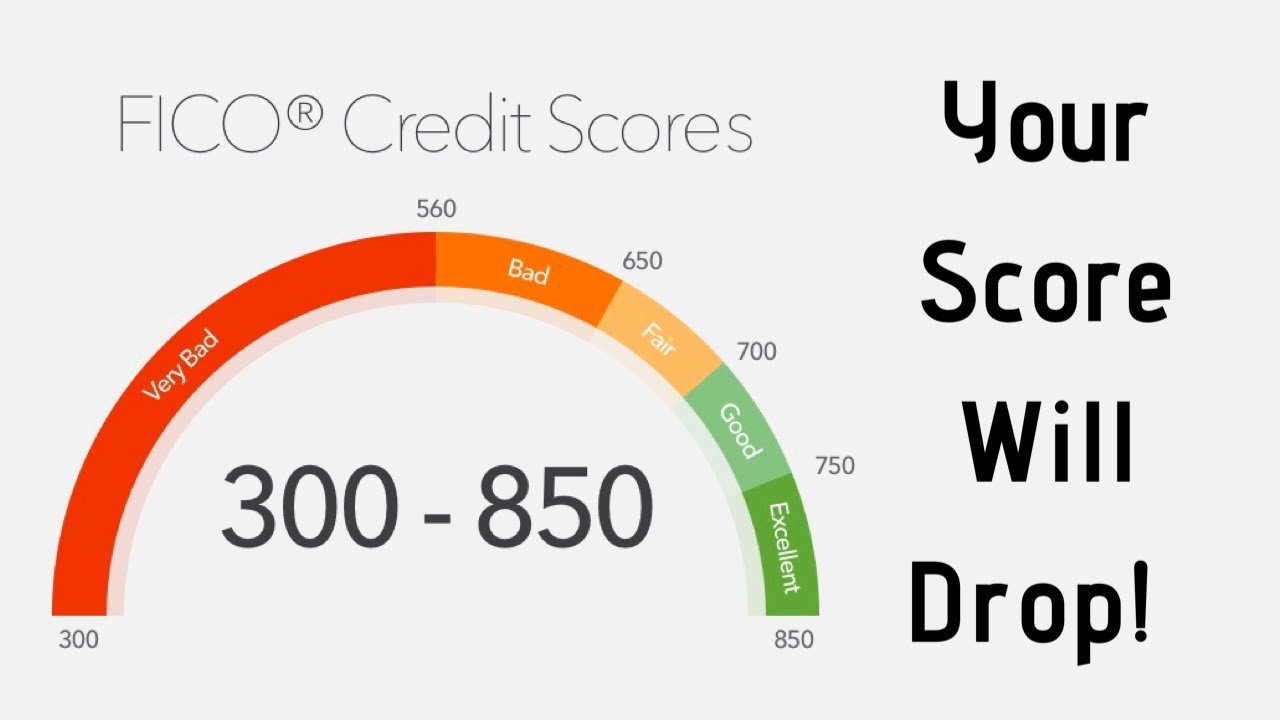

The two major consumer credit scoring companies are FICO and VantageScore; while they both use the same 300 to 850 scale for generating scores, the way those scores are calculated can be different. For example, VantageScore factors in items like your pattern of behavior while FICO scores do not. But even within one scoring system there can be discrepancies between your score, depending on which scoring model is being used.

Its critical that you know what score youre looking at. Not just if its a FICO score, but is it the same FICO score as the one youre used to, Griffin says.

For instance, a typical FICO score has a score range between 300 and 850, with 850 being the best possible score. But a lender for an auto loan will often use the specific FICO Auto Score, which goes up to 900 points, so your score could appear dramatically different on that report when youre preparing to buy a car.

Your Credit Card Was Closed

Much like having a credit limit decrease, closing a credit card can have a similar impact because both of these changes impact your credit utilization ratio.

For example, if you just have one credit card that has a $2,000 limit and you owe $600 on it, your credit utilization ratio is 30 percent . But if the creditor drops your credit limit down to $1,000, your credit utilization goes up to 60 percent, which makes you a greater risk as a borrower.

Similarly, if you have a credit limit of $2,000 between two credit cards , and you owe $600 on just one of those cards, your credit utilization ratio is still 30 percent. But if you then choose to close the card that has a zero balance because you don’t use it, now all of a sudden your credit utilization jumps up to 60 percent, which can drop your credit score.;

The longevity of accounts shows lenders that you’re a trustworthy borrower. By closing an account, you lower your overall credit availability, which in turn impacts your credit score.

Read Also: Why Is There Aargon Agency On My Credit Report

Changes In Ficos Formula

The FICO formula changes occasionally, most recently in December 2016. The purpose is to keep up with the changing needs of consumers and lenders. As well as the standard model, there are also industry-specific versions, such as for the auto-lending industry.

Obviously, there have been several different versions of the FICO scoring model, and lenders have the option to choose which version they are going to use. Since different versions of the formula look at things slightly differently, your credit score may change if a lender begins to use a different version.

The table below shows the wide variation in the versions used by different lenders in different industries:

Why Did My Credit Score Drop And How To Save It

Have you taken a look at your recently and seen a drop? A decrease of even a few points can signal youâre not as qualified to access credit services as you were before, so it pays to spend some time learning about why this happens. Use our guide to discover what makes a score drop and what you can do to reverse the damage.

Don’t Miss: Carmax Finance Companies

Why Did My Credit Score Drop Reasons And Possible Scenarios

We use credit cards for payments in emergencies. It is challenging to keep track of the transactions. As per our convenient time, we check the credit report once. We were surprised to know why did my credit score drop on the card.

Dont get surprised. There are several reasons for it. This article will help us understand. A high credit score is helpful to get fast approval of the loans.;

The banks offer an annual hike in the credit score. It is applicable for customers who have a good credit history. A good history creates an optimistic report in the credit bureau. Scroll down for more information.;

Your Credit Utilization Increased

Putting even a few hundred dollars on a credit card can upset your âcredit utilization.â What does this term mean? Itâs the amount of available credit you currently use compared to your total card limits. If you have spent $300 on a card, but you have $1000 in total credit lines for all your cards, your utilization is 30 percent. Credit score models reward those who can keep this utilization number low, usually below 30 percent. Even a small purchase can push that number too high and significantly drop your score.

âSolution: Start making payments on your cards, beginning with the most âmaxed outâ cards, if possible. In addition to looking at your total spent across all cards, check to be sure youâre not too close to the limit on any one card. Itâs better to have your balances spread out. You can also request a credit limit increase on a card with the intention of not spending any more on it. This gives you more available credit in proportion to your existing debt.

You May Like: Is 524 A Good Credit Score

Its Never A Good Feeling To See That Your Credit Scores Have Dropped Since You Last Checked But Being Able To Quickly Identify The Cause Can Help You Take The Right Steps To Get Them Back On Track

Credit scores can drop due to a variety of reasons, including late or missed payments, changes to your credit utilization rate, a change in your credit mix, closing older accounts , or applying for new credit accounts. And dont forget that credit report inaccuracies due to mistakes or identity theft can also cause a dip.

Lets look at the nine main reasons why your credit scores might have dropped, and how you can address each of them.

There Is Inaccurate Information On Your Credit Report

Regularly checking your credit reports is one of the best ways to ensure no inaccurate information shows up in your file. Although it’s rare, mistakes happen, and it is possible that incorrect information on your credit reportsuch as inaccurate personal data or payment historyis causing your scores to drop.

If something in your report is inaccurate, it could be a result of a lender accidentally reporting the wrong information. It could also be a sign that you have fallen victim to identity fraud. If you see something you believe is inaccurate, dispute the information with all three credit bureaus as soon as possible. But keep in mind, some pieces of data can’t be disputed, like credit inquiries, accurate birth dates and credit scores.

You May Like: Aargon Collection Agency Bbb

Get Your Credit Score Improved Professionally

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

Duplicated Accounts On Your Credit Profile

If you have multiple accounts on your credit report for the same debt, it will negatively impact your credit score and your ability to obtain future credit. It is crucial to dispute duplicate accounts in your credit report and have them removed.

You should notify the credit providers that they are reporting the same debt multiple times. Provide copies of supporting documents to the credit provider detailing why the account needs to get investigated. Your dispute must be investigated by the credit provider, just like with the credit bureaus. Once the credit provider confirms that your complaint is accurate, all credit bureaus get notified to amend or remove the listed duplicated account from your credit report.

Also Check: Speedy Cash Credit Check

You’re Delinquent On One Or More Payments

If you can, make minimum payments on delinquent accounts as soon as possible. These won’t erase the impact to your credit, but they at least help you avoid any further damage. A payment that’s late by 30 days isn’t as bad as one that’s late by 60 or 90 days.

Keep in mind that if you’re less than 30 days late on a payment, you can still prevent it from hurting your credit. Creditors can only report late payments that are past due by at least 30 days. If you make a minimum payment that’s 29 days late, you could incur a late fee, but your credit score will remain intact.

But what if you can’t make minimum payments? Contact creditors and ask about their hardship plans. Many creditors have been providing extra assistance during the pandemic. You may be able to temporarily get lower monthly payments or put them on hold.

Another option is refinancing debt. With debt consolidation loans, you could get a lower interest rate and even a lower monthly payment. The same is often true with balance transfer credit cards. These options do, however, typically require that you have at least a fair to good credit score.

Your Credit Score May Soon Change Heres Why

FICO is tweaking its all-important formula. Scores will rise for about 40 million people and drop for another 40 million.

Your credit score that all-important passport within the financial world may be about to change. And it wont necessarily be because of anything you did or didnt do.

The Fair Isaac Corporation, the company that creates the widely used three-digit FICO score, is tweaking its formula. Consumers in good financial standing should see their scores bounce a bit higher. But millions of people already in financial distress may experience a fall meaning theyll have more trouble getting loans or will pay more for them.

Lenders use FICO scores to judge how likely you are to make timely payments on your loans. But theyre also used in lots of other ways, and can influence how much you pay for car insurance to whether youll qualify to rent a new apartment.

The changes, reported on Thursday by The Wall Street Journal, dont alter the main ingredients of your score, but they do take a more finely tuned view of certain financial behaviors that indicate signs of financial weakness.

For example, consumers who consolidate their credit card debt into a personal loan and then run up the balance on their cards again will be judged more severely.

Heres what you need to know about the new credit scoring system.

Also Check: Does Opensky Report To Credit Bureaus

A Derogatory Mark Was Added To Your Report

Your credit report is the source of data that lenders use to approve you for a loan. Itâs also the basis for your credit score. A bad mark on your credit history can cause issues for your score, even if it was a mistake and not something you actually did.

âSolution: In addition to checking your credit score, ask for a free copy of your full credit report from each of the three agencies every year. Look for errors and follow the procedures given at each of the bureauâs websites to dispute and resolve them.

Limit How Often You Apply For New Accounts

While you may need to open accounts to build your credit file, you generally want to limit how often you submit credit applications. Each application can lead to a hard inquiry, which may hurt your scores a little, but inquiries can add up and have a compounding effect on your credit scores. Opening a new account will also decrease your average age of accounts, and that could also hurt your scores.

Inquiries and the average age of your accounts are minor scoring factors, but you still want to be cautious about how many applications you submit. One exception is when you’re rate shopping for certain types of loans, such as an auto loan or mortgage. Credit scoring models recognize that rate shopping isn’t risky behavior and may ignore some inquiries if they occur within the span of a couple of weeks.

Don’t Miss: Why Is There Aargon Agency On My Credit Report

Handling A Dip In Credit Scores

A drop in your credit score can be stressful, but it doesn’t have to be permanent. There are ways to bring your score back up and to prevent another decrease in the future. Remember that credit scores are dynamic, and that you have the ability to improve yours with your own habitsan empowering truth that you can apply to other parts of your financial life too.

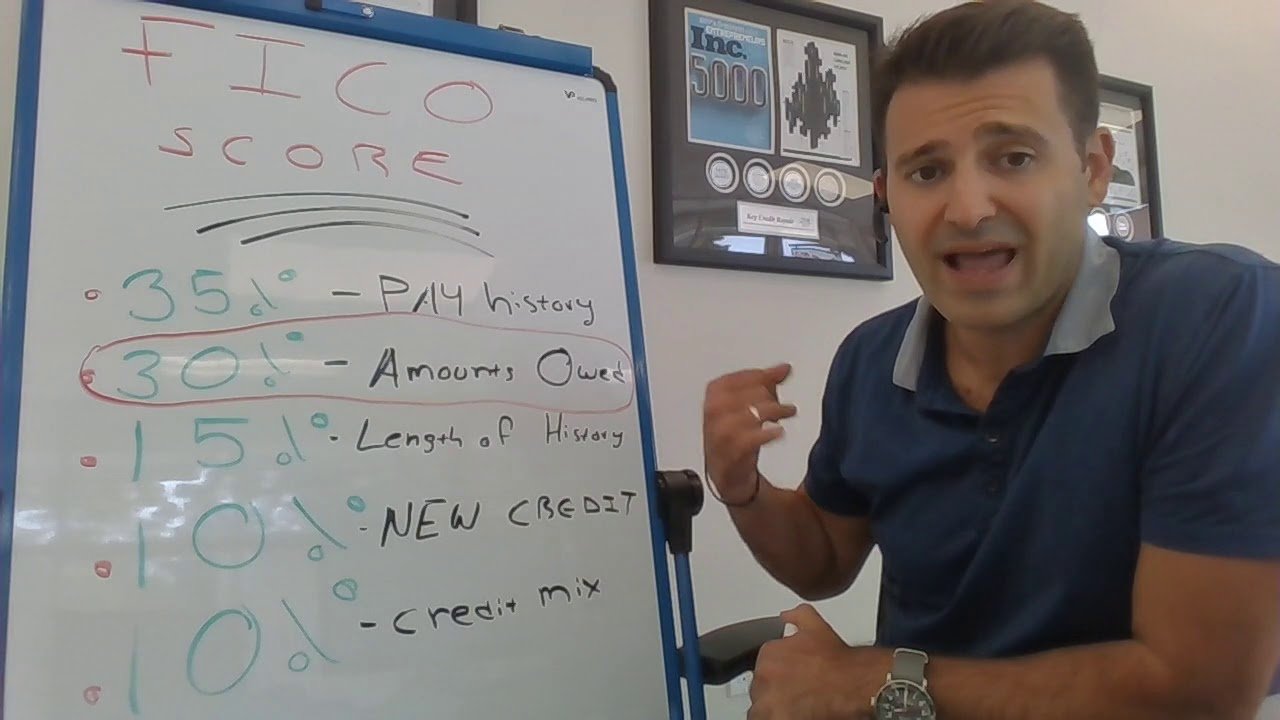

Late Or Missed Payment

Payment history is a critical component of credit scores. In fact, FICO® says that its the most important factor in its scoring model, accounting for 35% of it.

If you were only a few days late on a payment, its unlikely to show up on your credit reports. But once payments are more than 30 days late, card issuers will report them as delinquent to the credit bureaus. If this happens to you, you can expect your credit scores to take a hit. And if the payment is reported as being 60 or 90 days late, your credit scores could fall even further.

Keeping track of payments can be difficult, especially if you have multiple credit cards and loans. If youre worried about bills getting lost in the mail pile, enrolling in automatic payments could be a smart move.

Also Check: Does Paypal Credit Affect Your Credit

Bad Information Has Aged On Your Credit Report

Late payments, debts in collections, loan defaults, and other black marks on your credit report certainly lead to decreased credit scores. The good news is as these issues fade into the past, they begin to have less of an impact. And, eventually, theyre no longer considered at all in calculating your score.

You Ran Up A Larger Than Normal Balance On Your Credit Cards

According to myFICO , Amounts Owed accounts for 30% of your credit score:

The 5 categories that make up your credit score

A lot of people assume that if they pay their bill in full every month, making a big purchase or charging up more than they usually do wont affect their score, Silverman says. But thats not the case. It all depends on when your balance gets reported to the credit bureaus. If they see that you owe a larger than the normal amount for you, it will probably hurt your score.

The good news is that as soon as your spending habits return to normal, your score should bounce back, she says.

Read Also: Why Is There Aargon Agency On My Credit Report

Youve Been A Victim Of Fraud

If none of the above applies, but your score has dropped significantly, then you may want to take a good look at your full credit report for any suspicious activity. Purchases you dont remember making, loans taken out in your name and maxed out credit cards you never signed up for are major red flags of identity theft.

Someone maxing out a fraudulent or stolen account could certainly affect your credit score, Griffin says. Thats why we always encourage people to check their credit histories regularly.

Unlike most of the other reasons that your credit score might drop, if youre a victim of identity theft, you will be able to remove the activity thats hurting your score from your credit report. But its better to catch suspicious activity sooner rather than later in order to avoid spending hours trying to verify the legitimacy of every item on your report.

Enrolling in a free credit monitoring service like those offered by Experian and Credit Karma can help you catch and protect yourself from fraud.

This article was written by Kenadi Silcox from Money and was legally licensed through the Industry Dive publisher network. Please direct all licensing questions to .