Which Credit Score Is Used By Banks

Non-Banking Financial Companies and banks use the credit score provided by CIBIL, Experian and Equifax to determine the potential risk of lending to a customer. The lenders make use of these scores fix the credit limit for all eligible customers. The CIBIL score is a three digit number that ranges from 300 to 900.

How To Maintain Your Credit Score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. Thats the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 Thats because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

Legal

What Is A Good Credit Score In Canada

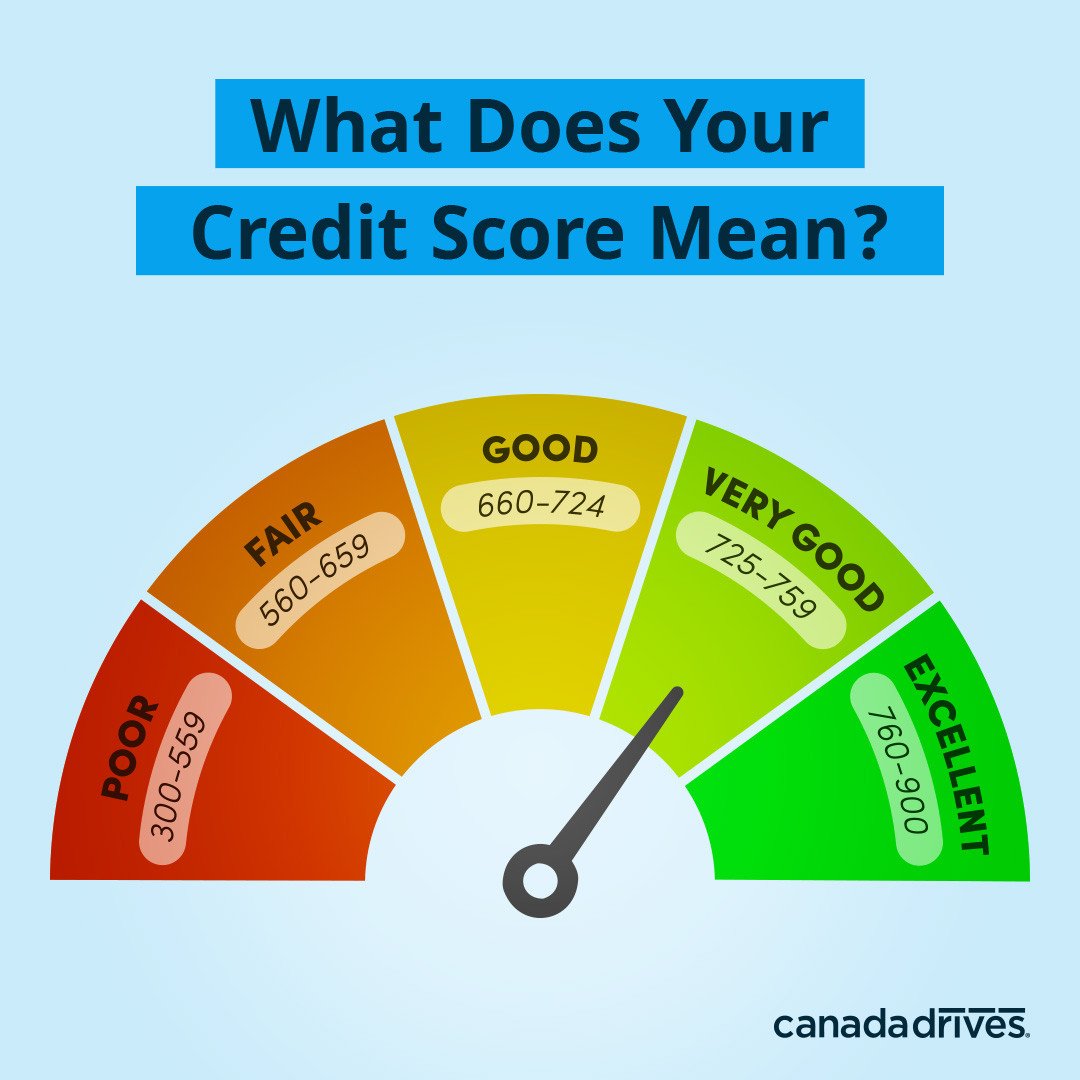

A good credit score is a three digit number. In Canada, it ranges from 660-900. A good credit score is based on the three digit number you receive from TransUnion or Equifax.

Your score is calculated from the credit report, which includes payment history, amount of debt you have, and how long your credit history is. The credit score will help a lender figure out what they can offer you in terms of loans or and at what rate. If you have good credit, youre most likely to get the loans you want at low rates. Your good credit shows that you pay your bills and manage your money well enough to pay back loans.

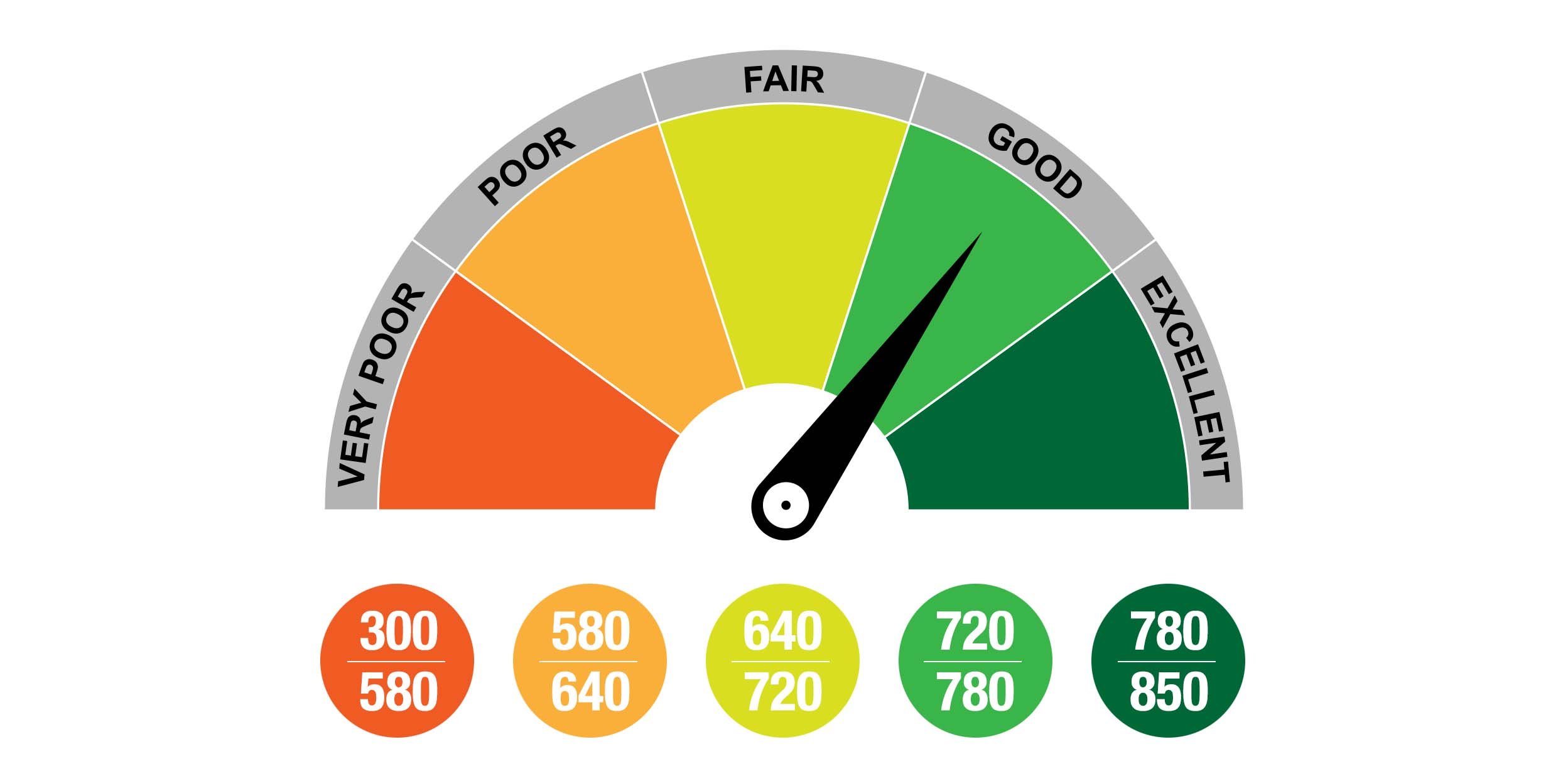

A score that reflects good credit is 660-719. If your score is 720 to 779, its considered very good, and if youre 780 and above, you have excellent credit. The higher the score, the more youve demonstrated responsible credit management. This gives lenders more confidence in loaning you money.

Different lenders have different opinions on what they consider a good credit score. For instance, Canadian Mortgage and Housing Corporation will allow Canadians to apply for CMHC mortgage insurance with score as low as 600. At traditional banks, 660 is considered good enough to get a mortgage.

Read Also: Does Uplift Do A Hard Credit Check

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired.

What About Transunions Credit Score

TransUnion uses the VantageScore® 3.0 model, but the above way of looking at it still applies: two different lenders may have completely different opinions on what a good-enough TransUnion score is. And since lenders may use several different sources of information to evaluate an applicants creditworthiness, one lender may view two separate applicants differently, even if those applicants have the exact same TransUnion score under consideration.

Read Also: 809 Fico Score

Better Credit Cards With Perks

You can benefit from getting the best credit cards available in Canada for the lowest interest rates. Not only that but you can also get in on perks like cashback rewards and travel points. This can lead to free upgrades or free flights while youre traveling. You may get to enjoy additional travel perks like free entry to airport lounges around the world.

What Affects Your Credit Score

On the list of what affects your credit score, two factors have the biggest influence: Payment history, which is whether you pay on time, and credit utilization, which is how much of your credit limits you have in use.

Other factors matter but carry a little less weight: how long you’ve had credit, whether you have a mix of credit types and how frequently and recently you’ve applied for credit.

Read Also: Leasing Desk Screening

How To Fix A Credit Score

Many people come into financial hardship at times but luckily a bad credit score can be improved over time.

The first step is to determine your current credit score. Many credit bureaus and banks offer this information. The good news is you can view your credit without impacting your credit score.

If you discover that you have a poor credit score, the next step is to work to improve it. To do this, you can work to make your payments on or before the due date, dispute credit card errors, keep revolving balances below your credit limit, pay off existing loans, and vary your account types.

For more information, check our post on how to start building credit.

Is A 750 Credit Score Good Canada

As an example, if you have a good score it indicates your credit agencies and financial institutions consider you a good borrower due to your careful management of debt. Generally speaking, people who have good ratings like 700 and above get low risk. As your score grows, you move into the excellent category, meaning you are classified as having a good product.

Also Check: How Do I Notify Credit Bureaus Of A Death

What Is A Good Credit Score For An Auto Loan

Next to a mortgage, vehicles are often among the most expensive purchases the average adult makes in the United States. According to the Kelley Blue Book, an independent automotive valuation agency, the average price for a light vehicle purchase in the U.S. was $38,940 in May of 2020.

For a significant purchase like a car, having good credit could mean saving thousands when youre financing your purchase.

For example, someone with a FICO score of 620 who is looking to buy a new car is told by the car dealer they could qualify for a 60-month loan for $38,000.

According to the FICO Loan Savings Calculator, your loan in June 2020 would have an APR of 16.714% and your monthly payments would be $939. Over the life of the loan, youd pay an additional $18,315 in interest.

A $942 per month car loan payment is a significant amount, even if you can get approved. So, lets assume you hit the pause button and decide to work on improving your credit before taking out a loan. When you apply again down the line, you learn that youve boosted your score to a 670, which is considered a good credit score by most credit scoring models.

With a 670 credit score, the FICO Loan Calculator now estimates that you might qualify for an APR around 7.89%. Based on that rate, your monthly payment on the same $38,000 auto loan would be $768. You would pay $8,106 in total interest over the life of your loan.

Because you improved your credit score from poor to good, you would save:

How To Earn A Fair Credit Score:

If you are trying to get your credit score into the “fair” range, pull your credit report and examine your history. If you see missed payments or defaulted loans or lines of credit, do your best to negotiate with the lender directly. You may be able to work out an agreement that allows you to make manageable, on-time payments. Getting back on track with these consistent payments could help improve your credit score over time. As you work through meeting your debt obligations, take care not to close any of your accounts. Open accounts with a long history could be positively contributing to your score and can continue to be used responsibly in the future.

Look at your credit report, create a budget that sets aside money to pay off your debts, and learn more about how credit scores are generated: these are the three fundamental steps in moving your credit score upwards.

You May Like: How To Remove Car Repossession From Credit Report

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

What Information Credit Scores Do Not Consider

FICO® and VantageScore do not consider the following information when calculating credit scores:

- Your race, color, religion, national origin, sex or marital status.

- Your age.

- Your salary, occupation, title, employer, date employed or employment history.

- Where you live.

- Soft inquiries. Soft inquiries are usually initiated by others, like companies making promotional offers of credit or your lender conducting periodic reviews of your existing credit accounts. Soft inquiries also occur when you check your own credit report or when you use from companies like Experian. These inquiries do not impact your credit scores.

Also Check: How To Check My Itin Credit Score

What Credit Score Is Needed To Buy A House

Generally, if you want to purchase a home with a conventional mortgage loan, your credit score should at least be in the low to mid-600s or higher. However, there are more accessible home loans backed by the FHA available to people with lower credit scores.

There are some important requirements for FHA loans. People with scores as low as 580 may qualify for an FHA loan with as little as 3.5% down. However, you will have to demonstrate a low debt-to-income ratio and be required to purchase mortgage insurance monthly, which is added to your monthly mortgage payment.

What Does It Mean If Your Credit Score Is High

Lenders tend to look at your credit score when you apply for credit, such as a credit card. Theyâre looking for someone who will be able to meet the repayments – someone who is low risk.

A higher credit score means your credit report contains information that shows youâre low risk, so youâre more likely to appeal to lenders. For example, if your report shows that you always pay your bills on time, youâll be considered a reliable borrower.

If you have a high credit score, your application is more likely to be accepted. Youâre also more likely to be offered the best interest rates and higher credit limits.

Check your eligibility: See what offers you’re eligible for with your credit score.

You May Like: Remove Student Loans From Credit Report

Your Credit Scores Are An Important Aspect Of Your Financial Profile

They may be used to determine some of the most important financial factors in your life, such as whether or not youll be able to lease a vehicle, qualify for a mortgage or even land that cool new job.

And considering 71 percent of Canadian families carry debt in some form , good credit health should be a part of your current and future plans.

High, low, positive, negative theres more to your scores than you might think. And depending on where your numbers fall, your lending and credit options will vary. So what is a good credit score? What about a great one? Lets take a look at the numbers.

What Is A Good Credit Score For My Age

Your age doesnât directly influence your credit scores. But as FICO and VantageScore show, the age of your credit accounts is one factor that affects how scores are calculated.

That could be a reason peopleâs credit scores tend to increase as they get older. Their accounts have simply been open longer. But credit scores can rise or fall no matter how old you are. And having good credit scores comes down to more than just your age.

Also Check: Is 524 Bad Credit

Some Ideas To Improve Your Credit Score

Taking these steps can help improve your credit score over time. If you have any questions or need help correcting inaccuracies on your credit report, contact a reputable credit counseling or repair service. They can help you understand the steps you need to take to improve your credit score.

If youre looking for more tips on how to improve your credit score, visit the Federal Trade Commissions website at FTC.gov. There, you can find helpful articles on credit counseling, repairing your credit history, and more. You can also check out our Credit Center for more information on improving your credit score.

How To Earn A Very Good Credit Score:

As with borrowers in the excellent/exceptional credit score range, borrowers labeled as “very good” by their FICO Score will have a solid history of on-time payments across a variety of credit accounts. Keeping them from an exceptional score may be a higher than 30% debt-to-credit limit ratio, or simply a short history with credit.

Recommended Reading: What Is Coaf Credit Inquiry

Be Cautious About Applying For Credit

If you apply for a variety of credit accounts in a short amount of time, this could impact your credit score. While a soft credit check for credit and loans doesnt have an impact on your credit score, a hard check does. A hard check is something that would be done at a bank, applying for a mortgage or at a car dealership if youre looking to purchase a new car. Dont apply for too much credit all at one time as it can reduce your .

What Is A Good Credit Score According To Lenders

Lenders, such as credit card issuers and mortgage providers, may set their own standards on what “good credit” means as they decide whether to grant you credit and at what interest rate.

In practice, though, a good credit score is the one that helps you get what you need or want, whether that’s access to new credit in a pinch or lower mortgage rates.

Read Also: Can A Closed Collection Account Be Reopened

How Is Your Credit Score Calculated

Your credit score is calculated using five factors:

Most of the information is automatically removed after 6-7 years so that student loan payment you missed 20 years ago wont be haunting your score today.

1. Whats your payment history?

This is obviously the most important factor affecting your credit score. Prospective creditors want to know that you are going to pay them back. Your payment history covers all of your consumer debt: credit cards, lines of credit, student loans, car loans, cell phone payments on contract, etc.

- Do you pay your bills on time?

- How frequently do you miss a payment?

- How many times have you missed a payment?

- How old are your missed payments?

2. How much do you currently owe?

When creditors look at how much you owe, theyre trying to determine whether or not you are able to take on more debt. Can you manage with more?

Besides looking at the amount of debt that you currently have, lenders will look at whats called debt utilization ratio: thats the amount of credit youre using compared to the amount thats available to you.

For example, if you have a credit card limit of $5,000 and youre constantly hovering at $3,600, then youre using 75% your available credit on an ongoing basis. To a creditor, that indicates that youre struggling to pay off your existing debt.

- How much in total do you currently owe?

- How much are your payments?

- How much of your available credit do you use on an ongoing basis?

How To Go From Good To Great

To borrow from Leo Tolstoy, all great credit scores are alike, but all bad credit scores are bad in their own way. That is, ideal credit scores are built on a similar set of healthy financial habits, but your scores can be damaged by any number of factors. There are many different issues that can hurt your credit, such as:

Late or missed payments. Too many open credit accounts. High credit card balances. High balances on loans. Too many credit applications.

The first step toward improving your credit health is avoiding getting trapped in the highs and lows of managing your credit.

Heather Battison, vice president of TransUnion Canada explains how consistency is key: The most important factor for building and maintaining your scores is to pay your bills on time and in full each month. This activity demonstrates your ability to responsibly manage credit and can positively impact your credit scores.

Its also key to remember that your payment history isnt just about paying your credit card bill. It also includes things like your cellphone bill, says Trevor Gillis, associate vice president of account management at TD Credit Cards.

Gillis says building good credit scores is based on using your credit card responsibly, which means making at least the required monthly minimum payment , making your payments by the payment due date and keeping your credit card utilization low.

Recommended Reading: How Many Authorized Users Can Be On A Capital One Credit Card