Challenging Your Information With Experian

Experian now holds two databases of consumer information this information is used by financial services providers when performing a credit assessment and in some instances a score enquiry on consumers. We receive consumer data from financial services providers when consumers make an application or update their details with the service provider. We also receive payment information that reflects consumer payment behaviour, such as if theyve made payments on time, have skipped payments or closed an account.

What Is A Credit Report

When you make a payment on a credit card or loan, the business that gave you the loan or credit keeps a record of how much and often you pay, as well as the credit limits and loan balances. Those businesses and other sources may report your credit, loan and payment history to one or more credit reporting companies. The credit reporting companies each combine the information they receive about your different credit, loan and payment activities into a credit report. The credit reporting companies prepare credit reports for people in the U.S. Since not all businesses report to all three credit reporting companies, the information on your credit reports may vary.

A credit report is an organized list of the information related to your credit activity. Credit reports may include:

- A list of businesses that have given you credit or loans

- The total amount for each loan or credit limit for each credit card

- How often you paid your credit or loans on time, and the amount you paid

- Any missed or late payments as well as bad debts

- A list of businesses that have obtained your report within a certain time period

- Your current and former names, address and/or employers

- Any bankruptcies or other public record information

Under Federal law, you are entitled to receive one free copy of your credit report from each credit reporting company every 12 months. For more information visit the Consumer Financial Protection Bureau’s website.

My Free Report And Score Frequently Asked Questions

How do I get my free credit report?

Experian offers South African consumers free unlimited access to their My Credit Check and My Credit Expert credit reports and credit scores.

- Visit www.mycreditcheck.co.za for your Experian Sigma credit report.

- Visit www.mycreditexpert.co.za for your Experian credit report.

What is Experian Sigma?

The My Credit Check portal references data from the Experian Sigma database, which is the historical Compuscan bureau database. Your My Credit Check credit report and credit score are generated from the Experian Sigma database.

Can anyone view my free credit report?

Your credit report cant be viewed by just anyone! The information contained in your credit report is confidential, and companies and individuals who wish to view your report may only do so for a prescribed purpose. The National Credit Regulator has set out specific guidelines in accordance with the National Credit Act that deal with prescribed purposes. Experian prides itself on protecting your privacy and we always comply by the rules and regulations provided by the NCR.

Is my free credit report stopping me from getting a job?

Do I need to check my free credit report if I pay all my debt on time?

Yes. It is important that you check your credit report regularly to ensure that the information is being reported to the credit bureau correctly. Also remember to use your credit report to detect any fraudulent activity against your record.

Read Also: What Day Does Opensky Report To Credit Bureaus

Why Don’t My Free Credit Reports Include Credit Scores

Your credit report and your credit score are not the same thing. Your credit report contains information that a credit reporting company has received about you. Your credit score is calculated by plugging the information in your credit report into a credit score formula. You may have multiple credit scores based upon who provided the score, and whether the company providing the score used their own scoring model or used a model available from a third party.

Federal law gives you the right to ask for a copy of your credit report from each nationwide credit reporting company every year for free. However, the law does not require the credit reporting companies to provide a free credit score.

Generate Your Credit Report Online

You can save reports to your desktop or print them out so youll have access later.

If you need to request a report or reports by mail, send a request form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

Your report or reports should be sent within 15 business days.

You can also get your credit reports by calling 877-322-8228. Visually impaired consumers can also call this number to request audio, large-print or Braille reports.

Recommended Reading: Whats A Good Paydex Score

Warning About Impostor Websites

Only one website is authorized to fill orders for the free annual credit report you are entitled to under law: AnnualCreditReport.com. Other websites that claim to offer “free credit reports,””free credit scores,” or “free credit monitoring” are not part of the legally-mandated free annual credit report program.

In some cases, the “free” product comes with strings attached. For example, some sites sign you up for a supposedly “free” service that converts to one you have to pay for after a trial period. If you don’t cancel during the trial period, you may unwittingly agree to let the company start charging fees to your credit card.

Some “impostor” sites use terms like “free report” in their names others have URLs that purposely misspell Annualcreditreport.com in the hopes that you will mistype the name of the official site. Some of these “imposter” sites direct you to other sites that try to sell you something or collect your personal information.

Annualcreditreport.com and the nationwide credit reporting companies will not send you an email asking for your personal information. If you get an email, see a pop-up ad, or get a phone call from someone claiming to be from Annualcreditreport.com or any of the three nationwide credit reporting companies, do not reply or click on any link in the message. It’s probably a scam. Ensure you are on the right website by verifying through the Consumer Financial Protection Bureau .

What Do Your Free My Credit Check And My Credit Expert Reports Look Like

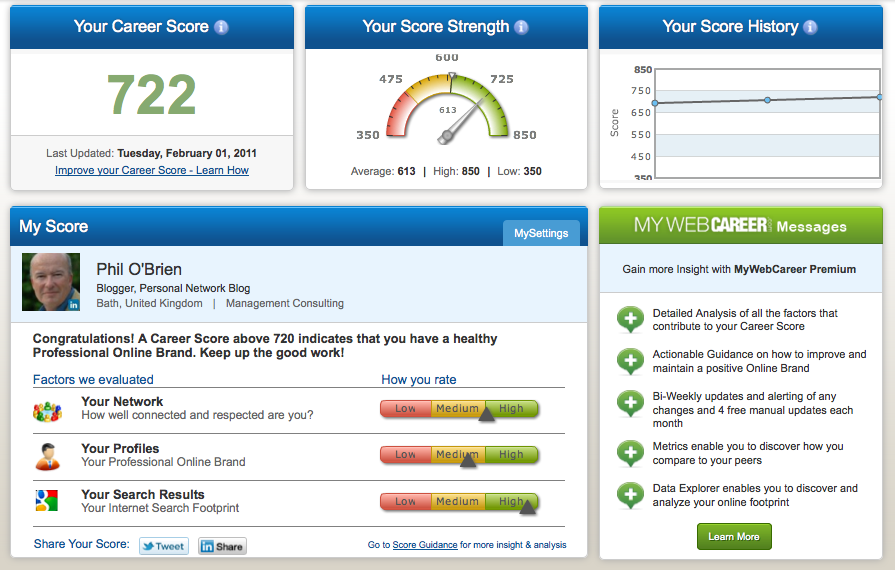

Each of Experians free credit reports includes your credit score and payment behaviour in a simple and easy to understand format. Information is grouped for you to see what activity has the biggest impact on your credit score and finances. The free credit report is an in-house credit bureau check.

We have included quick tips to explain the data and give advice on how to better manage your credit. On the dashboard, you will be able to see an overview of your credit report you dont need to spend hours sifting through a lot of data.

The free credit check platform includes:

- Your personal details

Read Also: Increase Fico Score 50 Points

How Often Can I Get A Free Report

Federal law gives you the right to get a free copy of your credit report every 12 months. Through the pandemic, everyone in the U.S. can get a free credit report each week from all three national credit bureaus at AnnualCreditReport.com.

Also, everyone in the U.S. can get six free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. Thats in addition to the one free Equifax report you can get at AnnualCreditReport.com.

What Is A Free Credit Report

The free My Credit Check and My Credit Expert services generate full free credit reporst which provide a comprehensive records of your financial history, detailed information on your borrowing and spending habits, payment trends and contact details. Information includes accounts you opened, payments youve skipped, judgments taken against you and what you owe your creditors.

Don’t Miss: Usaa Authorized User

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Where Does The Information On Your Credit Report Come From

The data included in Experians free credit reports comes from credit providers you have borrowed from. Whether its a clothing account, a loan from the bank, or cell phone contract, all credit data gets sent to registered credit bureaus, like Experian, which enables credit bureaus to do credit bureau checks.

Recommended Reading: What Is Syncb Ntwk

Your Childs Credit Report

Parents can place a Protected Consumer security freeze on their childs credit reports to help prevent identity theft. Check a childs credit report before they turn 16.

Youll need to provide the following:

- childs full name

- copy of social security card

- addresses for the past two years

- copy of the parents drivers license

- copy of proof of residence for the parent, such as a utility bill

- guardians should include guardianship papers

Send or submit the information to each of the three major credit reporting bureaus.

Do I Have To Pay For My Credit Report

It depends. There are many free credit report resources available, but there are several that also charge fees. With so many free resources available, there really isn’t any need to pay for your credit report. Just make sure you access your credit report through a verified site, such as those listed in this guide and sites that start with “https.”

Also Check: Acima Personal Loans

Basics Of Credit Reports And Scores

Your are statements of your . And there are three major bureaus that compile credit reports: Equifax®, Experian® and TransUnion®. Each credit bureau compiles its own credit reports, so your credit reports may be slightly different.

Your are based on the information in those credit reports. Generally speaking, the higher the score, the better. FICO® and VantageScore® provide some of the most commonly used scores. But keep in mind that you have many different credit scores that different lenders use.

As the Consumer Financial Protection Bureau explains, âYour score can differ depending on which credit reporting agency provided the information, the scoring model, the type of loan product, and even the day when it was calculated.â

Why Is Credit Important?

Your because it gives lendersâand othersâa general idea of how financially responsible you are. And many companies use your credit to predict your future financial behaviors.

So the better your credit, the better your chances of qualifying for things like credit cards, loans, mortgages and other credit products. And the better your rates might be.

Should I Order Reports From All Three Credit Bureaus At The Same Time

You can order free reports at the same time, or you can stagger your requests throughout the year. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports. Because each credit bureau gets its information from different sources, the information in your report from one credit bureau may not reflect all, or the same, information in your reports from the other two credit bureaus.

You May Like: When Do Credit Companies Report

Get Your Credit Score And Report For Free

If you’ve ever applied for credit or a loan, there will be a credit report about you.

You have a right to get a copy of your credit report for free every 3 months. It’s worth getting a copy at least once a year.

Your credit report also includes a credit rating. This is the ‘band’ your credit score sits in .

Usually, you can access your report online within a day or two. Or you could have to wait up to 10 days to get your report by email or mail.

Contact these credit reporting agencies for your free credit report:

Since different agencies can hold different information, you may have a credit report with more than one agency.

Some credit reporting agencies may provide your credit score for free check with them directly.

Alternatively, you can get your credit score for free from an online credit score provider, such as , Finder or Canstar. This usually only takes a few minutes.

Typically, you agree to their privacy policy when you sign up, which lets them use your personal information for marketing. You can opt out of this after you sign up.

Avoid any provider that asks you to pay or give them your credit card details.

Does Checking My Credit Report Hurt My Credit

No, checking your credit report does not hurt your credit. And checking your credit score doesn’t hurt your credit either. These actions are considered “soft pulls” which don’t affect your credit score. Actions, such as applying for a credit card, which require a “hard pull,” temporarily ding your credit score.

Learn more: Check your odds of getting approved for a credit card without hurting your credit score.

Read Also: How To Dispute Repossession On Credit Report

Fix Mistakes In Your Credit Report

When you get your credit report, check that:

- all the loans and debts listed are yours

- details such as your name and date of birth are correct

If something is wrong or out of date, contact the credit reporting agency and ask them to fix it. This is a free service.

Some companies may try to charge you to get all negative information removed from your credit report. The only thing they can ask the credit reporting agency to remove is wrong information. And you can do that yourself see .

If there are loans or debts in your report that you know nothing about, it could mean someone has stolen your identity. See identity theft for what to do.

Which Credit Report Is Most Accurate

No one credit report is innately more accurate than the others. Your TransUnion credit report might contain information that your Equifax credit report doesnt, or vice versa.

This is partly because lenders are not required to report your information to all three credit bureaus. In some cases, they may only report to one bureau and not the others, or they may report information at different times.

In any case, its a good idea to review your credit reports on a regular basis so that you can be sure any discrepancies are minor.

Ready to help your credit go the distance? Log in or create an account to get started.

Read Also: How Often Does Bank Of America Report To Credit Bureaus

Get Your Credit Score

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

Submit Your Request In Person:

Equifax has four office locations where you can request a free copy of your Equifax credit report in-person and receive a printed copy of your credit report after your identity is confirmed. Copies of the request form you will need to complete are available onsite.

You need to bring with you at least two forms of identification, including 1 photo identification and proof of current address. Also, you must provide the original copies of your chosen identification – photocopies and electronic versions are not accepted at the office. Examples of acceptable documentation include:

- Driver’s License

- Utility Bills

Acceptable Supporting IDs:

- Birth Certificate Issued in Canada

- T4 slip

- Citizenship and Immigration Canada Document IMM1000 or IMM1442

- Social Insurance Number Card issued by Canadian Government

- Certificate of Naturalization

Providing your Social Insurance Number is optional. If you provide your S.I.N., we will cross-reference it with our records to help ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

Recommended Reading: 824 Fico Score

Your Credit Score And Report

You can get your Equifax credit score and credit report for free with Borrowell! Check your credit score or download your credit report whenever you’d like. Receive weekly updates on how your score has changed, get personalized tips how to improve your score, and find the best financial products that match your profile. Checking your credit score with Borrowell doesn’t hurt it.