What To Look Out For With The Premier Bankcard Secured Credit Card

-

Annual fee

The PREMIER Bankcard® Secured Credit Card charges an annual fee, which is deducted from the initial amount of credit you have available. For example, if you have a credit limit of $200, your initial available credit will be $150.

-

High APR

If you carry a balance on your card from month to month, you will be subject to an fairly high APR. That said, a high APR is to be expected from a card designed for individuals with limited or poor credit. Just know that you can avoid interest charges entirely by paying off the entire balance when the statement is due.

-

Limited card benefits

Other than offering free monthly access to your credit score, the PREMIER Bankcard® Secured Credit Card doesnt come with many perks.

Additionally, the card does not offer a sign-up bonus or rewards for the purchases you make.

Merrick Bank Credit Cards: Are They Right For You

Advertiser Disclosure

Advertiser Disclosure: ValuePenguin is an advertising-supported comparison service which receives compensation from some of the financial providers whose offers appear on our site. This compensation from our advertising partners may impact how and where products appear on our site . To provide more complete comparisons, the site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, approved or otherwise endorsed by the credit card issuer. This site may be compensated through a credit card issuer partnership.

The Merrick Bank credit cards are designed for individuals with bad credit and those trying to build their credit histories. However, they come with too many fees for us to recommend them over other cards that will likely be available to these consumers, such as the Capital One Platinum Secured Credit Card.

Quarterly Fico From First Premier

Another amazing benefit from First Premier is that you get quarterly access to your FICO Score for free.

Your FICO score is the one used by over 90% of lenders when it comes to making credit approval decisions.

To view your FICO score, every quarter you just need to log into your online account and look at your statement.

Also Check: Does Snap Report To Credit Bureaus

Make On Time Payments

Making on time payments sounds like a super simple thing to do however, we all live in the real world where things almost never go as planned.

Be sure, no matter what, to make your payments on time because it is super important and is one of the largest factors in your credit score.

No matter what, avoid late payments.

Apply For Secured Credit Card

When you are first building your credit, you may not qualify for an unsecured or regular credit card. This may be due to either a low credit score or not yet having any credit score.

A secured credit card may be an option to establish credit that may eventually help you qualify for other cards with higher limits and better rates. A secured credit card means you put money down to secure the card, which serves as a guarantee to the card issuer that you can pay your bill when its due. Your deposit often is equal to your credit limit.

Recommended Reading: Experian.com Viewreport

Can Opening A Bank Account Hurt Your Credit Score

Put very simply, opening a checking account very seldom, if ever, affects your credit score. There are a few exceptions to this, but they are rare and typically dont have a major impact. Your credit score is intended to track how you handle your debts, such as making mortgage payments, repaying loans, and so forth.

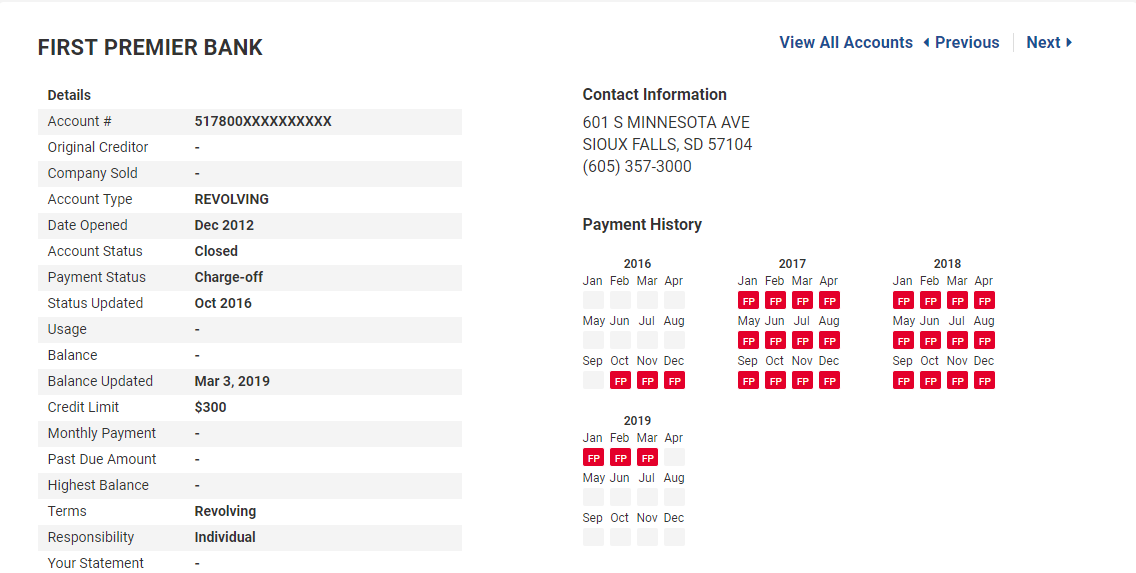

What Credit Bureau Does First Premier Bank Use

You can apply for one with bad credit or no credit score at all. There is a fixed rate, though: First Premiers APR of 36% for its unsecured cards and 19.9% for its secured credit card. On the plus side, First Premier reports your activity to the major credit bureaus TransUnion, Experian and Equifax.

You May Like: What Credit Bureau Does Sprint Use

What Is A 623 Dispute Letter

The name 623 dispute method refers to section 623 of the Fair Credit Reporting Act . The method allows you to dispute a debt directly with the creditor in question as long as you have already filed your complaint with the credit bureau and completed their process.

Build Credit For Rent You Pay

Your rent payment can also help you in your quest to build credit. There are services now through which you can pay your rent, so it gets reported to the three credit bureaus. Why not use your biggest monthly expense to build credit over time?

Consistently focus on paying your bills on time each month and keep your balances as low as possible. For more information about home, auto, and personal loans, visit any Huntington branch.

You May Like: Aargon Agency Pay For Delete

How To Use The Premier Bankcard Mastercard Credit Card

Before applying for the PREMIER Bankcard Mastercard, consider other options for poor credit or no credit history. The Indigo Platinum Mastercard* or Capital One Platinum Credit Card* are both unsecured options for people with bad or limited credit that will provide a much clearer and less costly path to good credit.

If you still want to apply for this card, or you own it already, make sure you never carry a balance. Not only will you avoid accruing 36% interest on any revolving balances but youll build your credit to qualify for other, better card options. When First Premier reports your card use to the credit bureaus, youll want to show only a positive history of timely payments in full.

If youre using this card to improve your credit, you should also keep your in mind. Experts recommend keeping your utilization under 30% for the best chances of improving your score. If youre issued a $300 credit limit from First Premier, that means you should keep your monthly balances below $90 to maintain an ideal utilization rate and thats including any fees deducted from your limit.

Do Not Apply For First Premier Bank To Re

IF you want to re-establish credit…..

Do NOT apply for “First Premier’s Bank” credit card. What a rip-off!!! Their fees are OUTRAGEOUS!! Don’t get excited by their rate of 9.9%. After paying all of their ridiculous fees, you’re better off getting a credit card with a rate of 29.99% or higher with no fees. There is no need to throw money away.

Apply with your local credit union or Orchard bank for a secured credit card or shared secured installment loan. This is the least expensive way to re-establishing credit.

P.S.. Applied bank does not report to all 3 credit bureaus. They only report to Experian and Transunion.

Don’t Miss: Syncb Bp

Whether You Have Recent Missed Payments Or Defaults On Your Report

Missed payments can stay on your credit report for seven years and bankruptcies for 10. You will more than likely need to re-establish a history of making payments on time, as well as reducing your principle debt every month, by paying more than the minimum payment due. Although missed payments stay on your report for seven years, their impact fades over time. All may not be lost if you’ve missed your payment by a few days. If the missed payment is an exception rather than the rule, then pay the bill as soon as you can and ask the lender if they could refrain from reporting the late payment to the bureaus this one time. There’s no guarantee this will work, but it mightyou could set up automatic payments in return, as a goodwill gesture. Just be sure that you catch that missed payment as soon as possible, because its impact on your credit score will get worse with every day it’s in default.

Become An Authorized User On Someone Elses Credit

Similarly, you can become an authorized user on another persons credit card. Again, this is often a parents card, but this method also works with spouses who have good credit. You get the benefit of their credit history associated with the card, in addition to the chance to use credit responsibly. The key here is to make sure the other person never makes late payments or defaults on their card. You should consider contacting the card issuer to make sure that they report information on authorized users to the credit bureaus.

Don’t Miss: Attcidls

Best Overall Paid Service

-

Identity insurance

Yes, $1 million for all plans

See our methodology, terms apply. To learn more about IdentityForce®, visit their website or call 855-979-1118.

Who’s this for? IdentityForce® UltraSecure and UltraSecure+Credit offer the most extensive security features that monitor your information on a variety of sites and services, including the dark web, court records and social media .

Consumers receive alerts for potential fraud on your bank, credit card and investment accounts, as well as the use of your medical ID, social security number and address.

For a complete credit monitoring and identity protection service, opt for UltraSecure+Credit. This plan provides the added benefit of three-bureau credit monitoring and credit score updates. You can also track how your score changes over time and simulate how certain actions can impact your score .

UltraSecure costs $9.99 per month or $99.90 per year and $13.99 per month or $139.90 per year for UltraSecure+Credit. This is a 40% discount that’s good from Nov. 16 to Dec. 6, 2021.

Review Credit Report For Errors

- Incorrect street address

- Incorrect name

- Fraudulent accounts, otherwise known as accounts that you didnt open. Beware, as this could be identity theft.

- Inaccurate credit limits

- Wrong birth date

- Spouses information is inaccurate

- Accounts that are mistakenly shown as being open or closed. Look to see if theres a notation on the account saying if you or the creditor closed the account .

- Wrong payment status information

Don’t Miss: Tax Id Credit Score

Capital One Quicksilverone Cash Rewards Credit Card

- Earn unlimited 1.5% cash back on every purchase, every day

- Earn cash rewards without signing up for rotating categories

- Be automatically considered for a higher credit line in as little as 6 months

- Monitor your credit profile with the CreditWise® app, free for everyone

- $0 fraud liability if your card is ever lost or stolen

- No limit to how much cash back you can earn, and cash back doesn’t expire for the life of the account

- Help strengthen your credit for the future with responsible card use

- Get customized alerts and manage your account with the Capital One mobile app

| $69 |

Review: Our Thoughts On The Merrick Bank Credit Cards

Merrick Bank offers three credit card products: the Merrick Bank Double Your Line Platinum Visa® Credit Card, the Merrick Bank Secured Visa® Credit Card and the Merrick Bank Visa® Card. Unlike points or cash back cards, these cards do not feature any rewards. Instead, they are focused on customers with limited access to credit or those looking to improve their credit histories. While Merrick Bank does report your payment history to all three credit bureauswhich helps cardholders build creditit is not worth paying the exorbitant fees for this service. This is especially true when you compare the Merrick Bank cards to other bad credit credit cards that have no annual fee.

| Merrick Bank Double Your Line Platinum Visa® Credit Card | Merrick Bank Secured Visa® Credit Card | Merrick Bank Visa® Card |

|---|---|---|

| Apply NowOn Merrick Bank’s Secure Website |

Note: Merrick Bank does not provide the current rates and fees for the Merrick Bank Double Your Line Platinum Visa® Credit Card and the Merrick Bank Visa® Card. The details we note above were gathered from previous credit card agreements and may differ from the current pricing information for these cards.

Don’t Miss: How To Remove A Public Record From Your Credit Report

How Long Does It Take For My First Premier Payment To Post

Funds availability for First Premier credit cards depends how you sent your payment. If you mailed it, you should allow 7-10 days for your payment to be posted. If you submitted it online, by phone, via Western Union Quick Collect or via MoneyGram Express payment, your payment will post by the next business day.

How Often Do Credit Reports And Scores Get Updated

The next logical question is, when your credit card issuer sends the information to a credit bureau, when does it appear on your credit report?

Generally, you can count on your information to be added to your credit report as soon as the bureau receives it. According to TransUnion, when the credit bureaus receive information regarding your accounts, they typically add it to your credit report right away.

Your credit scores are calculated based on the data in your report every time a creditor requests them. However, you probably shouldnt expect any dramatic changes every time your credit issuer reports your most recent payment. Building credit can be a lengthy process that requires patience, but if you pay on time every time, youll see the results.

Your credit score isnt guaranteed to change with every timely payment.

Brian Martucci, credit expert at Money Crashers

Credit scores update when the information used to calculate them changes enough to produce a different result, Brian Martucci, credit expert at Money Crashers, explains. In other words, your credit score isnt guaranteed to change with every timely payment.

That might not be the case with late payments. Whenever a delinquency appears on your credit file, it can significantly hurt your credit. The longer the debt goes unpaid, the more damage it can do to your scores.

See related: How long does a late payment stay on your credit report?

You May Like: Credit Score Of 524

What Happens If I Go Over My Credit Limit But Pay It Off

Using credit cards and paying off your balances every month or keeping balances very low shows financial responsibility. More, exceeding your credit cards limit can put your account into default. If that happens, it will be noted on your credit report and be negatively factored into your credit score.

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page.

Don’t Miss: Notify Credit Bureaus Of Death

Which Bank Give Credit Card Easily

the Axis Bank Insta Easy credit card is one of the best instant approval credit cards in India. procuring this credit card is hassle-free as you do not have to give any income proof or other additional details. having a fixed deposit of INR 20,000 in any Axis Bank branch makes you eligible for this instant credit card.

First Premier Bank Gold Mastercard

| Up-to $125 first year, $49 annually. | |

| Rewards Earning Rate | This card does not offer a rewards program. |

| Foreign transaction fee |

The First PREMIER Bank Gold Mastercard is no longer available. The information contained in this article is accurate as of November 2021.

The First Premier Bank Gold Mastercard is not one of our top-rated credit cards for bad credit. You can review our list of the best credit cards for bad credit for what we think are better options.

Recommended Reading: Centurylink Credit Check

Oakstone Gold Secured Mastercard

- No minimum credit score requirements! We invite all credit types to apply! No processing or application fees!

- Includes Free Real-Time Access to Your Credit Score and Ongoing Credit Monitoring powered by Experian

- Helps strengthen your credit with responsible card use. Reports to three national bureaus

- Fast, easy application process. Choose your credit line and open your Personal Savings Deposit Account to secure your line.

- Nationwide Program though not yet available in NY, IA, AR, or WI

- Get a fresh start! A discharged bankruptcy still in your credit bureau file will not cause you to be declined.

- See website for additional Oakstone Gold Secured Mastercard® details

| $49 |

Secured Sable One Credit Card

- New! Get a dollar-for-dollar match on all cash back at the end of your first year with Sableâs Double Cash Bonus.

- Earn 2% cash back on everyday purchases at Amazon, Uber, Uber Eats, Whole Foods, Netflix, Spotify, and more! Plus, earn 1% cash back on all other purchases.

- No credit check or US credit history required

- No SSN required for non US citizens

- Build US credit history from day 1 at major credit bureaus

- Get unsecured in as little as 4 months

- No annual fee, no minimum security deposit

- Premium benefits like coverage in the event your covered cell phone is stolen or damaged , rental car insurance, and much more!

| N/A |

You May Like: Does Aarons Do A Credit Check

Watch Out For Aliases

First Premier typically offers a single credit card. However, it regularly changes the name of this card sometimes, but not always, in accordance with tweaks to its terms. The same basic offer has been called the Possibilities Card, the Forward Card, the Gold Card, the Classic Card, the Platinum Card and the Centennial Card. So make sure to be on the lookout for this marketing gimmick, and always analyze a cards terms to see if its really a wolf in sheeps clothing