How To Correct Mistakes In Your Credit Report

Both the credit bureau and the business that supplied the information to a credit bureau have to correct information thats wrong or incomplete in your report. And they have to do it for free. To correct mistakes in your report, contact the credit bureau and the business that reported the inaccurate information. Tell them you want to dispute that information on your report. Heres how.

How To Avoid A Judgement

While a judgement remark itself may not be a credit destroyer these days, it can still do damage to other aspects of your life. A judgement can rear its ugly head on your background reports all the way up to 20 yearswhich is a long time for a financial mistake to hang over your head.

A judgement also puts you at risk for having your wages garnished or the seizure of other personal assets, and that is a whole other mess to deal with. So to avoid a judgement, its best to avoid paying your debts late, to begin with.

We know that isnt always easy for some people. After all, in the age of the coronavirus, 63% of Americans live paycheck to paycheckIf youre not in a position to pay up, you might want to consider stretching out your payments and lowering your APR by consolidating your debt.

Moreover, if you find yourself on the struggle bus, just remember that communication is paramount. The key to dealing with collectors and creditors is not by ignoring their warnings, but by responding adequately. And especially do not ignore legal proceedings or requests from the courts.

Most of the time all they want is to hear from you or for you to cough up some sort of payment. To some creditors, something is better than nothing if you are showing an effort to try and make it right.

About the author

Solve Your Problem With Evictions On Your Credit Report With The Help Of Donotpay

Removing evictions from a credit report can be daunting. The process is tedious, and its pretty easy to give up along the way. Sadly, an eviction in your credit report can get in the way when house hunting. This is the last experience you want to go through. The good news is DoNotPay has you covered.

How to clean up your credit report using DoNotPay:

If you want to clean up your credit report but dont know where to start, DoNotPay has you covered in 3 easy steps:

You can also check out our other credit products, including Credit Limit Increase, Get My Credit Report, Keep Unused Cards Active, and more!

Read Also: Syncb Verizon

If You Don’t Owe The Debt

If you don’t owe the debt, you can ask the court to re-open the case against you – this is called setting aside your CCJ. You can only do this if you can prove you have a genuine legal reason for not owing the money.

You can ask the court to set aside the CCJ by filling in form N244. Youll probably have to pay a fee for your case to be looked at again.

If the court agrees that you dont owe the money, your CCJ will be removed from the Register.

Removing the entry could take up to 4 weeks. It should be easier for you to get credit after the entry has been removed.

Dispute The Information With The Credit Reporting Company

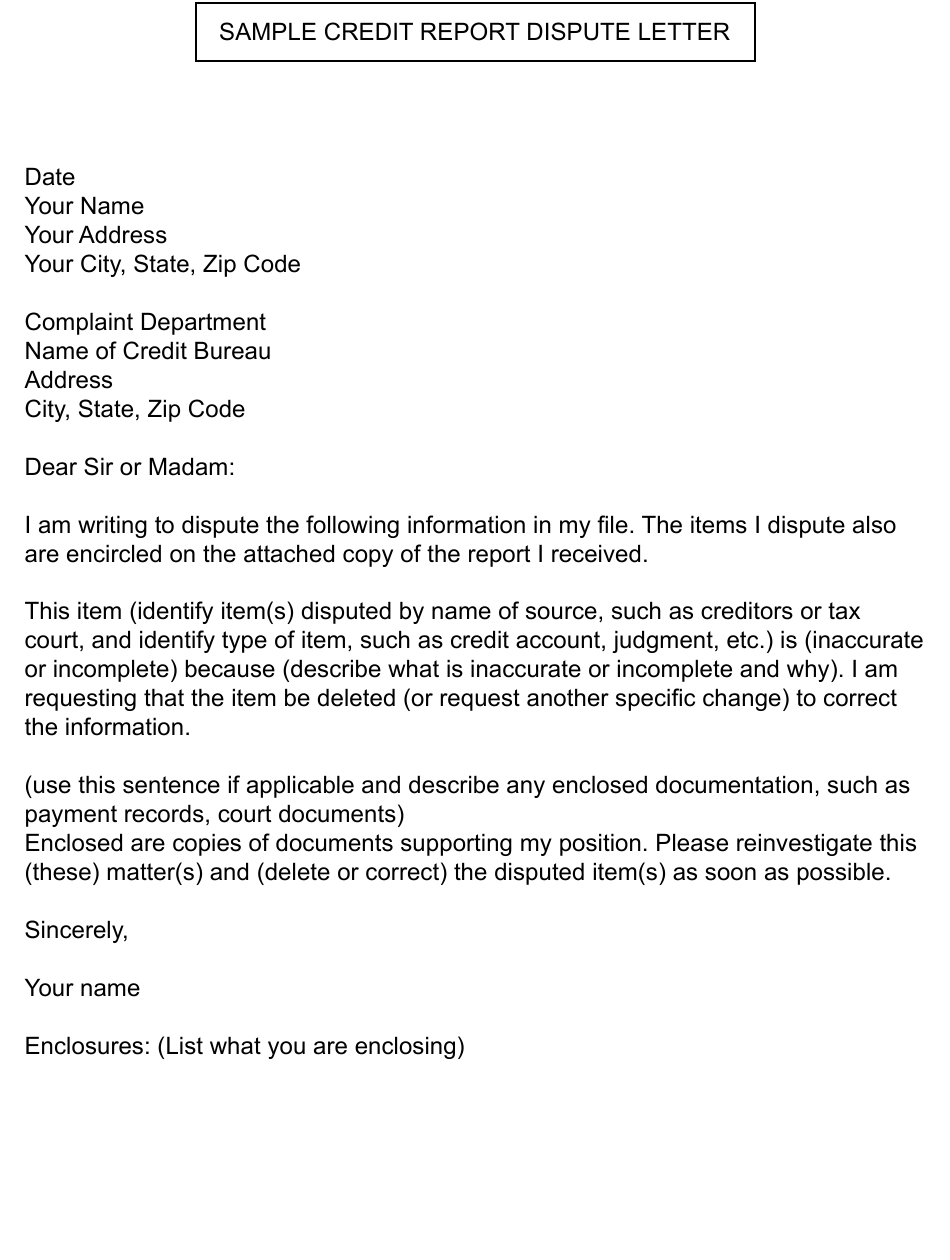

If you identify an error on your credit report, you should start by disputing that information with the . You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute. You can also use our instructions

If you mail a dispute, your dispute letter should include:

You may choose to send your letter of dispute to credit reporting companies by certified mail and ask for a return receipt, so that you will have a record that your letter was received.

You can contact the nationwide credit reporting companies online, by mail, or by phone:

Read Also: Remove Transunion Inquiries

How Judgements Affect Your Credit

A judgement is usually entered on a credit report as a public record/derogatory mark. Depending on the state, a judgement can be on your record or background report for 5 to 20 years. However, a judgement may only show up on your credit reports for up to seven years.

The real kicker is the fact that there have been recent changes to how judgements appear on your credit report. The NCAP, a settlement established in 2015, is responsible for these changes.

The NCAPs responsibility is to structure and create credit requirements to ensure consumer accuracy. A public record can be very damaging to a consumer, therefore, its super important for the creditor to make sure the information is correct.

Changes that occurred in 2017-2018 essentially prevent judgements from appearing on credit reports. Period.

How? Its quite contradictory actually. The NCAP requires the listing of specific personal and identifying information on all records to ensure the utmost accuracy. This information includes things like name, social security number, date of birth, and the consumers address.

However, privacy laws also prohibit public records including any of the above information. This means that civil judgements cant appear on credit reports because for them to appear, theyd have to include the personal information that violates privacy laws.

Looking to raise your credit score? Take a look at the most popular credit repair companies.

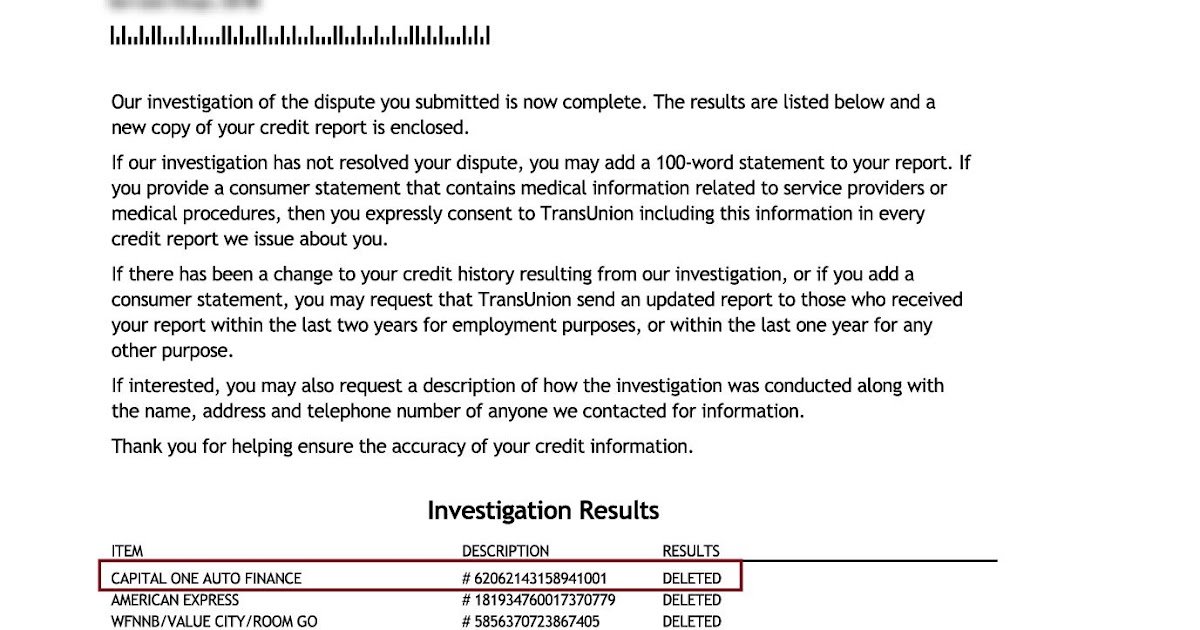

How Does The Dispute Process Work

File a dispute for free

If you see information on your Equifax credit report that you believe is inaccurate or incomplete, you have two options to submit a dispute form and required documents: electronically or by postal mail.

Results

After your dispute is processed, we will notify you with the results and outcome of the investigation. If you submitted your documents electronically, you will receive the results by email. If you printed and mailed in your dispute information, your results will be mailed to you.

Please note that you will need to contact Trans Union of Canada, Inc. directly to correct inaccuracies found on your TransUnion Canada credit file.

Recommended Reading: What Credit Bureau Does Care Credit Use

Do You Still Have To Pay Rent After Being Evicted

After a tenant is evicted from a property, the landlord can no longer charge them monthly rent. This means that if you send out an eviction notice and the tenant agrees to leave, they will still owe you for the previous months of back rent, but they will not be responsible for any months of future rent.

Also Check: How To Check Credit Score With Chase

Other Places Where The Negative Information Is Reported

- Tenant screening reports: Rental history reports can be obtained through rental screening companies hired by potential landlords for tenant verification.

- Court records: This includes any information regarding judicial trials and judgments against the tenant. The information related to the eviction judgment appears in the public records section of the credit report.

- Rental background checks: This includes police verification of the tenants past eviction information and history, along with the data collected from the three major credit bureausTransUnion, Equifax, and Experian.

Also Check: Coaf On Credit Report

Discount For Family Members Couples And Active Military

Lexington Law is now offering $50 off the initial set-up fee when you and your spouse or family members sign up together. The one-time $50.00 discount will be automatically applied to both you and your spouses first payment.

Active military members also qualify for a one-time $50 discount off the initial fee.

How Long & What Happens Next

It generally takes a few weeks for your credit score to improve once they have processed the disputes and resolutions.

Patience

Patience was never my biggest strength, so while I remember feeling like several months passed before I saw noticeable improvements in my score, it was actually around 6-8 weeks when the improvements really took effect.

My credit score was initially in the low 600s, so I watched it climb steadily through the 600s. It even climbed into the low 700s.

Applying for New Credit

Then I applied for a loan. I qualified for the lowest interest rate my credit union offered. My new car was waiting for me at the dealership the day I arrived home in Tennessee.

Its worth noting that the climb up the charts can vary depending on a number of factors. For example, if you successfully remove a judgment from six years ago, it may not have any noticeable impact on your credit score- while removing a judgment from one or two years ago can have a significant impact on your score.

The formulas that compute credit scores assign the most weight to the most recent items on your report. Intuitively it makes sense, as lenders are going to be more interested in what your financial health looks like today. They are less concerned with how you were performing many years ago.

As your credit improves, you will likely receive offers for new loans and credit cards. Its important to know how those can impact your credit as well.

Recommended Reading: What Is A Leasingdesk Score

Appeal For A Vacated Judgment

A vacated judgment is one that you appealed, and the court dismissed. This is a great way to handle a judgment, and there are several ways to get your judgment vacated:

- File a motion appealing the original ruling. You have a good chance of succeeding, especially if the person suing you didn’t follow the correct legal procedure.

- File an appeal of procedural grounds. This may include receiving a judgment without a hearing or not receiving a summons to court.

If you successfully appeal your judgment, then the case is dismissed. The person suing you still has the option to re-file, but since it’s costly and time-consuming, they may not pursue it again.

Get Current On All Your Debt Obligations

Are there any past due accounts lingering on your credit report? Make a plan to get current right away or work with the creditor to break up the payments. Not only does payment history account for 35 percent of your credit score, but the last thing you need when trying to rebuild your credit score is another account going into collections.

Don’t Miss: What Does Public Record Mean On Your Credit Report

Negotiate With The Collection Agency

If your previous landlord turned your debt to collection agencies, you should contact the respective agency regarding this. You can then negotiate with them and have the eviction information and collection account removed from your credit records.

Removing a collection from your credit report can be done by offering a pay-for-delete agreement to the agency. You can also clear up your past dues in exchange for the removal of negative remarks from your credit history.

Again, it would help if you asked everything in writing to save yourself from being cheated and have proof for future reference.

Recommended Reading: How To Unlock My Transunion Credit Report

Statute Of Limitations On Judgments

The statute of limitations on judgments is long–very long, usually, 12 to 20 years and many are renewable therefore the judgment could follow you around forever. Even if you pay it you will be stuck with a ‘satisfied judgment” for 7 years from the date satisfied not filed! This can be a hopeless situation so avoid being sued at all costs.

Be sure to always check your SOL for debts if you have been served because if it is expired you can use that to dismiss the case. Many debtors are served every day for debts and they simply do not show up in court and a default judgment is entered against them – big mistake! Had half of them simply checked their SOL they would have found that the debt may have expired years before, but since they did not dispute this, the judgment was awarded. You can use an expired SOL as a solid defense in court against a creditor/collector to stop a judgment.

Also Check: Lowes 0 Financing For 18 Months

What If I Dispute The Debt

To have the opportunity to dispute a judgement debt, you will need to apply to the court that issued the judgement to set it aside.

An application to set aside a default judgement must address the following:

- the reason you failed to file a defence within the time frame

- any bona fide defence you have in respect of the claim and

- the reason you have delayed in making the application .

Where you have paid the judgement debt, this may be regarded as admitting the validity of the creditors claim. This can make getting an order to set aside the default judgement very difficult, as you have already admitted that you were previously in debt and needed to pay someone back.

Pay It And Wait For It To Come Off Of Your Credit Report

If you werenât successful in your appeal and your judgment is accurate, your last option is to pay it off and wait for it to come off of your credit report.

A judgment is sometimes removed if you pay it. Some state laws require judgments to be removed from your credit report when they are paid.

Some states also allow debt collectors and creditors to re-file the judgment if it is unpaid, also known as an unsatisfied judgment. This is why itâs worth it to pay your judgment as soon as you can if you cannot get it removed.

Recommended Reading: Does Aarons Build Your Credit

Ways To Remove Collections From Credit Report

Still, there is a chance you could get the collection removed. A collection stays on your credit report for seven years from the time of your last payment, and there are three ways to get it taken off.

Write To The Credit Bureau

The second step is to provide the letter from the credit provider to the credit reporting agency alongside a request that they remove the judgement from your record. For some credit reporting agencies, just this step alone will be sufficient to remove the court judgement from your credit rating.

Unfortunately, other credit reporting agencies may simply add a notation to your credit report saying that you have repaid the judgement debt. Some future credit providers may be satisfied with seeing that you have repaid the judgement debt. However, for most lenders, even just having a court judgement on your credit report will deter them from providing you with credit.

Recommended Reading: Does Care Credit Build Your Credit

Remove Old Judgments From Your Credit Report

As with any item on your credit report, you have the right to dispute any judgment or charge-off that you see on your report. You can write a dispute letter to the court that issued the judgment to ask them to validate the debt. The judgment may have been reported in error or may already be satisfied , in which case they will not be able to validate it. You can also write to the credit bureau and ask them to remove the judgment from your credit report under the new rules of the NCAP.

When you are contesting a debt, it cannot appear on your credit report. This is one of the basic tenets of credit repair. If the information is found to be incorrect, the credit bureaus must remove it. If the credit bureaus fail to do this, they and the original creditor could be subject to penalties. If you notify the credit reporting agencies about incorrect information on your report and they refuse to take action, you can consult with an attorney about filing a lawsuit. Or you can get help from a credit repair company that may carry more weight with the credit bureaus.